Feeling lost in a sea of interview questions? Landed that dream interview for Options Advisor but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Options Advisor interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

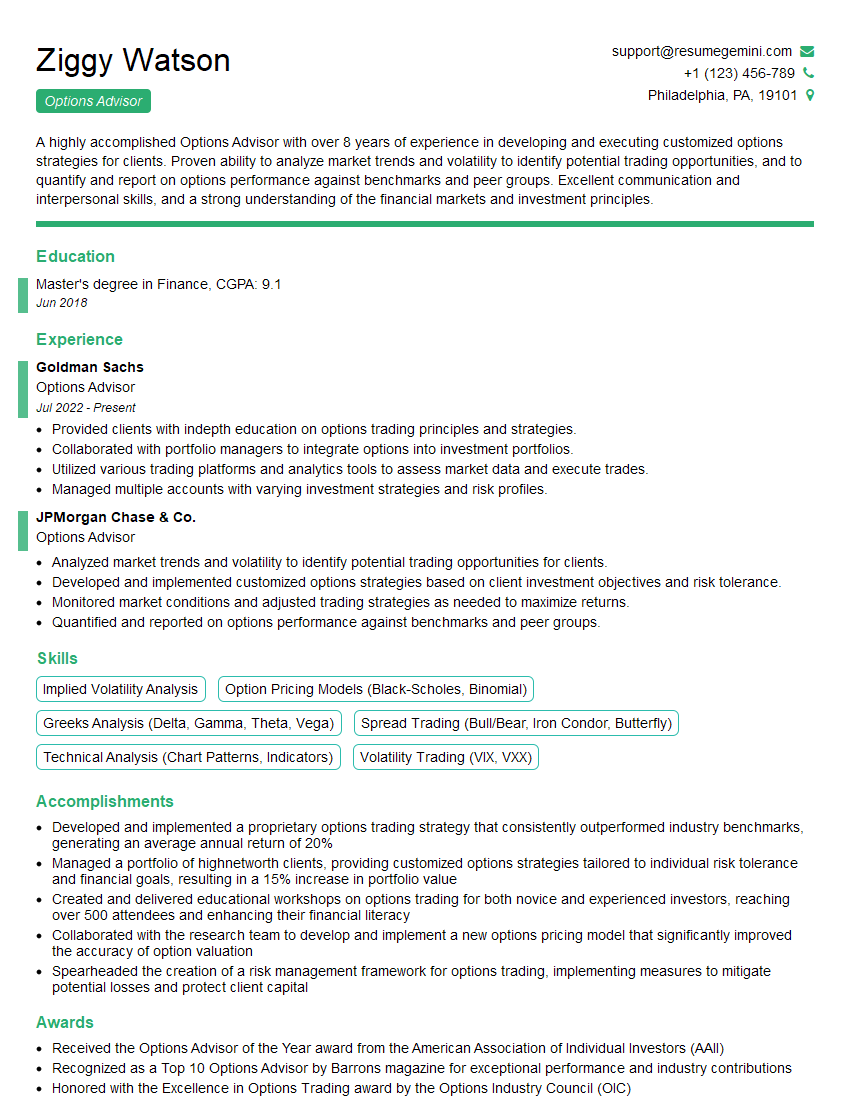

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Options Advisor

1. Explain the role of an Options Advisor.

As an Options Advisor, I serve as a guide to clients seeking to make informed decisions regarding options trading. My responsibilities entail understanding their financial objectives, risk tolerance, and investment horizon, and providing tailored advice and execution strategies.

2. Describe the different types of options strategies.

Covered Call

- Generate income by selling a call option against a stock owned.

- Limits upside potential if the stock price rises.

Cash-Secured Put

- Receive a premium for selling a put option, obligating the sale of a stock at a set price.

- Potential to acquire the stock below market price if it falls.

3. How do you determine the appropriate strike price for an option?

I consider the following factors when determining the strike price:

- Current market price of the underlying asset.

- Client’s risk tolerance and investment goals.

- Volatility of the underlying asset.

4. Explain the concept of option Greeks.

Option Greeks are metrics that measure the sensitivity of an option’s price to changes in various factors:

- Delta: Sensitivity to changes in the underlying asset’s price.

