Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Options Trader interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Options Trader so you can tailor your answers to impress potential employers.

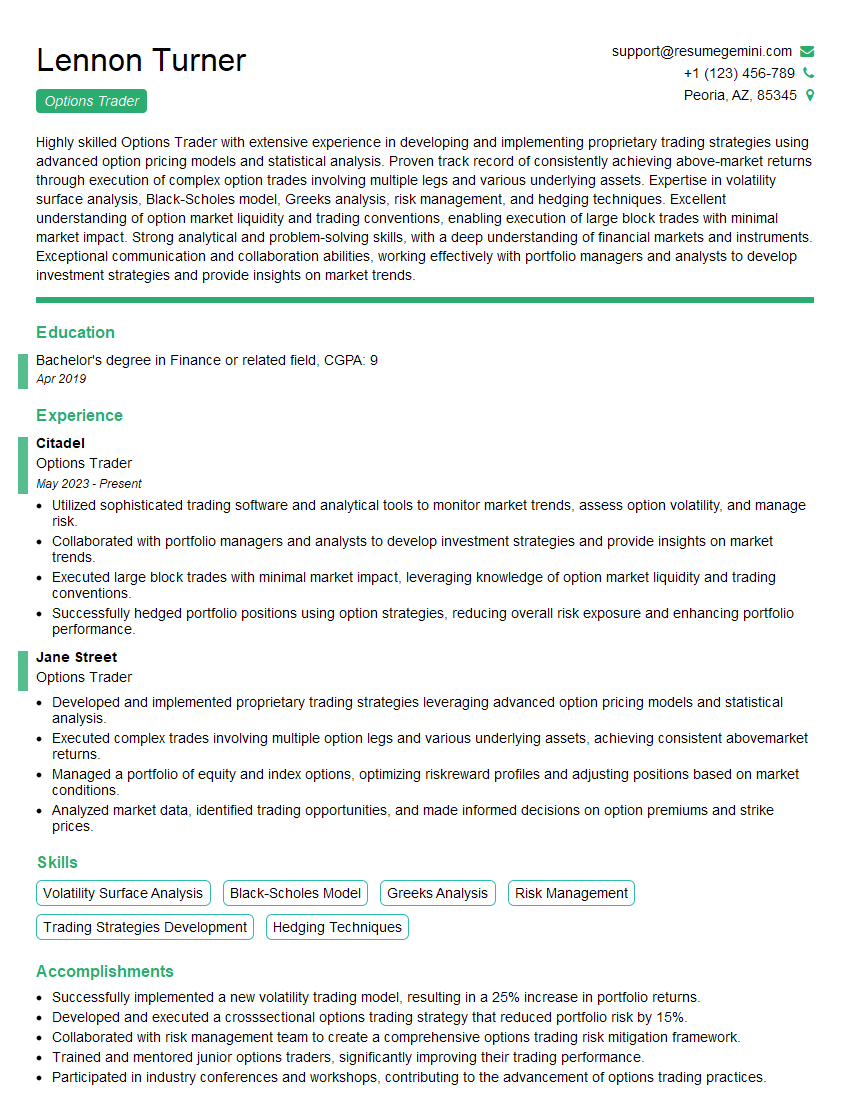

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Options Trader

1. Calculate the time premium of a call option that is currently trading at $3.45 with a strike price of $50 and a maturity of 3 months. The risk-free rate is 5% and the stock price is $52.

Steps:

- Calculate the time value by subtracting the intrinsic value from the option price. Intrinsic value = max(0, Stock price – Strike price) = max(0, $52 – $50) = $2

- Calculate the time premium by dividing the time value by the number of days to expiration. Number of days to expiration = 3 months * 30 days = 90 days. Time premium = $3.45 – $2 = $1.45

Answer: $1.45

2. Describe how you would hedge a portfolio that is long 100 shares of XYZ stock and short 2 call options with a strike price of $100 that have 30 days to expiration.

Possible hedging strategy:

- Sell 100 shares of XYZ stock.

- Buy 2 call options with a lower strike price (e.g., $95).

Explanation: This strategy aims to reduce the portfolio’s sensitivity to changes in the stock price. Selling 100 shares of XYZ stock will offset the positive delta of the long stock position. Buying 2 call options with a lower strike price will create a negative delta that partially offsets the positive delta of the short call options.

3. What is the Black-Scholes model and how is it used in options trading?

Definition:

- The Black-Scholes model is a mathematical formula that calculates the theoretical fair value of an option.

Uses in options trading:

- Pricing options.

- Hedging option positions.

- Developing trading strategies.

4. Explain the concept of implied volatility and its significance in options pricing.

- Definition: Implied volatility is a measure of the market’s expectations of future price volatility.

- Significance: It is a key input in the Black-Scholes model and significantly affects the option price. Higher implied volatility leads to higher option prices.

