Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Mortgage Loan Originator interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Mortgage Loan Originator so you can tailor your answers to impress potential employers.

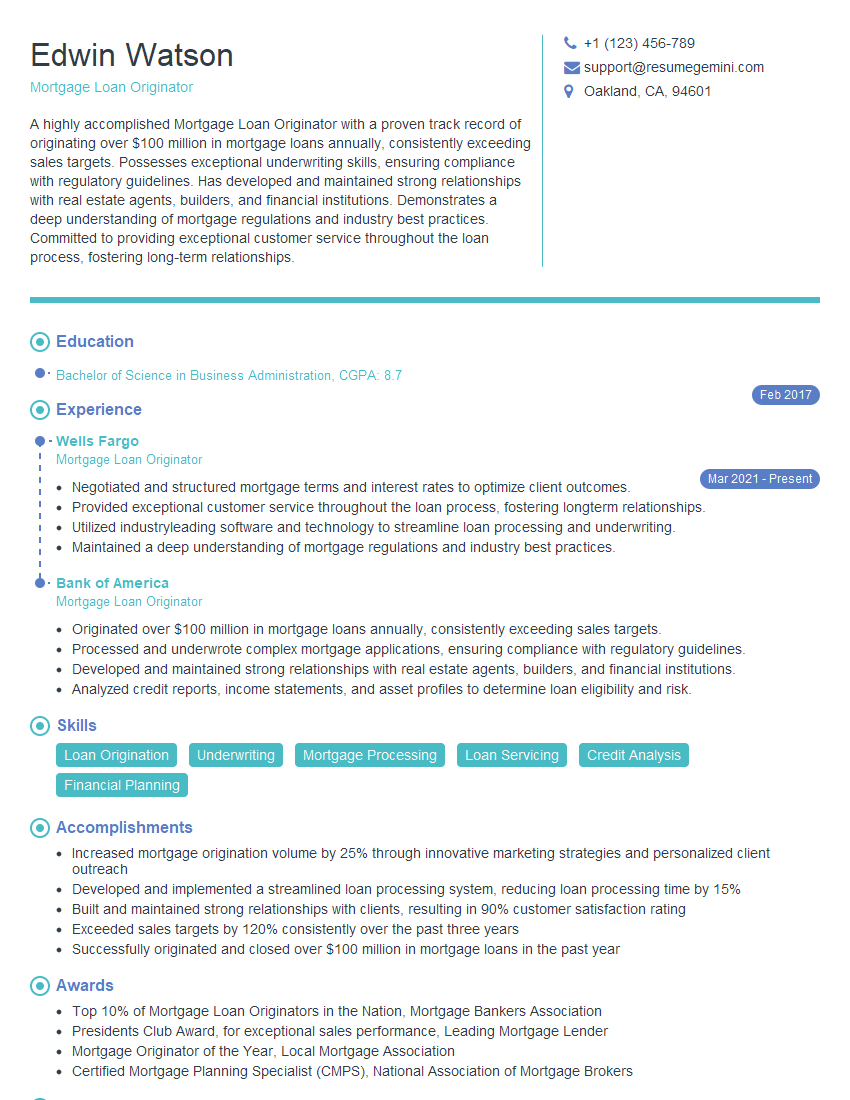

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mortgage Loan Originator

1. Tell us about the types of mortgage programs you are familiar with and your thoughts on how those programs impact the overall lending market?

- Government-backed loans (FHA, VA, USDA): These loans are insured by the government and offer low down payment options and more flexible credit requirements.

- Conventional loans: These loans are not backed by the government and typically require a higher down payment and stricter credit requirements.

- Jumbo loans: These loans exceed the conforming loan limits set by Fannie Mae and Freddie Mac and are often used to finance high-value properties.

- Bridge loans: These loans are used to finance a new home purchase before the sale of the existing home.

2. What are some of the most important factors to consider when evaluating a borrower’s creditworthiness?

subheading of the answer

- Credit score: This is a numerical representation of a borrower’s credit history and is a key factor in determining interest rates and loan approval.

- Debt-to-income ratio: This ratio measures the amount of a borrower’s monthly debt payments relative to their income and is used to assess their ability to repay a mortgage.

- Employment history: Lenders will consider the stability and longevity of a borrower’s employment when assessing their risk.

- Assets and liabilities: Lenders will review a borrower’s assets and liabilities to determine their overall financial health.

subheading of the answer

- Other factors: Lenders may also consider factors such as a borrower’s age, education, and marital status when evaluating their creditworthiness.

3. Walk me through the process of originating a mortgage loan.

- Pre-approval: Determine the borrower’s eligibility and loan amount.

- Application: Collect the borrower’s financial and personal information.

- Processing: Verify the borrower’s information and prepare the loan file.

- Underwriting: Review the loan file and make a decision on approval.

