Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Non Profit Financial Controller position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

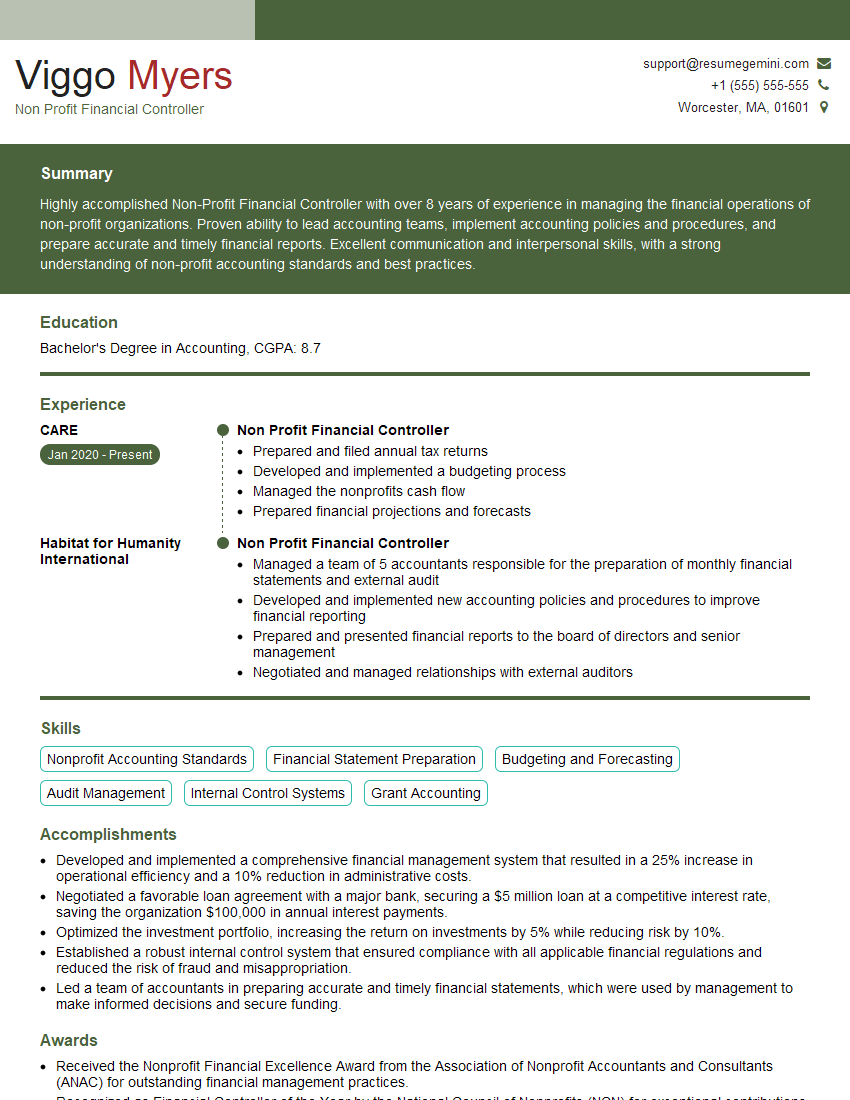

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Non Profit Financial Controller

1. Describe the key accounting principles and standards applicable to non-profit organizations.

The key accounting principles and standards applicable to non-profit organizations are:

- Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 958, Not-for-Profit Entities

- Generally Accepted Accounting Principles (GAAP)

- International Financial Reporting Standards (IFRS)

2. Explain the difference between a non-profit’s Statement of Financial Position and a for-profit’s Balance Sheet.

Net Assets

- A non-profit’s Statement of Financial Position includes net assets, which represent the residual interest in the assets of the organization after deducting its liabilities.

- A for-profit’s Balance Sheet includes equity, which represents the residual interest in the assets of the organization after deducting its liabilities.

Nature of Expenses

- A non-profit’s Statement of Financial Position may include expenses that are not directly related to the generation of revenue.

