Are you gearing up for a career in Money Room Supervisor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Money Room Supervisor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

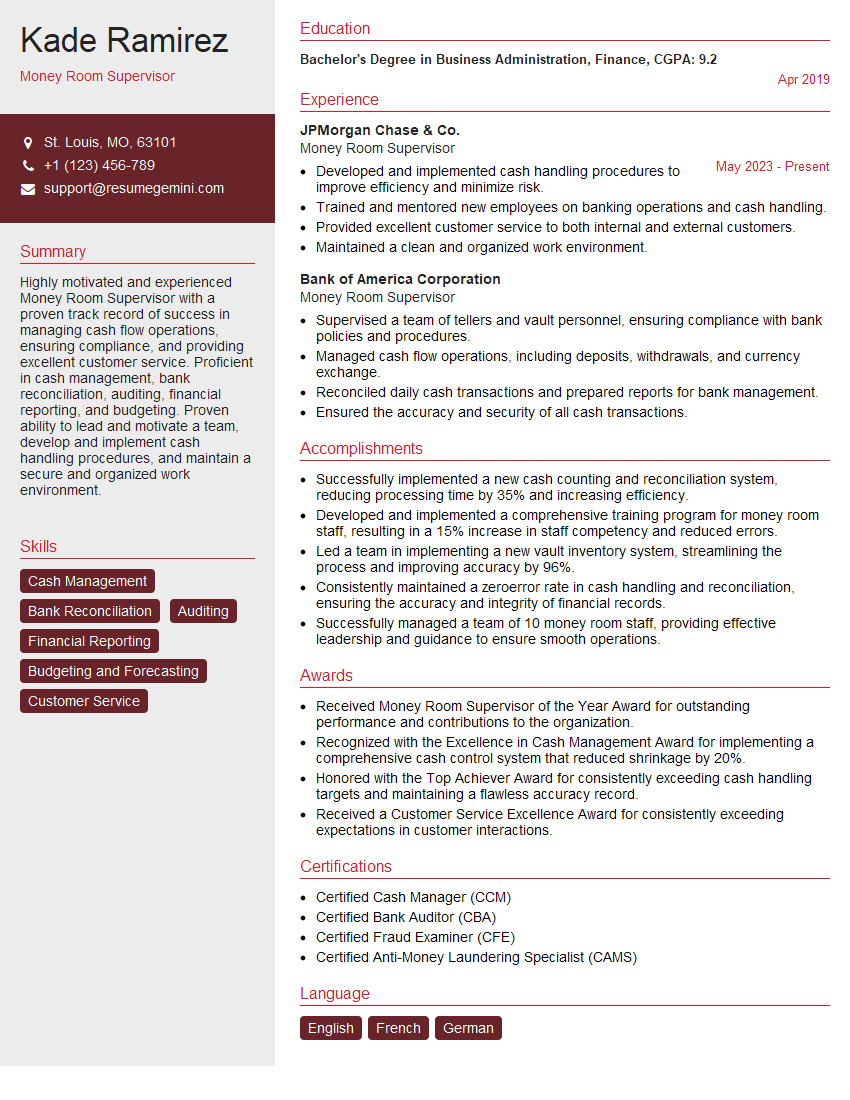

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Money Room Supervisor

1. Describe the key responsibilities and duties of a Money Room Supervisor?

The Money Room Supervisor is responsible for the overall management and supervision of the money room, including cash handling, cash reconciliation, and cash forecasting.

- Supervise and manage a team of cash handlers and tellers

- Ensure that all cash handling procedures are followed correctly

- Reconcile cash balances on a daily basis

- Forecast cash needs and ensure that there is sufficient cash on hand

- Maintain a clean and organized money room

- Train and develop staff on cash handling procedures

- Investigate any discrepancies or errors in cash handling

- Work closely with other departments, such as accounting and operations, to ensure that cash flow is managed effectively

2. What are the essential skills and qualifications required for a Money Room Supervisor?

A Money Room Supervisor should have a strong understanding of cash handling procedures and cash management principles.

- Strong leadership and management skills

- Excellent communication and interpersonal skills

- Proven ability to supervise and motivate a team

- In-depth knowledge of cash handling procedures and cash management principles

- Experience in a cash-handling environment

- Ability to work independently and as part of a team

- Ability to work under pressure and meet deadlines

- Strong analytical and problem-solving skills

- Excellent attention to detail

- Ability to maintain confidentiality

3. What are the key challenges faced by Money Room Supervisors?

Money Room Supervisors face a number of challenges, including managing cash flow, ensuring compliance with regulations, and preventing fraud.

- Managing cash flow to ensure that there is sufficient cash on hand to meet demand

- Ensuring compliance with all relevant regulations

- Preventing fraud and theft

- Motivating and retaining a team of cash handlers

- Keeping up with changes in technology and regulations

4. How would you handle a situation where there is a discrepancy in the cash balance?

If there is a discrepancy in the cash balance, I would first try to identify the source of the error. I would then take steps to correct the error and prevent it from happening again.

