Are you gearing up for an interview for a Nonprofit Financial Controller position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Nonprofit Financial Controller and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

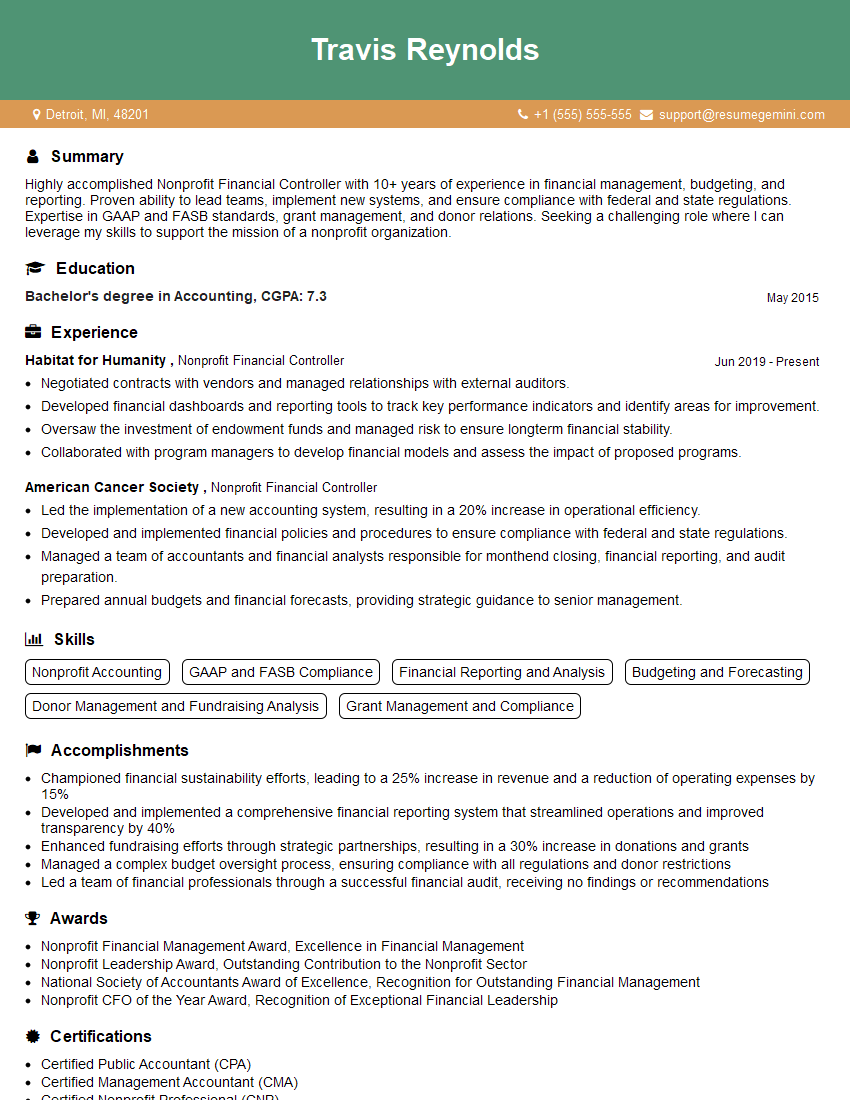

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Nonprofit Financial Controller

1. What are the key differences between for-profit and nonprofit accounting?

- Nonprofit organizations have a mission-driven focus, while for-profit organizations prioritize profit maximization.

- Nonprofits rely on grants, donations, and other non-operating revenues, while for-profits primarily generate revenue through sales of goods or services.

- Nonprofits must adhere to specific reporting requirements and regulations, such as the Uniform Guidance, while for-profits are subject to different accounting standards.

2. How do you ensure compliance with GAAP and other relevant accounting standards?

Maintaining Up-to-Date Knowledge

- Stay informed of GAAP updates through professional development and subscriptions.

- Review relevant accounting standards to understand their implications for nonprofit financial reporting.

Internal Control System

- Establish a robust internal control system to prevent errors and ensure accuracy.

- Regularly monitor and update the control system to address changing needs.

External Audit Process

- Coordinate with external auditors to ensure proper audit procedures are followed.

- Review audit findings and promptly address any identified issues.

3. Describe your experience in managing a nonprofit budget.

- Developed and implemented annual budgets aligned with the organization’s mission and strategic goals.

- Monitored budget performance throughout the fiscal year and made necessary adjustments.

- Collaborated with program managers to ensure alignment between program expenses and funding sources.

- Prepared financial reports for stakeholders, including the board of directors and donors.

4. How do you handle complex accounting transactions in a nonprofit setting?

- Identify the nature and accounting treatment of complex transactions, such as grants with matching requirements or restricted funds.

- Research relevant accounting standards and consult with external resources as needed.

- Document transactions thoroughly and maintain clear audit trails.

- Seek guidance from experienced accountants or auditors when necessary.

5. What is your approach to forecasting and planning for the future?

- Analyze historical financial data and industry trends to develop forecasts.

- Identify potential risks and opportunities and develop contingency plans.

- Develop scenarios and projections for different funding scenarios.

- Collaborate with senior management to align financial planning with strategic priorities.

6. How do you stay updated on the latest developments in nonprofit financial management?

- Attend industry conferences and workshops.

- Subscribe to professional journals and newsletters.

- Network with other nonprofit finance professionals.

- Engage in continuing education courses and certifications.

7. What is your experience in managing capital projects?

Planning and Budgeting

- Develop financial plans for capital projects, including estimates, funding sources, and timelines.

- Manage project budgets and track expenditures closely.

Construction and Implementation

- Oversee accounting aspects of project implementation, including vendor payments and capital asset management.

- Monitor project progress and communicate any financial risks to stakeholders.

Post-Completion

- Prepare financial reports and ensure proper capitalization of capital assets.

- Monitor ongoing expenses and depreciation related to the capital project.

8. How do you ensure the accuracy and reliability of financial data?

- Establish rigorous accounting processes and procedures.

- Regularly reconcile accounts to identify and correct any discrepancies.

- Implement internal controls to prevent fraud and errors.

- Seek external audits to provide an independent assessment of financial data.

9. Describe your experience in using accounting software for nonprofit organizations.

- Proficient in nonprofit-specific accounting software, such as QuickBooks Nonprofit or NetSuite Nonprofit.

- Experience in customizing financial reports and dashboards to meet the organization’s needs.

- Knowledge of importing and exporting data between different systems.

- Ability to troubleshoot technical issues and provide support to users.

10. How do you manage relationships with external stakeholders, such as donors and auditors?

Donors

- Maintain clear and transparent communication with donors regarding financial matters.

- Provide timely and accurate financial reports to demonstrate the impact of their donations.

Auditors

- Collaborate with external auditors to provide necessary documentation and information.

- Address audit findings and implement recommendations to enhance financial reporting.

- Maintain open lines of communication to foster a positive and productive relationship.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Nonprofit Financial Controller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Nonprofit Financial Controller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Nonprofit Financial Controller is a highly responsible position that plays a vital role in the financial health and stability of the organization. The key job responsibilities include:

1. Financial Management

Overseeing the financial operations of the organization, including:

- Preparing and managing the annual budget

- Developing and implementing financial policies and procedures

- Managing cash flow and investments

2. Accounting and Reporting

Managing the accounting functions of the organization, including:

- Preparing financial statements in accordance with GAAP or FASB standards

- Filing tax returns and other regulatory reports

- Auditing financial records

3. Internal Control

Establishing and maintaining a system of internal control to ensure the accuracy and reliability of financial information, including:

- Developing and implementing internal control policies and procedures

- Reviewing and testing internal controls

- Reporting on internal control weaknesses

4. Financial Planning and Analysis

Providing financial analysis and support to management, including:

- Preparing financial projections and forecasts

- Analyzing financial performance and identifying trends

- Recommending financial strategies

Interview Tips

To ace the interview for the position of Nonprofit Financial Controller, candidates should:

1. Research the Organization

Familiarize yourself with the organization’s mission, programs, and financial situation. This will demonstrate your interest in the role and your understanding of the organization’s needs.

2. Prepare for Behavioral Questions

Nonprofit organizations often use behavioral questions to assess candidates’ skills and experiences. Be prepared to share specific examples of your work that demonstrate your skills in financial management, accounting, and internal control.

3. Highlight Your Passion for the Mission

Nonprofit organizations are driven by their mission. Show the interviewer that you are passionate about the organization’s mission and that you are motivated to use your financial expertise to support its goals.

4. Ask Insightful Questions

Prepare thoughtful questions to ask the interviewer about the organization’s financial situation, challenges, and future plans. This will demonstrate your engagement and interest in the role.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Nonprofit Financial Controller interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!