Feeling lost in a sea of interview questions? Landed that dream interview for Mortgage Loan Officer but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Mortgage Loan Officer interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

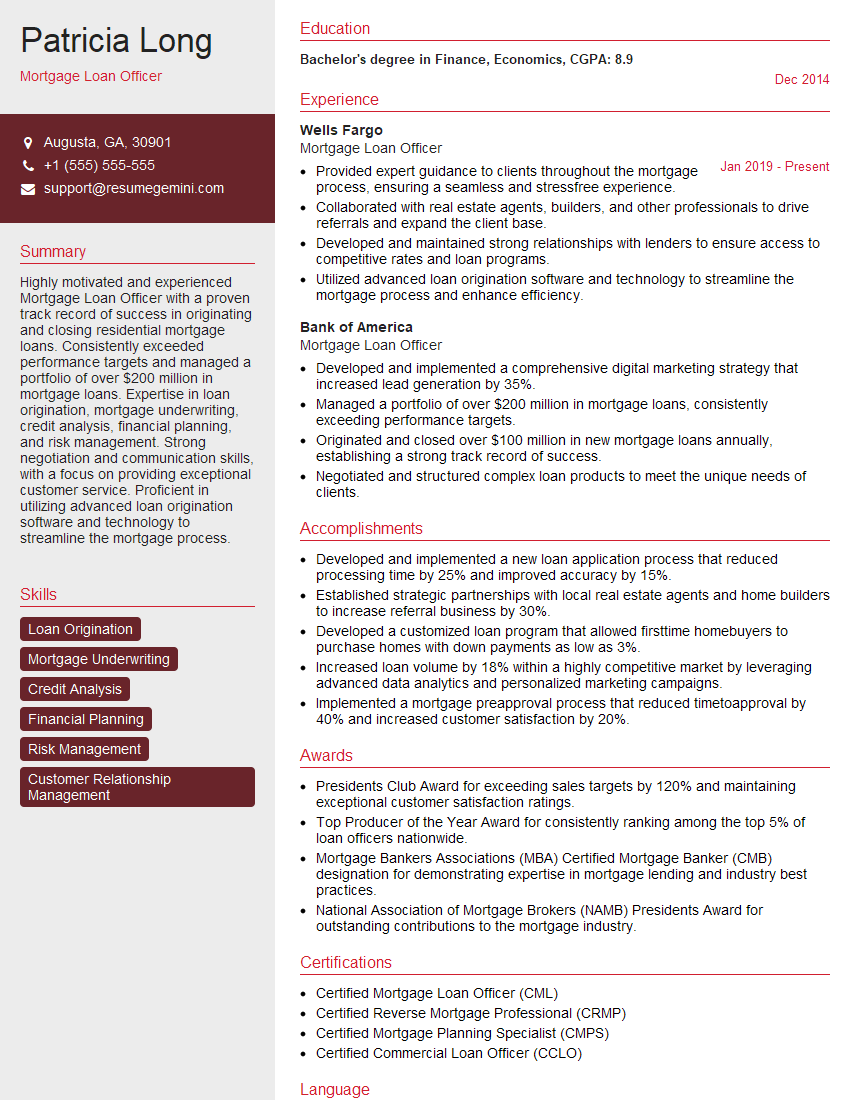

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mortgage Loan Officer

1. Explain the different types of mortgage loans available and their key features?

- Conventional Loans: These loans are not backed by the government and typically require a higher credit score and down payment.

- FHA Loans: These loans are backed by the Federal Housing Administration and allow for lower credit scores and down payments.

- VA Loans: These loans are backed by the Department of Veterans Affairs and are available to eligible veterans and military members.

- USDA Loans: These loans are backed by the United States Department of Agriculture and are available to low- and moderate-income borrowers in rural areas.

2. Describe the process of pre-approving a mortgage loan?

Gather borrower information

- Collect the borrower’s personal and financial information, including income, assets, debts, and credit history.

Analyze borrower’s financial situation

- Review the borrower’s income, expenses, and credit history to determine their debt-to-income ratio and creditworthiness.

- Calculate the maximum loan amount the borrower can afford.

Issue a pre-approval letter

- Provide the borrower with a pre-approval letter that states the maximum loan amount they are eligible for.

- The pre-approval letter is valid for a specific period of time.

3. How do you determine a borrower’s debt-to-income ratio?

The debt-to-income ratio (DTI) is calculated by dividing the borrower’s monthly debt payments by their monthly gross income. Lenders use DTI to assess a borrower’s ability to repay a mortgage loan.

- Monthly debt payments include mortgage payments, car payments, credit card payments, and other recurring debt obligations.

- Monthly gross income includes the borrower’s salary, wages, self-employment income, and other regular forms of income.

- DTI should not exceed 36% for conventional loans and 50% for FHA loans.

4. What are the different sources of down payment funds?

- Personal savings

- Gifts from family or friends

- Down payment assistance programs

- Seller financing

- Equity from the sale of a previous home

5. Explain the underwriting process for a mortgage loan?

Loan application

- The borrower completes a loan application and provides supporting documentation.

