Are you gearing up for an interview for a Mortgage Loan Computation Clerk position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Mortgage Loan Computation Clerk and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

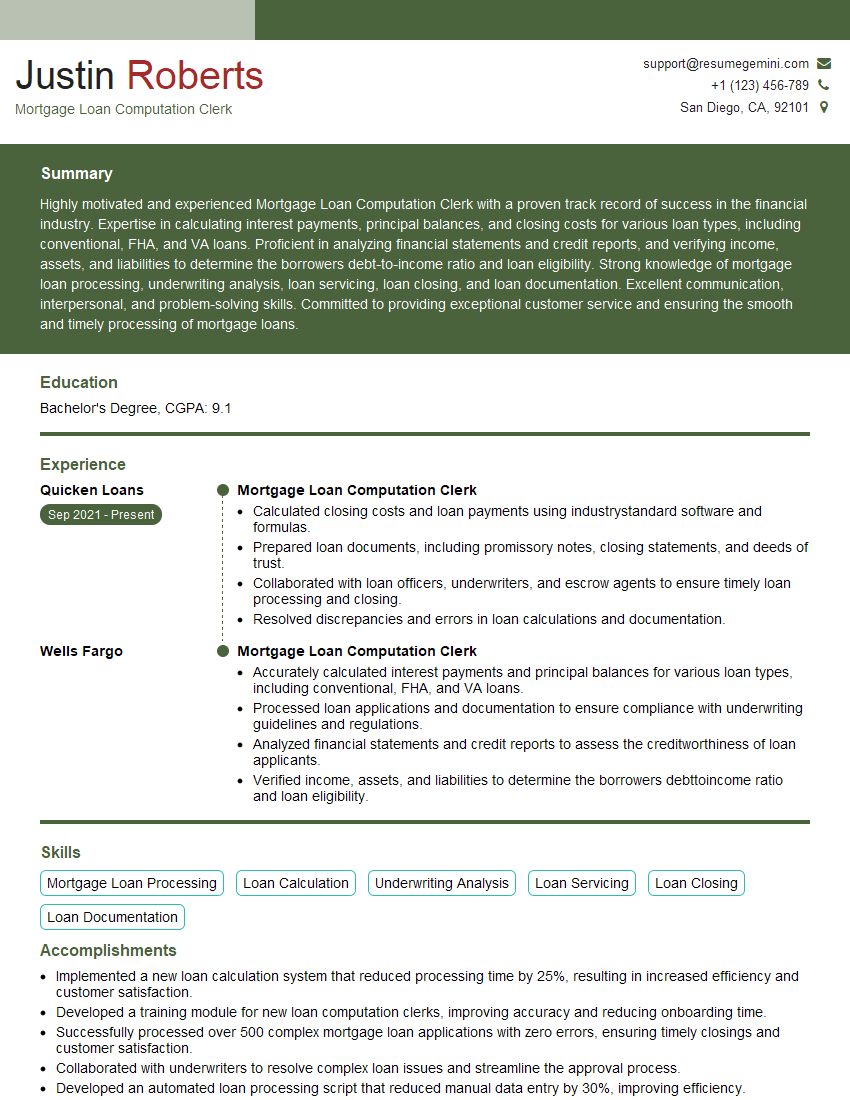

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mortgage Loan Computation Clerk

1. Walk me through the steps involved in calculating the monthly mortgage payment for a new loan applicant?

Answer

- Determine the loan amount, interest rate, and loan term.

- Convert the interest rate into a monthly rate by dividing the annual rate by 12.

- Calculate the number of payments by multiplying the loan term by 12.

- Use the formula P = (L x r x (1 + r)^n ) / ((1 + r)^n – 1) to calculate the monthly payment, where P is the monthly payment, L is the loan amount, r is the monthly interest rate, and n is the number of payments.

2. How do you handle situations where the borrower’s financial information is incomplete or inconsistent?

Answer

- Verify the information with the borrower: Contact the borrower to clarify any inconsistencies or missing information.

- Review alternative documentation: Consider using other financial documents, such as bank statements or tax returns, to supplement the incomplete information.

- Request additional information: Ask the borrower to provide additional documentation or explanations to support their financial standing.

- Consult with a supervisor: If the inconsistencies cannot be resolved, consult with a supervisor for guidance.

3. Explain the process of calculating the loan-to-value ratio (LTV) for a mortgage application?

Answer

- Determine the appraised value of the property.

- Calculate the loan amount based on the borrower’s request.

- Divide the loan amount by the appraised value and multiply by 100 to get the LTV percentage.

4. How do you ensure accuracy and compliance when calculating mortgage loan payments?

Answer

- Use automated tools: Utilize software or spreadsheets to perform calculations and minimize errors.

- Review calculations carefully: Double-check all inputs and calculations to ensure they are accurate.

- Comply with regulations: Adhere to industry standards and government regulations to ensure compliance.

- Seek guidance when needed: Consult with supervisors or experts as necessary to ensure proper calculation methods.

5. Describe the different types of mortgage loan programs and their eligibility criteria?

Answer

- Conventional loans: Typically require higher credit scores and down payments.

