Are you gearing up for a career in Mortgage Consultant? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Mortgage Consultant and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

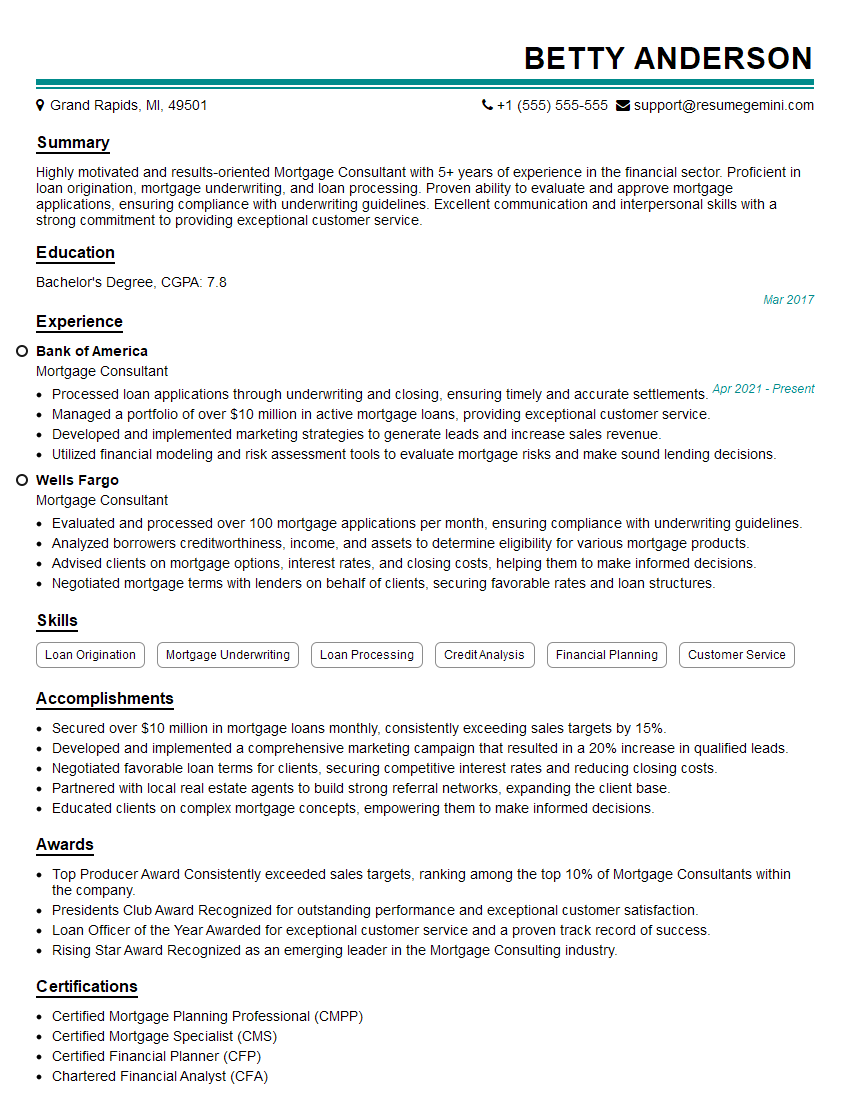

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mortgage Consultant

1. What are the key factors that you consider when evaluating a mortgage application?

- Credit history and score

- Debt-to-income ratio

- Loan-to-value ratio

- Property type and condition

- Applicant’s income and employment history

2. How do you determine the best mortgage product for a particular client?

Client’s financial situation

- Income and expenses

- Credit history

- Debt-to-income ratio

Client’s goals

- Purchase price

- Down payment

- Interest rate

- Loan term

Current market conditions

- Interest rates

- Loan programs

- Housing inventory

3. What are some of the most common challenges faced by mortgage consultants?

- Keeping up with changing regulations

- Educating clients about complex financial products

- Navigating the underwriting process

- Dealing with difficult clients

- Meeting sales targets

4. How do you stay up-to-date on the latest mortgage industry trends?

- Reading industry publications

- Attending industry conferences

- Taking continuing education courses

- Networking with other professionals

5. What are your strengths as a mortgage consultant?

- Excellent communication and interpersonal skills

- Strong understanding of mortgage products and processes

- Ability to analyze financial data and make sound recommendations

- Proven track record of success in meeting sales targets

6. What are your weaknesses as a mortgage consultant?

- I am sometimes too detail-oriented and can get bogged down in the minutiae

- I am not always the most patient person, and I can sometimes get frustrated with clients who are slow to make decisions

7. Why are you interested in this position?

- I am passionate about helping people achieve their homeownership goals

- I am confident that my skills and experience would make me a valuable asset to your team

- I am eager to learn and grow in this role

8. What are your salary expectations?

- My salary expectations are commensurate with my experience and qualifications

- I am open to negotiating a salary that is fair and competitive

9. What is your availability to start work?

- I am available to start work immediately

- I am willing to relocate for the right opportunity

10. Do you have any questions for me?

- What is the company culture like?

- What are the opportunities for advancement?

- What are the company’s goals for the future?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mortgage Consultant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mortgage Consultant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Mortgage Consultants are financial professionals who specialize in providing advice and guidance to clients seeking to obtain or refinance mortgages. They play a crucial role in helping individuals and families secure financing for their homes.

1. Client Consultation and Needs Assessment

Consult with potential and existing clients to assess their financial situation, mortgage needs and goals.

- Determine clients’ eligibility for different types of mortgage products.

- Explain loan options, terms, and interest rates.

2. Loan Origination and Processing

Originate and process mortgage applications, ensuring accuracy and completeness.

- Collect and review financial documentation.

- Order and interpret appraisals, credit reports, and other relevant documents.

3. Underwriting and Loan Approval

Collaborate with underwriters to evaluate loan applications and make recommendations for approval.

- Analyze financial data to assess creditworthiness and risk.

- Ensure compliance with regulatory requirements and lender guidelines.

4. Closing and Post-Closing Support

Guide clients through the closing process, preparing necessary paperwork and ensuring a smooth transaction.

- Explain loan terms and conditions at closing.

- Provide ongoing support after closing, addressing any questions or concerns.

Interview Tips

1. Research the Company and Industry

Demonstrate your understanding of the specific mortgage company and the broader mortgage industry. Research their loan products, market share, and reputation. This shows initiative and interest in the role.

- Visit the company’s website and social media pages.

- Read industry news and reports.

2. Prepare Examples of Your Skills

Use specific examples from your previous experience to illustrate your skills in client consultation, loan processing, and underwriting. Quantify your results whenever possible.

- Describe a time you successfully helped a client obtain a mortgage despite challenging financial circumstances.

- Share an example of how you streamlined the loan processing timeline, saving time and improving efficiency.

3. Practice Answering Common Interview Questions

Anticipate common interview questions and prepare thorough answers that highlight your qualifications.

- Why are you interested in a career as a Mortgage Consultant?

- What are your strengths and weaknesses as they relate to this role?

4. Ask Thoughtful Questions

During the interview, ask thoughtful questions that demonstrate your interest in the company and the position. This shows you’re engaged and interested in learning more.

- What sets this mortgage company apart from others in the industry?

- What professional development opportunities are available to employees?

Next Step:

Now that you’re armed with the knowledge of Mortgage Consultant interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Mortgage Consultant positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini