Feeling lost in a sea of interview questions? Landed that dream interview for Middle Card Tender but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Middle Card Tender interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

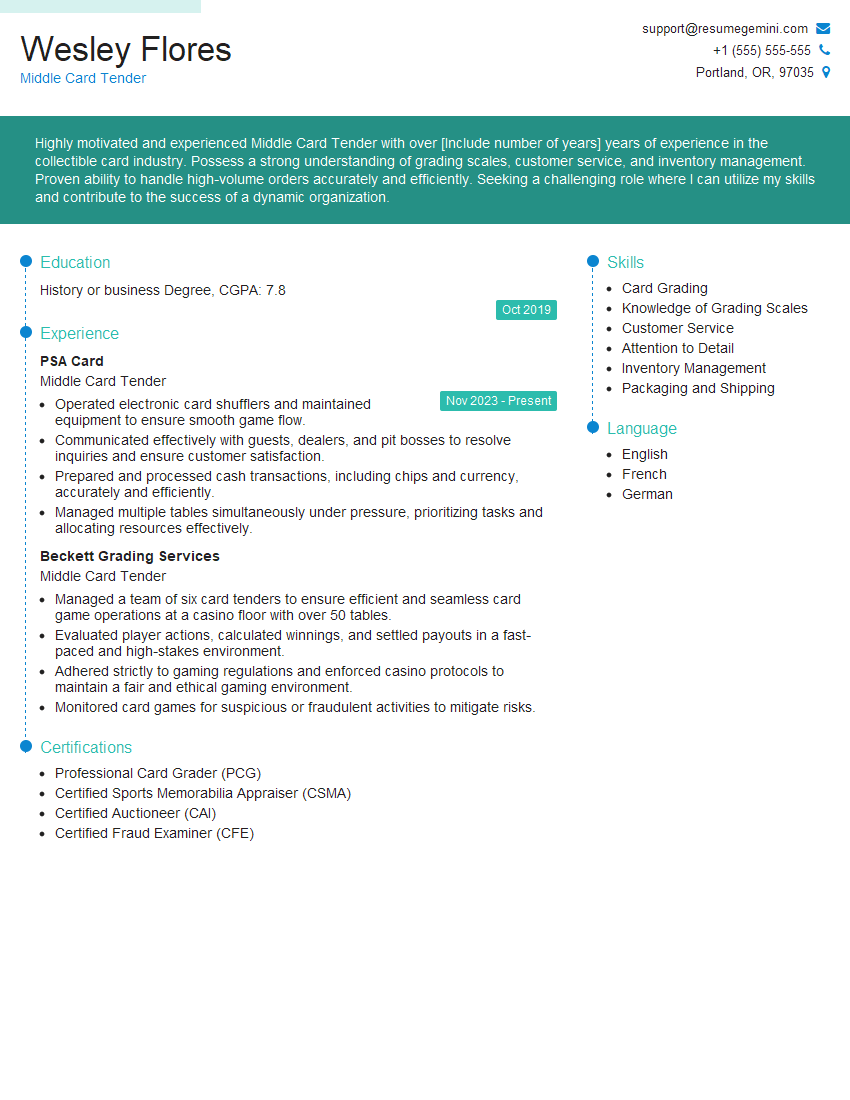

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Middle Card Tender

1. What is the procedure for processing new card applications?

In this role, I will be responsible for processing new card applications. I understand the importance of accuracy and timeliness in this process. Here’s a detailed outline of my approach to processing new card applications:

- Receive and review the completed application form, ensuring that all required information is provided and legible.

- Verify the applicant’s identity and creditworthiness through a thorough background check.

- Calculate the applicant’s credit limit based on their financial history and risk profile.

- Issue the approved credit card to the applicant, along with relevant documentation.

- Maintain accurate records of all processed applications, including approvals, denials, and cancellations.

2. How do you handle disputes or complaints from cardholders?

Maintaining Customer Satisfaction

- Respond promptly to any disputes or complaints received from cardholders.

- Actively listen to the cardholder’s concerns and gather relevant information.

- Investigate the issue thoroughly to determine the root cause.

Resolving Disputes

- Work closely with the cardholder to resolve the dispute fairly and efficiently.

- Provide clear and detailed explanations of the resolution.

- Follow up with the cardholder to ensure their satisfaction.

3. What measures do you take to prevent fraud and unauthorized card usage?

Fraud prevention is a critical aspect of card processing. Here are the measures I implement to safeguard cardholder accounts:

- Monitor cardholder transactions for suspicious activity using advanced fraud detection systems.

- Request additional verification from cardholders when unusual or high-risk transactions are detected.

- Educate cardholders on fraud prevention practices through regular communication.

- Cooperate with law enforcement agencies and other financial institutions to combat fraud.

