Are you gearing up for an interview for a Mutual Fund Advisor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Mutual Fund Advisor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

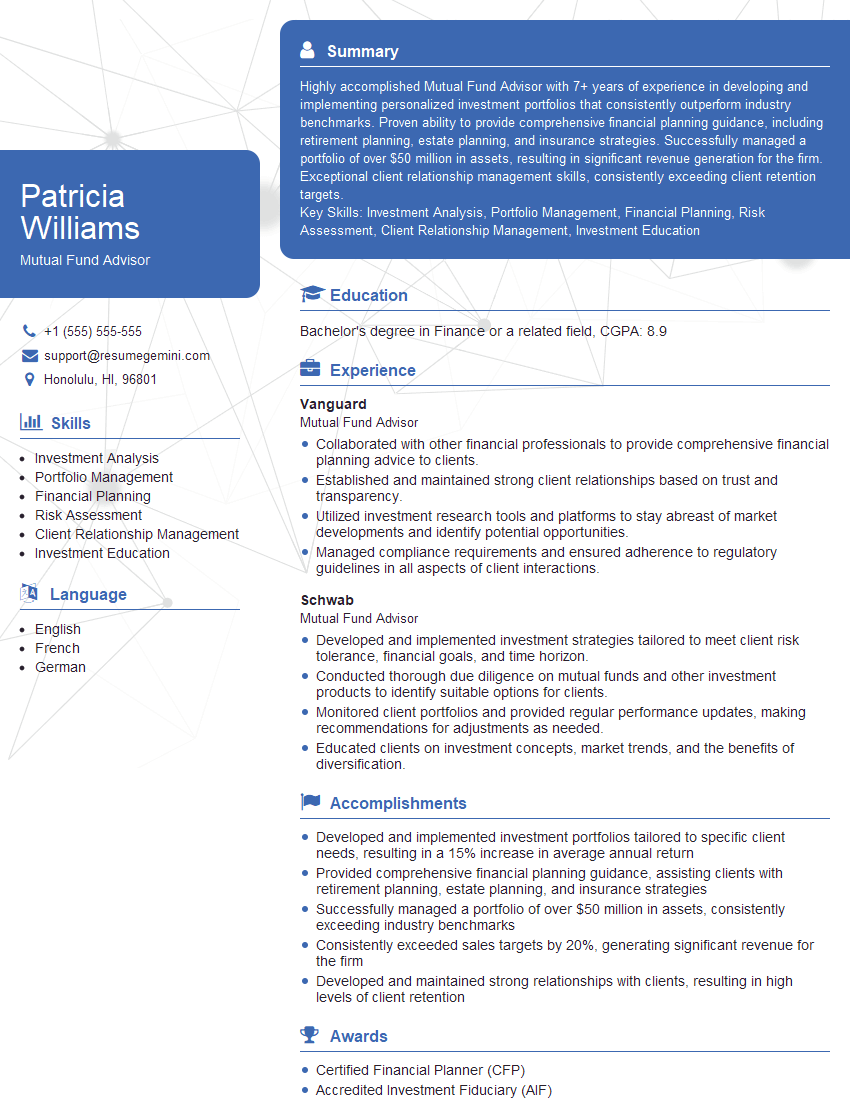

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mutual Fund Advisor

1. Explain the various types of mutual funds and their key characteristics?

Mutual funds come in various forms, each with unique attributes. Here are the main categories:

- Equity Funds: Invest primarily in the stock market, aiming for capital appreciation. Subtypes include large-cap, mid-cap, and small-cap funds.

- Debt Funds: Invest in fixed-income securities like bonds and government securities, providing stable returns and lower risk.

- Hybrid Funds: Combine equity and debt investments, balancing risk and returns. They offer diversification and suit moderate risk-takers.

- Index Funds: Track and replicate a specific market index (e.g., Nifty 50 or Sensex), offering broad exposure to the market.

- Exchange-Traded Funds (ETFs): Traded on exchanges like stocks, ETFs provide diverse investments in a single fund.

2. How do you assess and compare the performance of different mutual funds?

Quantitative Measures:

- Returns: Overall gains generated by the fund over a specified period.

- Standard Deviation: Measures the volatility of returns, indicating risk.

- Sharpe Ratio: Adjusts returns for risk, showing the excess return per unit of risk taken.

Qualitative Measures:

- Fund Manager’s Experience and Track Record: Experience and past performance of the fund manager.

- Fund House Reputation: Standing and reputation of the asset management company launching the fund.

- Investment Process: The strategy and methodology employed by the fund manager.

3. Describe the factors that influence the performance of a mutual fund?

- Market Conditions: Economic trends, interest rates, and political events can impact market returns.

- Fund Manager’s Strategy: The investment decisions and asset allocation approach adopted by the fund manager.

- Asset Mix: Proportion of equity, debt, and other asset classes held by the fund.

- Expense Ratio: Operating costs of the fund, which reduce returns.

- Investor Behavior: Inflows and outflows of investor money can affect fund performance.

4. Explain the role of SEBI in regulating the mutual fund industry in India?

- Issuing Guidelines: SEBI sets regulations and guidelines for the operation and management of mutual funds.

- Monitoring Performance: SEBI monitors fund performance and investigates any irregularities.

- Protection of Investors: SEBI implements measures to protect investor interests, such as disclosure requirements and grievance redressal mechanisms.

- Regular Reporting: Mutual funds are required to submit regular reports to SEBI, providing transparency and accountability.

- Enforcing Regulations: SEBI has the authority to impose penalties and take enforcement actions against non-compliant entities.

