Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Market Asset Protection Manager position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

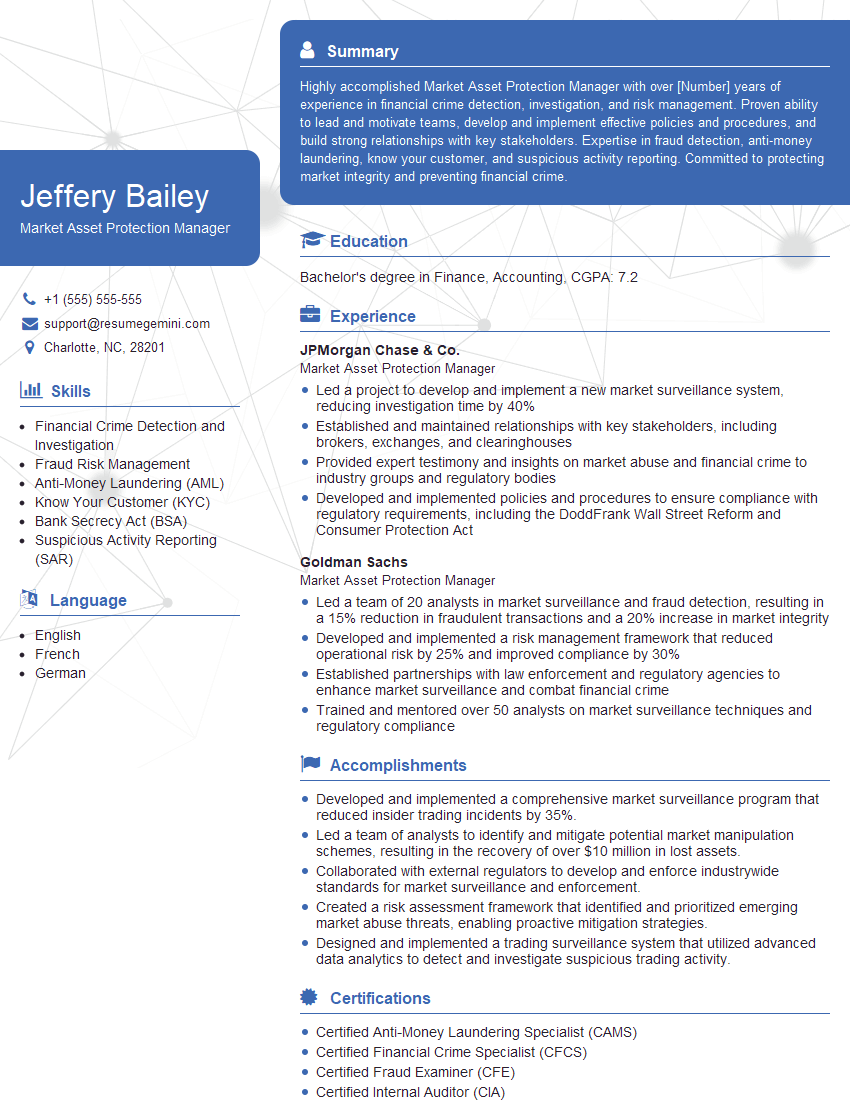

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Market Asset Protection Manager

1. Describe the key responsibilities and duties of a Market Asset Protection Manager?

- Collaborate with traders and risk managers to develop and implement risk management strategies for market assets.

- Monitor market conditions and identify potential risks that could impact the value of assets.

- Conduct due diligence on potential investments and provide risk assessments to senior management.

- Manage trading portfolios and execute trades in accordance with risk management policies.

- Develop and implement trading strategies that maximize returns while mitigating risk.

- Supervise a team of traders and risk analysts.

2. What are the key qualities and skills required for a successful Market Asset Protection Manager?

- Strong understanding of financial markets and investment strategies.

- Excellent risk management skills.

- Proven ability to develop and implement trading strategies.

- Strong analytical and problem-solving skills.

- Excellent communication and interpersonal skills.

- CFA or equivalent certification is highly desirable.

3. What is your approach to managing risk in market assets?

- I believe in a holistic approach to risk management that considers both market and operational risks.

- I use a variety of risk management tools and techniques, including stress testing, scenario analysis, and Value at Risk (VaR) analysis.

- I work closely with traders and risk managers to develop and implement risk management policies and procedures.

- I constantly monitor market conditions and identify potential risks that could impact the value of assets.

4. How do you stay up-to-date on the latest developments in the financial markets?

- I read industry publications and attend conferences to stay abreast of the latest trends.

