Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Mortgage Originator position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

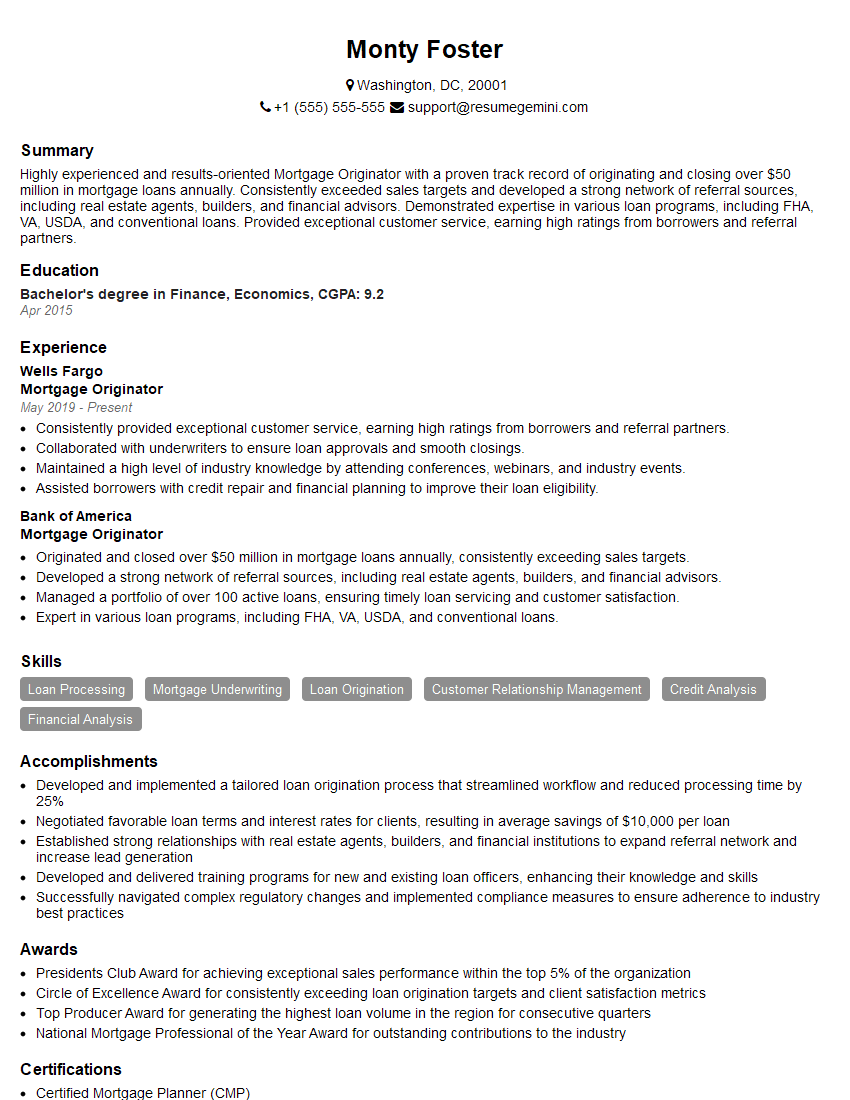

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mortgage Originator

1. What is the definition of a mortgage?

A mortgage is a loan taken out to buy a home or property, in which the property itself acts as collateral for the loan. The borrower agrees to repay the loan, plus interest, over a defined period of time, and if they fail to do so, the lender has the right to foreclose on the property and sell it to recover their funds.

2. What are the different types of mortgages available?

Fixed-rate mortgages

- Interest rate remains the same throughout the loan term

- Monthly payments are stable and predictable

Adjustable-rate mortgages (ARMs)

