Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Management Accountant interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Management Accountant so you can tailor your answers to impress potential employers.

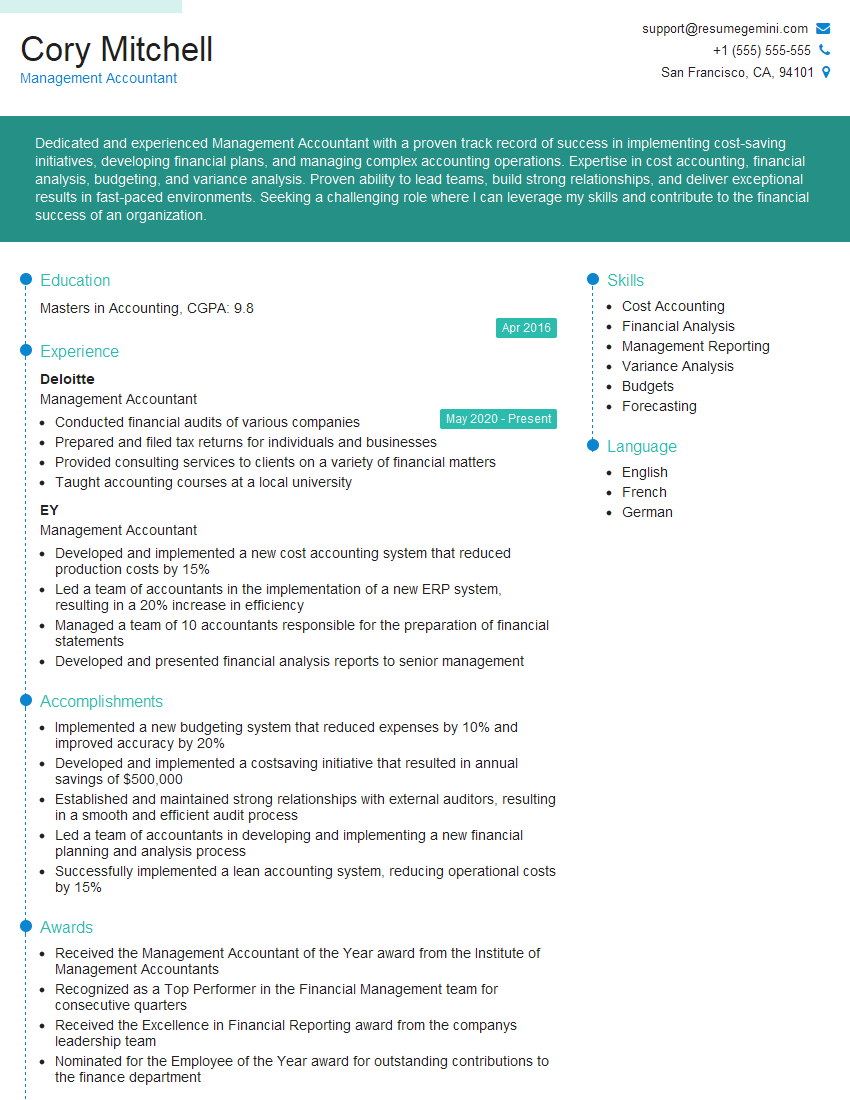

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Management Accountant

1. How do you ensure the accuracy and reliability of management accounting reports?

I adhere to strict quality control procedures, including:

- Double-checking all calculations and data entries

- Reviewing reports thoroughly for errors or inconsistencies

- Seeking input from other team members and external auditors to verify findings

2. Describe your experience in implementing budgeting and forecasting processes within an organization.

Budgeting Process

- Developed and implemented a budgeting system that aligns with the organization’s strategic goals

- Collaborated with department heads to gather input and ensure accuracy

- Monitored and analyzed budget performance regularly

Forecasting Process

- Established a robust forecasting model using historical data and market trends

- Utilized advanced statistical techniques to predict future performance

- Provided management with timely and actionable insights

3. How do you handle the challenge of managing multiple and sometimes conflicting priorities?

I prioritize tasks based on their importance and urgency using a matrix framework.

