Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Mortgage Accounting Clerk interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Mortgage Accounting Clerk so you can tailor your answers to impress potential employers.

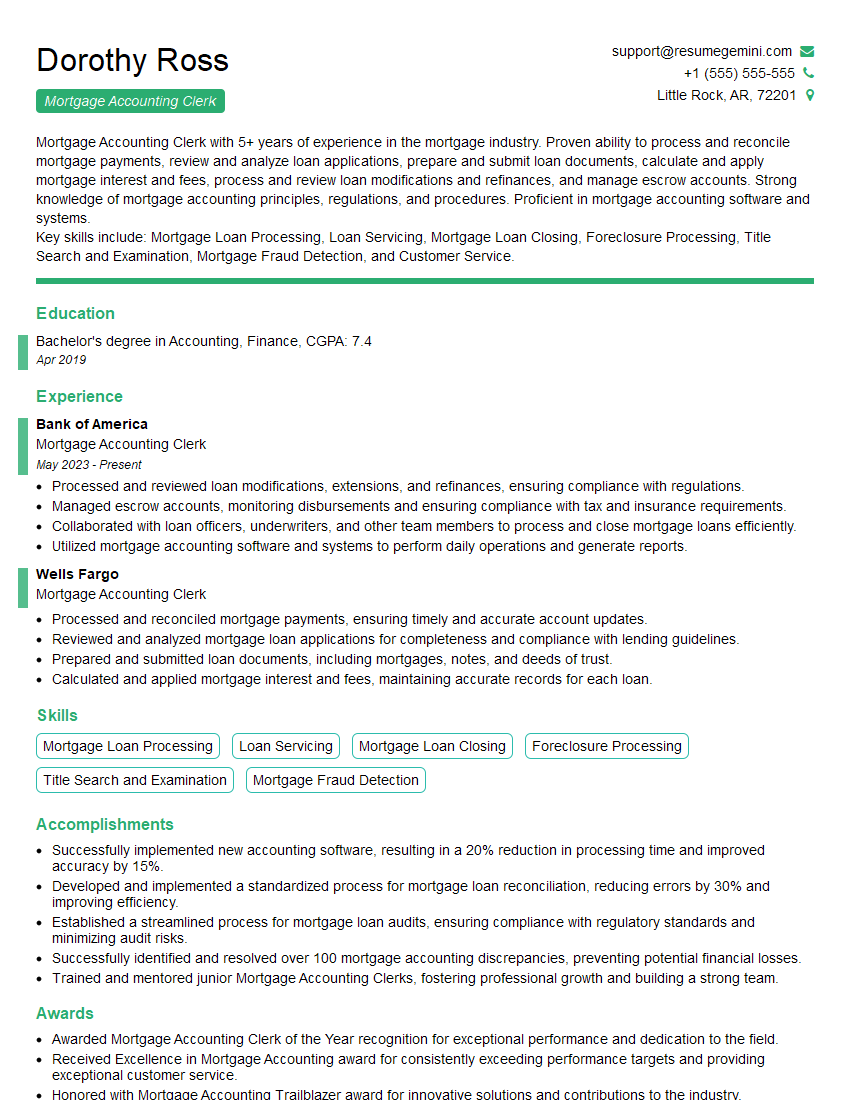

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mortgage Accounting Clerk

1. Explain the process of recording mortgage payments?

- When a mortgage payment is received, it is initially recorded as a debit to the Cash account and a credit to the Unearned Revenue account.

- As the mortgage is paid down over time, the Unearned Revenue account is reduced and the Interest Income account is increased.

- The principal portion of the payment is recorded as a debit to the Mortgage Loan account.

2. What are the different types of mortgage loans and their accounting treatments?

Fixed-Rate Mortgages

- The interest rate on a fixed-rate mortgage remains the same for the life of the loan.

- The monthly payments are fixed and do not change.

Adjustable-Rate Mortgages (ARMs)

- The interest rate on an ARM can change periodically, usually every six months or one year.

- The monthly payments can also change, depending on the interest rate.

3. How do you handle mortgage prepayments?

- When a mortgagor prepays a mortgage, the prepayment is recorded as a debit to the Mortgage Loan account and a credit to the Prepaid Expense account.

- As the prepaid expense is used up, it is amortized to the Interest Income account.

4. What are the different types of mortgage servicing fees and how are they accounted for?

- Mortgage servicing fees are typically charged by the lender to cover the costs of servicing the mortgage.

- The fees can be either fixed or variable, and they can be paid upfront or over the life of the loan.

- Mortgage servicing fees are recorded as a debit to the Servicing Fees Income account and a credit to the Unearned Revenue account.

5. How do you account for mortgage foreclosures?

- When a mortgage is foreclosed, the lender takes possession of the property.

- The lender then sells the property and uses the proceeds to pay off the mortgage balance.

- Any remaining proceeds are distributed to the mortgagor.

- The foreclosure process is recorded as a loss on the lender’s books.

6. What are the key internal controls for mortgage accounting?

- Segregation of duties

- Proper authorization of transactions

- Reconciliation of bank statements

- Periodic reviews of mortgage servicing fees

7. What are the current trends in mortgage accounting?

- The use of electronic payment systems

- The growth of non-traditional mortgage products

- The increasing use of data analytics

8. What are the challenges of mortgage accounting?

- The complexity of mortgage transactions

- The need to comply with complex regulations

- The impact of technology on mortgage accounting

9. What are the qualities of a successful mortgage accounting clerk?

- Strong analytical skills

- Excellent communication skills

- Attention to detail

- Knowledge of mortgage accounting principles

10. What is your favorite aspect of mortgage accounting?

I enjoy the challenge of working with complex transactions and the opportunity to learn about the mortgage industry.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mortgage Accounting Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mortgage Accounting Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Mortgage Accounting Clerk is entrusted with the responsibility of efficiently managing the financial operations related to mortgage loans. Their primary duties include:

1. Loan Processing

Initiating and processing loan applications by meticulously reviewing documentation, verifying income and assets, and ensuring compliance with established guidelines.

- Accurately entering loan data into the company’s loan origination system.

- Preparing loan documents, such as promissory notes, mortgages, and closing statements.

2. Loan Servicing

Managing loan accounts by monitoring payments, calculating interest, and maintaining accurate records.

- Processing loan payments, ensuring timely and accurate posting to customer accounts.

- Calculating and disbursing loan interest payments to investors.

- Maintaining loan files and ensuring compliance with regulatory requirements.

3. Collections and Default Management

Managing delinquent loans by contacting borrowers, negotiating payment plans, and initiating foreclosure proceedings if necessary.

- Identifying and following up on delinquent accounts.

- Negotiating payment arrangements and restructuring loans.

- Coordinating with legal counsel and outside collection agencies.

4. Reporting and Analysis

Preparing reports on loan performance, delinquencies, and other metrics to support management decision-making.

- Analyzing loan data to identify trends and areas for improvement.

- Providing financial information to internal and external stakeholders.

Interview Tips

To prepare for a Mortgage Accounting Clerk interview, consider the following tips:

1. Research the Company

Visit the company’s website and social media pages to learn about their culture, values, and recent developments. This will demonstrate your interest in the position and the company.

- Research the company’s loan products and services.

- Review industry news and trends to stay informed about the mortgage market.

2. Highlight Your Skills

Emphasize your qualifications and experience in the areas of loan processing, loan servicing, collections, and reporting. Use specific examples to showcase your abilities.

- Quantify your accomplishments, such as the number of loans processed or the amount of delinquent accounts collected.

- Describe your experience using relevant software, such as loan origination systems and accounting software.

3. Practice Common Interview Questions

Prepare for common interview questions by practicing your answers in advance. This will boost your confidence and enable you to present yourself clearly and effectively.

- Example Outline:

- Tell us about your experience in loan processing.

- Describe your role in managing delinquent loans.

- How do you stay up-to-date with industry regulations?

4. Dress Professionally

First impressions matter. Dress appropriately for the interview, typically consisting of business attire such as a suit or dress pants and a button-down shirt.

- Ensure your attire is clean, pressed, and fits well.

- Consider wearing neutral colors and avoiding excessive jewelry or accessories.

5. Be Enthusiastic and Positive

Convey your enthusiasm for the role and the mortgage industry. A positive attitude and a genuine interest in the position will make a lasting impression on the interviewer.

- Smile and maintain eye contact during the interview.

- Ask thoughtful questions at the end of the interview to demonstrate your engagement.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Mortgage Accounting Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!