Are you gearing up for an interview for a Office Work and Bookkeeper position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Office Work and Bookkeeper and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

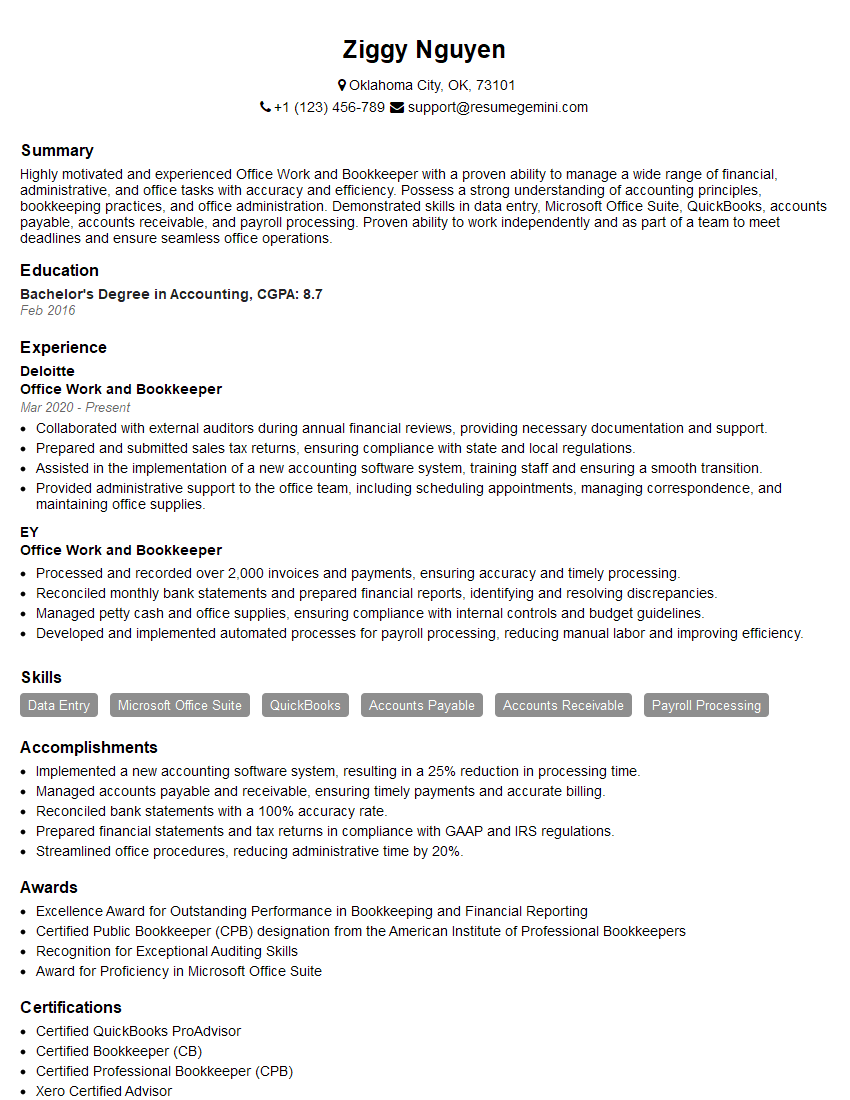

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Office Work and Bookkeeper

1. How do you ensure accuracy in your bookkeeping entries?

To ensure accuracy in my bookkeeping entries, I follow several best practices:

- Cross-checking and reconciliation: I regularly reconcile bank statements, invoices, and other financial documents to identify and correct any discrepancies.

- Double-entry bookkeeping: I use double-entry bookkeeping to ensure that every transaction is recorded in at least two accounts.

- Regular reviews: I conduct periodic reviews of my bookkeeping records to identify and rectify any errors or omissions.

- Use of accounting software: I utilize accounting software with built-in error-checking features to minimize data entry errors.

2. What are the key principles of accrual accounting?

Definition of Accrual Accounting

- Revenue recognition: Recognize revenue when earned, regardless of receipt of payment.

- Expense recognition: Recognize expenses when incurred, regardless of payment.

Advantages of Accrual Accounting

- Accurate financial reporting: Provides a clearer picture of a company’s financial health by matching revenues and expenses to the periods in which they occur.

- Improved decision-making: Enables businesses to make informed decisions based on up-to-date financial information.

3. Can you explain the difference between a debit and a credit in the context of bookkeeping?

- Debit: An increase in an asset or expense account, or a decrease in a liability or equity account.

- Credit: An increase in a liability or equity account, or a decrease in an asset or expense account.

- Double-entry system: Debits and credits are always recorded in equal amounts to maintain accounting balance.

4. What are the different types of financial statements and what information do they provide?

- Income statement: Summarizes revenues, expenses, and profits over a specific period.

- Balance sheet: Provides a snapshot of a company’s financial health at a given point in time, showing assets, liabilities, and equity.

- Cash flow statement: Tracks the movement of cash and cash equivalents over a period.

5. How do you handle the reconciliation of bank statements?

I follow these steps to reconcile bank statements:

- Compare transactions: Match transactions on the bank statement to those recorded in the company’s books.

- Identify discrepancies: Investigate any differences between the two sets of records and make necessary adjustments.

- Update records: Update the company’s books and the bank statement to reflect the reconciled balances.

6. What is your experience with using accounting software?

I am proficient in using various accounting software, including QuickBooks, Sage, and NetSuite. My experience includes:

- Setting up and maintaining accounting systems.

- Recording and processing financial transactions.

- Preparing financial reports and statements.

- Performing bank reconciliations and other accounting tasks.

7. How do you stay updated on changes in accounting regulations and standards?

- Continuing education: Attend workshops, webinars, and conferences to stay informed about industry developments.

- Professional subscriptions: Subscribe to accounting publications and online resources to receive updates on new regulations and standards.

- Networking: Connect with other accounting professionals and engage in discussions to stay abreast of best practices and emerging trends.

8. Can you describe your approach to managing accounts payable?

My approach to accounts payable management involves:

- Establishing clear processes: Setting up a system for receiving, verifying, and processing invoices.

- Efficient data entry: Accurately recording invoice details and ensuring proper coding.

- Vendor communication: Maintaining open communication with vendors to resolve queries and ensure timely payments.

- Compliance with regulations: Adhering to all applicable regulations related to accounts payable.

9. How do you handle the preparation and filing of payroll taxes?

- Tax calculation: Accurately calculating payroll taxes based on current rates and employee withholdings.

- Filing deadlines: Ensuring timely filing of payroll tax returns to avoid penalties.

- Recordkeeping: Maintaining detailed records of payroll taxes for audit purposes.

- Communication with tax authorities: Addressing any queries or correspondence from tax authorities promptly.

10. How do you ensure the confidentiality of sensitive financial information?

- Access controls: Restricting access to sensitive financial data to authorized personnel only.

- Data protection: Encrypting sensitive data and implementing firewalls to safeguard against unauthorized access.

- Employee training: Educating employees on the importance of data security and confidentiality.

- Regular audits: Conducting regular audits to identify and address any security vulnerabilities.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Office Work and Bookkeeper.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Office Work and Bookkeeper‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Office Work and Bookkeeper is responsible for a range of administrative and financial tasks that keep the office running smoothly and efficiently. Key responsibilities include:

1. Administrative Duties

Perform general office duties, such as answering phones, greeting visitors, and sorting and distributing mail.

- Ensure that office supplies are ordered and stocked as needed.

- Maintain office equipment, such as computers, printers, and copiers.

2. Financial Duties

Maintain accurate financial records, including accounts payable and receivable.

- Process invoices and payments.

- Reconcile bank statements.

3. Customer Service

Provide excellent customer service to both internal and external customers.

- Answer questions about products and services.

- Resolve customer complaints.

4. Other Duties

Perform other duties as assigned by the supervisor.

- Assist with special projects.

- Cover for other employees during their absence.

Interview Tips

Preparing for an interview can help you feel more confident and make a positive impression on the interviewer. Here are some tips to help you ace your interview for an Office Work and Bookkeeper position:

1. Research the Company

Before your interview, take some time to research the company you’re applying to. This will help you understand their business, culture, and what position they are looking to fill.

- Visit the company’s website.

- Read articles about the company in the news.

2. Practice Your Answers

Once you have a good understanding of the company, you can start practicing your answers to common interview questions. This will help you feel more prepared and confident during the interview.

- Use the STAR method to answer questions about your experience.

- Be prepared to talk about your skills and how they can benefit the company.

3. Dress Professionally

First impressions matter, so it’s important to dress professionally for your interview. This means wearing clean, pressed clothes that are appropriate for an office setting.

- Avoid wearing jeans, t-shirts, or sneakers.

- Consider wearing a suit or dress pants and a button-down shirt.

4. Be Polite and Respectful

Be polite and respectful to everyone you meet during your interview, including the receptionist, the interviewer, and other employees. This will create a positive impression and make you more likely to get the job.

- Make eye contact and smile when you greet people.

- Be attentive and engaged during the interview.

5. Follow Up

After your interview, send a thank-you note to the interviewer. This is a great way to reiterate your interest in the position and thank them for their time.

- Keep your thank-you note brief and professional.

- Reiterate your key qualifications and how they align with the position.

Next Step:

Now that you’re armed with the knowledge of Office Work and Bookkeeper interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Office Work and Bookkeeper positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini