Feeling lost in a sea of interview questions? Landed that dream interview for Marine Underwriter but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Marine Underwriter interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

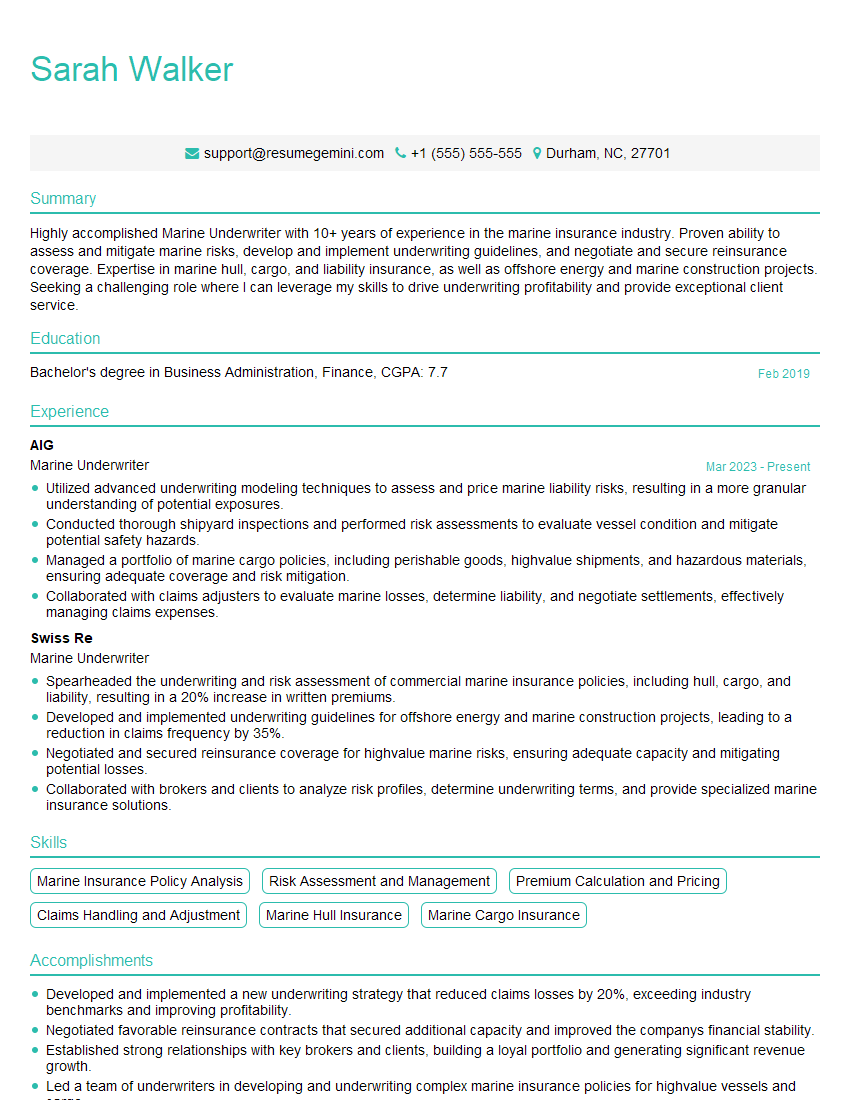

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Marine Underwriter

1. How would you assess and determine the risk profile of a marine cargo shipment?

- Gather information about the shipment, including the type of cargo, value, origin, destination, and transit route.

- Review the shipper’s and consignee’s financial stability and creditworthiness.

- Assess the potential for physical damage or loss during transit, considering factors such as the type of packaging, stowage, and handling.

- Evaluate the risks associated with theft, piracy, or other criminal activity.

- Consider the potential for delays or disruptions during transit due to weather, political instability, or other unforeseen events.

2. What are the key considerations when determining the appropriate premium for a marine insurance policy?

Factors affecting premium calculation

- The value of the insured item

- The risk profile of the shipment

- The type of coverage desired

- The deductible or excess amount

- The insurance company’s underwriting guidelines

Additional Considerations

- The competitive landscape and market conditions

- The insurer’s loss history and financial stability

- The client’s risk tolerance and budget

3. How would you handle a claim for damage to a marine cargo shipment?

- Promptly acknowledge the claim and begin the investigation process.

- Gather all necessary documentation, including the insurance policy, bill of lading, and damage report.

- Inspect the damaged goods and determine the cause of loss.

- Negotiate a fair and reasonable settlement with the claimant.

