Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Mortgage Banker interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Mortgage Banker so you can tailor your answers to impress potential employers.

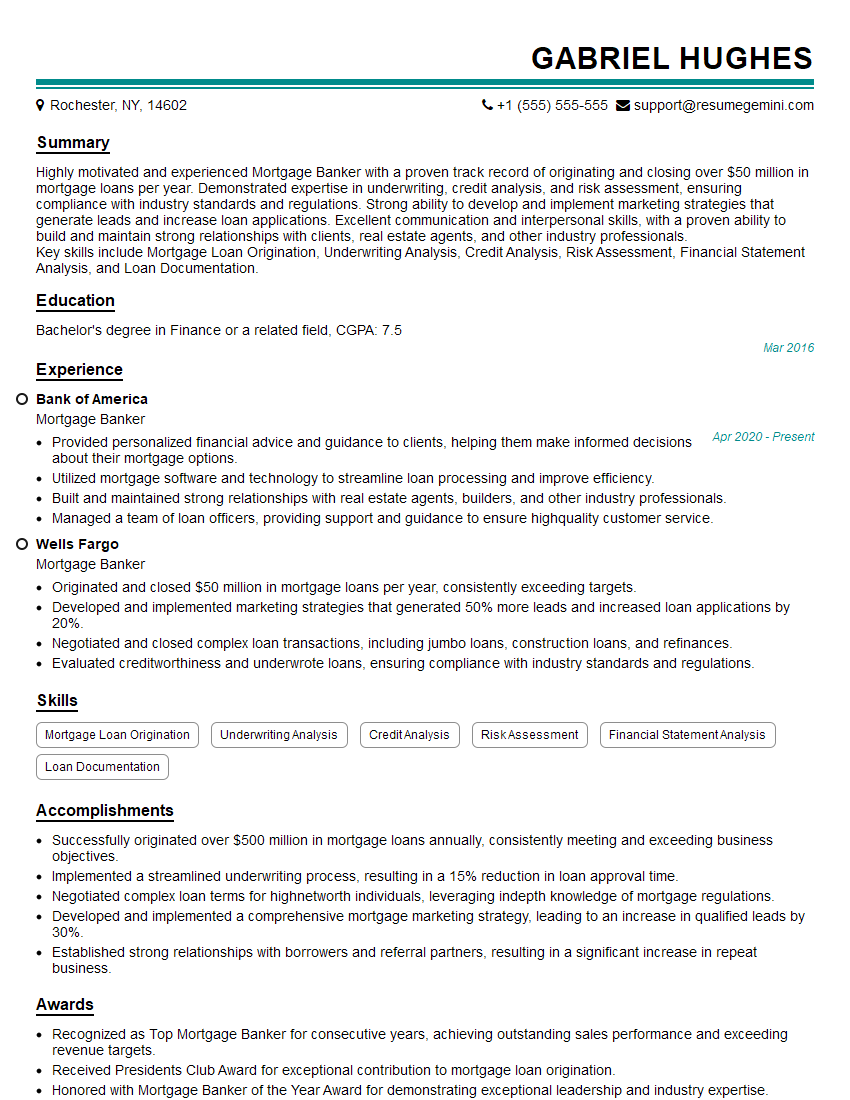

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mortgage Banker

1. What is the difference between a fixed-rate mortgage and an adjustable-rate mortgage?

A fixed-rate mortgage has an interest rate that remains the same for the life of the loan. An adjustable-rate mortgage (ARM) has an interest rate that can change periodically, typically based on an index such as the prime rate. ARMs often have lower initial interest rates than fixed-rate mortgages, but the interest rate can increase over time, which can make them more expensive in the long run.

