Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Money Examiner position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

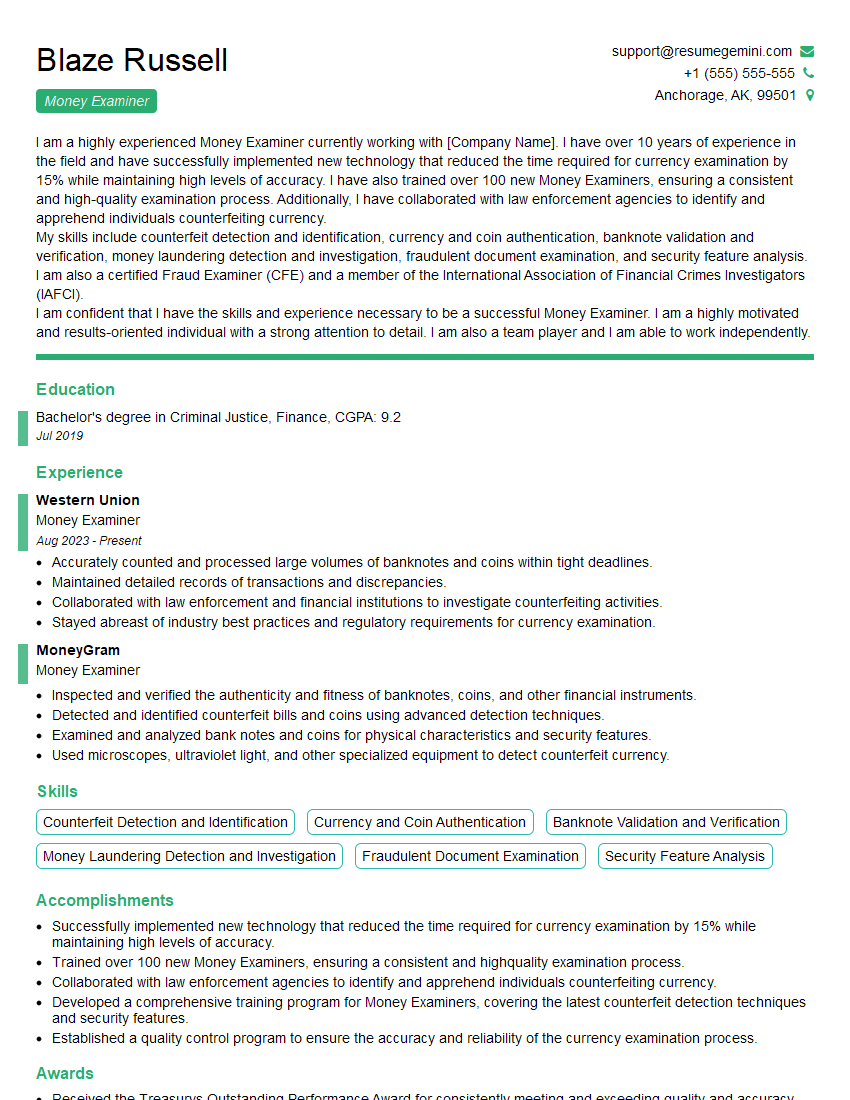

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Money Examiner

1. What are the key responsibilities of a Money Examiner?

As a Money Examiner, I would be responsible for:

- Examining and verifying the authenticity of currency, coins, and other forms of legal tender.

- Identifying and detecting counterfeit money and preventing its circulation.

- Training law enforcement and financial institutions on counterfeit detection techniques.

- Providing expert testimony in court cases involving counterfeit money.

2. Describe the different methods used to detect counterfeit money.

Physical Examination:

- Inspecting the paper quality, texture, and color.

- Examining the printing, including the sharpness of lines and the presence of microprinting.

- Checking for security features such as watermarks, holograms, and security threads.

Technological Examination:

- Using ultraviolet light to detect hidden fluorescent markings.

- Employing infrared spectroscopy to analyze the chemical composition of the paper.

- Applying microscopy to examine the fine details of the printing and security features.

3. What are the common techniques used to counterfeit money?

Counterfeiters often use various techniques to mimic genuine currency, including:

- Color copying: Reproducing the image of real money using high-quality copiers.

- Offset printing: Creating counterfeit bills using printing presses similar to those used for legitimate currency.

- Screen printing: Printing counterfeit money using a mesh screen that transfers ink onto the paper.

- Intaglio printing: Copying the raised printing found on genuine banknotes using special equipment.

