Are you gearing up for a career in Mutual Fund Accountant? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Mutual Fund Accountant and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

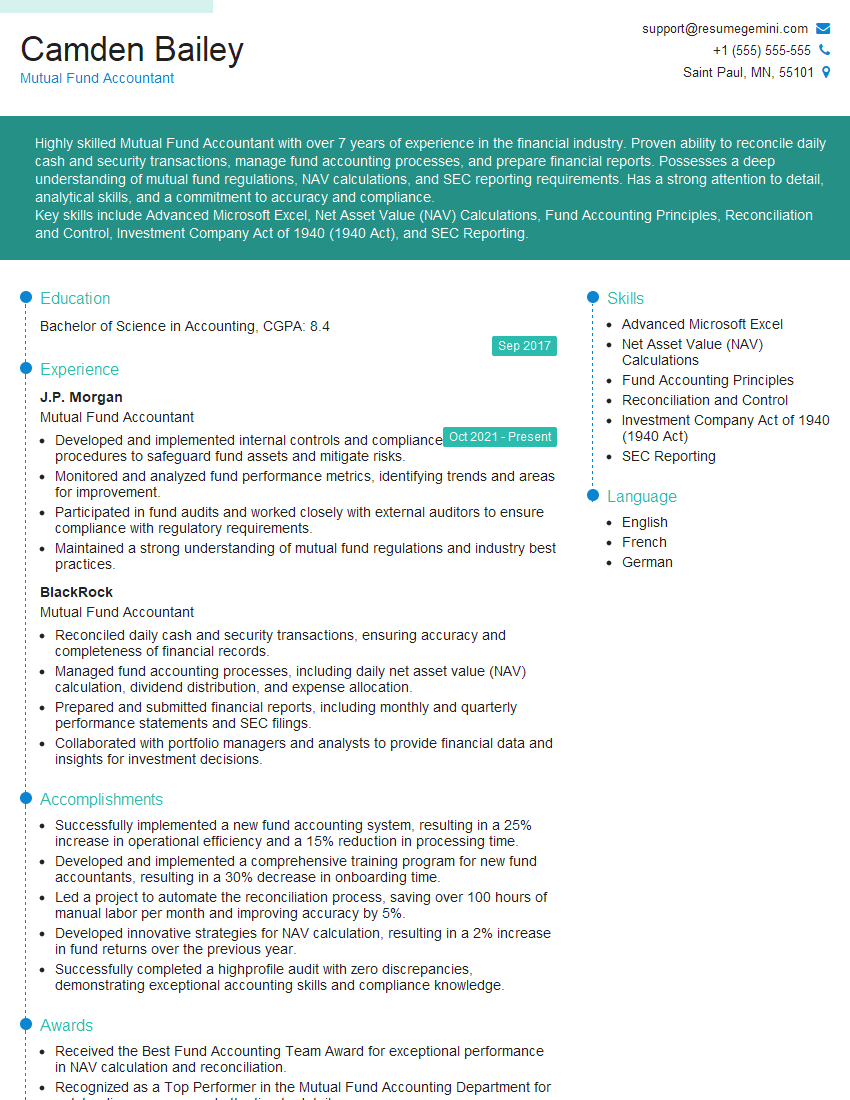

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mutual Fund Accountant

1. What is the role of a Mutual Fund Accountant?

- Maintain accurate and timely accounting records for mutual funds

- Prepare financial statements in accordance with GAAP and SEC regulations

- Calculate net asset values (NAVs) and distribute them to investors

- Monitor compliance with fund prospectus and investment guidelines

- Work with auditors and regulators to ensure compliance

2. What are the key accounting principles and standards that apply to mutual funds?

US GAAP

- ASC 820 – Fair Value Measurements and Disclosures

- ASC 946 – Financial Services – Investment Companies

- ASC 606 – Revenue from Contracts with Customers

International Financial Reporting Standards (IFRS)

