Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Municipal Bond Trader position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

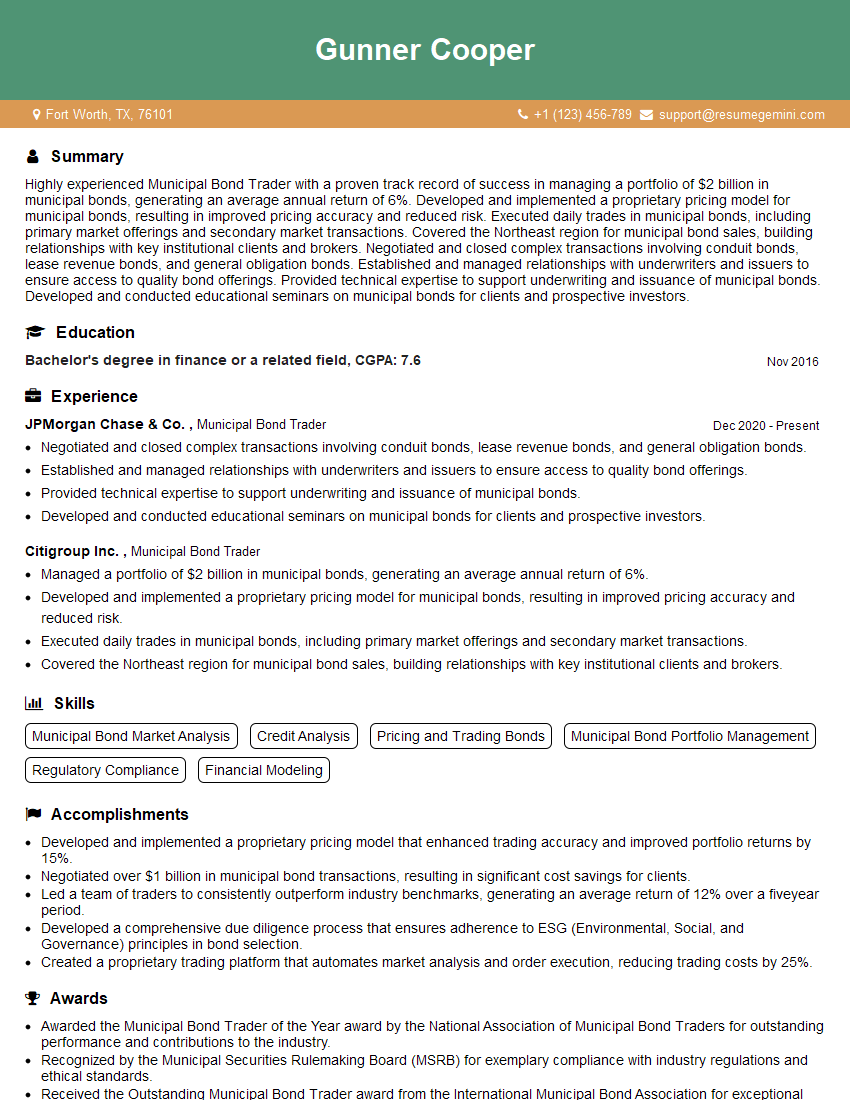

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Municipal Bond Trader

1. Describe the process of valuing a municipal bond

The process of valuing a municipal bond involves several key steps:

- Gather relevant data: Collect information on the bond’s key characteristics, including its maturity date, coupon rate, and yield to maturity.

- Assess credit risk: Evaluate the financial health and stability of the issuer, considering factors like their tax base, debt burden, and economic outlook.

- Determine interest rate risk: Analyze the impact of interest rate fluctuations on the bond’s value, considering its duration and sensitivity to rate changes.

- Calculate present value: Discount the future cash flows from the bond back to the present value using a yield curve that reflects the prevailing market rates.

- Adjust for liquidity: Factor in the bond’s marketability and trading volume to adjust the valuation for the ease or difficulty of buying or selling it.

2. Explain the concept of yield to maturity

Definition

- Yield to maturity (YTM) is the annualized rate of return an investor expects to earn by holding a bond until its maturity date.

