Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Mergers and Acquisitions Banker (M&A Banker) position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

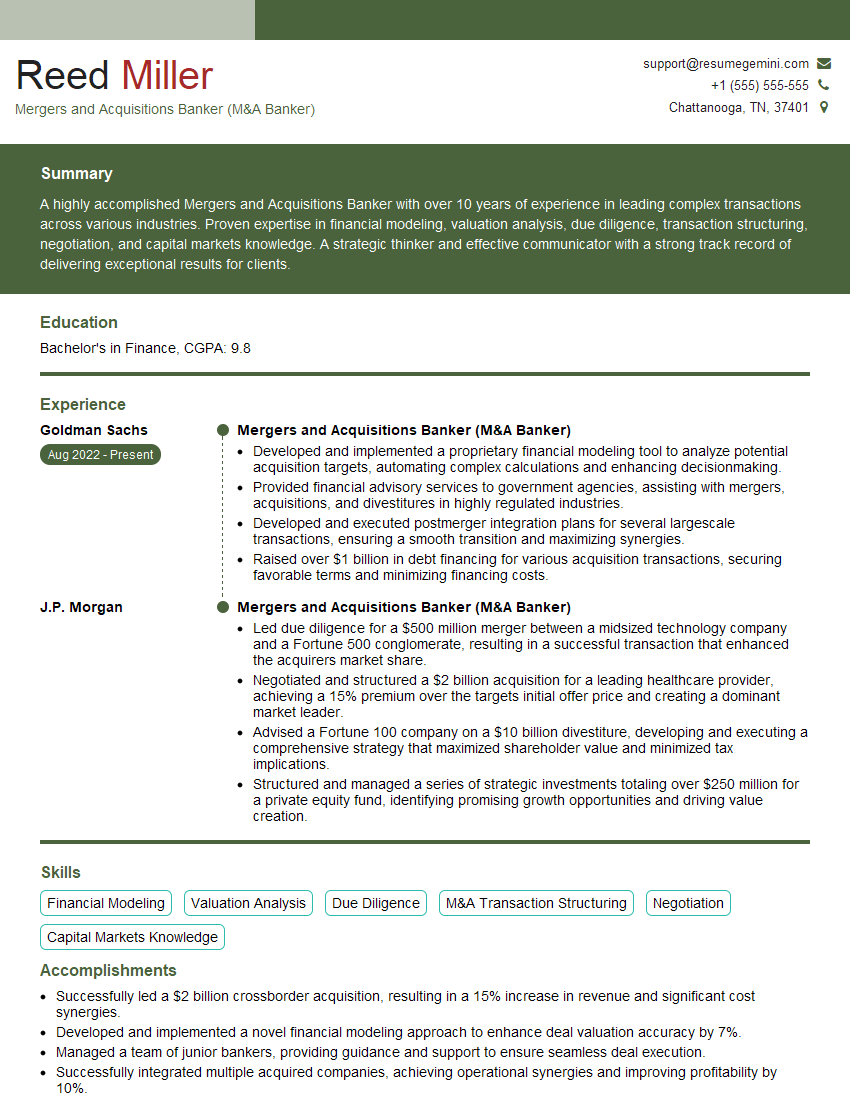

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mergers and Acquisitions Banker (M&A Banker)

1. Walk me through your understanding of the mergers and acquisitions process, including the key players involved.

– Due diligence: investigating the target company’s financial and legal status before the acquisition. – Valuation: determining the target company’s worth. – Negotiation: reaching an agreement on the terms of the acquisition. – Integration: merging the target company into the acquirer’s operations.

– Key players: – Target company: the company being acquired. – Acquirer: the company acquiring the target company. – Investment banker: advises the target company on the transaction. – Legal counsel: advises both the target company and the acquirer on the legal aspects of the transaction. – Accountant: provides financial advice to both the target company and the acquirer.

2. Discuss the different types of mergers and acquisitions and the factors that determine the choice of structure.

Types of mergers and acquisitions:

- Horizontal merger: a merger between two companies in the same industry and at the same stage of the value chain.

- Vertical merger: a merger between two companies in different stages of the same value chain.

- Conglomerate merger: a merger between two companies in different industries.

