Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Mutual Fund Manager position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

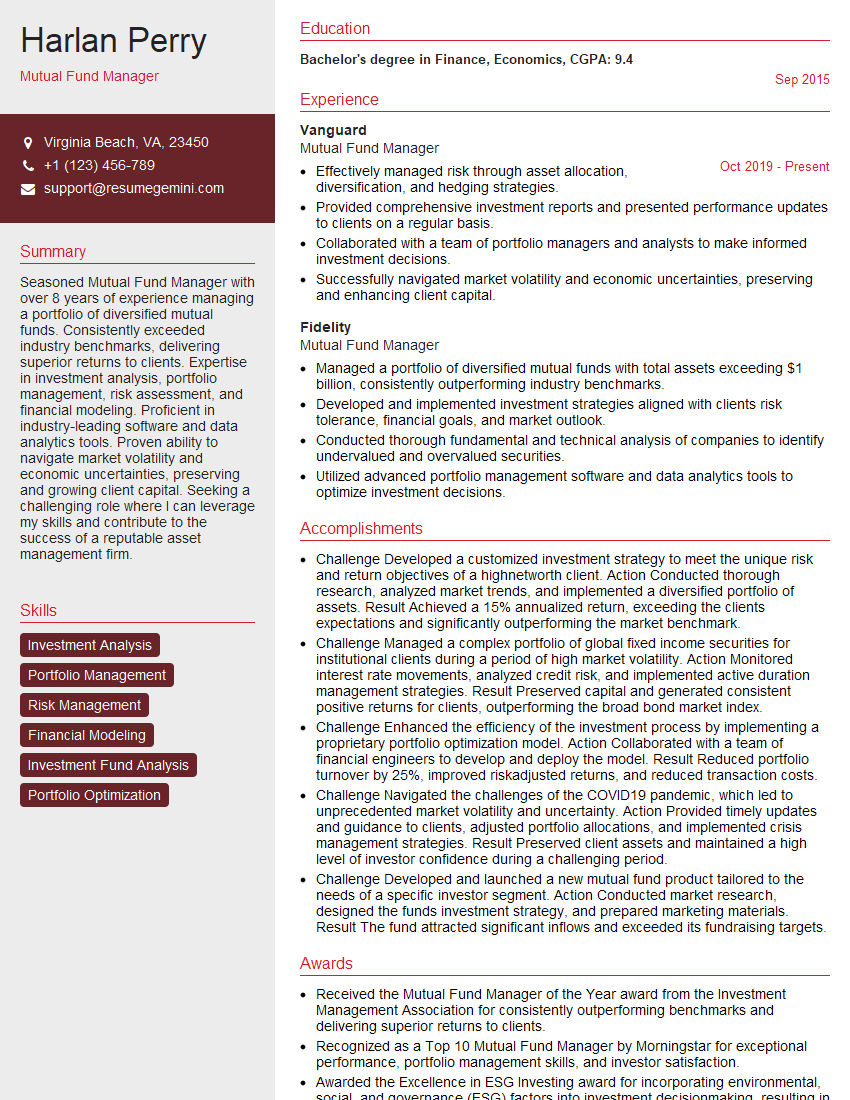

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mutual Fund Manager

1. If a client had invested ₹10,000 in your mutual fund at the start of the year, and the NAV is now ₹12,000, what is the absolute return?

The absolute return is the difference between the current NAV and the initial investment. In this case, the absolute return is ₹12,000 – ₹10,000 = ₹2,000.

2. What is your investment philosophy and how does it drive your fund selection process?

Steps Involved in Fund Selection Process:

- Identify the investment objective and risk tolerance of the client.

- Research and analyze potential funds that meet the client’s criteria.

- Evaluate the fund’s performance, management team, and investment strategy.

- Make a decision on which funds to recommend to the client.

Investment Philosophy:

- Focus on long-term growth potential.

- Diversify investments across asset classes and sectors.

- Invest in high-quality companies with strong fundamentals.

3. Describe your risk management process for managing a mutual fund portfolio.

The risk management process involves identifying, assessing, and mitigating risks that may affect the performance of the mutual fund portfolio. The process includes the following steps:

- Identify potential risks.

- Assess the likelihood and impact of each risk.

- Develop strategies to mitigate the risks.

- Monitor the risks and adjust the strategies as needed.

4. How do you stay up-to-date on the latest market trends and economic developments?

I stay up-to-date on the latest market trends and economic developments by reading industry publications, attending conferences, and networking with other professionals.

- Reading industry publications.