- Gamma: Sensitivity to changes in Delta.

- Theta: Sensitivity to the time remaining until expiration.

5. How do you assess the risk of an options strategy?

I assess risk by considering:

- Potential profit and loss.

- Breakeven point.

- Margin requirements.

- Historical volatility and implied volatility.

6. What are some of the common mistakes that options traders make?

Common mistakes include:

- Trading without a clear strategy.

- Ignoring risk management principles.

- Overtrading and using excessive leverage.

- Failing to understand the complexities of options.

7. How do you stay up-to-date on market trends and developments in the options industry?

I continuously stay informed by:

- Reading industry publications and research reports.

- Attending webinars and conferences.

- Monitoring market news and data.

- Networking with other professionals in the field.

8. What is your approach to educating your clients about options trading?

I believe in tailoring my approach to each client’s knowledge level and making complex concepts understandable. I use:

- Interactive presentations and case studies.

- Risk simulations and hypothetical scenarios.

- One-on-one consultations and personalized guidance.

9. Discuss a challenging situation you encountered as an Options Advisor and how you resolved it.

In one instance, a client insisted on pursuing an aggressive options strategy despite my concerns about potential risk. I spent time explaining the risks and exploring alternative strategies that aligned with their objectives. By presenting data and scenario analyses, I eventually persuaded them to adopt a more conservative approach that ultimately protected their capital.

10. Why are you interested in joining our firm as an Options Advisor?

I am particularly drawn to your firm’s reputation for providing exceptional client service and your commitment to ethical and responsible investing. I believe that my skills and experience would be a valuable asset to your team, and I am eager to contribute to your continued success.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Options Advisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Options Advisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Options Advisor is a financial professional who advises clients on the use of options as investment vehicles. This role requires a deep understanding of option strategies, risk management, and market dynamics.

1. Advising Clients

The primary responsibility of an Options Advisor is to provide tailored advice to clients on the use of options.

- Conduct detailed financial assessments to understand client investment objectives, risk tolerance, and time horizon.

- Identify suitable option strategies based on client needs and market conditions.

- Develop and implement personalized trading plans for clients.

2. Market Analysis

Staying abreast of market trends and economic indicators is crucial for Options Advisors.

- Monitor market movements, including stock prices, volatility, and interest rates.

- Identify emerging opportunities and potential risks in the options market.

- Conduct technical and fundamental analysis to inform option trading decisions.

3. Risk Management

Options trading involves inherent risks, and minimizing these risks is a key aspect of the Options Advisor’s role.

- Assess and manage risks associated with option strategies.

- Develop and implement risk mitigation strategies, such as stop-loss orders and hedging techniques.

- Educate clients on the risks involved in options trading.

4. Relationship Management

Building and maintaining strong relationships with clients is essential for Options Advisors.

- Establish and nurture relationships with high-net-worth individuals, family offices, and institutional investors.

- Provide ongoing support and guidance to clients throughout their investment journey.

- Stay updated on client preferences and adjust strategies accordingly.

Interview Tips

Preparing thoroughly for an Options Advisor interview is crucial for success. Here are some tips to help you ace the interview:

1. Research the Firm and Position

Demonstrating a deep understanding of the firm’s culture, investment philosophy, and the specific role you’re applying for will set you apart.

- Visit the firm’s website, read their research reports, and attend industry events to gather information.

- Thoroughly review the job description and identify key skills and responsibilities the firm is looking for.

2. Highlight Your Skills and Experience

Showcase your proficiency in option strategies, risk management, and market analysis.

- Quantify your accomplishments and provide specific examples of your success in these areas.

- Use the STAR method (Situation, Task, Action, Result) to describe your experiences.

3. Prepare Questions to Ask

Asking thoughtful questions during the interview demonstrates your interest in the position and the firm.

- Prepare questions about the firm’s investment approach, risk management policies, and growth strategies.

- Ask about the team you would be working with and the firm’s culture.

4. Dress Professionally and Practice Etiquette

First impressions matter. Dress appropriately and maintain a professional demeanor throughout the interview.

- Arrive on time and greet the interviewer with a firm handshake and eye contact.

- Be polite, respectful, and attentive during the interview.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Options Advisor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.