- Closing: Finalize the loan documents and disburse the funds.

4. How do you handle objections from borrowers who may not fully understand the loan process or have concerns about the terms of their loan?

- Listen to the borrower’s concerns and try to understand their perspective.

- Explain the loan process and terms in a clear and concise manner.

- Provide examples and scenarios to help the borrower visualize the impact of the loan.

- Be patient and answer all of the borrower’s questions.

- If necessary, refer the borrower to a trusted third-party (such as an attorney or financial advisor) for further clarification.

5. What are some of the ethical considerations that you must be aware of as a Mortgage Loan Originator?

- Fair lending: Mortgage Loan Originators must comply with fair lending laws and regulations, which prohibit discrimination in lending based on race, religion, national origin, gender, marital status, etc.

- Conflicts of interest: Mortgage Loan Originators must avoid conflicts of interest, such as receiving compensation from multiple parties involved in the transaction.

- Privacy: Mortgage Loan Originators must protect the privacy of borrowers and keep their personal information confidential.

- Transparency: Mortgage Loan Originators must be transparent with borrowers about the loan process and the terms of their loan.

6. What are some of the challenges you face in your role as a Mortgage Loan Originator?

- Keeping up with changes in the mortgage industry.

- Navigating complex loan programs and regulations.

- Dealing with difficult borrowers.

- Managing a high volume of paperwork.

- Meeting production goals.

7. What are some of the most important skills that a Mortgage Loan Originator needs to be successful?

- Strong communication skills.

- Excellent analytical skills.

- In-depth knowledge of mortgage products and programs.

- Ability to work independently and as part of a team.

- Time management skills.

- Problem-solving skills.

8. What are some of the trends that you are seeing in the mortgage industry?

- Growth in non-QM loans.

- Increased use of technology in the mortgage process.

- Expansion of the jumbo loan market.

- Greater focus on energy-efficient mortgages.

- Increased regulation of the mortgage industry.

9. What are your long-term career goals?

- I would like to become a top producer in my field.

- I am interested in developing a team of loan officers and building my own branch.

- I am passionate about helping people achieve their homeownership dreams and would like to continue to do so in a leadership role.

10. Why are you interested in working for our company?

- I am impressed by your company’s reputation for excellence in the mortgage industry.

- I am aligned with your company’s values and commitment to customer service.

- I believe that my skills and experience would be a valuable asset to your team.

- I am excited about the opportunity to contribute to the continued success of your company.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mortgage Loan Originator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mortgage Loan Originator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Mortgage Loan Originator is responsible for interacting with potential borrowers, assessing their financial situations, and helping them secure mortgage loans. The primary objective is to facilitate the homeownership process, ensuring that borrowers obtain the most suitable mortgage products tailored to their unique needs and financial capabilities. Key responsibilities include:

1. Lead Generation and Qualification

Generate leads through various channels, such as networking, referrals, and online marketing.

- Qualify potential borrowers by assessing their credit history, income, and debt-to-income ratio.

- Identify suitable mortgage programs based on borrower qualifications and preferences.

2. Loan Application Processing

Assist borrowers in completing loan applications accurately and efficiently.

- Collect and review financial documentation, including income statements, tax returns, and asset statements.

- Analyze borrower’s financial situation to determine loan eligibility and appropriate loan terms.

3. Loan Underwriting and Approval

Prepare loan packages for submission to underwriters for review and approval.

- Negotiate loan terms with borrowers, including interest rates, loan amounts, and repayment schedules.

- Resolve any underwriting issues or conditions that may arise during the loan approval process.

4. Loan Closing and Post-Closing Support

Coordinate loan closings, ensuring all necessary documentation is signed and executed.

- Provide post-closing support to borrowers, answering any questions or concerns they may have.

- Maintain relationships with borrowers for potential future business opportunities.

Interview Tips

Preparing thoroughly for a Mortgage Loan Originator interview is crucial to showcasing your skills and qualifications. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Familiarize yourself with the company’s history, culture, and mortgage products. Understand the current mortgage market trends and regulations.

2. Practice Common Interview Questions

Prepare for common interview questions related to your experience, qualifications, and knowledge of the mortgage industry.

3. Highlight Your Sales and Communication Skills

Emphasize your ability to build rapport with clients, understand their needs, and effectively communicate mortgage concepts.

4. Showcase Your Loan Processing Expertise

Demonstrate your knowledge of loan applications, underwriting guidelines, and closing procedures. Discuss your experience in resolving underwriting issues.

5. Discuss Your Commitment to Ethics and Compliance

Mortgage Loan Originators must adhere to strict ethical and compliance standards. Highlight your understanding of these regulations and your commitment to ethical practices.

6. Be Enthusiastic and Professional

Show genuine interest in the role and the company. Maintain a professional demeanor throughout the interview.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Mortgage Loan Originator interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.