Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Money Manager position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

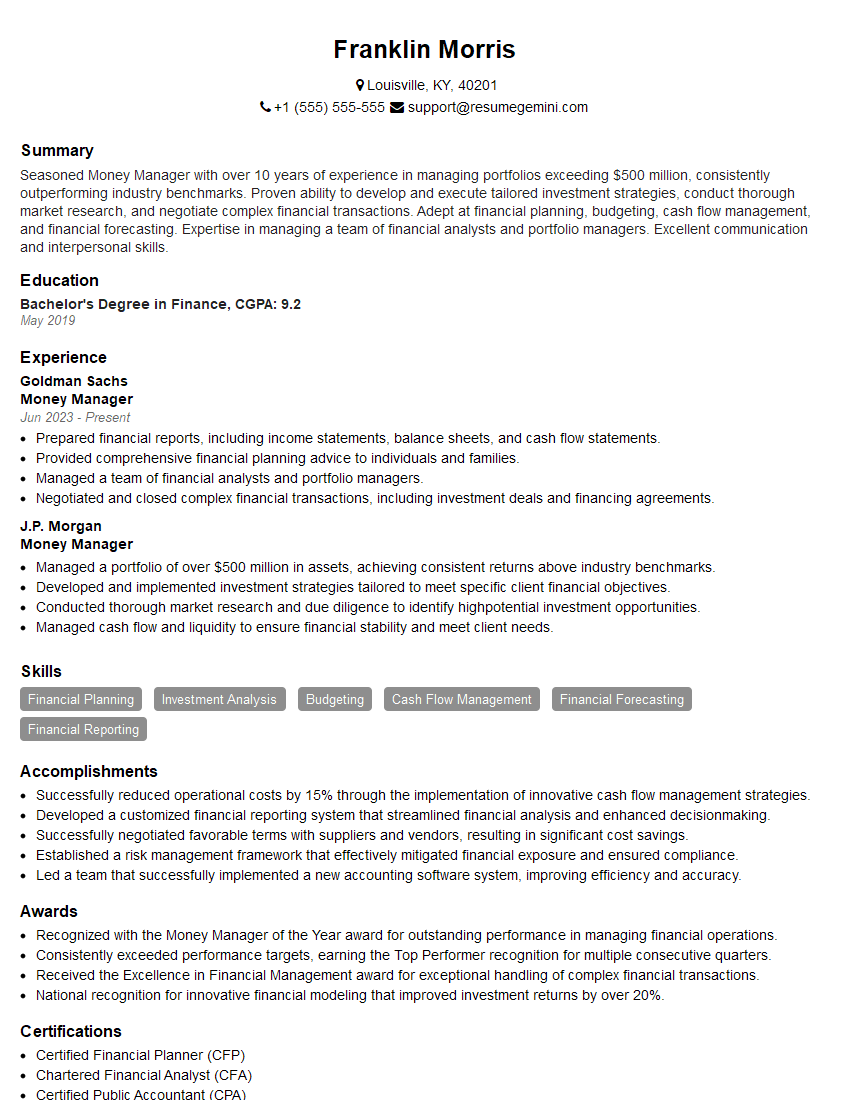

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Money Manager

1. Describe the key elements of a comprehensive cash management strategy?

A comprehensive cash management strategy should include the following key elements:

- Cash forecasting: Accurately predicting future cash flows is critical for effective cash management.

- Investment strategy: Determining the best ways to invest excess cash while maintaining liquidity and maximizing returns.

- Credit management: Establishing and managing credit lines to ensure access to funding when needed.

- Payment and collection strategies: Optimizing processes for timely payments and collections.

- Contingency planning: Developing plans to address unexpected events that could impact cash flow.

