Are you gearing up for a career in Mutuel Teller? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Mutuel Teller and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

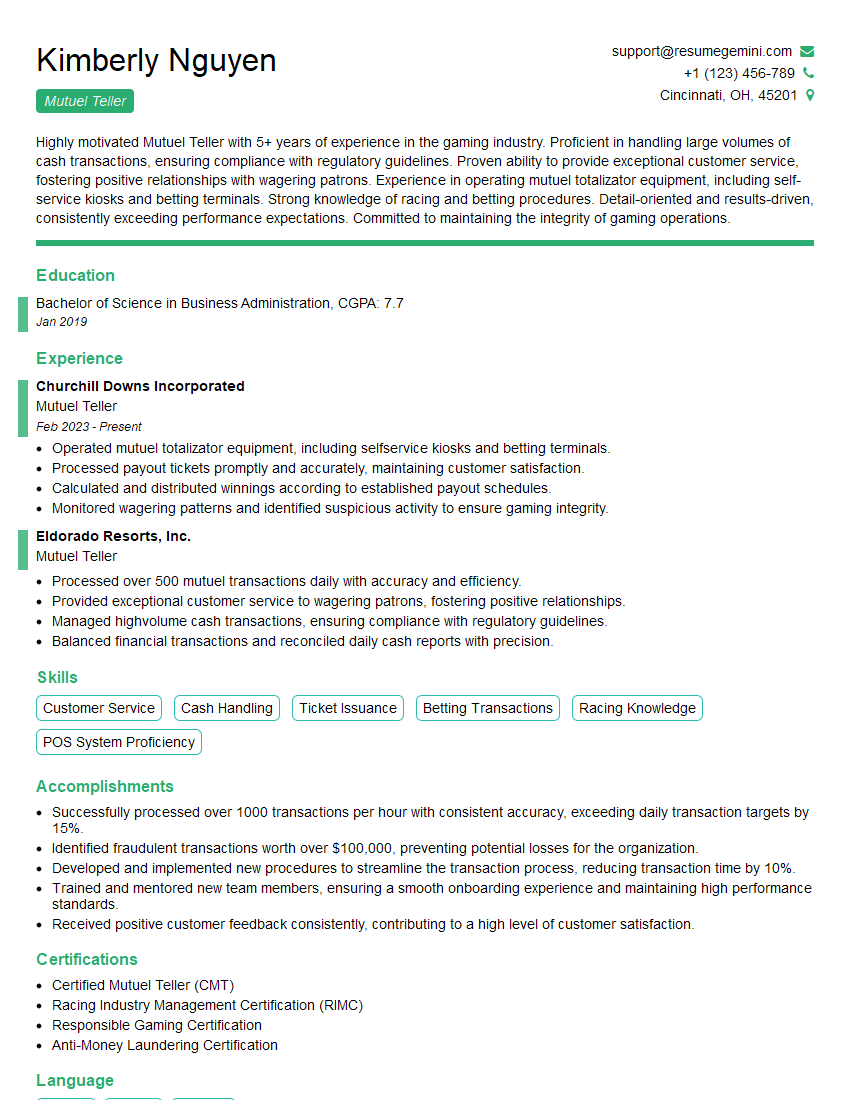

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mutuel Teller

1. How do you handle rush hours effectively?

- Greet customers cheerfully and professionally, while remaining calm under pressure.

- Process transactions accurately and efficiently, using a variety of methods such as cash, credit cards, and vouchers.

2. What is your strategy for providing excellent customer service?

Understanding Customer’s Needs

- Actively listen to customers’ requests and queries.

- Identify their needs and preferences.

Proactive Communication

- Clearly explain betting options and procedures.

- Provide regular updates on race progress and payouts.

3. How do you calculate and verify betting payouts accurately?

- Understanding Betting Types and Odds: Thorough knowledge of different bet types (e.g., win, place, show) and how they determine payouts.

- Calculating Payouts: Using established formulas and betting software to calculate winnings based on odds and stake amounts.

4. Describe your understanding of the pari-mutuel betting system.

- Pool System: Explain that bets are combined into a pool and winners share the proceeds, minus house commission.

- Odds Fluctuation: Describe how changes in betting patterns affect odds and payouts.

5. What measures do you take to maintain a secure and controlled betting environment?

- ID Verification: Checking identification to ensure eligibility and prevent underage betting.

- Monitoring Transactions: Keeping a vigilant eye on betting patterns to identify suspicious activities.

6. Can you explain the different types of bets accepted at a racetrack?

- Straight Bets: Win, place, show.

- Exotic Bets: Quinella, exacta, trifecta.

7. How do you handle irate or intoxicated customers?

- Remain Calm and Professional: Maintain composure and avoid escalating the situation.

- Active Listening: Allow the customer to express their concerns without interrupting.

8. What is your favorite part about being a Mutuel Teller?

- Interaction with Customers: Enjoying the social aspect of the job and building relationships.

- Thrilling Environment: Finding excitement in the fast-paced and dynamic atmosphere of a racetrack.

9. How do you stay informed about the latest industry regulations and best practices?

- Industry Publications: Reading trade magazines and attending conferences.

- Compliance Training: Participating in regular training programs to stay up-to-date on regulatory changes.

10. What are your career goals? How does this position align with them?

- Advancement Opportunities: Exploring potential for growth within the organization.

- Professional Development: Seeking opportunities to enhance skills and knowledge.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mutuel Teller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mutuel Teller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Mutuel Teller is responsible for performing various tasks related to the processing of betting transactions at horse racing or other gambling events.

1. Cash Handling

Handle and process cash transactions efficiently and accurately.

- Collect bets from customers.

- Payout winnings to customers.

- Maintain accurate records of transactions.

2. Customer Service

Provide exceptional customer service to ensure satisfaction.

- Answer customer inquiries and provide information about bets.

- resolve customer complaints or queries promptly.

- Uphold a friendly and professional demeanor.

3. Operating Systems and Equipment

Operate and maintain betting systems and equipment.

- Use betting terminals to process transactions.

- Monitor betting boards and displays.

- Ensure that equipment is in proper working order.

4. Compliance and Regulations

Adhere to all applicable gambling laws and regulations.

- Verify the identity of customers.

- Prevent underage gambling.

- Report any suspicious activities.

Interview Tips

Preparing thoroughly for a Mutuel Teller interview can increase your chances of success. Here are some tips to help you ace the interview:

1. Research the Company and Position

Familiarize yourself with the company’s history, operations, and culture.

- Visit the company website.

- Read industry news and articles.

- Learn about the specific responsibilities of the Mutuel Teller role.

2. Practice Answering Common Interview Questions

Anticipate potential interview questions and prepare thoughtful responses.

- Tell me about your experience in handling cash transactions.

- How do you ensure accuracy in your work?

- Describe a time when you provided excellent customer service.

3. Highlight Your Skills and Experience

Emphasize your relevant skills and experience that align with the job requirements.

- Quantify your accomplishments whenever possible.

- Use examples to demonstrate your abilities.

- Tailor your responses to the specific role and company.

4. Dress Professionally and Arrive on Time

Make a positive first impression by dressing appropriately and arriving on time for the interview.

- Choose business attire that is clean and pressed.

- Arrive at the interview location 10-15 minutes early.

5. Be Confident and Enthusiastic

Confidence and enthusiasm can make a significant impact on the interviewer’s perception.

- Maintain eye contact and speak clearly.

- Be positive and enthusiastic about the position.

- Show that you are eager to learn and contribute to the team.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Mutuel Teller interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!