- Document the claim process and maintain accurate records for future reference.

4. What are the key differences between a marine hull and machinery policy and a marine cargo policy?

- Coverage: A marine hull and machinery policy covers the physical damage or loss of the vessel itself, while a marine cargo policy covers the loss or damage of goods being transported.

- Insured parties: A marine hull and machinery policy typically covers the vessel owner, while a marine cargo policy covers the shipper or consignee of the goods.

- Perils covered: A marine hull and machinery policy typically covers perils such as sinking, grounding, collision, and fire, while a marine cargo policy covers perils such as theft, pilferage, and damage during transit.

- Premium calculation: The premium for a marine hull and machinery policy is typically based on the value of the vessel, while the premium for a marine cargo policy is typically based on the value of the goods being transported.

5. What are the major challenges facing the marine insurance industry today?

- Increased frequency and severity of natural disasters due to climate change

- Rising costs of ship construction and repairs

- Increased competition from global insurers

- Regulatory changes and compliance requirements

- Cyber risks and data breaches

6. How do you stay up-to-date on the latest developments in the marine insurance industry?

- Attend industry conferences and seminars

- Read trade publications and online resources

- Network with other marine insurance professionals

- Take continuing education courses

- Follow industry experts and thought leaders on social media

7. What are your thoughts on the use of technology in the marine insurance industry?

- Technology can improve efficiency and accuracy in underwriting, claims processing, and risk management.

- Data analytics can help insurers identify and mitigate risks more effectively.

- Online platforms can make it easier for clients to obtain quotes and purchase insurance.

- However, it is important to ensure that technology is used responsibly and does not compromise data security or privacy.

8. What are your strengths and weaknesses as a marine underwriter?

-

Strengths:

- Strong technical knowledge of marine insurance principles and practices

- Excellent risk assessment and underwriting skills

- Proven ability to negotiate and settle claims fairly and efficiently

- Effective communication and interpersonal skills

- Up-to-date on the latest developments in the marine insurance industry Weaknesses:

- Limited experience in certain specialized areas of marine insurance

- Working on improving time management skills

- Can be overly detail-oriented at times

9. Why are you interested in working for our company?

- I am impressed by your company’s reputation as a leading provider of marine insurance.

- I am eager to contribute my skills and experience to your team.

- I am confident that I can make a significant contribution to your company’s success.

10. Do you have any questions for me?

- I am interested in learning more about the company’s underwriting guidelines.

- I would like to know more about the company’s claims process.

- I am curious about the company’s plans for growth in the future.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Marine Underwriter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Marine Underwriter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Marine Underwriters play a crucial role in assessing and managing risks associated with marine operations. Their key responsibilities include:

1. Risk Assessment and Evaluation

Analyze and assess marine risks, including vessel and cargo damage, liability claims, and environmental hazards.

2. Underwriting Policy Development

Develop and implement underwriting policies and procedures to determine premiums and coverage terms for various marine insurance products.

3. Premium Calculation and Collection

Calculate and collect insurance premiums based on the assessed risks and policy terms.

4. Claims Processing

Process and manage insurance claims, investigating incidents, assessing damages, and determining appropriate settlements.

5. Relationship Management

Build and maintain relationships with clients, brokers, and other stakeholders in the marine insurance industry.

Interview Tips

Preparing thoroughly for a Marine Underwriter interview is essential to showcase your skills and experience. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Familiarize yourself with the company’s history, operations, and marine insurance portfolio. Research current industry trends and market conditions.

2. Highlight Relevant Skills and Experience

Emphasize your proficiency in risk assessment, underwriting policy development, premium calculation, and claims processing. Quantify your accomplishments using specific examples.

3. Demonstrate Insurance Knowledge

Showcase your understanding of marine insurance principles, policy types, and common risks. Discuss your experience with maritime law, international conventions, and risk management techniques.

4. Prepare for Technical Questions

Expect technical questions related to underwriting guidelines, claims handling procedures, and marine insurance regulations. Study industry best practices and regulations to prepare for these questions.

5. Practice Presentation Skills

Most interviews will involve a presentation or case study. Practice presenting your case clearly and concisely, highlighting your analytical skills, solution-oriented approach, and ability to communicate complex concepts.

6. Be Professional and Enthusiastic

Dress appropriately and arrive punctually for the interview. Maintain a positive and enthusiastic demeanor throughout the process. Show genuine interest in the role and the company’s mission.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Marine Underwriter role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.