Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Operational Risk Manager position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

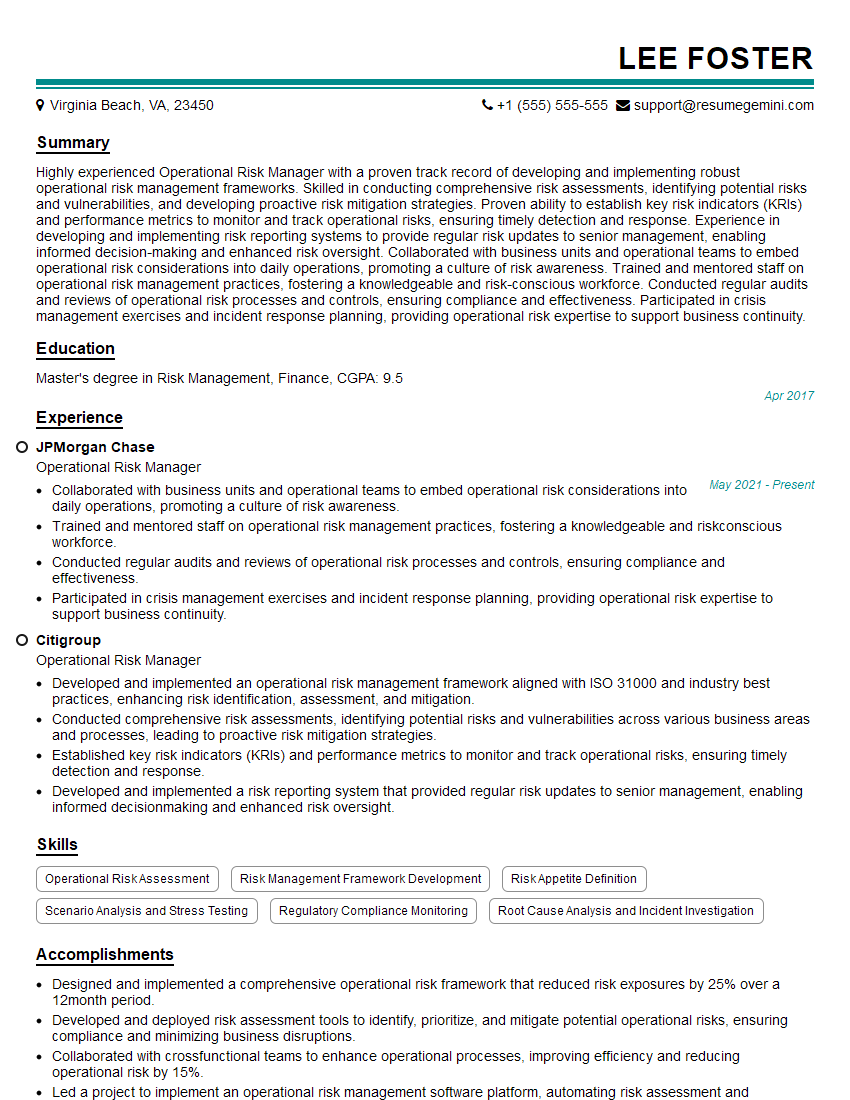

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Operational Risk Manager

1. How do you identify and assess operational risks in an organization?

To identify and assess operational risks, I employ a comprehensive approach that involves:

- Conducting risk workshops and interviews with key stakeholders to gather insights into potential risks.

- Analyzing historical data, industry reports, and regulatory requirements to identify potential vulnerabilities.

- Utilizing risk assessment methodologies, such as Failure Mode and Effects Analysis (FMEA) and Risk Matrix Analysis, to evaluate the likelihood and impact of risks.

2. How do you prioritize and manage operational risks?

Risk Prioritization

- Employing a risk scoring system that considers the likelihood and impact of risks.

- Prioritizing risks based on their overall risk score and potential business impact.

Risk Management

- Developing mitigation plans to address high-priority risks.

- Implementing risk controls and monitoring their effectiveness.

- Communicating risk information to relevant stakeholders and ensuring their involvement in risk management processes.

3. How do you integrate operational risk management into an organization’s overall risk management framework?

To integrate operational risk management into an organization’s overall risk management framework, I focus on the following key steps:

- Understanding the organization’s overall risk appetite and tolerance.

- Mapping operational risks to the organization’s strategic objectives and business processes.

- Establishing a clear and consistent risk management language and methodology across the organization.

- Collaborating with other risk management functions to ensure a comprehensive and coordinated approach.

4. How do you ensure that operational risks are effectively communicated and understood throughout the organization?

Effective risk communication is crucial. I employ a multifaceted approach that includes:

- Developing clear and concise risk reports that highlight key findings and recommendations.

- Conducting regular risk awareness training for employees at all levels.

- Establishing open and ongoing communication channels to facilitate discussions about risk management.

5. How do you keep up with industry best practices and regulatory changes related to operational risk management?

To stay abreast of industry best practices and regulatory changes, I take the following steps:

- Attending industry conferences and workshops.