Loan review

- An underwriter reviews the loan application and supporting documentation to verify the borrower’s financial situation and creditworthiness.

- The underwriter evaluates the borrower’s income, assets, debts, and credit history.

Loan approval

- If the underwriter is satisfied with the borrower’s financial situation and creditworthiness, they will approve the loan.

- The lender will issue a loan commitment letter that outlines the terms of the loan.

Loan closing

- The borrower and lender meet to sign the loan documents.

- The borrower receives the loan proceeds and the property is transferred to their name.

6. What are the most common reasons for a mortgage loan to be denied?

- Insufficient income

- Excessive debt

- Poor credit history

- Insufficient down payment

- Property issues

7. How do you handle difficult clients?

- Stay calm and professional.

- Listen to the client’s concerns.

- Explain the situation clearly and patiently.

- Offer solutions to the client’s problems.

- Be willing to compromise.

8. What are the ethical considerations involved in mortgage lending?

- Lenders have a responsibility to act in the best interests of their clients.

- Lenders must avoid conflicts of interest.

- Lenders must be transparent about the terms of the loan.

- Lenders must not engage in predatory lending practices.

9. What are the latest trends in the mortgage industry?

- The use of technology to streamline the loan process.

- The growth of non-traditional mortgage products.

- The increasing popularity of down payment assistance programs.

10. Why are you interested in working for our company?

I am interested in working for your company because I am impressed with your commitment to providing excellent customer service. I am also impressed with your company’s reputation for being a leader in the mortgage industry. I believe that my skills and experience would be a valuable asset to your team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mortgage Loan Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mortgage Loan Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Mortgage Loan Officer is primarily responsible for originating, processing, and closing mortgage loans for individuals and businesses. They are the primary point of contact for borrowers throughout the loan process and are responsible for ensuring that all loan requirements are met. Here are the key job responsibilities of a Mortgage Loan Officer:

1. Originating Mortgage Loans

Mortgage Loan Officers generate leads, pre-qualify borrowers, and take loan applications. They also collect and verify all necessary documentation, such as income statements, tax returns, and credit reports.

- Interview potential borrowers to determine their financial needs and goals

- Explain different loan options and guide borrowers in selecting the best loan for their situation

- Collect and review financial documentation to assess the borrower’s creditworthiness and ability to repay the loan

2. Processing Mortgage Loans

Once a loan application is complete, Mortgage Loan Officers process the loan by ordering a credit report, verifying employment and income, and obtaining an appraisal of the property. They also prepare the loan file and submit it to the underwriter for approval.

- Order and review credit reports to assess the borrower’s credit history

- Contact employers and verify the borrower’s employment and income

- Coordinate with appraisers to obtain an appraisal of the property

- Prepare the loan file and submit it to the underwriter for approval

3. Closing Mortgage Loans

After the loan is approved, Mortgage Loan Officers close the loan by preparing the closing documents and meeting with the borrower to sign the loan documents. They also disburse the loan funds and ensure that the loan is properly recorded.

- Prepare the closing documents, including the mortgage note, deed of trust, and closing disclosure

- Meet with the borrower to sign the loan documents

- Disburse the loan funds to the borrower and the seller

- Ensure that the loan is properly recorded with the county recorder

4. Maintaining Relationships with Borrowers

Mortgage Loan Officers maintain relationships with borrowers after the loan is closed. They provide customer service and answer any questions that borrowers may have. They also monitor the loan’s performance and work with borrowers to resolve any issues that may arise.

- Provide customer service to borrowers and answer any questions they may have

- Monitor the loan’s performance and work with borrowers to resolve any issues that may arise

- Provide updates to borrowers on their loan status and any changes to their loan terms

Interview Tips

Preparing for a Mortgage Loan Officer interview can be daunting, but with the right strategies, you can increase your chances of success. Here are some interview tips to help you ace your next interview:

1. Research the company and the position

Before you go on an interview, take some time to research the company and the position you’re applying for. This will help you understand the company’s culture, values, and goals. It will also help you tailor your answers to the specific requirements of the position.

- Visit the company’s website

- Read the job description carefully

- Talk to people who work at the company

2. Practice your answers to common interview questions

There are a number of common interview questions that you’re likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. Practicing your answers to these questions will help you feel more confident and prepared during your interview.

- Write down your answers to common interview questions

- Practice your answers out loud

- Get feedback from a friend or family member

3. Be prepared to talk about your experience and skills

The interviewer will want to know about your experience and skills as a Mortgage Loan Officer. Be prepared to talk about your accomplishments, your strengths, and your weaknesses. You should also be able to provide specific examples of your work.

- Highlight your experience in originating, processing, and closing mortgage loans

- Quantify your accomplishments whenever possible

- Be prepared to talk about your strengths and weaknesses

4. Dress professionally and arrive on time

First impressions matter, so it’s important to dress professionally and arrive on time for your interview. This shows the interviewer that you’re serious about the position and that you respect their time.

- Choose a conservative outfit that is appropriate for a business setting

- Be on time for your interview

- Be polite and respectful to the interviewer

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Mortgage Loan Officer, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Mortgage Loan Officer positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.