5. Discuss the different types of option strategies and their risk-reward profiles.

Types of option strategies:

- Bullish strategies: These strategies aim to profit from an increase in the underlying asset’s price. Examples include long calls, bull spreads.

- Bearish strategies: These strategies aim to profit from a decrease in the underlying asset’s price. Examples include long puts, bear spreads.

- Neutral strategies: These strategies aim to profit from a change in the underlying asset’s volatility or time decay. Examples include covered calls, iron condors.

Risk-reward profiles:

- High risk, high reward: Naked calls, naked puts.

- Moderate risk, moderate reward: Spreads, iron condors.

- Low risk, low reward: Covered calls, cash-secured puts.

6. How do you evaluate the performance of an options trading strategy?

- Metrics: Return on investment (ROI), profit factor, Sharpe ratio.

- Factors: Risk tolerance, time horizon, trading style.

7. Describe your process for managing risk in options trading.

- Risk assessment: Identifying and quantifying potential risks.

- Risk mitigation: Implementing strategies to reduce or eliminate risks, such as hedging, position sizing.

- Risk monitoring: Regularly monitoring risk exposure and adjusting strategies as needed.

8. How do you stay up-to-date on market trends and news that may affect your options trading?

- News sources: Financial news websites, market newsletters, industry publications.

- Technical analysis: Charting tools, indicators, technical reports.

- Social media: Following industry experts, traders, and analysts.

9. Tell me about a successful options trade you executed. What was the strategy, how did you manage risk, and what was the outcome?

Steps:

- Describe the strategy: Outline the type of option strategy used and the underlying asset involved.

- Discuss risk management: Explain how you identified and mitigated risks associated with the trade.

- State the outcome: Summarize the profit or loss achieved and the factors that contributed to the success of the trade.

10. How would you approach trading options in a volatile market environment?

- Strategies: Adjusting trading strategies to focus on short-term trades, employing strategies with lower delta exposure, or considering hedging positions.

- Risk management: Emphasizing risk management techniques like reducing position sizes, using stop-loss orders, and monitoring risk metrics closely.

- Flexibility: Adapting trading strategies and risk management approach as market conditions evolve.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Options Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Options Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Options Traders are responsible for buying and selling options contracts, which are financial instruments that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. The key job responsibilities of an Options Trader include:

1. Market Analysis

Analyzing market conditions and trends to identify trading opportunities.

- Conducting technical analysis of price charts and market data.

- Monitoring economic news and events that may impact the market.

2. Option Strategy Development

Developing and implementing trading strategies based on market analysis.

- Identifying potential trading opportunities and formulating strategies to capitalize on them.

- Determining the appropriate option type, strike price, and expiration date for each trade.

3. Risk Management

Managing risk by monitoring positions and adjusting strategies as needed.

- Setting stop-loss orders to limit potential losses.

- Calculating and managing the risk-reward ratio for each trade.

4. Trade Execution

Executing trades efficiently and effectively.

- Placing orders with brokers and monitoring their execution.

- Adjusting orders as needed based on market conditions.

5. Performance Evaluation

Tracking and evaluating trading performance.

- Analyzing profitability, Sharpe ratio, and other performance metrics.

- Identifying areas for improvement and adjusting strategies accordingly.

Interview Tips

Preparing for an Options Trader interview requires a thorough understanding of the role and its responsibilities, as well as the ability to demonstrate your skills and experience. Here are some tips to help you ace your interview:

1. Research the Company and Position

Familiarize yourself with the company’s business, trading strategies, and culture. Understand the specific requirements of the Options Trader position you’re applying for.

- Visit the company website and read recent news articles or financial reports.

- Network with current employees or industry professionals to gain insights.

2. Practice Your Technical Skills

Options trading involves complex financial concepts and strategies. Be prepared to discuss your understanding of the following:

- Option types (calls, puts, straddles, strangles, etc.)

- Option pricing models (Black-Scholes, binomial trees, etc.)

- Greek letters (delta, gamma, theta, vega, rho)

3. Showcase Your Risk Management Expertise

Risk management is a critical aspect of options trading. Be able to articulate your approach to managing risk, including:

- Stop-loss orders and profit targets.

- Position sizing and portfolio diversification.

- Stress testing and scenario analysis.

4. Emphasize Your Analytical and Decision-Making Abilities

Options traders need to be able to analyze market data, identify trends, and make quick decisions. Highlight your analytical skills and explain how you approach decision-making under pressure.

- Provide examples of successful trades you’ve made and the thought process behind them.

- Discuss your experience in using trading software and data analysis tools.

5. Be Prepared for Behavioral Questions

Behavioral questions are common in interviews, and they assess your teamwork, communication, and problem-solving abilities. Prepare for questions such as:

- Describe a challenging trading situation you faced and how you overcame it.

- Tell me about a time when you had to collaborate with others to achieve a trading goal.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Options Trader interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.