Feeling lost in a sea of interview questions? Landed that dream interview for Mergers and Acquisitions Consultant but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Mergers and Acquisitions Consultant interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

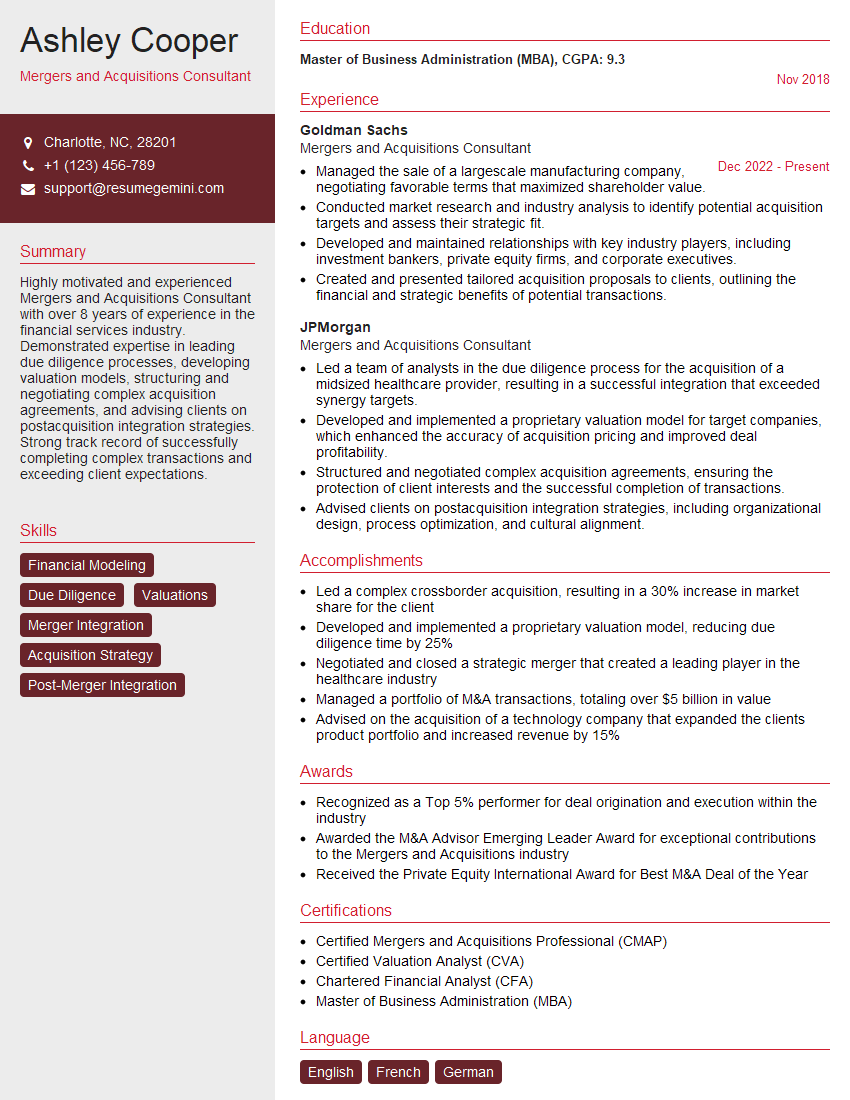

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mergers and Acquisitions Consultant

