Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Money Order Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

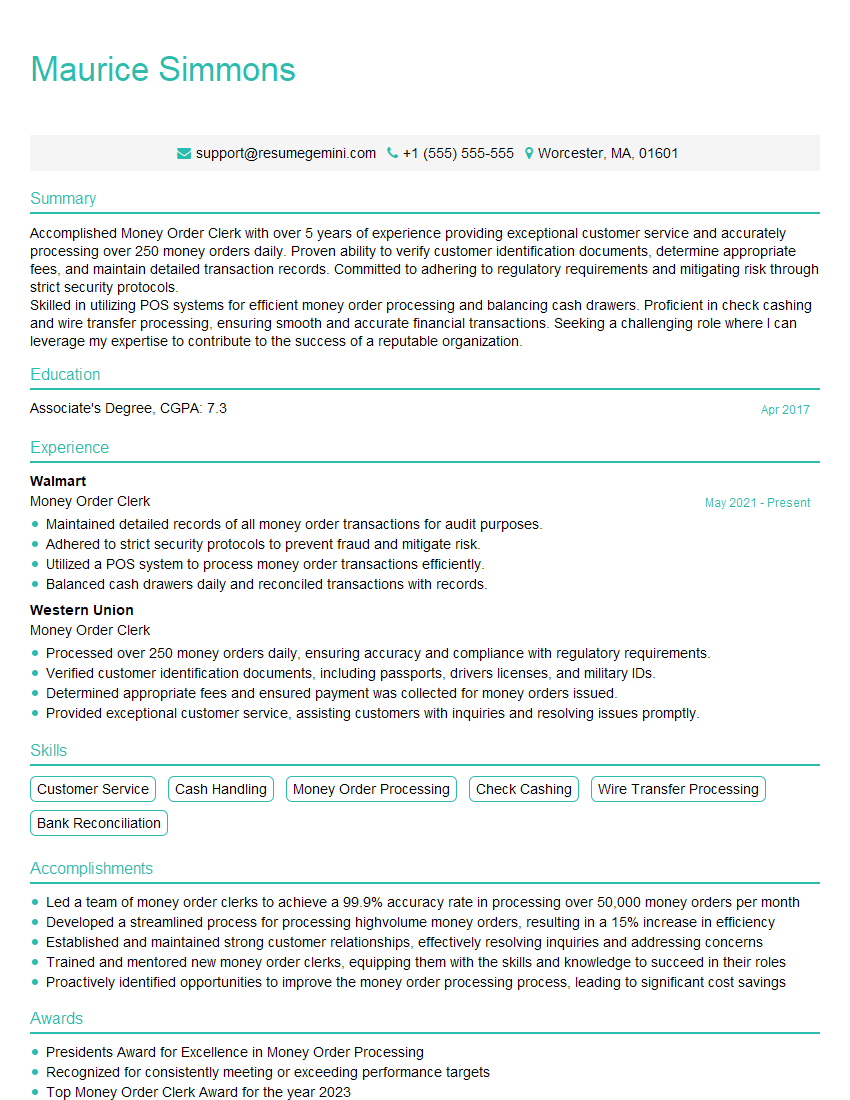

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Money Order Clerk

1. Elaborate on the key responsibilities associated with the Money Order Clerk position, and how your skills align with these duties?

- Process and issue money orders, ensuring all necessary details are recorded accurately and securely.

- Verify customer identification and ensure compliance with regulations to prevent fraud and money laundering.

- Maintain up-to-date knowledge of money order procedures and regulations.

- Handle customer inquiries and provide excellent customer service.

- Reconcile cash transactions and ensure accuracy of financial records.

2. Describe your understanding of the Fraud Prevention measures implemented in money order transactions. How do you stay vigilant in detecting potential fraudulent activities?

Identification Verification

- Requesting government-issued IDs, such as passports or driving licenses, to verify the customer’s identity.

- Checking for inconsistencies between the customer’s appearance and the ID presented.

- Observing the customer’s behavior and demeanor for any signs of suspicious activity.

Transaction Monitoring

- Flagging transactions that exceed certain thresholds or involve unusual patterns.

- Reviewing customer history to identify potential red flags or previous fraudulent activities.

- Reporting suspicious transactions to supervisors or law enforcement as necessary.

3. In a scenario where a customer presents a damaged or incomplete money order, explain the steps you would take to resolve the issue promptly and accurately?

- Calmly assess the situation and listen to the customer’s concerns.

- Request a valid ID from the customer and verify their identity.

- Examine the damaged money order and document its condition thoroughly.

- Follow established protocols for handling damaged or incomplete money orders.

- If the money order is valid and redeemable, process a new one and void the damaged one.

- If the money order is not redeemable due to damage or incomplete information, explain the situation to the customer and provide guidance on how to proceed.

4. Explain the importance of maintaining confidentiality and protecting sensitive customer information in your role as a Money Order Clerk?

- Protecting customer privacy is crucial to build trust and maintain the integrity of financial transactions.