- Reading industry publications and research papers.

- Participating in professional organizations and networking with peers.

- Monitoring regulatory updates and ensuring compliance with relevant regulations.

6. How do you measure the effectiveness of an operational risk management program?

Measuring the effectiveness of an operational risk management program is crucial. I employ the following metrics:

- Number of operational risk events and their financial impact.

- Effectiveness of risk controls and mitigation plans.

- Level of risk awareness and understanding within the organization.

- Alignment of operational risk management practices with industry best practices and regulatory requirements.

7. How do you handle conflicts between different stakeholders with varying risk appetites?

Addressing conflicts between stakeholders with varying risk appetites requires a diplomatic and collaborative approach. I employ the following strategies:

- Facilitating open and transparent dialogue to understand the concerns and objectives of each stakeholder.

- Presenting risk information in a clear and objective manner, highlighting the potential benefits and consequences of different risk management options.

- Seeking compromises and consensus-building approaches that balance the interests of all stakeholders.

8. How do you balance the need for risk management with the need for business growth and innovation?

Striking a balance between risk management and business growth requires a proactive and adaptive approach. I believe in:

- Establishing a risk appetite that aligns with the organization’s strategic objectives.

- Integrating risk management into the business planning process to identify and address potential risks early on.

- Promoting a culture of risk awareness and encouraging employees to embrace calculated risk-taking.

9. How do you use data and analytics to inform operational risk management decisions?

Leveraging data and analytics is essential for evidence-based risk management. I employ the following techniques:

- Collecting and analyzing historical data to identify patterns and trends.

- Using predictive analytics to anticipate future risks and their potential impact.

- Developing risk dashboards and other data visualization tools to monitor risks and track progress.

10. How do you stay informed about emerging operational risks and best practices?

To stay up-to-date on emerging operational risks and best practices, I engage in the following activities:

- Regularly monitoring industry news and regulatory updates.

- Participating in professional networks and attending conferences.

- Seeking input from external experts and consultants.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Operational Risk Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Operational Risk Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Operational Risk Managers are responsible for identifying, assessing, and mitigating risks that may arise from the day-to-day operations of a business. Their key responsibilities include:

1. Risk Identification and Assessment

Identifying and assessing operational risks throughout the organization, considering both internal and external factors, and evaluating the potential impact and likelihood of risk events.

- Conducting risk assessments to evaluate the likelihood and potential impact of risks.

- Developing and implementing risk mitigation strategies to reduce the probability and severity of risks.

2. Risk Monitoring and Reporting

Continuously monitoring and reporting on operational risks to senior management and stakeholders, providing timely updates on risk status and trends, and recommending appropriate actions.

- Developing and implementing risk monitoring systems to track and analyze risks.

- Preparing and presenting risk reports to senior management and other stakeholders.

3. Risk Management Program Development and Implementation

Developing and implementing a comprehensive risk management program that includes risk identification, assessment, mitigation, monitoring, and reporting processes.

- Developing and implementing policies and procedures for operational risk management.

- Providing training and support to employees on operational risk management practices.

4. Regulatory Compliance

Ensuring compliance with relevant regulatory requirements and industry best practices related to operational risk management.

- Staying abreast of regulatory requirements and industry best practices related to operational risk management.

- Developing and implementing policies and procedures to ensure compliance with regulatory requirements.

Interview Tips

To ace the interview for an Operational Risk Manager position, candidates should thoroughly prepare and showcase their knowledge and skills in risk management. Here are some tips to help candidates excel in the interview:

1. Research the Company and Role

Familiarize yourself with the company’s industry, business operations, and risk profile. Understanding the specific role and responsibilities of the Operational Risk Manager within the organization will demonstrate your interest and preparation.

- Visit the company’s website to learn about their business, industry, and recent news.

- Review the job description carefully to identify the key requirements and expectations of the role.

2. Highlight Your Risk Management Expertise

Emphasize your experience in operational risk management, including your knowledge of risk identification, assessment, mitigation, and monitoring techniques. Provide specific examples of your work, such as risk assessments you’ve conducted or risk management programs you’ve implemented.

- Quantify your accomplishments whenever possible to demonstrate the impact of your risk management initiatives.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide clear and concise examples of your work.

3. Demonstrate Your Communication and Interpersonal Skills

Operational Risk Managers need to be able to communicate effectively with a wide range of stakeholders, including senior management, business units, and regulatory bodies. Highlight your ability to clearly articulate risk assessments, present recommendations, and influence decision-making.

- Share examples of how you have successfully communicated risk information to different audiences.

- Emphasize your ability to build and maintain relationships with key stakeholders.

4. Stay Up-to-Date on Regulatory Compliance

Operational Risk Managers must be aware of relevant regulatory requirements and industry best practices. Demonstrate your knowledge of these regulations and how you have implemented them in your previous roles.

- Stay informed about regulatory changes and updates in the industry.

- Share examples of how you have ensured compliance with regulatory requirements in your previous work.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Operational Risk Manager, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Operational Risk Manager positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.