Are you gearing up for a career in Multi-line Claims Adjuster? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Multi-line Claims Adjuster and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

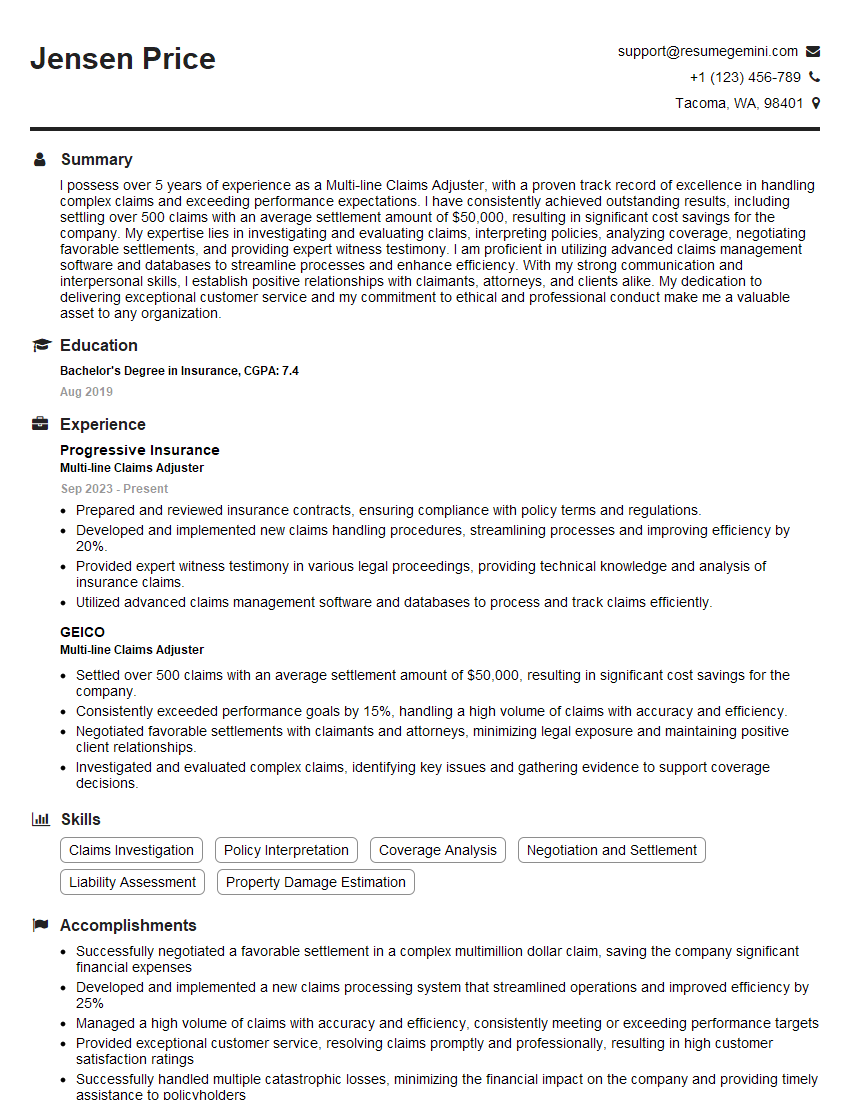

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Multi-line Claims Adjuster

1. How would you approach an investigation of a complex property damage claim involving multiple parties and significant property damage?

I would begin by gathering all relevant information and documentation, such as police reports, witness statements, and photographs. I would then conduct a thorough inspection of the property to assess the extent of the damage. Once I have a clear understanding of the facts of the case, I would begin to identify the responsible parties and assess their liability. I would also work with experts to determine the value of the damages and the cost of repairs. Throughout the process, I would keep all parties informed of my progress and findings.

2. Describe your experience in handling bodily injury claims. What are some of the key challenges you have faced in these cases?

Negotiating with claimants and their attorneys

- Bodily injury claims can be complex and challenging, particularly when there are serious injuries or fatalities. Some of the key challenges I have faced include

- Negotiating with claimants and their attorneys to reach a fair and equitable settlement.

Investigating the cause of the accident

- Investigating the cause of the accident and determining liability.

Assessing the extent of the injuries and damages

- Assessing the extent of the injuries and damages and determining the appropriate amount of compensation.

Managing the claim process and ensuring compliance with all applicable laws and regulations.

3. How do you stay up-to-date on the latest changes in insurance laws and regulations?

I stay up-to-date on the latest changes in insurance laws and regulations by attending industry conferences and seminars, reading industry publications, and taking continuing education courses. I also make it a point to network with other claims professionals and to stay informed about relevant court decisions. By staying up-to-date on the latest changes, I am better able to provide my clients with the best possible service.

