Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Option Trader interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Option Trader so you can tailor your answers to impress potential employers.

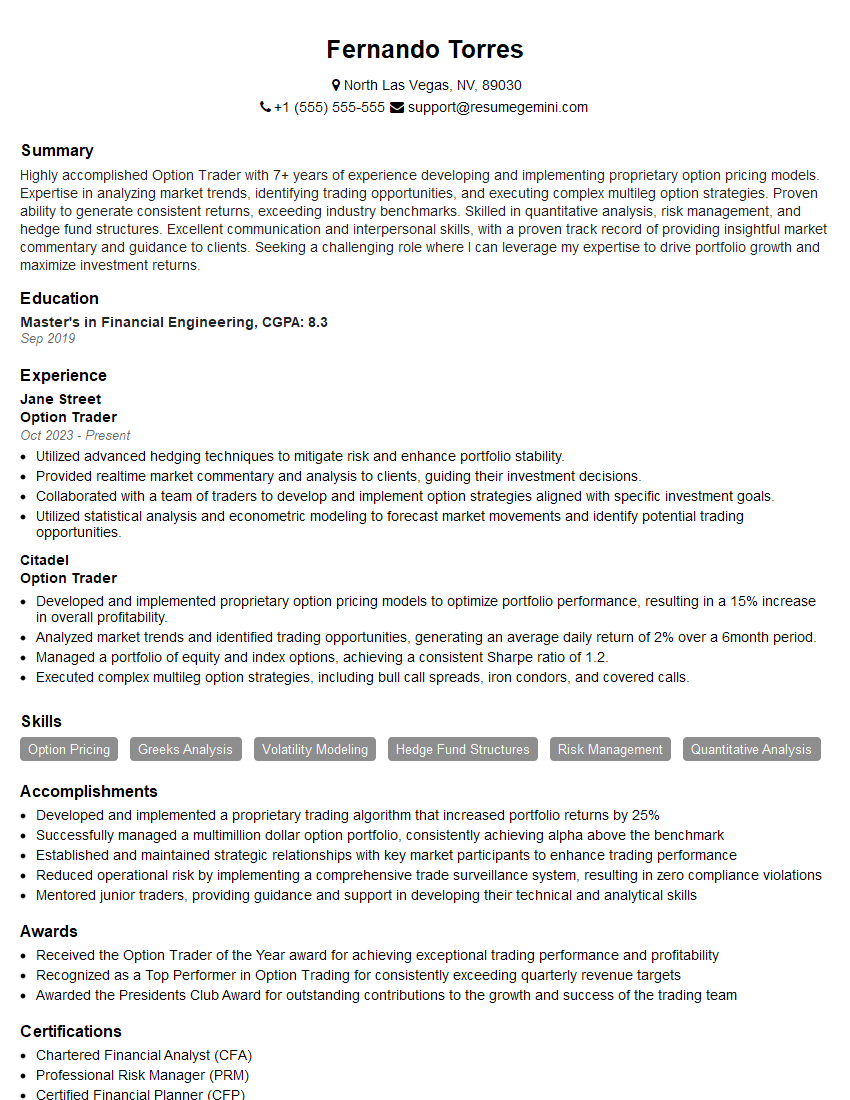

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Option Trader

1. What are the different types of option strategies and which ones do you have the most experience with?

There are many different types of option strategies, each with their own unique risks and rewards. Some of the most common option strategies include:

- Covered calls

- Cash-secured puts

- Protective puts

- Bull calls

- Bear puts

- Straddles

- Strangles

The most experience I have with option strategies is covered calls. Covered calls involve selling a call option against a stock that you own. This strategy can be used to generate income and reduce risk.

2. How do you determine the risk and reward of an option strategy?

Risk assessment

- The risk of an option strategy is determined by a number of factors, including the underlying asset, the strike price, the expiration date, and the volatility of the underlying asset.

- To determine the risk of an option strategy, it is important to consider the potential for the underlying asset to move in an unfavorable direction.

- The reward of an option strategy is determined by the amount of profit that can be made if the underlying asset moves in a favorable direction.

- To determine the reward of an option strategy, it is important to consider the potential for the underlying asset to move in a favorable direction.

Reward assessment

- The reward of an option strategy is determined by a number of factors, including the underlying asset, the strike price, the expiration date, and the volatility of the underlying asset.

- To determine the reward of an option strategy, it is important to consider the potential for the underlying asset to move in a favorable direction.

3. How do you manage risk in an option trading strategy?

There are a number of ways to manage risk in an option trading strategy. Some of the most common risk management techniques include:

- Using a stop-loss order

- Using a trailing stop-loss order

- Using a volatility stop-loss order

- Using a hedging strategy

- Using a protective put option

The best risk management technique for a particular option trading strategy will depend on the specific strategy and the trader’s individual risk tolerance.

4. What are some of the most common mistakes that option traders make?

Some of the most common mistakes that option traders make include:

- Not understanding the risks involved

- Overtrading

- Not using a stop-loss order

- Not managing risk properly

- Trading on emotions

Avoiding these mistakes can help option traders to improve their chances of success.

5. What are some of the key factors to consider when evaluating an option trading strategy?

When evaluating an option trading strategy, it is important to consider a number of key factors, including:

- The risk of the strategy

- The reward of the strategy

- The liquidity of the underlying asset

- The volatility of the underlying asset

- The trader’s individual risk tolerance

- The trader’s individual trading goals

It is also important to backtest the strategy on historical data to see how it would have performed in different market conditions.

6. What are some of the most important qualities of a successful option trader?

Some of the most important qualities of a successful option trader include:

- Discipline

- Risk management skills

- Emotional control

- A good understanding of the options market

- A strong work ethic

Successful option traders are also able to learn from their mistakes and adapt their strategies to changing market conditions.