- IFRS 10 – Consolidated Financial Statements

- IFRS 13 – Fair Value Measurement

- IFRS 7 – Financial Instruments: Disclosures

3. How do you calculate the net asset value (NAV) of a mutual fund?

- Add up the market value of all the fund’s assets

- Subtract the fund’s liabilities

- Divide the result by the number of outstanding shares

4. What are the different types of mutual funds?

- Open-end funds

- Closed-end funds

- Exchange-traded funds (ETFs)

- Index funds

- actively managed funds

- Target-date funds

5. What are the key risks associated with investing in mutual funds?

- Market risk

- Interest rate risk

- Inflation risk

- Currency risk

- Credit risk

- Liquidity risk

6. What are the different types of fees that mutual funds can charge?

- Management fees

- Sales charges (loads)

- Redemption fees

- 12b-1 fees

- Expense ratios

7. How do you monitor compliance with fund prospectus and investment guidelines?

- Review the prospectus and investment guidelines regularly

- Monitor the fund’s portfolio and transactions

- Work with the fund’s investment adviser and legal counsel

- Conduct internal audits

8. What are the key accounting controls that should be in place for mutual funds?

- Authorization of transactions

- Segregation of duties

- Reconciliation of accounts

- Independent verification of data

- Internal controls over financial reporting

9. What are the different types of financial statements that mutual funds must prepare?

- Statement of operations

- Statement of financial position

- Statement of cash flows

- Statement of changes in net assets

- Notes to financial statements

10. What are the key regulatory agencies that oversee mutual funds?

- Securities and Exchange Commission (SEC)

- Financial Industry Regulatory Authority (FINRA)

- State securities regulators

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mutual Fund Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mutual Fund Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Mutual Fund Accountants play a pivotal role in the financial health of investment companies. Their primary responsibilities include:

1. Fund Accounting

Recording and maintaining accurate financial records for mutual funds, including transactions, cash flows, and investments.

2. Financial Reporting

Preparing and issuing financial statements, such as balance sheets, income statements, and statements of cash flows, in accordance with GAAP and SEC regulations.

3. Performance Calculation

Calculating and verifying the performance of mutual funds, including net asset value (NAV), investment returns, and other performance metrics.

4. Audit Preparation and Support

Assisting with internal and external audits by providing documentation, data analysis, and explanations.

5. Regulatory Compliance

Ensuring compliance with all applicable laws and regulations, such as the Investment Company Act of 1940 and the Securities Exchange Act of 1934.

6. Investment Analysis

Reviewing and analyzing investment portfolios to monitor performance and identify potential opportunities or risks.

7. Customer Service

Responding to investor inquiries and providing information about fund performance and account status.

8. Other Duties

May perform other accounting or finance-related tasks as assigned, such as budgeting, forecasting, and cash management.

Interview Tips

Preparing for a Mutual Fund Accountant interview requires thorough research and practice. Here are some tips to help you ace it:

1. Research the Company and Industry

Familiarize yourself with the investment company and the mutual fund industry. Read their website, news articles, and financial reports.

2. Practice Financial Modeling and Analysis

Mutual Fund Accountants are expected to have strong financial modeling and analysis skills. Practice using Excel or other software to analyze financial data and calculate performance metrics.

3. Review GAAP and SEC Regulations

Be familiar with Generally Accepted Accounting Principles (GAAP) and Securities and Exchange Commission (SEC) regulations governing mutual funds.

4. Highlight Your Accounting Experience

Emphasize your accounting experience, especially in the investment or financial industry. Showcase your ability to maintain accurate records, prepare financial statements, and perform audits.

5. Demonstrate Attention to Detail

Mutual Fund Accountants must be meticulous and have a strong attention to detail. Provide examples that demonstrate your ability to work accurately and efficiently.

6. Prepare for Behavioral Questions

Behavioral questions are commonly used in interviews to assess your soft skills. Practice answering questions that focus on your teamwork, problem-solving, and communication abilities.

7. Prepare Questions for the Interviewers

Asking thoughtful questions shows your interest in the position and the company. Prepare questions about the company’s investment philosophy, portfolio management process, or career advancement opportunities.

8. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally and arrive for the interview on time to demonstrate your respect for the company and your interest in the position.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Mutual Fund Accountant, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Mutual Fund Accountant positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.