- It represents the effective interest rate that equates the present value of the bond’s future cash flows to its current market price.

Factors Affecting YTM

- Coupon rate

- Maturity date

- Current market interest rates

- Credit risk premium

3. What are the key factors that drive municipal bond prices?

The key factors that drive municipal bond prices include:

- Interest rate environment: Changes in interest rates can significantly impact bond prices, as they affect the present value of future cash flows.

- Creditworthiness of the issuer: The financial strength and stability of the issuer play a major role in determining the bond’s risk premium.

- Supply and demand: Market supply and demand for a particular bond can influence its price.

- Tax status: Municipal bonds are typically tax-exempt, which makes them attractive to investors seeking tax-advantaged income.

- Market sentiment: Overall investor sentiment and market conditions can also impact bond prices.

4. How do you assess the credit risk of a municipal bond issuer?

Assessing the credit risk of a municipal bond issuer involves analyzing various factors:

- Financial ratios: Evaluating the issuer’s debt-to-asset ratio, coverage ratio, and other financial metrics to gauge their ability to meet debt obligations.

- Economic profile: Studying the economic outlook of the issuer’s jurisdiction, considering factors like population, employment, and tax base.

- Management and governance: Examining the issuer’s management team and governance practices to assess their competence and transparency.

- Legal and regulatory framework: Analyzing the legal and regulatory environment within which the issuer operates to identify potential risks or constraints.

- Credit rating: Reviewing credit ratings assigned to the issuer by independent agencies to gain insights into their creditworthiness.

5. What are the different types of municipal bonds and their respective characteristics?

There are several types of municipal bonds, each with distinct characteristics:

- General obligation bonds: Backed by the full faith and credit of the issuer, typically offering lower yields but higher credit quality.

- Revenue bonds: Secured by the revenue generated from a specific project or enterprise, offering higher yields but potentially higher risk.

- Private activity bonds: Issued to finance private projects that serve a public purpose, offering tax-free income but may have lower liquidity.

- Variable-rate demand bonds: Bonds with interest rates that fluctuate based on prevailing market interest rates, offering potential flexibility but also higher interest rate risk.

- Conduit bonds: Issued by government-related entities to finance projects on behalf of private borrowers, providing tax benefits to investors.

6. Describe the process of executing a municipal bond trade

Executing a municipal bond trade typically involves the following steps:

- Identify the desired bond: Determine the specific bond to be traded based on its characteristics and current market conditions.

- Find a counterparty: Connect with a broker-dealer or another market participant to match the buy or sell order.

- Negotiate the terms: Agree on the trade details, including price, quantity, settlement date, and other relevant terms.

- Execute the trade: Submit the trade order to the relevant trading platform or broker-dealer.

- Settle the trade: Complete the transaction on the agreed settlement date by exchanging the bonds for payment.

7. How do you stay up-to-date on market trends and new developments in the municipal bond market?

To stay informed about market trends and new developments in the municipal bond market, I follow these practices:

- Monitor industry publications and news sources: Read industry journals, subscribe to newsletters, and follow credible financial news outlets.

- Attend conferences and seminars: Participate in industry events to gain insights from experts and stay abreast of emerging trends.

- Network with market participants: Build relationships with brokers, analysts, and other professionals to exchange information and gain different perspectives.

- Analyze market data: Regularly review market statistics, trading volumes, and price movements to identify patterns and trends.

- Conduct independent research: Proactively study market reports, research papers, and other sources to deepen my understanding of market dynamics.

8. What are the ethical and regulatory considerations in municipal bond trading?

In municipal bond trading, adhering to ethical and regulatory considerations is crucial:

- Conflict of interest avoidance: Ensure there are no conflicts between my personal interests and my clients’ interests.

- Disclosure of material information: Promptly disclose any material information that could affect the value or liquidity of a bond.

- Best execution: Strive to obtain the best possible terms for clients when executing trades.

- Compliance with regulations: Adhere to all applicable laws and regulations governing municipal bond trading.

