Are you gearing up for an interview for a Medical Insurance Claims Processor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Medical Insurance Claims Processor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

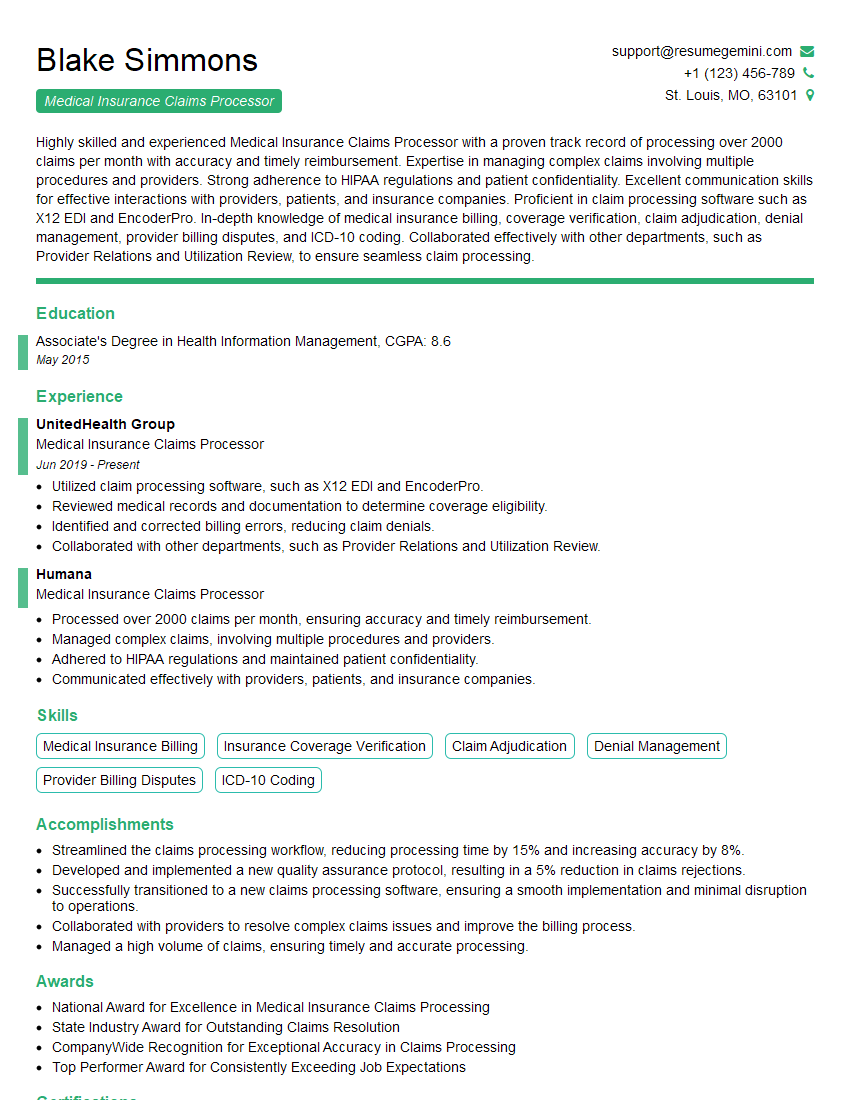

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Medical Insurance Claims Processor

1. What is the difference between primary and secondary health insurance?

Primary health insurance is the first line of coverage for a person’s medical expenses. It is typically provided by an employer or through a government program, such as Medicare or Medicaid. Secondary health insurance is designed to cover expenses that are not covered by primary insurance, such as deductibles, copayments, and coinsurance. It is typically purchased by individuals who want to have more comprehensive coverage.

2. What are the most common types of health insurance claims?

Medical claims

- Hospitalization

- Doctor visits

- Prescription drugs

Dental claims

- Cleanings

- Fillings

- Crowns

Vision claims

- Eye exams

- Glasses

- Contact lenses

3. What is the process for submitting a health insurance claim?

The process for submitting a health insurance claim typically involves the following steps:

- Contact your health insurance company to obtain a claim form.

- Complete the claim form and attach any necessary documentation, such as receipts for medical expenses.

- Mail the claim form to your health insurance company.

- Your health insurance company will review the claim and process it accordingly.