- A for-profit’s Balance Sheet will typically only include expenses that are directly related to the generation of revenue.

3. What are the critical components of an internal control system for a non-profit organization?

- Control environment

- Risk assessment

- Control activities

- Information and communication

- Monitoring

4. How do you ensure the accuracy and completeness of financial reporting for a non-profit organization?

Ensuring the accuracy and completeness of financial reporting for a non-profit organization involves:

- Implementing and maintaining a strong internal control system

- Performing regular reconciliations

- Reviewing financial reports for reasonableness

- Obtaining an audit or review from an independent auditor

5. Describe the process for preparing a non-profit organization’s budget.

- Develop a budget calendar

- Forecast revenue and expenses

- Review and approve the budget

- Monitor and adjust the budget throughout the year

6. What are the essential elements of a non-profit organization’s financial management policy?

- Mission and values

- Financial responsibilities

- Budgeting

- Accounting

- Auditing

7. What are the common financial challenges faced by non-profit organizations?

- Fluctuating revenue

- Limited resources

- Regulatory compliance

- Competition for funding

8. How do you stay up-to-date on the latest accounting and financial reporting requirements for non-profit organizations?

- Attend conferences and webinars

- Read industry publications

- Network with other non-profit financial professionals

9. What is your experience with managing investments for a non-profit organization?

My experience with managing investments for a non-profit organization includes:

- Developing and implementing an investment policy

- Selecting and monitoring investment managers

- Reporting on investment performance

10. How do you work with the board of directors on financial matters?

- Provide the board with regular financial reports

- Discuss financial matters with the board

- Make recommendations to the board on financial matters

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Non Profit Financial Controller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Non Profit Financial Controller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Non Profit Financial Controller, you will be responsible for overseeing all financial operations of the organization. This includes:

1. Financial Reporting and Analysis

You will be responsible for preparing and submitting all required financial reports, including quarterly and annual reports and budget summaries. You will also be responsible for analyzing financial data and trends to make informed decisions.

- Preparing detailed financial reports for board meetings

- Providing financial insights to support decision-making

2. Budgeting and Forecasting

You will be responsible for developing and executing an annual budget for the organization. You will also be responsible for developing long-term financial forecasts using assumptions and research.

- Developing annual budgets that align with organizational goals

- Modeling financial scenarios to project organizational performance

3. Internal Controls and Compliance

You will be responsible for ensuring that the organization has adequate internal controls in place to protect its assets and ensure compliance with applicable laws and regulations.

- Implementing internal controls to safeguard financial assets

- Ensuring compliance with all applicable financial regulations

4. Donor Relations

You will be responsible for building and maintaining relationships with donors and grantors. You will also be responsible for soliciting and managing gifts.

- Providing donors with timely financial information

- Working with external auditors to ensure accuracy of financial information

Interview Tips

To ace your interview for the Non Profit Financial Controller position, consider the following tips:

1. Research the Organization

Before the interview, take the time to research the organization’s mission, goals, and financial history. This will help you understand the organization’s needs and demonstrate your interest in the position.

- Review the organization’s website, annual reports, and social media pages.

- Attend any public events or webinars hosted by the organization.

2. Practice Your Answers

Take some time to practice your answers to common interview questions. This will help you feel more confident and prepared during the interview.

- Think about your experience in financial reporting, budgeting, and compliance.

- Prepare examples of how you have successfully managed financial operations.

3. Highlight Your Passion

Nonprofit organizations are driven by mission. During your interview, be sure to highlight your passion for the organization’s mission and your commitment to making a difference.

- Share personal stories or experiences that demonstrate your commitment to the social sector.

- Explain how your skills and experience align with the organization’s goals.

4. Ask Insightful Questions

At the end of the interview, take the opportunity to ask insightful questions. This will show the interviewer that you are engaged and interested in the organization.

- Ask about the organization’s future financial plans and goals.

- Inquire about the team culture and work environment.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Non Profit Financial Controller interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!