4. How do you stay up-to-date with the latest counterfeiting trends?

To stay current with the evolving techniques used by counterfeiters, I:

- Attend industry conferences and seminars.

- Read specialized publications and journals.

- Collaborate with law enforcement agencies and other financial institutions.

- Participate in training programs provided by the government and central banks.

5. Describe a challenging case you encountered while examining money.

In a recent case, I was presented with a counterfeit $100 bill that was exceptionally well-crafted.

- The paper quality and texture were nearly indistinguishable from genuine currency.

- The printing was sharp and contained all the necessary security features.

After extensive examination, I discovered a subtle difference in the security thread. The counterfeit thread was slightly thinner and lacked the fluorescent properties of the genuine one.

6. How do you handle situations where large amounts of counterfeit money are involved?

When encountering substantial quantities of counterfeit currency, I:

- Secure the evidence and maintain a chain of custody.

- Notify law enforcement immediately.

- Cooperate with investigators to provide expert analysis and assist in the prosecution of the case.

7. What are the ethical considerations involved in your profession?

As a Money Examiner, I adhere to strict ethical principles:

- Maintaining confidentiality of sensitive information related to counterfeiting cases.

- Avoiding conflicts of interest and any actions that could compromise my objectivity.

- Upholding the integrity of the financial system by preventing the circulation of counterfeit money.

8. How do you contribute to the fight against money laundering?

In addition to detecting counterfeit money, I also contribute to the fight against money laundering through:

- Examining suspicious financial transactions and identifying patterns that may indicate money laundering activities.

- Providing training to financial institutions on money laundering detection techniques.

- Collaborating with law enforcement agencies to investigate and prosecute money laundering cases.

9. What is the impact of technology on the detection of counterfeit money?

Advancements in technology have significantly enhanced the detection of counterfeit money:

- Automated scanning devices can rapidly screen large amounts of currency for suspicious characteristics.

- Spectroscopic analysis can provide detailed information about the chemical composition of paper and ink.

- Digital imaging techniques allow for the precise comparison of genuine and counterfeit banknotes.

10. Describe your experience with training law enforcement and financial institutions.

I have extensive experience in providing training on counterfeit detection techniques to:

- Law enforcement officers, including police detectives and federal agents.

- Bank tellers, cashiers, and other financial institution employees.

- Retail store managers and staff.

My training sessions focus on:

- Recognizing the signs of counterfeit money.

- Using equipment and technology for counterfeit detection.

- Reporting and handling counterfeit currency appropriately.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Money Examiner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Money Examiner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Money Examiner, your primary responsibility will be to examine and verify the authenticity of currency. This involves inspecting banknotes and coins for signs of counterfeiting, detecting counterfeit notes or coins, and ensuring that all currency is genuine.

1. Examining Currency

You will be required to examine currency using a variety of techniques, including visual inspection, UV light detection, and magnetic ink detection. You will need to be able to identify genuine currency from counterfeit currency, and to spot any alterations or modifications to currency.

2. Verifying Authenticity

Once you have examined currency, you will need to verify its authenticity. This may involve checking the serial numbers, the security features, and the overall appearance of the currency. You will need to be able to make a quick and accurate determination of whether or not currency is genuine.

3. Detecting Counterfeit Currency

You will be responsible for detecting counterfeit currency. This may involve using a variety of techniques, including visual inspection, UV light detection, and magnetic ink detection. You will need to be able to identify the signs of counterfeit currency, and to distinguish between genuine and counterfeit currency.

4. Maintaining Records

You will be required to maintain records of all currency examined and verified. This may involve keeping a log of all currency examined, and recording any findings or detections of counterfeit currency.

Interview Tips

Preparing for a job interview can be a daunting task, but with the right preparation, you can increase your chances of success. Here are some tips to help you prepare for your job interview as a Money Examiner.

1. Research the Position

Before you go to your interview, take some time to research the position and the company. This will help you to understand the job requirements and to prepare for the questions that you may be asked.

2. Practice Your Answers

Once you have researched the position and the company, practice your answers to common interview questions. This will help you to feel more confident and prepared during your interview.

3. Dress Professionally

First impressions matter, so make sure to dress professionally for your interview. This means wearing a suit or other business attire.

4. Be On Time

Punctuality is important, so make sure to arrive for your interview on time. This shows that you are respectful of the interviewer’s time.

5. Be Yourself

The most important thing is to be yourself during your interview. This will help the interviewer to get a sense of who you are and what you have to offer.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Money Examiner role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.