- Adhering to privacy regulations and company policies to safeguard sensitive information, such as customer names, addresses, and financial details.

- Only sharing information with authorized individuals on a need-to-know basis.

- Using secure systems and procedures to prevent unauthorized access or data breaches.

- Reporting any potential security breaches or suspicious activities promptly.

5. How do you handle situations when customers are irate or confrontational? Provide an example of a challenging interaction and how you managed to resolve it?

- Maintain a calm and professional demeanor, even under pressure.

- Actively listen to the customer’s concerns and try to understand their perspective.

- Avoid interrupting or becoming defensive, and instead show empathy and understanding.

- Offer clear and concise explanations, and be willing to provide solutions that meet the customer’s needs.

- If necessary, escalate the issue to a supervisor or manager to seek support or provide additional assistance.

6. What is your approach to staying up-to-date on changes in regulations and industry best practices related to money order transactions?

- Regularly review updates from regulatory bodies and financial institutions.

- Attend industry conferences and webinars to gain insights from experts.

- Read trade publications and online resources to stay informed about new technologies and trends.

- Participate in training programs and workshops offered by the company or external providers.

- Seek guidance from experienced colleagues and supervisors.

7. How do you prioritize and manage multiple tasks in a fast-paced environment, ensuring accuracy and efficiency?

- Utilize time management techniques, such as setting priorities and creating to-do lists.

- Break down complex tasks into smaller, manageable steps.

- Delegate tasks to colleagues if necessary, while ensuring clear communication and accountability.

- Leverage technology and automation to streamline processes and improve efficiency.

- Stay focused and avoid distractions, maintaining accuracy and attention to detail.

8. What motivates you to perform at your best as a Money Order Clerk?

- The opportunity to provide excellent customer service and contribute to the financial well-being of individuals and businesses.

- The challenge of maintaining accuracy and security in a fast-paced financial environment.

- The importance of preventing fraud and upholding the integrity of financial transactions.

- The desire to continuously improve and stay up-to-date with industry best practices.

- The chance to work as part of a team and contribute to the success of the organization.

9. Describe a situation where you successfully handled a customer complaint. What approach did you take, and what was the outcome?

- Listened actively to the customer’s concerns and demonstrated empathy.

- Investigated the issue promptly and thoroughly to gather facts.

- Presented clear and concise explanations, acknowledging any errors or misunderstandings.

- Offered a fair and reasonable solution that met the customer’s needs within company guidelines.

- Followed up with the customer to ensure satisfaction and build rapport.

10. How do you handle disagreements or conflicts with colleagues in a professional and respectful manner?

- Approach discussions with a positive and open mind.

- Actively listen to different perspectives and try to understand the underlying reasons for the disagreement.

- Communicate ideas and opinions clearly and respectfully, without interrupting or becoming defensive.

- Seek common ground and work together to find mutually acceptable solutions.

- If necessary, involve a supervisor or manager to facilitate a constructive dialogue.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Money Order Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Money Order Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Money Order Clerks perform a variety of tasks related to processing and issuing money orders within a financial institution or other organization. Their primary responsibilities include:

1. Processing Money Order Transactions

Receive and review money order applications from customers, ensuring accuracy and completeness of all required information.

- Issue money orders for specified amounts, following established procedures.

- Handle cash and other forms of payment, including personal checks and debit cards.

2. Maintaining Records and Reconciling Accounts

Maintain accurate and up-to-date records of all money order transactions, including issuance, payment, and redemption.

- Reconcile daily transactions and ensure that all accounts are balanced.

- Report any discrepancies or suspicious activities to supervisors.

3. Providing Customer Service

Provide excellent customer service by answering inquiries, resolving complaints, and assisting customers with money order-related issues.

- Explain money order procedures, fees, and regulations.

- Maintain a positive and professional demeanor in all interactions with customers.

4. Ensuring Compliance and Security

Follow all applicable laws, regulations, and policies related to money order processing.

- Implement security measures to protect sensitive customer information and prevent fraud.

- Adhere to anti-money laundering and know-your-customer (KYC) regulations.

Interview Tips

To prepare for a Money Order Clerk interview, consider the following tips:

1. Research the Company and Position

Familiarize yourself with the financial institution or organization offering the position. Understand their products, services, and reputation.

- Review the job description carefully and identify the key responsibilities and qualifications.

- Research industry trends and best practices related to money order processing.

2. Highlight Relevant Skills and Experience

Emphasize your experience in financial services, particularly in money order processing or related roles.

- Showcase your skills in accuracy, attention to detail, and customer service.

- Provide specific examples of how you have successfully handled money order transactions.

3. Practice Common Interview Questions

Prepare for common interview questions related to money order processing, customer service, and compliance.

- Anticipate questions about your understanding of money order procedures and regulations.

- Practice answering questions about your ability to detect and prevent fraud.

4. Dress Professionally and Arrive Punctually

Make a positive impression by dressing professionally and arriving on time for your interview.

- Choose attire that is appropriate for a financial setting.

- Arrive early to show respect for the interviewer’s time.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Money Order Clerk role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.