5. Discuss the importance of risk management in mutual fund investing?

- Mitigating Financial Loss: Identifying and managing risks helps reduce potential losses for investors.

- Achieving Investment Goals: Risk management ensures that the fund remains on track to achieve its investment objectives.

- Protecting Capital: Managing risk helps preserve investor capital and prevents erosion of returns.

- Regulatory Compliance: Mutual funds are required by regulations to implement risk management practices.

- Investor Confidence: Effective risk management instills confidence among investors and promotes long-term investment.

6. How do you approach client onboarding and investment recommendations?

Client Onboarding

- Understanding Client Needs: Assess the client’s financial goals, risk tolerance, and investment horizon.

- KYC and Risk Profiling: Conduct Know-Your-Customer (KYC) procedures and determine the client’s risk profile.

- Suitability Analysis: Recommend funds that align with the client’s needs and objectives.

Investment Recommendations

- Fund Selection: Research and select funds based on the client’s risk appetite, investment goals, and market conditions.

- Asset Allocation: Determine the optimal mix of asset classes (equity, debt, etc.) to diversify the portfolio.

- Rebalancing: Regularly review and adjust the portfolio to maintain the desired asset allocation and risk levels.

7. Explain the different types of sales channels used in the mutual fund industry?

- Direct Sales: Selling funds directly to investors through the fund house’s website or mobile app.

- Intermediaries: Partnering with distribution channels such as banks, financial advisors, and fintech platforms.

- Online Aggregators: Platforms that compare and provide access to multiple funds from different fund houses.

- Robo-Advisors: Digital platforms that offer automated investment advice and portfolio management services.

- Independent Financial Advisors (IFAs): Professionals who provide unbiased financial advice and recommend funds based on the client’s needs.

8. Describe the ethical and legal responsibilities of a mutual fund advisor?

Ethical Responsibilities

- Acting in Client’s Best Interest: Putting the client’s needs above the advisor’s personal gain.

- Disclosure and Transparency: Providing clear and accurate information about funds, fees, and risks.

- Avoiding Conflicts of Interest: Disclosing any potential conflicts that may influence recommendations.

Legal Responsibilities

- Compliance with Regulations: Adhering to SEBI guidelines and other regulations governing the mutual fund industry.

- Suitability and Misrepresentation: Recommending funds suitable for the client’s risk profile and avoiding misrepresentation of information.

- Client Protection: Taking measures to protect client assets and preventing unauthorized transactions.

9. How do you stay up-to-date with industry trends and developments?

- Industry Publications: Reading financial newspapers, magazines, and online articles.

- Webinars and Conferences: Attending industry events and webinars to gain insights from experts.

- Professional Development: Pursuing certifications or attending workshops to enhance knowledge and skills.

- Networking: Connecting with other professionals in the industry, including fund managers and advisors.

- Market Analysis: Regularly monitoring market data, economic indicators, and company financials.

10. How do you handle client queries and complaints?

- Responsiveness: Promptly responding to client queries and addressing their concerns.

- Effective Communication: Clearly explaining investment concepts, fund performance, and risk factors.

- Problem Resolution: Working to resolve client complaints and finding satisfactory solutions.

- Documentation: Maintaining records of client interactions and resolving complaints promptly.

- Continuous Improvement: Seeking feedback from clients and improving service based on their suggestions.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mutual Fund Advisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mutual Fund Advisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Mutual Fund Advisor plays a pivotal role in guiding clients through complex financial landscapes. Their primary responsibilities include:

1. Client Relationship Management

Building and maintaining strong client relationships is paramount. Advisors establish trust by understanding client needs, risk tolerance, and financial goals.

- Meet with clients to assess their financial situation and objectives

- Develop personalized investment plans tailored to individual circumstances

- Provide ongoing financial advice and portfolio monitoring

2. Investment Analysis and Recommendation

Advisors leverage their expertise to analyze market trends and identify suitable investment options for clients.

- Research and evaluate mutual funds based on performance, risk, and fees

- Recommend appropriate funds that align with clients’ goals and risk tolerance

- Monitor fund performance and make adjustments as needed

3. Financial Planning and Advisory

Advisors go beyond investment recommendations, offering comprehensive financial planning services.

- Assist clients with retirement planning, estate planning, and tax optimization

- Provide guidance on budgeting, debt management, and insurance needs

- Educate clients on financial principles and investment strategies

4. Regulatory Compliance and Ethics

Advisors adhere to stringent regulatory guidelines and ethical standards.

- Maintain up-to-date knowledge of industry regulations and compliance requirements

- Prioritize clients’ best interests and ensure transparency in all interactions

- Uphold the highest ethical standards in financial advising

Interview Tips

To ace an interview for a Mutual Fund Advisor position, it’s imperative to prepare thoroughly. Here are some tips:

1. Research the Company and Industry

Before the interview, delve into the company’s background, mission, and investment philosophy. Stay informed about recent market trends and regulatory changes in the financial industry.

2. Highlight Relevant Skills and Experience

Emphasize your expertise in financial planning, investment analysis, and client relationship management. Quantify your accomplishments whenever possible, using specific metrics and examples.

3. Demonstrate Industry Knowledge

Showcase your understanding of different types of mutual funds, investment strategies, and market analysis techniques. Discuss your past experience in evaluating and recommending funds.

4. Focus on Client-Centered Approach

Mutual Fund Advisors are trusted advisors for their clients. Stress your ability to build rapport, actively listen, and prioritize clients’ financial well-being.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Mutual Fund Advisor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!