4. How do you stay up-to-date with the latest trends and regulations in the card processing industry?

Staying current with industry developments is crucial for effective card processing. I employ the following strategies:

- Regularly attend industry conferences and workshops.

- Subscribe to trade publications and online resources.

- Participate in online forums and discussion groups.

- Review relevant legislation and regulatory updates from government agencies.

5. What is your experience in using card processing software and systems?

I am proficient in utilizing various card processing software and systems, including:

- Merchant account management platforms

- Fraud detection and prevention tools

- Customer relationship management (CRM) systems

- Payment gateways and data security protocols

6. How do you manage multiple tasks and prioritize your workload?

In this fast-paced environment, efficient task management is essential. I prioritize my workload effectively using the following techniques:

- Create daily or weekly to-do lists.

- Break down large tasks into smaller, manageable steps.

- Use technology to streamline processes and automate tasks.

- Delegate responsibilities when appropriate.

- Communicate regularly with my team to ensure smooth coordination.

7. How do you assess the performance of card processing operations?

Regularly evaluating performance is vital for continuous improvement. I measure success based on the following metrics:

- Card processing efficiency (e.g., average processing time)

- Fraud prevention effectiveness (e.g., percentage of fraudulent transactions detected)

- Customer satisfaction levels (e.g., number of resolved complaints)

- Compliance with industry regulations and standards

8. What is your understanding of PCI DSS compliance requirements?

PCI DSS compliance is paramount in protecting cardholder data. I strictly adhere to the following requirements:

- Securely storing and transmitting cardholder information.

- Regularly scanning systems for vulnerabilities.

- Implementing strong access controls and encryption measures.

- Educating employees on PCI DSS requirements.

- Maintaining compliance documentation and reporting.

9. How do you handle high-volume card transactions during peak periods?

Managing high-volume transactions requires robust systems and efficient processes. I ensure seamless operations by:

- Optimizing payment processing infrastructure for scalability.

- Implementing automated workflows for faster transaction processing.

- Training staff on best practices for peak period management.

- Collaborating with external partners to enhance transaction capacity.

10. What is your experience in collaborating with other departments, such as finance and customer service?

Effective collaboration is crucial for smooth operations. I thrive in cross-functional environments by:

- Establishing clear communication channels.

- Attending regular meetings and actively participating in discussions.

- Seeking input and sharing knowledge with other departments.

- Providing timely and accurate information to support decision-making.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Middle Card Tender.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Middle Card Tender‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Middle Card Tenders are responsible for a wide range of tasks in a casino. Their primary duty is to ensure the smooth and efficient operation of card games, such as blackjack, poker, and baccarat.

1. Table Management

Middle Card Tenders are responsible for setting up and maintaining the card tables. This includes ensuring that the tables are clean and well-lit, and that all of the necessary supplies are available.

- Set up and break down card tables

- Maintain a clean and organized work area

- Ensure that all necessary supplies are available

2. Game Management

Middle Card Tenders are responsible for dealing the cards and managing the game play. They must be familiar with the rules of each game, and they must be able to make quick decisions. They must also be able to handle difficult customers and situations.

- Deal cards and manage game play

- Enforce game rules and procedures

- Handle customer inquiries and complaints

3. Cash Handling

Middle Card Tenders are responsible for handling large amounts of cash. They must be able to count money accurately and quickly, and they must be able to follow proper cash handling procedures.

- Count money accurately and quickly

- Follow proper cash handling procedures

- Maintain a clean and organized work area

4. Customer Service

Middle Card Tenders must be able to provide excellent customer service. They must be friendly, courteous, and helpful. They must also be able to handle difficult customers and situations.

- Provide excellent customer service

- Be friendly, courteous, and helpful

- Handle difficult customers and situations

Interview Tips

In order to ace your interview for a Middle Card Tender position, it is important to be prepared. Here are a few tips to help you get ready:

1. Research the Casino

Before your interview, take some time to research the casino where you are applying. Learn about the casino’s history, its games, and its amenities. This will show the interviewer that you are interested in the position and that you have taken the time to learn more about the company.

2. Practice Your Math Skills

Middle Card Tenders deal with large amounts of cash on a daily basis. As a result, it is important to have strong math skills. Practice counting money quickly and accurately. You may also want to brush up on your basic math skills, such as addition, subtraction, multiplication, and division.

3. Practice Your Customer Service Skills

Middle Card Tenders must be able to provide excellent customer service. Practice your interpersonal skills and your ability to handle difficult customers. You may want to role-play with a friend or family member to get some practice.

4. Be Prepared to Talk About Your Experience

If you have any experience working in a casino, be sure to highlight this in your interview. Talk about your responsibilities and how they have prepared you for the Middle Card Tender position. If you don’t have any experience working in a casino, focus on your skills and experience that would be relevant to the role, such as your customer service skills or your ability to handle large amounts of cash.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Middle Card Tender interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!