Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Mutual Fund Sales Agent position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

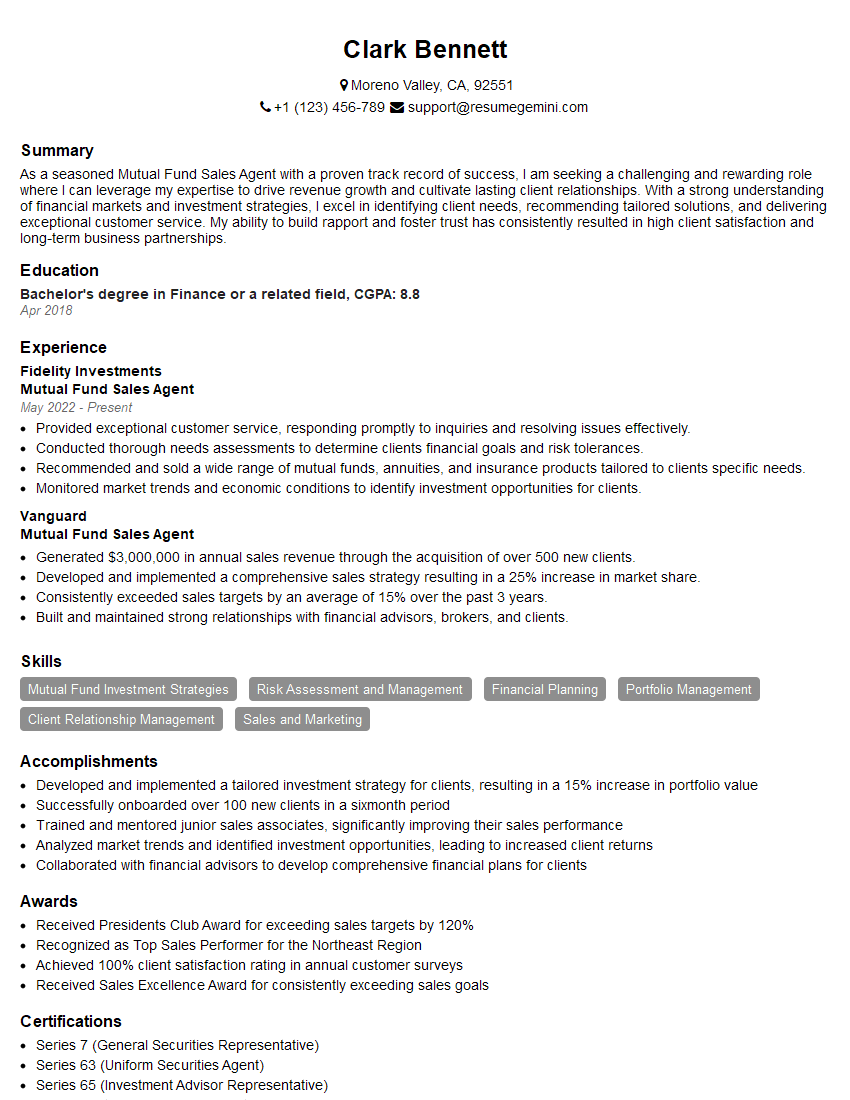

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mutual Fund Sales Agent

1. What are the different types of mutual funds and how do they differ from each other?

- Equity funds: Invest in stocks of companies and aim to provide capital appreciation.

- Debt funds: Invest in fixed-income securities such as bonds and government securities, and aim to provide stable returns.

- Hybrid funds: Combine both equity and debt investments, offering a balance between growth and stability.

- Index funds: Track and replicate a specific market index, such as the Nifty 50 or Sensex.

- Exchange-traded funds (ETFs): Similar to index funds but traded on stock exchanges like shares.

2. What are the key financial ratios used to evaluate mutual funds and how do you interpret them?

Profitability ratios

- Expense ratio: Measures the fund’s operating costs as a percentage of assets.

- Return on net assets (RONA): Measures the fund’s profitability relative to its net assets.

Solvency ratios

- Debt-to-equity ratio: Assesses the fund’s financial leverage and risk.

- Net asset value (NAV): Represents the per-unit value of the fund’s underlying assets.

3. How do you recommend mutual funds to clients based on their risk tolerance and financial goals?

- Assess the client’s risk tolerance using questionnaires or risk profiling tools.

- Determine the client’s financial goals, such as retirement planning, education funding, or wealth creation.

- Recommend funds that align with the client’s risk appetite and goals, considering factors like investment horizon, liquidity needs, and tax implications.

4. What are the regulatory requirements for Mutual Fund Sales Agents in India and how do you comply with them?

- Hold a valid AMFI Registration Number (ARN).

- Complete the National Institute of Securities Markets (NISM) certification in Mutual Funds Distribution.

- Adhere to the code of conduct and ethical guidelines set by AMFI and SEBI.

- Maintain accurate records of client interactions and transactions.

5. How do you stay updated on the latest market trends and mutual fund schemes?

- Attend industry seminars and conferences.

- Read financial newspapers, magazines, and research reports.

- Monitor market news and investment platforms.

- Consult with fund managers and financial experts.

6. How do you handle objections and complaints from clients and maintain a strong client relationship?

- Listen attentively to the client’s concerns.

- Address the objections or complaints promptly and professionally.

- Provide clear and understandable explanations.

- Offer solutions that are in the client’s best interests.

- Maintain regular communication and follow-ups.

7. What are the ethical considerations in mutual fund sales and how do you ensure ethical practices?

- Put the client’s interests first.

- Avoid conflicts of interest.

- Provide unbiased advice.

- Disclose all material information to clients.

- Comply with regulatory requirements and best practices.

8. How do you track and measure your performance as a Mutual Fund Sales Agent?

- Sales volume: Total value of mutual fund units sold.

- Client acquisition: Number of new clients acquired.

- Client retention: Percentage of clients who continue to invest through you.

- Customer satisfaction: Number of positive client reviews or testimonials.

- Continuing education: Number of professional development courses or certifications completed.

9. What is your understanding of the role of a Mutual Fund Sales Agent in the financial ecosystem?

- Provide financial advice and investment solutions to clients.

- Educate clients about mutual funds and investment strategies.

- Help clients achieve their financial goals through tailored recommendations.

- Act as a link between asset management companies and investors.

- Promote financial literacy and encourage savings and investments.

10. What are your strengths and weaknesses as a Mutual Fund Sales Agent?

- Strong knowledge of mutual funds and financial markets.

- Excellent communication and interpersonal skills.

- Ability to build rapport with clients and understand their needs.

- Dedication to ethical practices and client satisfaction.

- Limited experience in managing high-net-worth clients (could be converted to a strength with ongoing development).

- Working on improving my time management skills to handle a growing client base.

Strengths:

Weaknesses:

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mutual Fund Sales Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mutual Fund Sales Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Mutual Fund Sales Agents are responsible for selling mutual funds to individual and institutional investors. Their key responsibilities include:

1. Prospecting and lead generation

Identifying, qualifying, and developing potential clients through networking, referrals, and market research.

- Conducting thorough market research to identify target audience and potential investors

- Attending industry events, conferences, and seminars to establish connections

2. Client relationship management

Building and maintaining strong relationships with clients by providing personalized investment advice and ongoing support.

- Understanding clients’ financial goals, risk tolerance, and investment preferences

- Recommending suitable mutual fund products that align with clients’ objectives

3. Sales and marketing

Promoting and selling mutual funds through presentations, webinars, and marketing campaigns.

- Developing and executing sales strategies to reach and engage potential investors

- Organizing client events, webinars, and seminars to educate and inform investors

4. Regulatory compliance

Ensuring adherence to all applicable laws, regulations, and industry standards governing the sale of mutual funds.

- Maintaining a thorough understanding of regulatory requirements and industry best practices

- Performing due diligence on potential investments and ensuring compliance with prospectus guidelines

- Documenting all client interactions, transactions, and advice provided in accordance with regulatory standards

Interview Tips

To ace the interview for a Mutual Fund Sales Agent role, candidates should:

1. Research the company and industry

Familiarize yourself with the company’s history, business model, and mutual fund offerings. Stay up-to-date on industry trends, regulations, and market conditions.

- Visit the company website, read their reports, and conduct industry research through reputable sources.

- Follow the company’s social media channels and industry publications to stay informed about recent developments.

2. Highlight your sales skills and experience

Emphasize your ability to build relationships, communicate effectively, and persuade clients. Provide specific examples of successful sales experiences, especially in the financial sector.

- Quantify your sales achievements whenever possible, using numbers to demonstrate your success.

- Prepare stories or case studies that showcase your ability to identify client needs and develop tailored solutions.

3. Demonstrate knowledge of mutual funds

Exhibit a thorough understanding of mutual funds, including different types, investment strategies, and risk-return profiles.

- Be familiar with the different fund families, investment objectives, and performance history of various funds.

- Show your understanding of fund prospectus, investment terminology, and tax implications.

4. Emphasize ethical and compliant practices

Mutual fund sales require a high level of ethical conduct and regulatory compliance. Highlight your commitment to adhering to all relevant laws, regulations, and industry standards.

- Explain your understanding of fiduciary responsibilities and how you prioritize clients’ best interests.

- Provide examples of how you have handled compliance issues and maintained ethical practices in sales situations.

5. Prepare for common interview questions

Practice answering common interview questions specific to the mutual fund industry, such as:

- Why are you interested in a career as a Mutual Fund Sales Agent?

- What are your strengths and weaknesses as a sales professional?

- How do you approach building relationships with clients?

- How do you stay up-to-date on industry regulations and market trends?

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Mutual Fund Sales Agent interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!