- Identify the source of the error

- Correct the error

- Prevent the error from happening again

5. How would you implement new cash handling procedures?

To implement new cash handling procedures, I would first communicate the new procedures to the team. I would then provide training on the new procedures and answer any questions that the team may have.

- Communicate the new procedures to the team

- Provide training on the new procedures

- Answer any questions that the team may have

- Monitor the implementation of the new procedures

- Make adjustments to the new procedures as needed

6. How would you motivate and retain a team of cash handlers?

To motivate and retain a team of cash handlers, I would create a positive and supportive work environment. I would also provide opportunities for professional development and growth.

- Create a positive and supportive work environment

- Provide opportunities for professional development and growth

- Recognize and reward employee achievements

- Listen to employee feedback and address their concerns

- Empower employees to make decisions and take ownership of their work

7. What are the key trends in the cash management industry?

The cash management industry is constantly evolving. Some of the key trends include the increasing use of technology, the growing demand for mobile banking, and the increasing focus on security.

- Increasing use of technology

- Growing demand for mobile banking

- Increasing focus on security

- Consolidation of the industry

- Growth of alternative payment methods

8. How would you stay up-to-date on the latest developments in the cash management industry?

To stay up-to-date on the latest developments in the cash management industry, I would read industry publications, attend conferences, and network with other professionals.

- Read industry publications

- Attend conferences

- Network with other professionals

- Take online courses

- Join industry associations

9. What are your strengths and weaknesses as a Money Room Supervisor?

My strengths as a Money Room Supervisor include my strong leadership and management skills, my excellent communication and interpersonal skills, and my proven ability to supervise and motivate a team.

My weakness is that I am relatively new to the cash management industry. However, I am eager to learn and I am confident that I can quickly develop the necessary knowledge and skills.

10. Why are you interested in this position?

I am interested in this position because I am passionate about cash management and I am confident that I have the skills and experience necessary to be successful in this role.

I am also excited about the opportunity to work with a team of talented professionals and to contribute to the success of your organization.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Money Room Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Money Room Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Money Room Supervisor is responsible for overseeing and managing the daily operations of the money room, ensuring accuracy and compliance with all policies and procedures.

1. Financial Management

The Supervisor is directly accountable for the preparation and maintenance of all financial records, including cash flow, bank balances, and daily cash reports.

- Prepare and review daily and monthly financial reports.

- Reconcile daily cash transactions and ensure accuracy.

- Monitor cash flow and maintain optimal cash levels.

- Approve and process cash disbursements and deposits.

2. Cash Handling and Security

The Supervisor is responsible for the safe and secure handling of all cash transactions within the money room.

- Establish and enforce cash handling procedures.

- Supervise and train staff on cash handling best practices.

- Monitor and maintain security measures, including surveillance cameras and access control.

- Conduct regular audits and inspections to ensure compliance.

3. Team Management and Supervision

The Supervisor leads and supervises a team of Money Room Assistants, providing guidance and support.

- Hire, train, and develop team members.

- Delegate tasks and responsibilities effectively.

- Provide ongoing performance feedback and coaching.

- Maintain a positive and productive work environment.

4. Compliance and Regulations

The Supervisor is responsible for ensuring that all money room operations comply with applicable laws and regulations.

- Stay up-to-date on regulatory changes and industry best practices.

- Implement and enforce compliance policies and procedures.

- Conduct training and awareness sessions for team members.

- Respond to audits and inquiries from regulatory agencies.

Interview Tips

To ace your interview for a Money Room Supervisor position, consider the following tips and hacks:

1. Research the Company and Role

Thoroughly research the company, its industry, and the specific responsibilities of the Money Room Supervisor. Demonstrate your knowledge and interest during the interview.

- Visit the company website and social media pages.

- Review the job description thoroughly and identify keywords.

- Prepare specific examples of your experience and skills that align with the job requirements.

2. Highlight Your Financial Management Skills

Emphasize your experience in managing financial transactions, including cash handling, bank reconciliations, and cash flow analysis. Provide concrete examples of your accuracy and attention to detail.

- Quantify your accomplishments, using specific metrics and results.

- Describe how you have implemented and improved financial processes.

- Discuss your understanding of internal controls and compliance requirements.

3. Showcase Your Team Leadership Abilities

Demonstrate your ability to lead and motivate a team. Share experiences where you have effectively delegated tasks, provided performance feedback, and fostered a positive work environment.

- Emphasize your communication, interpersonal, and problem-solving skills.

- Provide examples of how you have successfully managed team dynamics and resolved conflicts.

- Discuss your strategies for training and developing staff.

4. Prepare for Technical Questions

Expect technical questions about money room operations, cash handling procedures, and security measures. Be prepared to discuss your knowledge of these topics and how you would handle various scenarios.

- Study common cash handling and security practices.

- Research applicable laws and regulations related to money room operations.

- Think through hypothetical situations that may arise and prepare your responses.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Money Room Supervisor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.