Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Master Tax Advisor interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Master Tax Advisor so you can tailor your answers to impress potential employers.

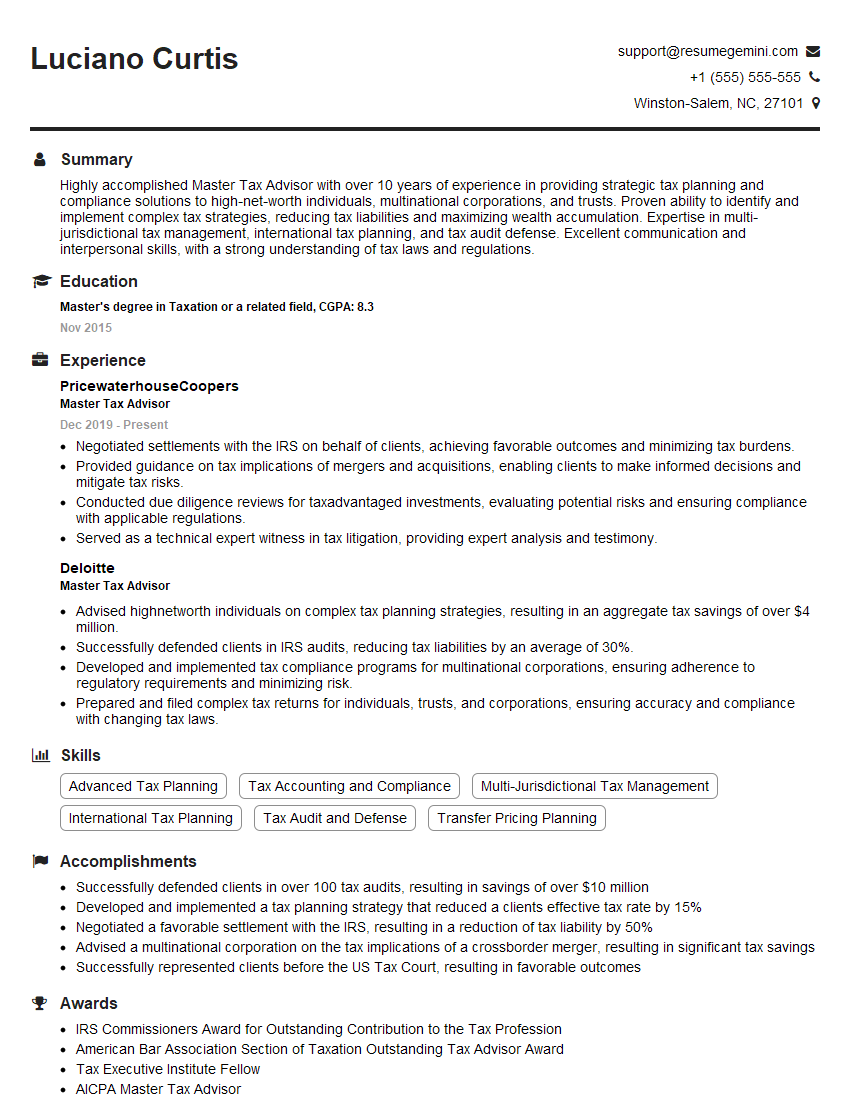

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Master Tax Advisor

1. What are the key tax considerations that businesses should be aware of when expanding internationally?

Sample Answer: As a Master Tax Advisor, I would advise businesses to consider the following key tax considerations when expanding internationally:

- Tax rates and structures: Different countries have different tax rates and structures, so it is important to understand the tax implications of expanding into a new jurisdiction.

- Tax treaties: Tax treaties can help to reduce or eliminate double taxation, so it is important to determine whether there is a tax treaty in place between the home country and the host country.

- Transfer pricing: Transfer pricing is the pricing of goods and services between related entities in different countries. It is important to ensure that transfer pricing is structured in a way that minimizes tax liability.

- Indirect taxes: Indirect taxes, such as value-added tax (VAT), can also impact the cost of doing business. It is important to understand the indirect tax rules in the host country.

- Compliance costs: Expanding internationally can also increase compliance costs. It is important to factor in the cost of hiring local tax advisors and preparing tax returns in multiple jurisdictions.

2. How would you advise a multinational corporation on structuring its global tax strategy?

Tax planning

- Identifying tax-efficient jurisdictions for different business activities.

- Optimizing transfer pricing policies to minimize global tax liability.

- Utilizing tax incentives and deductions available in different countries.

Tax compliance

- Ensuring compliance with tax laws and regulations in all jurisdictions of operation.

- Implementing robust tax risk management systems.

- Establishing a centralized tax function to coordinate global tax reporting and compliance.

Tax controversy management

- Developing strategies to proactively manage tax audits and disputes.

- Representing the company in tax appeals and litigation.

- Negotiating favorable settlements with tax authorities.

3. What are some of the most common tax planning techniques used by businesses?

Sample Answer: Some of the most common tax planning techniques used by businesses include:

- Income shifting: Shifting income to lower-tax jurisdictions.

- Deduction maximization: Maximizing allowable deductions to reduce taxable income.

- Tax deferral: Deferring the recognition of income or expenses to reduce current tax liability.

- Tax credits: Utilizing tax credits to reduce tax liability.

- Loss harvesting: Selling losing investments to offset gains and reduce tax liability.

4. How do you stay up-to-date on the latest tax laws and regulations?

Sample Answer: As a Master Tax Advisor, I stay up-to-date on the latest tax laws and regulations by:

- Reading tax journals and publications.