7. How do you stay up-to-date on the latest developments in the options market?

I stay up-to-date on the latest developments in the options market by reading industry publications, attending conferences, and networking with other traders.

- Some of the industry publications that I read regularly include Option Trader, The Journal of Portfolio Management, and The Option Trader’s Bible.

- I also attend industry conferences, such as the Options Industry Conference and the Global Options Conference.

- Finally, I network with other traders through online forums and social media.

8. What are some of the challenges that you have faced as an option trader?

Some of the challenges that I have faced as an option trader include:

- The volatility of the options market

- The risk of losing money

- The need to constantly stay up-to-date on the latest developments in the market

- The emotional challenges of trading

However, I have been able to overcome these challenges by developing a sound trading plan, managing my risk carefully, and staying disciplined.

9. What are your goals as an option trader?

My goals as an option trader are to:

- Generate consistent income

- Grow my trading account over time

- Help others to learn about option trading

- Make a positive impact on the world

I believe that option trading can be a powerful tool for achieving financial success and I am excited to continue to learn and grow as a trader.

10. Why are you interested in working for our company?

I am interested in working for your company because I am impressed with your commitment to providing quality education and support to option traders.

- I believe that my skills and experience would be a valuable asset to your team.

- I am confident that I can make a significant contribution to your company’s success.

- I am excited about the opportunity to work with a team of talented and experienced professionals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Option Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Option Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Option Traders are financial professionals who buy and sell options contracts in the financial markets. Their primary goal is to generate profits through the accurate prediction of stock price movements and the exploitation of market inefficiencies. To succeed in this role, Option Traders must possess a deep understanding of options trading strategies, risk management techniques, and market dynamics.

1. Market Analysis and Trading

Option Traders begin their day by thoroughly analyzing market data, including stock prices, economic indicators, and news events. They utilize technical analysis tools, such as charts and indicators, to identify potential trading opportunities. Based on their analysis, they develop trading strategies and execute trades accordingly.

- Conduct fundamental and technical analysis of underlying assets and market conditions.

- Identify and evaluate trading opportunities based on market trends and volatility.

- Execute buy and sell orders for options contracts, including calls, puts, straddles, and spreads.

2. Risk Management

Risk management is a crucial aspect of Option Trading. Traders must carefully calculate and manage risk exposure to protect their capital. They employ various techniques, such as hedging and position sizing, to limit potential losses and preserve their trading profits.

- Assess and quantify risk levels associated with different trading strategies.

- Implement stop-loss orders and other risk management measures to mitigate losses.

- Monitor market conditions and adjust positions accordingly to manage risk.

3. Trading Execution and Account Management

Option Traders are responsible for executing trades efficiently and managing their trading accounts. They must have a strong understanding of trading platforms and order types to ensure timely and accurate execution of orders. Additionally, they monitor their trading performance, adjust strategies as needed, and maintain compliance with regulatory requirements.

- Execute trades through electronic trading platforms or brokers.

- Manage trading accounts, including monitoring positions, calculating profit and loss, and reconciling statements.

- Comply with regulatory requirements and ethical guidelines related to trading.

4. Collaboration and Communication

Option Traders often work as part of a team and collaborate with colleagues, including analysts, brokers, and risk managers. They effectively communicate their trading ideas, market insights, and risk assessments to team members and stakeholders. Strong communication skills are essential for building relationships and exchanging valuable information.

- Collaborate with analysts and other traders to share market insights and develop trading strategies.

- Communicate trading ideas and risk assessments to brokers, clients, and other stakeholders.

- Participate in team meetings, presentations, and discussions.

Interview Tips

Preparing for an Option Trader interview requires a combination of technical knowledge, market understanding, and communication skills. Here are some interview tips and tricks to help you ace your interview:

1. Brush up on Options Trading Basics

Review the fundamentals of options trading, including contract types, pricing models, and trading strategies. Familiarize yourself with key concepts such as delta, gamma, and vega, and their impact on option prices.

- Study different options trading strategies, such as covered calls, protective puts, and iron condors.

- Practice calculating option prices using the Black-Scholes model.

- Stay updated on current market trends and economic news.

2. Highlight Your Analytical and Problem-Solving Skills

Emphasize your ability to analyze market data, identify trading opportunities, and develop effective trading strategies. Provide specific examples from your previous experience that demonstrate your analytical and problem-solving capabilities.

- Describe a time when you successfully identified a mispriced option and profited from the trade.

- Explain how you manage risk in your trading strategies and the techniques you use to limit potential losses.

- Discuss your understanding of different market dynamics and how you adjust your strategies accordingly.

3. Showcase Your Trading Platform Proficiency

Familiarity with electronic trading platforms is essential for Option Traders. Highlight your experience using specific trading platforms, such as Bloomberg, TradeStation, or TT, and demonstrate your proficiency in executing trades, managing orders, and analyzing market data.

- Explain how you use trading platforms to identify and execute trading opportunities efficiently.

- Describe your experience with different order types and how you use them to manage risk and achieve trading objectives.

- Discuss your ability to develop and implement automated trading strategies using trading platform tools.

4. Prepare for Behavioral Questions

Behavioral questions are commonly used in interviews to assess your personality, work style, and fit for the role. Be prepared to answer questions about your strengths and weaknesses, your approach to teamwork, and your ethical values.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples.

- Focus on demonstrating your analytical skills, problem-solving abilities, and commitment to ethical trading practices.

- Practice answering behavioral questions in advance to build confidence and fluency.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Option Trader, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Option Trader positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.