- Acquisition: a transaction in which one company acquires a controlling interest in another company.

Factors that determine the choice of structure:

- Strategic objectives of the acquirer

- Regulatory considerations

- Tax implications

- Accounting considerations

3. Describe the role of financial modeling in the mergers and acquisitions process.

Financial modeling is used in the mergers and acquisitions process to:

- Value the target company

- Project the financial impact of the acquisition

- Identify and mitigate financial risks

- Make informed decisions about the acquisition

4. Discuss the importance of due diligence in mergers and acquisitions.

Due diligence is important in mergers and acquisitions because it allows the acquirer to:

- Identify and assess any risks associated with the target company

- Verify the financial and legal status of the target company

- Negotiate a fair and equitable price for the target company

- Avoid any surprises after the acquisition

5. What are the key legal considerations in mergers and acquisitions?

- Regulatory approvals

- Antitrust laws

- Tax implications

- Employee benefits

- Intellectual property rights

6. How do you stay up-to-date on the latest trends in mergers and acquisitions?

I stay up-to-date on the latest trends in mergers and acquisitions by:

- Reading industry publications

- Attending industry conferences

- Networking with other professionals in the field

- Taking continuing education courses

7. What are the challenges and opportunities in the mergers and acquisitions market today?

Challenges:

- Increased regulatory scrutiny

- Global economic uncertainty

- Technological disruption

Opportunities:

- Low interest rates

- Abundant private equity capital

- Technological advances

8. How do you approach the integration of two companies after a merger or acquisition?

I approach the integration of two companies after a merger or acquisition by:

- Developing a clear integration plan

- Communicating the plan to all employees

- Establishing a strong leadership team

- Monitoring the integration process closely

- Making adjustments as needed

9. What are your strengths and weaknesses as a mergers and acquisitions banker?

Strengths:

- Strong analytical skills

- Excellent communication and interpersonal skills

- Deep knowledge of the mergers and acquisitions market

- Proven track record of success

Weaknesses:

- I can be a bit too detail-oriented at times.

- I am still relatively new to the field of mergers and acquisitions.

10. Why are you interested in working for our firm?

I am interested in working for your firm because:

- Your firm is a leader in the mergers and acquisitions market.

- I am impressed by your firm’s commitment to its clients.

- I believe that I have the skills and experience that would make me a valuable asset to your team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mergers and Acquisitions Banker (M&A Banker).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mergers and Acquisitions Banker (M&A Banker)‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Mergers and Acquisition bankers are highly skilled financial professionals who play a critical role in the mergers and acquisitions process. They are responsible for advising clients on strategic mergers, acquisitions, and divestitures, as well as raising capital and providing financial analysis. Key job responsibilities include:

1. Client advisory

Providing strategic advice to clients on mergers, acquisitions, and divestitures. This includes evaluating potential targets, conducting due diligence, and negotiating transaction terms.

2. Financial analysis

Conducting financial analysis to assess the value of target companies and to develop financial models to support transaction decisions.

3. Capital raising

Raising capital for clients to finance mergers and acquisitions. This includes working with banks, private equity firms, and other investors.

4. Transaction execution

Managing the execution of mergers and acquisitions, including negotiating transaction terms, drafting legal documents, and coordinating with other parties involved in the transaction.

Interview Tips

To ace an interview for a Mergers and Acquisitions Banker position, it is important to be well-prepared. Here are some tips to help you succeed:

1. Research the firm

Learn as much as you can about the firm, its culture, and its track record in mergers and acquisitions. This will help you to understand the firm’s values and to tailor your answers to the interviewer’s questions.

2. Practice your answers

Take some time to think about the most common interview questions and to practice your answers. This will help you to feel more confident and prepared during the interview.

3. Be prepared to talk about your experience

The interviewer will want to know about your experience in mergers and acquisitions. Be prepared to talk about your role in past transactions, the challenges you faced, and the results you achieved.

4. Be enthusiastic

Mergers and acquisitions is a fast-paced and exciting field. Show the interviewer that you are passionate about the work and that you are eager to learn and grow.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Mergers and Acquisitions Banker (M&A Banker) interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.