- Attending tax conferences and seminars.

- Taking continuing education courses.

- Networking with other tax professionals.

- Using online tax research tools.

5. What are some of the ethical considerations that tax advisors should be aware of?

Sample Answer: As a Master Tax Advisor, I am aware of the following ethical considerations:

- Confidentiality: Tax advisors must maintain the confidentiality of their clients’ tax information.

- Conflicts of interest: Tax advisors must avoid conflicts of interest that could impair their objectivity.

- Competence: Tax advisors must be competent in the areas of tax law and practice in which they provide advice.

- Diligence: Tax advisors must exercise due diligence in providing tax advice.

- Objectivity: Tax advisors must be objective in providing tax advice.

6. What are some of the challenges that tax advisors are facing today?

Sample Answer: Some of the challenges that tax advisors are facing today include:

- The increasing complexity of tax laws.

- The globalization of businesses.

- The rise of tax audits.

- The increasing scrutiny of tax advisors by regulatory authorities.

- The need to keep up with the latest tax laws and regulations.

7. What are some of the opportunities that tax advisors have today?

Sample Answer: Some of the opportunities that tax advisors have today include:

- The increasing demand for tax advice.

- The growing need for tax advisors who are knowledgeable about international tax laws.

- The opportunity to specialize in niche areas of tax law.

- The opportunity to work with a variety of clients.

- The opportunity to make a significant impact on their clients’ businesses.

8. What are your thoughts on the future of tax advising?

Sample Answer: I believe that the future of tax advising is bright. As the tax laws become increasingly complex, businesses will need to rely on tax advisors to help them navigate the tax landscape. Tax advisors will also have the opportunity to play a more strategic role in their clients’ businesses, helping them to make tax-efficient decisions.

9. What are your strengths and weaknesses as a tax advisor?

Strengths

- Strong technical knowledge of tax laws and regulations.

- Excellent communication and interpersonal skills.

- Ability to analyze complex tax issues and develop creative solutions.

- Proven track record of success in helping clients reduce their tax liability.

- Strong work ethic and commitment to providing high-quality service.

Weaknesses

- Limited experience in international tax law.

- Not yet a CPA (but actively working towards it).

- Sometimes I can be a bit too detail-oriented.

- I am always looking for ways to improve my skills and knowledge.

10. Why are you interested in this position?

Sample Answer: I am very interested in this position as a Master Tax Advisor because it would allow me to use my skills and experience to help your clients navigate the complex tax landscape. I am confident that I can make a significant contribution to your firm and to your clients.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Master Tax Advisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Master Tax Advisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities of a Master Tax Advisor

Master Tax Advisors are highly skilled professionals who provide strategic tax planning and advisory services to individuals and businesses. They are responsible for:

1. Tax Planning and Compliance

Master Tax Advisors develop and implement tax strategies that minimize tax liabilities while ensuring compliance with all applicable tax laws and regulations. They provide guidance on complex tax issues, such as international taxation, mergers and acquisitions, and estate planning.

- Analyzing tax laws and regulations to identify opportunities for tax savings

- Developing and implementing tax planning strategies to minimize tax liability

- Preparing and filing tax returns to ensure compliance with tax laws

2. Tax Research and Analysis

Master Tax Advisors conduct in-depth research and analysis on tax laws and regulations to stay abreast of changes and identify new opportunities for tax planning. They also provide analysis of complex tax issues to clients.

- Conducting research on tax laws and regulations to identify changes and opportunities

- Analyzing complex tax issues to provide advice to clients

- Staying up-to-date on the latest tax laws and regulations

3. Client Relationship Management

Master Tax Advisors build strong relationships with clients by understanding their unique financial situation and goals. They provide personalized advice and support to help clients achieve their tax objectives.

- Developing and maintaining strong relationships with clients

- Understanding clients’ financial situation and goals

- Providing personalized advice and support to help clients achieve their tax objectives

4. Ethical and Professional Standards

Master Tax Advisors are held to the highest ethical and professional standards. They must maintain confidentiality, act with integrity, and avoid any conflicts of interest.

- Maintaining confidentiality of client information

- Acting with integrity and professionalism

- Avoiding any conflicts of interest

Interview Preparation Tips for a Master Tax Advisor

To ace the interview for a Master Tax Advisor position, it is crucial to prepare thoroughly and demonstrate your knowledge, skills, and experience.

1. Research the Role and the Company

Take the time to research the specific role and the company you are applying to. This will help you understand the company’s culture, values, and the expectations of the position. You can also use this research to tailor your answers to the interviewer’s questions.

2. Practice Your Answers

Once you have a good understanding of the role and the company, practice answering common interview questions. This will help you feel more confident and prepared during the interview.

3. Highlight Your Experience and Skills

Be sure to highlight your relevant experience and skills in your resume and cover letter. Use specific examples to demonstrate your abilities, such as how you have successfully implemented tax planning strategies or conducted complex tax research.

4. Be Prepared for Tax-Related Questions

Expect to be asked questions about tax laws and regulations, tax planning strategies, and tax analysis. Prepare for these questions by studying relevant materials and reviewing past tax cases.

5. Show Your Personality

Master Tax Advisors are often trusted advisors to clients. It is important to show the interviewer that you are not only knowledgeable and skilled, but also personable and approachable.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Master Tax Advisor, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Master Tax Advisor positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.