- FHA loans: Backed by the Federal Housing Administration and offer lower down payments and more flexible credit requirements.

- VA loans: Available to eligible military members and veterans, offering no down payment and competitive rates.

- USDA loans: Designed for low-income borrowers in rural areas, offering no down payment options.

6. How do you handle exceptions or special circumstances in mortgage loan computations?

Answer

- Assess the situation: Determine the nature and impact of the exception.

- Consult with management: Discuss the exception with supervisors to seek guidance.

- Use alternative methods: If necessary, use alternative calculation methods to accommodate the exception.

7. Describe the importance of communication with borrowers during the mortgage loan computation process?

Answer

- Builds trust and credibility: Open communication helps establish a positive relationship and ensures the borrower understands the process.

- Reduces errors: Clear communication prevents misunderstandings and minimizes errors in loan calculations.

- Provides clarity: Explaining the calculations to borrowers ensures they understand the terms and conditions of their loan.

8. How do you keep up-to-date with changes in mortgage loan regulations and industry best practices?

Answer

- Attend industry conferences: Participate in events and workshops to stay informed about the latest regulations and trends.

- Read industry publications: Stay up-to-date by subscribing to newsletters and trade magazines.

- Complete continuing education courses: Enhance knowledge and skills through professional development programs.

9. How do you prioritize and manage multiple loan computation tasks simultaneously?

Answer

- Set priorities: Identify the most urgent tasks based on due dates and borrower needs.

- Use time management tools: Utilize calendars and task lists to stay organized and track progress.

- Delegate tasks: Assign specific tasks to colleagues when appropriate to ensure timely completion.

10. Describe a previous work experience where you had to resolve a complex issue related to mortgage loan computations?

Answer

- Describe the issue: Explain the nature of the complex issue that arose.

- Explain the steps taken: Discuss the processes and methods used to resolve the issue.

- Highlight the outcome: Emphasize the positive results achieved in resolving the complex computation issue.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mortgage Loan Computation Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mortgage Loan Computation Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Mortgage Loan Computation Clerks are responsible for performing complex calculations and preparing loan documents for mortgage applications. Their primary goal is to ensure the accuracy and compliance of mortgage loan-related computations and paperwork.

1. Perform Mortgage Loan Calculations

Clerks calculate loan amounts, interest rates, monthly payments, and other financial data based on loan terms and underwriting guidelines.

- Calculate loan amounts based on loan applications and credit reports.

- Determine interest rates based on market conditions and lender policies.

- Calculate monthly payments using amortization schedules and other financial formulas.

2. Prepare Loan Documents

Clerks prepare loan documents, such as mortgage notes, deeds of trust, and closing statements, ensuring their accuracy and compliance with legal and regulatory requirements.

- Draft mortgage notes outlining the terms and conditions of the loan.

- Prepare deeds of trust to secure the loan against the property.

- Create closing statements detailing the final loan costs and disbursements.

3. Review and Analyze Loan Applications

Clerks review loan applications to ensure completeness and accuracy, and analyze financial data to determine loan eligibility and risk.

- Verify income, assets, and credit history of loan applicants.

- Analyze financial ratios and other data to assess loan risk.

- Make recommendations on loan approval or denial based on analysis.

4. Maintain Records and Communicate with Borrowers

Clerks maintain loan records, track loan progress, and communicate with borrowers to provide updates and address any questions or concerns.

- Maintain accurate loan files and track loan status throughout the process.

- Respond to borrower inquiries and provide status updates.

- Coordinate with other departments and external entities to resolve loan-related issues.

Interview Tips

Preparing for a Mortgage Loan Computation Clerk interview requires understanding the role’s responsibilities and tailoring your answers to demonstrate your skills and experience.

1. Research the Company and Position

Familiarize yourself with the mortgage industry, the company’s lending practices, and the specific responsibilities of the role.

- Visit the company website to learn about their loan products and services.

- Read industry publications and articles to stay updated on mortgage trends.

- Review the job description carefully and identify the key skills and qualifications required.

2. Highlight Your Calculations and Analysis Skills

Emphasize your proficiency in financial calculations, attention to detail, and ability to analyze financial data.

- Provide examples of complex calculations you have performed in previous roles.

- Discuss your experience in reviewing and analyzing financial statements.

- Explain how you use data to make informed decisions and solve problems.

3. Showcase Your Understanding of Mortgage Processes

Demonstrate your knowledge of mortgage lending processes, including loan documentation, underwriting guidelines, and closing procedures.

- Describe the steps involved in processing a mortgage loan application.

- Explain the different types of mortgage loans and their features.

- Discuss your experience in working with borrowers, lenders, and other stakeholders.

4. Practice Your Communication and Interpersonal Skills

Mortgage Loan Computation Clerks interact with borrowers, colleagues, and supervisors on a daily basis. Highlight your ability to communicate clearly, build relationships, and resolve conflicts.

- Share examples of how you effectively communicated complex financial information to non-financial professionals.

- Describe how you handle challenging conversations and maintain a positive attitude.

- Emphasize your teamwork and collaboration skills.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Mortgage Loan Computation Clerk interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.