2. What are the different types of financial instruments used in cash management?

Short-term investments:

- Money market accounts

- Commercial paper

- Certificates of deposit (CDs)

Long-term investments:

- Bonds

- Stocks

- Real estate

3. How do you calculate the weighted average cost of capital (WACC)?

WACC is calculated using the following formula:

WACC = (E / (D + E)) * RE + (D / (D + E)) * RD * (1 – T)

- Where:

- E is the market value of equity

- D is the market value of debt

- RE is the cost of equity

- RD is the cost of debt

- T is the corporate tax rate

4. What are the advantages and disadvantages of using a lockbox system?

Advantages:

- Accelerates cash collection

- Reduces the risk of lost or stolen checks

- Provides better control over cash receipts

Disadvantages:

- Can be expensive to set up and maintain

- May not be suitable for all businesses

- Can lead to increased bank fees

5. How do you manage foreign exchange risk?

There are a number of ways to manage foreign exchange risk, including:

- Forward contracts: Locking in an exchange rate for a future transaction.

- Options: Giving the option to buy or sell a currency at a specified exchange rate.

- Currency swaps: Exchanging one currency for another at a specified exchange rate.

- Hedging: Using financial instruments to offset the risk of exchange rate fluctuations.

6. What are the key metrics for measuring cash management performance?

- Cash conversion cycle

- Days sales outstanding (DSO)

- Days payable outstanding (DPO)

- Inventory turnover ratio

- Return on invested capital (ROIC)

7. How do you stay up-to-date with the latest trends in cash management?

I stay up-to-date with the latest trends in cash management by:

- Reading industry publications and attending conferences

- Networking with other cash management professionals

- Taking continuing education courses

8. What are the ethical considerations that money managers must be aware of?

Money managers must be aware of the following ethical considerations:

- Fiduciary duty: Acting in the best interests of their clients

- Conflicts of interest: Avoiding situations where their personal interests could conflict with the interests of their clients

- Market manipulation: Refraining from engaging in activities that could artificially affect the price of securities

- Insider trading: Using non-public information to make investment decisions

9. How do you build and maintain strong relationships with clients?

I build and maintain strong relationships with clients by:

- Communicating regularly and effectively

- Being responsive to their needs

- Providing personalized service

- Going the extra mile

10. What are your career goals?

My career goals are to:

- Continue to develop my skills and knowledge in cash management

- Become a recognized expert in the field

- Manage a large and successful cash management team

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Money Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Money Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Money Manager is responsible for managing the financial affairs of individuals or organizations. Their primary role is to safeguard the client’s financial interests and ensure the effective growth of their financial assets.

1. Financial Planning and Budgeting

Developing comprehensive financial plans tailored to the client’s needs and goals.

- Conduct thorough financial assessments, considering risk tolerance, time horizon, and cash flow requirements.

- Forecast financial scenarios and recommend appropriate investment strategies.

2. Investment Management

Managing client investments to achieve their financial objectives.

- Research and select investment portfolios that align with the client’s risk profile and return expectations.

- Monitor market trends and make adjustments to the portfolio as needed.

3. Tax Planning and Compliance

Ensuring compliance with tax regulations and minimizing tax liability.

- Prepare and file tax returns on behalf of clients.

- Provide guidance on tax-advantaged investments and strategies.

4. Estate Planning

Assisting clients with estate planning and wealth transfer strategies.

- Create and review wills, trusts, and other estate planning documents.

- Educate clients on probate and inheritance tax laws.

Interview Tips

Preparing for an interview for a Money Manager position requires thorough research and a well-crafted strategy. Here are some tips to help you ace the interview:

1. Research the Organization and the Position

Before the interview, take the time to thoroughly research the organization and the Money Manager position. Understand their business model, investment philosophy, and any specific requirements for the role.

2. Practice Your Answers to Common Interview Questions

Prepare for common interview questions such as “Tell me about your experience in financial planning” or “How do you manage risk in your investment strategies?” Practice answering these questions concisely and effectively, highlighting your knowledge and skills.

3. Showcase Your Problem-Solving Abilities

Money Managers must be able to analyze complex financial situations and provide effective solutions. Share examples from your experience where you successfully solved a financial problem or helped a client achieve their financial goals.

4. Emphasize Your Communication and Interpersonal Skills

Money Managers work closely with clients and other professionals. Emphasize your ability to communicate effectively, build strong relationships, and clearly explain financial concepts.

5. Be Prepared to Discuss Your Fees and Services

Money Managers typically charge fees for their services. Be prepared to discuss your fee structure and explain the value you offer to potential clients.

6. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally and arrive on time for your interview. This demonstrates your respect for the interviewers and the organization.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Money Manager interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.