4. What are some of the most common reasons why health insurance claims are denied?

Some of the most common reasons why health insurance claims are denied include:

- The claim is not submitted on time.

- The claim is incomplete or contains errors.

- The service or procedure is not covered by the health insurance policy.

- The patient has not met their deductible.

5. What are some tips for avoiding health insurance claim denials?

Some tips for avoiding health insurance claim denials include:

- Submit claims on time.

- Complete claims forms accurately and completely.

- Make sure that the services or procedures you are claiming are covered by your health insurance policy.

- Keep track of your deductible and make sure you have met it before submitting a claim.

6. What is the role of a medical insurance claims processor?

The role of a medical insurance claims processor is to review and process health insurance claims. They determine whether the claim is valid, and if so, they process the payment to the healthcare provider.

7. What are the essential skills and qualifications for a medical insurance claims processor?

- Strong knowledge of medical terminology and anatomy.

- Excellent communication and interpersonal skills.

- Attention to detail and accuracy.

- Ability to work independently and as part of a team.

8. What are the common challenges faced by medical insurance claims processors?

- The need to stay up-to-date on changes in health insurance regulations.

- The high volume of claims that need to be processed.

- The need to make decisions that can impact the financial well-being of patients.

9. What is the average salary for a medical insurance claims processor?

The average salary for a medical insurance claims processor is $35,000 per year.

10. What is the job outlook for medical insurance claims processors?

The job outlook for medical insurance claims processors is expected to be good over the next few years. This is due to the increasing demand for health insurance coverage and the aging population.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Medical Insurance Claims Processor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Medical Insurance Claims Processor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Medical Insurance Claims Processor, you will be responsible for a diverse range of tasks essential for the smooth operation of the healthcare insurance system. Your primary duties will include:

1. Claims Processing

You will be the first point of contact for processing incoming claims from healthcare providers.

- Review and assess the validity and completeness of submitted claims.

- Identify discrepancies, missing information, and errors in claims.

- Request additional documentation or clarification from providers as necessary.

2. Claim Adjudication

Once claims are received and validated, you will be responsible for determining the appropriate coverage and payment based on policy guidelines.

- Analyze claims to determine policy eligibility and coverage requirements.

- Apply appropriate co-pays, deductibles, and other benefits.

- Issue payments to healthcare providers based on approved claims.

3. Denial and Appeal Management

You will handle denied claims and appeals, ensuring that decisions are made fairly and in accordance with insurance regulations.

- Communicate denial decisions to providers, explaining the reasons and providing clear explanations.

- Review appeals and determine if additional documentation or clarification is required.

- Make decisions on appeals and provide clear and concise explanations of the outcomes.

4. Quality Assurance

To ensure accuracy and compliance, you will be responsible for monitoring the quality of processed claims.

- Conduct regular audits to identify errors and areas for improvement.

- Develop and implement quality control measures to prevent future errors.

- Stay updated on industry best practices and regulations to ensure compliance.

5. Customer Service

You will interact with healthcare providers and policyholders, providing excellent customer service throughout the claims process.

- Answer inquiries related to claims processing and policy coverage.

- Resolve customer issues promptly and efficiently.

- Maintain a positive and professional demeanor.

Interview Preparation Tips

To ace your interview for a Medical Insurance Claims Processor position, consider the following tips:

1. Understand the Industry and Role

Familiarize yourself with the healthcare insurance industry, including regulations, policies, and common procedures. Learn about the specific job responsibilities and expectations of the role.

2. Practice Claims Processing

Practice processing mock claims to demonstrate your understanding of the process. Review common scenarios and prepare examples of how you would handle them. Consider using online resources or reaching out to professionals in the field for guidance.

3. Showcase Your Customer Service Skills

Highlight your ability to interact effectively with healthcare providers and policyholders. Provide examples of how you have resolved customer issues and maintained a positive attitude.

4. Emphasize Attention to Detail

Stress your meticulousness in reviewing and processing claims. Explain how you avoid errors and ensure accuracy throughout your work.

5. Prepare Questions for the Interviewer

Asking thoughtful questions demonstrates your engagement and interest in the role. Prepare questions about the company’s claims processing system, quality assurance measures, and opportunities for professional development.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Medical Insurance Claims Processor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!