- Attending conferences.

- Networking with other professionals.

5. What are some of the challenges you have faced as a mutual fund manager, and how did you overcome them?

Some of the challenges I have faced as a mutual fund manager include:

- Market volatility.

- Economic downturns.

- Client redemptions.

- Regulatory changes.

I have overcome these challenges by:

- Developing a sound investment strategy.

- Diversifying the portfolio.

- Communicating with clients regularly.

- Staying up-to-date on regulatory changes.

6. What is your approach to investor relations and how do you build and maintain strong relationships with clients?

My approach to investor relations is to be transparent, communicative, and responsive. I believe that it is important to build and maintain strong relationships with clients by:

- Providing regular updates on the performance of the fund.

- Answering client questions promptly and thoroughly.

- Meeting with clients regularly to discuss their investment goals.

- Hosting educational events for clients.

7. What are your thoughts on the use of technology in the mutual fund industry?

I believe that technology can be a valuable tool for mutual fund managers. Technology can be used to:

- Automate tasks.

- Improve communication with clients.

- Provide investors with access to real-time information.

I am always looking for ways to use technology to improve the efficiency and effectiveness of my work.

8. Describe your ethical responsibilities as a mutual fund manager.

As a mutual fund manager, I have a fiduciary duty to act in the best interests of my clients. This means that I must:

- Put the interests of my clients first.

- Avoid conflicts of interest.

- Act with integrity and professionalism.

I take my ethical responsibilities very seriously and I am committed to always acting in the best interests of my clients.

9. What are your goals for the next year as a mutual fund manager?

My goals for the next year as a mutual fund manager are to:

- Continue to grow the assets under management.

- Improve the performance of the fund.

- Build stronger relationships with clients.

- Stay up-to-date on the latest market trends.

10. Why are you interested in this position with our company?

I am interested in this position with your company because I am impressed with your company’s commitment to providing high-quality investment products and services to your clients. I believe that my skills and experience would be a valuable asset to your team, and I am confident that I can make a significant contribution to your company’s success.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mutual Fund Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mutual Fund Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Mutual Fund Managers are responsible for managing and making decisions for their clients. Specific tasks includes:Key responsibilities

1. Investment Management

Conduct extensive research and analysis of financial markets, different funds and sectors to identify potential investment opportunities.

- Build and maintain diversified portfolios that align with the fund’s objectives and investment strategies.

- Monitor portfolio performance and make necessary adjustments to meet investment goals.

2. Financial Analysis

Perform complex financial analysis, including risk assessment, due diligence, and valuation modeling.

- Evaluate the financial health and prospects of companies to make informed investment decisions.

- Identify and manage potential risks associated with investments.

3. Client Management

Communicate with clients, provide investment updates, and address any concerns they may have.

- Present investment strategies and performance to clients in a clear and concise manner.

- Actively listen to client feedback and incorporate their input into investment decisions.

4. Regulatory Compliance

Ensure compliance with applicable laws and regulations, including the Investment Company Act of 1940.

- Maintain accurate records and prepare timely reports for regulatory agencies.

- Adhere to ethical guidelines and best practices in managing client portfolios.

Interview Tips

Interview Prepration

1. Research the Company and Position

Thoroughly research the mutual fund company, its investment strategies, and the specific role you are applying for.

- Gain insights into the company’s culture, values, and recent performance.

- Understand the specific responsibilities and expectations associated with the role.

2. Highlight Your Skills and Experience

Tailor your resume and cover letter to emphasize your relevant skills and experience.

- Quantify your accomplishments and demonstrate your ability to analyze financial data and make sound investment decisions.

- Showcase your understanding of the mutual fund industry and its regulatory framework.

3. Practice Mock Interviews

Conduct mock interviews with friends, family, or a career counselor to improve your communication and response skills.

- Prepare for common interview questions about your investment philosophy, risk management strategies, and client management approach.

- Practice articulating your knowledge and experience in a clear and concise manner.

4. Dress Professionally and Be Punctual

Make a positive first impression by dressing professionally and arriving on time for your interview.

- Choose attire that is appropriate for a business setting and conveys confidence and professionalism.

- Allow ample time for travel and ensure you arrive at the interview location with time to spare.

5. Follow Up and Seek Feedback

After the interview, promptly send a thank-you note to the hiring manager expressing your appreciation and reiterating your interest in the position.

- Inquire about the next steps in the hiring process and request feedback on your performance.

- The feedback can help you identify areas for improvement and enhance your interview skills for future opportunities.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Mutual Fund Manager interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!