2. What are the different types of mortgage loans available?

Government-insured loans

- Federal Housing Administration (FHA) loans

- Veterans Administration (VA) loans

- United States Department of Agriculture (USDA) loans

Conventional loans

- Conforming loans

- Non-conforming loans (also known as jumbo loans)

3. How do you determine a borrower’s eligibility for a mortgage?

To determine a borrower’s eligibility for a mortgage, lenders consider the following factors:

- Credit score

- Debt-to-income ratio

- Income and employment history

- Assets and liabilities

- Property type and location

- Loan amount and terms

4. What are the different steps involved in the mortgage process?

- Pre-approval

- Loan application

- Loan underwriting

- Loan approval

- Closing

5. What are some of the challenges that mortgage bankers face in today’s market?

- Rising interest rates

- Increased competition

- Regulatory changes

- Economic uncertainty

- Technology advancements

6. What are the qualities of a successful mortgage banker?

- Strong sales and marketing skills

- Excellent communication and interpersonal skills

- Deep knowledge of the mortgage industry

- Ability to build and maintain relationships

- Attention to detail and accuracy

7. How do you stay up-to-date on the latest trends in the mortgage industry?

- Attend industry conferences and webinars

- Read industry publications

- Network with other mortgage professionals

- Take continuing education courses

8. What is your favorite part of being a mortgage banker?

My favorite part of being a mortgage banker is helping people achieve their dream of homeownership. I enjoy working with borrowers to find the best loan program for their needs and helping them navigate the mortgage process. It is very rewarding to see the joy on a borrower’s face when they close on their new home.

9. What is your biggest challenge as a mortgage banker?

My biggest challenge as a mortgage banker is dealing with the constantly changing regulatory environment. The mortgage industry is heavily regulated, and the rules and regulations are constantly changing. This can make it difficult to keep up with the latest requirements and ensure that my clients are getting the best possible loans.

10. What are your career goals?

My career goal is to become a top-producing mortgage banker. I want to build a successful business and help as many people as possible achieve their dream of homeownership. I am also interested in getting involved in the mortgage industry and helping to shape the future of the industry.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mortgage Banker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mortgage Banker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Mortgage Bankers are the financial professionals in charge of securing loans for homebuyers. They evaluate borrowers’ creditworthiness, determine interest rates, and guide them through the loan application process. Key job responsibilities include:

Originate Mortgage Loans

Interviewers will ask about your experience in originating mortgage loans. Highlight your expertise in assessing borrowers’ financial situations, determining loan eligibility, and guiding them through the loan application process.

- Qualify borrowers by evaluating their credit history, income, and assets.

- Determine interest rates and loan terms based on borrower’s creditworthiness.

- Prepare and submit loan applications to lenders.

Analyze Market Trends

Interviewers will assess your understanding of mortgage market trends. Showcase your ability to track interest rate fluctuations, economic conditions, and changes in government regulations.

- Monitor interest rate trends and economic conditions.

- Research and stay informed about government regulations and policies affecting the mortgage industry.

- Identify and capitalize on market opportunities.

Develop and Maintain Client Relationships

Mortgage Bankers rely heavily on building and maintaining relationships with clients and referral partners. Emphasize your interpersonal skills, communication abilities, and customer service orientation.

- Build and maintain relationships with real estate agents, builders, and other professionals.

- Provide excellent customer service to borrowers throughout the loan process.

- Generate and nurture leads through networking and marketing activities.

Manage and Grow Loan Portfolio

Interviewers will inquire about your experience in managing loan portfolios. Exhibit your proficiency in tracking loan performance, mitigating risk, and ensuring compliance with regulations.

- Track loan performance and identify potential problems.

- Implement risk management strategies to mitigate potential losses.

- Ensure compliance with applicable laws and regulations.

Interview Preparation Tips

To ace a Mortgage Banker interview, consider the following tips.

Research the Industry and Company

Demonstrate your knowledge of the mortgage industry and the specific company you’re applying to. Research market trends, company culture, and recent news. This shows your interest and enthusiasm for the role.

Practice Your Pitch

Prepare a concise and compelling pitch that highlights your skills and experience. Tailor it to the job description, emphasizing how your qualifications meet the company’s needs.

Quantify Your Accomplishments

Use specific examples and numbers to quantify your accomplishments. For instance, instead of saying “I developed a high-performing loan portfolio,” say “I managed a loan portfolio of $100 million, resulting in a 98% success rate.”

Prepare for Technical Questions

Be prepared to answer technical questions about mortgage products, underwriting guidelines, and industry regulations. Review industry publications and consult with professionals in the field.

Ask Thoughtful Questions

Asking insightful questions at the end of the interview shows your engagement and interest in the role. Prepare questions about the company’s growth plans, market outlook, and opportunities for professional development.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Mortgage Banker role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.