4. What is your experience with using insurance software and technology to manage claims?

I have extensive experience with using insurance software and technology to manage claims. I am proficient in using a variety of claims management systems, including [list of software]. I am also familiar with the use of data analytics and other technologies to improve claims handling efficiency and effectiveness.

5. How do you build rapport with policyholders and claimants?

I build rapport with policyholders and claimants by being empathetic, understanding, and respectful. I take the time to listen to their concerns and to explain the claims process in a clear and concise manner. I am also responsive to their inquiries and keep them updated on the status of their claim. By building rapport with policyholders and claimants, I am able to create a positive and productive relationship that benefits both parties.

6. What are your strengths as a claims adjuster?

- My strengths as a claims adjuster include:

- Strong communication and interpersonal skills

- Excellent analytical and problem-solving skills

- Ability to work independently and as part of a team

- Strong work ethic and dedication to providing excellent customer service

7. What is your claims philosophy?

My claims philosophy is to handle each claim fairly and efficiently, while providing excellent customer service. I believe that it is important to build strong relationships with policyholders and claimants, and to work with them to achieve a mutually agreeable resolution. I am also committed to staying up-to-date on the latest changes in insurance laws and regulations, and to using technology to improve claims handling efficiency and effectiveness.

8. How do you handle difficult or angry customers?

When dealing with difficult or angry customers, I remain calm and professional. I listen to their concerns and try to understand their point of view. I then explain the claims process and answer their questions in a clear and concise manner. I also try to find common ground and work with them to achieve a mutually agreeable resolution. By remaining calm and professional, and by showing empathy and understanding, I am usually able to defuse the situation and build a positive relationship with the customer.

9. What are your career goals?

My career goals are to continue to develop my skills and knowledge as a claims adjuster, and to eventually move into a management role. I am also interested in specializing in a particular area of claims, such as property damage or bodily injury. I am confident that I have the skills and experience necessary to achieve my goals, and I am excited to see what the future holds.

10. Why are you interested in this position?

I am interested in this position because it offers me the opportunity to use my skills and experience to help people in need. I am also excited about the opportunity to work for a company that is committed to providing excellent customer service. I believe that my skills and experience would be a valuable asset to your team, and I am confident that I can make a positive contribution to your company.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Multi-line Claims Adjuster.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Multi-line Claims Adjuster‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Multi-line Claims Adjusters are responsible for handling a range of claims across multiple insurance lines. Their key responsibilities include:

1. Claims Investigation

Investigating claims, gathering evidence, and determining liability.

- Interviewing policyholders, witnesses, and medical professionals.

- Inspecting damaged property and assessing its value.

2. Claims Negotiation

Negotiating and settling claims with policyholders and claimants.

- Calculating and offering settlements based on policy coverage and evidence.

- Negotiating with attorneys and other parties involved in the claim.

3. Customer Service

Providing excellent customer service to policyholders and claimants throughout the claims process.

- Communicating clearly and effectively with customers.

- Answering questions and addressing concerns.

4. Claims Documentation

Documenting claims thoroughly and accurately, ensuring all relevant information is captured.

- Preparing claim reports, settlement agreements, and other necessary documentation.

- Maintaining detailed records of all communications and activities related to the claim.

Interview Tips

To ace the interview for a Multi-line Claims Adjuster position, follow these tips:

1. Research the Company and Industry

Demonstrate your knowledge of the insurance industry and the specific company you’re applying to. Research their target market, claim procedures, and reputation in the industry.

2. Highlight Relevant Experience and Skills

Emphasize your prior experience in claims handling, negotiation, customer service, and documentation. Use specific examples to illustrate your abilities and how they align with the job requirements.

3. Showcase Your Attention to Detail

Claims adjusters must be meticulous and thorough. Highlight your strong attention to detail and ability to analyze information accurately. Provide examples of your ability to spot discrepancies and conduct thorough investigations.

4. Demonstrate Your Communication Skills

Effective communication is crucial for claims adjusters. Emphasize your ability to communicate clearly and professionally with policyholders, claimants, and other parties involved in the claim.

5. Be Prepared for Behavioral Interview Questions

Behavioral interview questions focus on past experiences. Prepare for questions about how you’ve handled difficult claims, negotiated with challenging parties, and provided exceptional customer service.

6. Ask Thoughtful Questions

Asking insightful questions at the end of the interview shows your engagement and interest. Inquire about the company’s claim process, training opportunities, and opportunities for professional development.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Multi-line Claims Adjuster role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.