- Delegate responsibilities effectively to maximize efficiency

- Communicate openly with stakeholders to manage expectations

- Remain adaptable and flexible to adjust priorities as needed

4. How do you stay up-to-date with the latest accounting principles and regulations?

I actively engage in professional development activities, including:

- Attending conferences and workshops

- Subscribing to industry publications

- Seeking certification and continuing education

5. Explain the role of management accounting in supporting decision-making within an organization.

Management accounting provides critical information for decision-making by:

- Analyzing financial data to identify areas of opportunity and risk

- Developing performance metrics and KPIs to monitor progress towards goals

- Evaluating the financial impact of strategic decisions

6. How do you collaborate with other departments, such as sales and operations, to ensure a cohesive financial strategy?

I foster strong relationships with other departments by:

- Attending regular meetings and actively participating in cross-functional initiatives

- Sharing financial insights and analysis to inform decision-making

- Seeking input and feedback from colleagues to ensure alignment

7. Describe your experience in developing and implementing cost-control measures.

I have successfully implemented cost-control measures that include:

- Conducting variance analysis to identify areas of overspending

- Negotiating favorable terms with vendors

- Optimizing production processes to reduce waste

8. How do you use data analysis techniques to improve financial performance?

I utilize data analysis techniques, such as:

- Trend analysis to identify patterns and forecast future performance

- Regression analysis to determine relationships between variables

- Scenario analysis to evaluate the potential impact of different decisions

9. Describe your experience in managing a team of accountants.

Team Management

- Developed and implemented performance management systems

- Provided training and mentorship to enhance team skills

- Foster a collaborative and supportive work environment

Team Leadership

- Set clear goals and expectations

- Communicate effectively and provide regular feedback

- Recognize and reward team achievements

10. Describe a situation where you had to overcome a significant challenge as a management accountant.

During a major financial audit, I identified a material error in the company’s financial statements.

- Thoroughly investigated the issue and developed a remediation plan

- Communicated findings clearly to senior management and external auditors

- Worked diligently to implement corrective actions and prevent future errors

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Management Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Management Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Management accountants are highly valued professionals who provide critical financial data and analysis to business leaders. They play a key role in strategic decision-making, cost control, and financial planning.

1. Financial Reporting and Analysis

Management accountants are responsible for preparing and analyzing financial reports, including balance sheets, income statements, and cash flow statements. They must have a strong understanding of accounting principles and be able to interpret financial data in a meaningful way.

- Prepare financial statements in accordance with Generally Accepted Accounting Principles (GAAP)

- Analyze financial data to identify trends and patterns

- Provide commentary and insights on financial performance to management

2. Budgeting and Forecasting

Management accountants develop and manage budgets and forecasts for their organizations. They must be able to accurately predict future financial performance and identify potential risks and opportunities.

- Develop and implement budgeting systems

- Forecast financial performance

- Monitor actual performance against budgets and forecasts

3. Cost Management

Management accountants are responsible for managing costs and improving efficiency. They must be able to identify areas where costs can be reduced and develop strategies to improve profitability.

- Develop and implement cost control systems

- Analyze costs and identify areas for improvement

- Develop strategies to reduce costs

4. Internal Control

Management accountants are responsible for developing and implementing internal control systems to ensure the accuracy and reliability of financial information. They must be able to identify and mitigate risks to the organization’s financial reporting process.

- Develop and implement internal control systems

- Assess risks to the financial reporting process

- Monitor internal control systems and make recommendations for improvements

Interview Tips

Preparing for a management accountant interview can be daunting, but with the right preparation, you can increase your chances of success. Here are a few tips to help you ace your interview:

1. Research the Company and the Role

Before you go on your interview, take the time to research the company and the specific role you are applying for. This will help you understand the company’s culture, values, and goals, and it will also help you prepare for the questions that you may be asked.

- Visit the company’s website

- Read articles about the company

- Talk to people who work at the company

2. Practice Common Interview Questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this role?” It is important to practice answering these questions in a clear and concise way. You should also be prepared to talk about your experience and qualifications, and how they relate to the role you are applying for.

- Practice answering common interview questions

- Get feedback from a friend or family member

- Record yourself answering questions

3. Be Yourself and Be Confident

It is important to be yourself and be confident in your interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. Be honest about your experience and qualifications, and be confident in your ability to do the job.

- Be yourself

- Be confident

- Be honest

4. Ask Questions

At the end of the interview, you will likely be given the opportunity to ask questions. This is a great chance to learn more about the company and the role, and to show the interviewer that you are interested and engaged. Some good questions to ask include:

- What are the biggest challenges facing the company?

- What are the most important qualities you are looking for in a candidate?

- What is the company culture like?

Next Step:

Now that you’re armed with the knowledge of Management Accountant interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Management Accountant positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini