Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Mutuel Department Manager position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

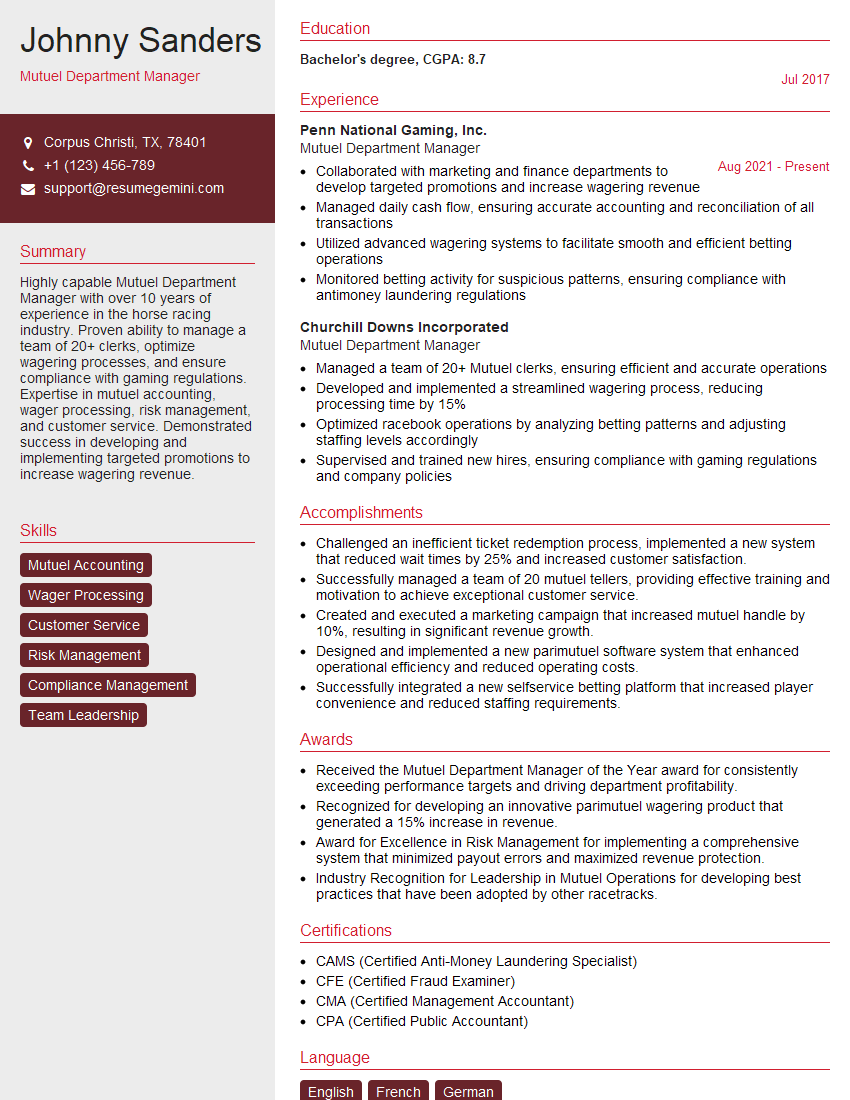

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mutuel Department Manager

1. What are the key performance indicators (KPIs) you use to measure the success of the mutuel department?

- Total mutuel handle

- Average daily handle

- Hold percentage

- Customer satisfaction

2. What are the different types of mutuel pools and how do they work?

There are several different types of mutuel pools, including:

pari-mutuel pools

- All the money wagered on a race (minus the takeout) is pooled together.

- The money is then divided among the winning tickets.

fixed-odds pools

- The odds are set before the race.

- The payouts are based on the odds.

3. How do you manage risk in the mutuel department?

- Set limits on the amount of money that can be wagered on each race.

- Monitor the mutuel pools to identify any suspicious activity.

- Work with the track security team to prevent fraud.

4. How do you handle customer complaints?

- Listen to the customer’s complaint and try to understand their perspective.

- Investigate the complaint to determine if there is any validity to it.

- Take appropriate action to resolve the complaint.

5. What are the different types of mutuel software and how do they work?

There are many different types of mutuel software available, each with its own advantages. Some of the most common types include:

- Pari-mutuel software

- Fixed-odds software

- Hybrid software

6. What are the challenges facing the mutuel department in today’s gambling market?

- Competition from online gambling

- The rise of sports betting

- The legalization of marijuana

7. What are your plans for the future of the mutuel department?

- Expand the range of mutuel products offered.

- Improve the customer experience.

- Partner with new technologies.

8. How do you stay up-to-date on the latest trends in the mutuel industry?

- Read industry publications.

- Attend conferences.

- Network with other mutuel managers.

9. What are your strengths and weaknesses as a mutuel department manager?

-

strengths:

- Strong knowledge of mutuel operations.

- Excellent customer service skills.

- Proven ability to manage risk. weaknesses:

- Limited experience with online gambling.

- Need to improve my public speaking skills.

10. Why are you interested in this position?

- I am passionate about the mutuel industry and believe that I can make a significant contribution to your team.

- I am confident that my skills and experience would make me a valuable asset to your company.

- I am excited about the opportunity to work with a team of talented professionals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mutuel Department Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mutuel Department Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Mutuel Department Manager is responsible for managing all aspects of the mutuel department, including customer service, cashier operations, and accounting. They are also responsible for overseeing the development and implementation of new mutuel systems and procedures.The key job responsibilities of a Mutuel Department Manager include:

1. Manage all aspects of the mutuel department

This includes supervising staff, overseeing customer service, and ensuring that all mutuel operations are conducted in a fair and efficient manner.

- Supervise a team of mutuel tellers and other staff

- Provide excellent customer service to patrons

- Ensure that all mutuel operations are conducted in a fair and efficient manner

2. Oversee cashier operations

This includes ensuring that all cashiers are properly trained and that they are following all established procedures.

- Train and supervise mutuel cashiers

- Ensure that all cashiers are following established procedures

- Resolve any customer disputes or complaints

3. Oversee accounting operations

This includes preparing financial reports, reconciling accounts, and ensuring that all mutuel funds are properly accounted for.

- Prepare financial reports

- Reconcile accounts

- Ensure that all mutuel funds are properly accounted for

4. Oversee the development and implementation of new mutuel systems and procedures

This includes working with other departments to develop new systems that will improve the efficiency and accuracy of mutuel operations.

- Work with other departments to develop new mutuel systems

- Implement new mutuel systems and procedures

- Train staff on new mutuel systems and procedures

Interview Tips

Here are some interview tips for candidates who are looking to ace their interview for a Mutuel Department Manager position:

1. Research the company and the position

Before you go on your interview, it is important to do your research and learn as much as you can about the company and the position you are applying for. This will show the interviewer that you are interested in the job and that you have taken the time to prepare for the interview.

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?”. It is important to practice your answers to these questions so that you can deliver them confidently and concisely.

3. Be prepared to talk about your experience and skills

The interviewer will want to know about your experience and skills, so be prepared to talk about your accomplishments in detail. Be sure to highlight your skills and experience that are most relevant to the Mutuel Department Manager position.

4. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally and arrive on time for your interview. This will show the interviewer that you are respectful of their time and that you are serious about the position.

5. Be yourself and be confident

The most important thing is to be yourself and be confident in your abilities. The interviewer will be able to tell if you are not being genuine, so it is important to be honest and authentic.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Mutuel Department Manager role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.