1. Walk me through the steps involved in a typical mergers and acquisitions transaction?

- Identifying and evaluating potential targets

- Conducting due diligence on the target company

- Negotiating the terms of the transaction

- Obtaining regulatory approvals

- Closing the transaction

- Integrating the two companies

2. What are the key factors to consider when evaluating a potential target for acquisition?

Financial factors

- Revenue

- Profitability

- Cash flow

- Debt

- Assets

Strategic factors

- Market share

- Competitive landscape

- Product portfolio

- Customer base

- Management team

Other factors

- Regulatory environment

- Political climate

- Economic conditions

3. What are the different types of due diligence that can be performed in a mergers and acquisitions transaction?

- Financial due diligence

- Legal due diligence

- Tax due diligence

- Operational due diligence

- Environmental due diligence

- IT due diligence

- Human resources due diligence

4. What are the key issues to negotiate in a mergers and acquisitions transaction?

- Purchase price

- Closing date

- Representations and warranties

- Covenants

- Indemnification

- Escrows

- Termination rights

5. What are the regulatory approvals that may be required in a mergers and acquisitions transaction?

- Hart-Scott-Rodino Antitrust Improvements Act (HSR)

- Bank Holding Company Act (BHCA)

- Federal Communications Commission (FCC)

- Federal Energy Regulatory Commission (FERC)

- Food and Drug Administration (FDA)

- Federal Trade Commission (FTC)

- Securities and Exchange Commission (SEC)

6. What are the challenges that can arise in integrating two companies after a merger or acquisition?

- Cultural differences

- Operational inefficiencies

- Employee turnover

- Customer churn

- Financial challenges

7. How do you manage the human capital aspects of a mergers and acquisitions transaction?

- Develop a communication plan

- Create a transition team

- Provide training and development

- Offer severance packages

- Outsource functions

8. What are the key trends in the mergers and acquisitions market?

- Increased globalization

- Rise of private equity

- Increased regulatory scrutiny

- Focus on innovation

- Digital transformation

9. What are the ethical considerations that should be taken into account in a mergers and acquisitions transaction?

- Conflicts of interest

- Insider trading

- Anti-competitive behavior

- Environmental concerns

- Social responsibility

10. What are the career opportunities for mergers and acquisitions professionals?

- Investment банкинг

- Private equity

- Corporate development

- Consulting

- Academia

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mergers and Acquisitions Consultant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mergers and Acquisitions Consultant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Mergers and Acquisitions Consultants are responsible for advising clients on mergers, acquisitions, and other business transactions. They provide strategic and financial advice, and help clients navigate the complex legal and regulatory landscape. Key job responsibilities include:

1. Advise clients on mergers, acquisitions, and other business transactions.

Consultants typically begin by meeting with clients to discuss their business goals and objectives. They then conduct due diligence on potential targets, and develop and negotiate the terms of the transaction.

2. Provide strategic and financial advice.

Consultants provide advice on a wide range of strategic and financial issues, including:

- Market analysis and industry trends

- Financial modeling and valuation

- Negotiation and deal structuring

3. Help clients navigate the complex legal and regulatory landscape.

Consultants work closely with legal and regulatory experts to ensure that transactions are compliant with all applicable laws and regulations.

4. Manage client relationships.

Consultants build and maintain strong relationships with clients, and provide ongoing support throughout the transaction process.

Interview Tips

To ace an interview for a Mergers and Acquisitions Consultant position, it’s important to prepare thoroughly and demonstrate your skills and experience. Here are some tips to help you succeed:

1. Research the company and the position.

Before the interview, take the time to research the company and the specific position you’re applying for. This will help you understand the company’s culture, values, and business goals, and how the position fits into the organization.

2. Practice your answers to common interview questions.

There are a number of common interview questions that you’re likely to be asked, such as:

- Tell me about your experience in mergers and acquisitions.

- What are your strengths and weaknesses as a consultant?

- Why are you interested in working for our company?

3. Be prepared to talk about your accomplishments.

In an interview, you’ll want to be able to highlight your accomplishments and demonstrate how you’ve helped clients achieve their business goals. Be prepared to provide specific examples of your work, and quantify your results whenever possible.

4. Be enthusiastic and professional.

First impressions matter, so it’s important to be enthusiastic and professional during your interview. Dress appropriately, arrive on time, and make sure you’re well-prepared to answer questions. Your enthusiasm for the position and the company will be evident, and it will make a positive impression on the interviewer.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Mergers and Acquisitions Consultant interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.