- Maintaining confidentiality: Protect sensitive client information and maintain confidentiality as required by regulations and ethical standards.

9. How do you manage risk in municipal bond trading?

Managing risk in municipal bond trading involves implementing various strategies:

- Diversification: Spread investments across different issuers, sectors, and maturities to reduce concentration risk.

- Credit analysis: Conduct thorough credit analysis of issuers to assess their financial health and ability to meet obligations.

- Interest rate hedging: Use financial instruments, such as interest rate swaps, to mitigate interest rate risk.

- Liquidity management: Maintain adequate liquidity to meet potential redemption requests and trading needs.

- Scenario analysis: Regularly conduct stress tests and scenario analyses to assess potential market downturns and their impact on portfolio performance.

10. What are the key challenges and opportunities you see in the municipal bond market?

Challenges

- Rising interest rates: Higher interest rates can negatively impact bond prices and reduce investor demand.

- Increased volatility: Market volatility can lead to fluctuations in bond prices and increased trading risks.

- Fiscal pressures on issuers: Fiscal constraints can affect the creditworthiness of municipal bond issuers.

Opportunities

- Diversification: Municipal bonds offer diversification benefits and can enhance portfolio resilience.

- Tax-advantaged income: Municipal bonds provide tax-free income, which can be attractive to certain investors.

- Infrastructure investment: Growing infrastructure needs can drive demand for municipal bonds that finance infrastructure projects.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Municipal Bond Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Municipal Bond Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Municipal Bond Trader is responsible for buying and selling municipal bonds for clients. Their primary goal is to maximize profits while minimizing risks.

1. Research and Analysis

Conduct thorough research and analysis of the municipal bond market, including economic conditions, interest rates, and credit ratings.

- Evaluate the financial health of municipalities and their ability to repay debt.

- Monitor market trends and identify potential investment opportunities.

2. Execution of Trades

Execute trades on behalf of clients, ensuring best execution and meeting regulatory requirements.

- Negotiate prices and terms with other traders.

- Manage inventory and liquidity to facilitate efficient trading.

3. Client Relationship Management

Develop and maintain strong relationships with clients, understanding their investment objectives and risk tolerance.

- Provide personalized investment advice and recommendations.

- Respond to client inquiries and address any concerns promptly.

4. Risk Management

Implement and monitor risk management strategies to protect clients’ investments.

- Identify and assess potential risks associated with municipal bond investments.

- Develop and implement trading strategies that mitigate risks and maximize returns.

Interview Tips

Preparing thoroughly for a Municipal Bond Trader interview can significantly increase your chances of success. Here are some key tips to help you ace the interview:

1. Research the Company and Position

Research the company’s history, culture, and current market position. Understand the specific responsibilities of the Municipal Bond Trader role and how it aligns with your skills and experience.

- Review the company’s website, financial reports, and industry news.

- Network with professionals in the field to gain insights into the company and the industry.

2. Highlight Your Skills and Experience

Emphasize your relevant skills and experience in municipal bond trading. Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Showcase your expertise in research and analysis, execution of trades, and risk management.

- Provide examples of successful investment strategies you have implemented.

3. Be Prepared for Technical Questions

Municipal Bond Trader interviews often involve technical questions to assess your understanding of the market and trading strategies. Be prepared to discuss:

- Valuation techniques for municipal bonds

- Credit analysis and risk assessment

- Trading strategies and execution

4. Practice Your Answers

Practice answering common interview questions related to municipal bond trading. This will help you become more confident and articulate during the interview.

- Prepare for questions about your experience, skills, and motivations.

- Rehearse your answers with a friend or mentor to get feedback.

5. Be Enthusiastic and Professional

Throughout the interview, maintain a positive and enthusiastic attitude. Dress professionally and arrive on time. Be respectful of the interviewer and their time.

- Express your interest in the role and the company.

- Demonstrate your commitment to the industry and your passion for municipal bond trading.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Municipal Bond Trader, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Municipal Bond Trader positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.