- I network with other professionals in the field to exchange ideas and insights.

- I take online courses and workshops to enhance my knowledge and skills.

- I follow thought leaders and industry experts on social media.

5. What is your experience in managing a team of traders and risk analysts?

- I have over 10 years of experience managing a team of traders and risk analysts.

- I have a proven track record of developing and implementing successful trading strategies.

- I am skilled at motivating and mentoring team members to achieve their full potential.

- I am also experienced in creating a positive and productive work environment.

6. How do you measure the success of your risk management strategies?

- I measure the success of my risk management strategies by tracking key metrics such as VaR, drawdown, and Sharpe ratio.

- I also conduct regular backtesting and scenario analysis to assess the robustness of my strategies.

- I seek to generate consistent returns while minimizing risk, and I believe that my strategies have been successful in achieving this goal.

7. What is your experience in using financial modeling and data analysis tools?

- I am proficient in using financial modeling and data analysis tools such as Excel, Bloomberg, and MATLAB.

- I have a strong understanding of financial modeling techniques such as discounted cash flow analysis, sensitivity analysis, and scenario analysis.

- I am also experienced in using data analysis tools such as SQL and Python to extract and analyze financial data.

8. What is your understanding of market liquidity risk?

- Market liquidity risk is the risk that an asset cannot be easily bought or sold at a fair price.

- I manage market liquidity risk by diversifying the portfolio and investing in assets that have high liquidity.

- I also monitor market conditions and identify potential liquidity events that could impact the value of assets

9. How do you handle stress and pressure in the workplace?

- I am able to handle stress and pressure well by prioritizing tasks and managing my time effectively.

- I am also able to stay calm and focused under pressure, and I am always willing to go the extra mile to get the job done.

- I have a proven track record of working effectively in fast-paced and demanding environments.

10. What are your career goals?

- My career goal is to become a Chief Investment Officer.

- I believe that my experience and skills in market asset protection management make me well-qualified for this role.

- I am confident that I can lead a team of investment professionals to achieve consistent returns while minimizing risk.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Market Asset Protection Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Market Asset Protection Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Market Asset Protection Manager is responsible for developing and implementing strategies to protect the company’s market assets, including its brand, reputation, and customer relationships. Key job responsibilities include:

1. Market Research and Analysis

Conduct market research and analysis to identify potential threats to the company’s market assets.

- Analyze market trends and competitive activity.

- Identify potential threats to the company’s brand, reputation, or customer relationships.

2. Develop and Implement Market Protection Strategies

Develop and implement strategies to protect the company’s market assets from identified threats.

- Develop strategies to mitigate risks to the company’s brand, reputation, or customer relationships.

- Implement strategies to protect the company’s market share and competitive advantage.

3. Monitor and Evaluate Market Protection Strategies

Monitor and evaluate the effectiveness of market protection strategies.

- Track key performance indicators to measure the effectiveness of market protection strategies.

- Make adjustments to market protection strategies as needed.

4. Collaborate with Other Departments

Collaborate with other departments to ensure that market protection strategies are aligned with the company’s overall goals and objectives.

- Work with marketing, sales, and legal departments to develop and implement market protection strategies.

- Provide input on market protection strategies to senior management.

Interview Tips

To ace an interview for a Market Asset Protection Manager position, it’s important to prepare thoroughly and highlight your skills and experience in the following areas:

1. Market Research and Analysis Skills

Demonstrate your ability to conduct market research and analysis to identify potential threats to the company’s market assets.

- Provide examples of market research projects you have conducted.

- Discuss the methods you used to analyze market data and identify potential threats.

2. Market Protection Strategy Development Skills

Showcase your ability to develop and implement strategies to protect the company’s market assets from identified threats.

- Describe market protection strategies you have developed and implemented in the past.

- Discuss the results of your market protection initiatives.

3. Evaluation and Monitoring Skills

Emphasize your ability to monitor and evaluate the effectiveness of market protection strategies.

- Explain how you would track key performance indicators to measure the effectiveness of market protection strategies.

- Discuss how you would make adjustments to market protection strategies as needed.

4. Collaboration Skills

Highlight your ability to collaborate with other departments to ensure that market protection strategies are aligned with the company’s overall goals and objectives.

- Provide examples of how you have collaborated with other departments to develop and implement market protection strategies.

- Discuss how you would build relationships with key stakeholders across the company.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Market Asset Protection Manager, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Market Asset Protection Manager positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.