- Interest rate can fluctuate based on market conditions

- Monthly payments may vary over time

FHA loans

- Backed by the Federal Housing Administration

- Designed for first-time homebuyers with lower credit scores and down payments

VA loans

- Backed by the Department of Veterans Affairs

- Available to eligible veterans and active-duty military personnel

3. What are the key factors that affect mortgage interest rates?

- Current economic conditions

- Federal Reserve interest rate policies

- Loan amount and term

- Borrower’s credit score and financial history

- Property value and location

4. How do you determine a borrower’s eligibility for a mortgage?

- Reviewing their credit history and score

- Assessing their income and debt-to-income ratio

- Verifying their employment and assets

- Inspecting the property they intend to purchase

5. What are the steps involved in processing a mortgage application?

- Collecting and verifying borrower information

- Ordering a credit report and appraisal

- Underwriting the loan and determining the borrower’s eligibility

- Issuing a loan commitment

- Closing the loan and disbursing funds

6. What are some of the common challenges you face as a mortgage originator?

- Navigating complex mortgage regulations and guidelines

- Dealing with borrowers who have complex financial situations

- Managing multiple tasks and meeting tight deadlines

- Staying up-to-date on industry trends and changes

- Building and maintaining strong relationships with lenders and real estate agents

7. How do you stay informed about industry best practices and legal requirements?

- Attending industry conferences and seminars

- Reading trade publications and online resources

- Consulting with experienced mortgage professionals

- Maintaining membership in professional organizations

8. What is your approach to building and maintaining relationships with clients?

- Establishing clear and open communication channels

- Providing personalized service tailored to their individual needs

- Being responsive and available to answer their questions

- Educating them about the mortgage process and available options

- Following up with them regularly to ensure their satisfaction

9. How do you differentiate yourself from other mortgage originators in the market?

- Highlighting your experience, expertise, and track record

- Emphasizing your commitment to customer service and satisfaction

- Providing innovative solutions and tailored financing options

- Building strong relationships with lenders and real estate agents

- Leveraging technology to streamline the mortgage process

10. How do you measure your success as a mortgage originator?

- Customer satisfaction and positive feedback

- Volume of closed loans and loan origination fees generated

- Repeat business and referrals from satisfied clients

- Recognition and awards within the industry

- Contribution to the success of the mortgage brokerage or financial institution

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mortgage Originator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mortgage Originator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Mortgage Originators are responsible for initiating and processing mortgage loan applications. They work with potential homebuyers to assess their financial situation, determine their borrowing capacity, and guide them through the mortgage process.

1. Lead Generation and Qualification

Mortgage Originators generate mortgage loans by networking with real estate agents, attending industry events, and using online marketing techniques

- Identify and qualify potential borrowers

- Assess borrowers’ financial situation

2. Loan Processing

Mortgage Originators process mortgage loan applications by collecting and verifying borrower documentation, underwriting the loan, and preparing the loan for closing

- Collect and verify borrower documentation

- Underwrite the loan

- Prepare the loan for closing

3. Customer Service

Mortgage Originators provide excellent customer service by communicating with borrowers throughout the mortgage process, answering their questions, and addressing their concerns

- Communicate with borrowers

- Answer borrowers’ questions

- Address borrowers’ concerns

4. Regulatory Compliance

Mortgage Originators must comply with all applicable federal and state regulations governing the mortgage industry

- Comply with federal and state regulations

- Stay up to date on changes to the mortgage industry

Interview Tips

Preparing for a mortgage originator interview can be daunting, but a little preparation can go a long way. Here are some tips to help you ace your interview:

1. Research the Company and the Position

Take some time to learn about the company you’re interviewing with and the specific position you’re applying for. This will help you understand the company’s culture and values, and it will also give you a better idea of what the job entails.

- Visit the company’s website

- Read articles about the company

- Talk to people who work at the company

2. Practice Your Answers to Common Interview Questions

There are a few common interview questions that you’re likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It’s helpful to practice your answers to these questions in advance so that you can deliver them confidently and concisely.

- Use the STAR method (Situation, Task, Action, Result) to answer interview questions

- Practice your answers with a friend or family member

3. Be Prepared to Talk About Your Experience and Skills

The interviewer will want to know about your experience and skills as a mortgage originator. Be prepared to talk about your accomplishments in your previous roles, and highlight the skills that make you a good fit for the position.

- Quantify your accomplishments using numbers whenever possible

- Use action verbs to describe your skills and experience

4. Dress Professionally and Arrive on Time

First impressions matter, so dress professionally for your interview and arrive on time. This shows the interviewer that you’re serious about the position and that you respect their time.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Mortgage Originator interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!