Are you gearing up for a career in Open Claims Representative? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Open Claims Representative and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

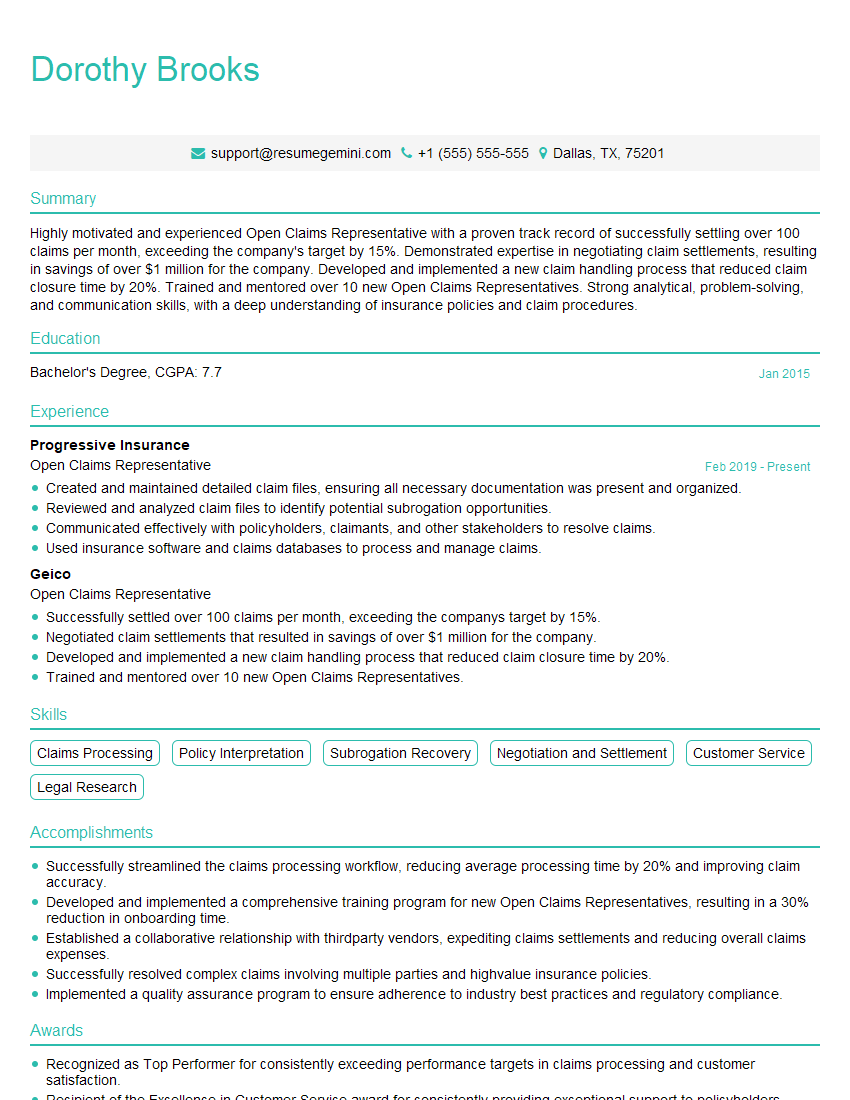

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Open Claims Representative

1. What steps would you take to investigate a claim for property damage?

In order to investigate a claim for property damage, I would follow these steps:

- Review the policy and applicable endorsements to determine coverage and limits.

- Contact the insured to obtain a detailed statement of the loss.

- Inspect the damaged property and take photographs.

- Obtain estimates for repairs or replacement.

- Review the estimates and determine the amount of the loss.

- Negotiate a settlement with the insured.

2. How would you handle a claim involving a disputed liability?

In order to handle a claim involving a disputed liability, I would:

Review the policy and applicable endorsements

- To determine coverage and limits.

- To identify any exclusions or conditions that may apply.

Collect evidence

- To support or refute the insured’s claim.

- This may include witness statements, police reports, and medical records.

Negotiate with the claimant

- To try to reach a settlement that is fair to both parties.

- If a settlement cannot be reached, the claim may need to be litigated.

3. What are the most common types of fraud you encounter in claims handling?

- Exaggerated or fabricated claims

- False or misleading statements

- Concealment of material facts

- Duplicate claims

- Insurance fraud rings

4. How do you handle claims involving complex or unusual coverages?

- Review the policy and applicable endorsements carefully.

- Consult with experts in the field, such as attorneys or accountants.

- Research similar claims or case law.

- Document the claim thoroughly and keep all parties informed.

5. What are the ethical considerations involved in claims handling?

- Honesty and integrity

- Objectivity

- Confidentiality

- Fairness

- Professionalism

6. What are your strengths and weaknesses as a claims representative?

- Excellent communication and interpersonal skills

- Strong analytical and problem-solving skills

- Detail-oriented and organized

- Ability to work independently and as part of a team

- Knowledge of insurance policies and procedures

- Sometimes I can be too detail-oriented

- I am still learning about some of the more complex coverages

Strengths

Weaknesses

7. Why are you interested in working as an open claims representative?

I am interested in working as an open claims representative because I enjoy helping people. I am also interested in the insurance industry and I believe that I have the skills and experience necessary to be successful in this role.

8. What are your salary expectations?

My salary expectations are in line with the industry average for open claims representatives with my experience and qualifications.

9. Are you willing to work overtime?

Yes, I am willing to work overtime if necessary to meet the demands of the job.

10. Are you comfortable working in a fast-paced environment?

Yes, I am comfortable working in a fast-paced environment. I am able to prioritize my work and meet deadlines even under pressure.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Open Claims Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Open Claims Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Open Claims Representatives are responsible for a wide range of tasks related to the processing and resolution of insurance claims. Some of their key duties include:

1. Investigating and Evaluating Claims

An Open Claims Representative will investigate and evaluate insurance claims to determine their validity and extent.

- Reviewing claim forms, policies, and other documentation

- Interviewing policyholders, witnesses, and other parties involved in the claim

- Inspecting damaged property or injuries

- Assessing the extent of the damages or injuries and determining the amount of the claim

2. Negotiating and Settling Claims

Once an Open Claims Representative has evaluated a claim, they will negotiate and settle it with the policyholder.

- Discussing the claim with the policyholder and explaining the terms of the settlement

- Negotiating the amount of the settlement

- Preparing and issuing settlement checks

- Closing the claim file

3. Providing Customer Service

Open Claims Representatives are responsible for providing customer service to policyholders. They answer questions, explain the claims process, and help policyholders through the claim process.

- Answering phone calls and emails from policyholders

- Providing information about the claims process

- Assisting policyholders in completing claim forms

- Resolving customer complaints

4. Maintaining Records

Open Claims Representatives are responsible for maintaining records of all claims they process. These records include claim forms, policies, correspondence, and settlement agreements.

- Filing claim forms and other documents

- Creating and maintaining electronic records

- Tracking the status of claims

- Preparing reports on claims activity

Interview Tips

To ace an interview for an Open Claims Representative position, it is important to be prepared and well-informed about the job. Here are a few tips to help you prepare:

1. Research the Company and the Position

Before the interview, take some time to research the insurance company and the specific position you are applying for. This will help you understand the company’s culture, values, and how the position fits into the overall organization.

- Visit the company’s website and read about their mission, vision, and values.

- Look up the specific position on the company’s website or on job boards.

- Read reviews of the company on websites like Glassdoor.

2. Practice Answering Common Interview Questions

There are a number of common interview questions that you are likely to be asked in an interview for an Open Claims Representative position. It is helpful to practice answering these questions in advance so that you can deliver clear and concise answers.

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

- What is your experience with claims processing?

- How do you handle difficult customers?

3. Be Prepared to Talk About Your Experience

The interviewer will want to know about your experience and qualifications for the position. Be prepared to talk about your previous experience in claims processing, customer service, and other relevant areas.

- Highlight your skills in investigating claims, negotiating settlements, and providing customer service.

- Quantify your accomplishments whenever possible. For example, you could say that you “processed over 100 claims per month with a 95% customer satisfaction rating.”

- Be prepared to discuss your experience with specific types of claims, such as auto, home, or business claims.

4. Dress Professionally and Arrive on Time

First impressions matter, so it is important to dress professionally for your interview. It is also important to arrive on time for your interview. This shows the interviewer that you are respectful of their time and that you are organized and punctual.

- Choose a conservative outfit that is appropriate for a business setting.

- Make sure your clothes are clean and wrinkle-free.

- Arrive at the interview location at least 15 minutes early.

5. Be Yourself and Be Authentic

The most important thing is to be yourself and be authentic. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. Just relax, be yourself, and let your personality shine through.

- Don’t try to memorize a script or give rehearsed answers.

- Be genuine and honest in your responses.

- Let your personality shine through.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Open Claims Representative role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.