Feeling lost in a sea of interview questions? Landed that dream interview for Pawnbroker but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Pawnbroker interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

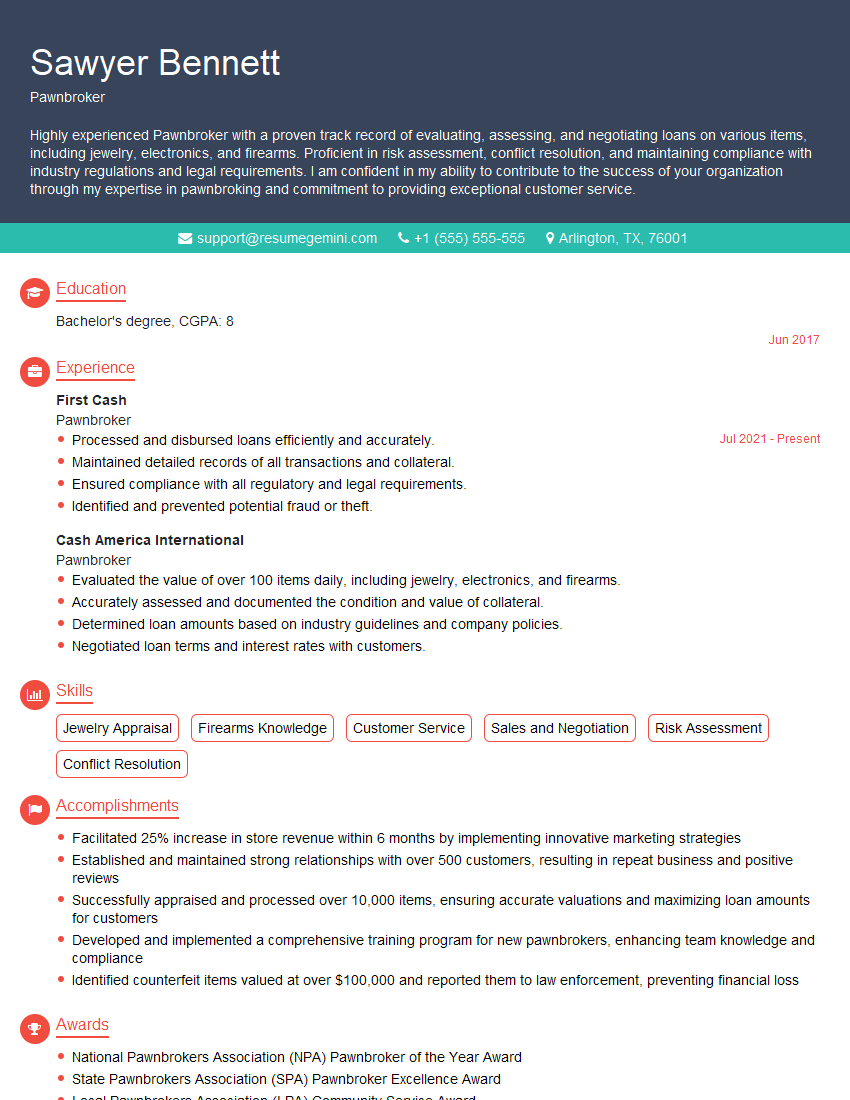

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Pawnbroker

1. How do you determine the value of an item brought in for pawn?

- Research the item’s make, model, and condition using online resources and databases.

- Examine the item closely for any signs of damage, wear, or repair.

- Consider the current market value and demand for similar items.

- Consult with experts or appraisers if necessary to determine the item’s authenticity and value.

2. What are the legal and ethical considerations you must be aware of when operating a pawn shop?

Compliance with Regulations

- Adhering to laws governing pawn transactions, security, and storage.

- Maintaining accurate records and documentation to meet regulatory requirements.

Customer Protection

- Disclosing terms and conditions of pawn loans clearly and fairly.

- Protecting customers’ privacy and confidentiality.

Crime Prevention

- Reporting suspicious or stolen items to law enforcement.

- Verifying customer identification and maintaining a database of transactions.

3. How do you handle situations where a customer is unable to repay their loan?

- Communicate with the customer to understand their situation and explore options.

- Provide extensions or payment plans if feasible and in accordance with company policy.

- Consider renegotiating the loan terms, such as reducing the interest rate or loan amount.

- As a last resort, foreclose on the pawned item and sell it to recover the loan amount.

4. What strategies do you use to prevent theft and fraud in the pawn shop?

- Implement security measures such as surveillance cameras, alarm systems, and access control.

- Train staff to identify suspicious behavior and counterfeit items.

- Establish clear policies and procedures for pawn transactions, including verification of customer identification.

- Collaborate with law enforcement to report stolen or fraudulent items.

5. How do you assess the risk of lending money on a particular item?

- Evaluate the item’s value and condition to determine its potential resale value.

- Consider the demand for the item in the current market.

- Assess the customer’s ability to repay the loan, including their credit history and income.

- Establish clear loan terms, including interest rates and repayment schedules.

6. What is your experience with assessing and valuing jewelry?

- Expertise in identifying and evaluating precious metals, gemstones, and jewelry designs.

- Knowledge of grading systems for diamonds, gold, and other gemstones.

- Experience in using tools and equipment for jewelry inspection and appraisal.

- Understanding of current market trends and pricing for jewelry.

7. What techniques do you use to negotiate with customers on pawn loans?

- Establish a rapport with the customer and understand their needs.

- Explain the terms and conditions of the loan clearly and fairly.

- Negotiate interest rates and loan amounts based on the item’s value and customer’s financial situation.

- Be willing to compromise and find mutually acceptable solutions.

8. How do you stay up-to-date with changes in regulations and industry best practices?

- Attend industry conferences and workshops.

- Read trade publications and subscribe to industry newsletters.

- Network with other pawnbrokers and professionals in the field.

- Participate in online forums and discussion groups.

9. What measures do you take to ensure the security of customers’ pawned items?

- Store pawned items in a secure, climate-controlled facility.

- Implement access control measures to limit who can access the storage area.

- Document the condition of pawned items upon receipt.

- Provide customers with receipts and clear instructions for redeeming their items.

10. What are the ethical responsibilities of a pawnbroker?

- Treating customers fairly and respectfully.

- Providing accurate and transparent information about pawn loans.

- Adhering to all applicable laws and regulations.

- Protecting customers’ privacy and confidentiality.

- Contributing to the safety and well-being of the community.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Pawnbroker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Pawnbroker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Pawnbroker is responsible for the smooth functioning of a pawnshop. They interact with customers to assess, evaluate and provide loans against pledged items while ensuring compliance with company policies and regulations.

1. Customer Interaction

Pawnbrokers greet customers, establish rapport, and understand their needs. They provide information about the pawnshop’s services, explain loan terms, and answer any questions customers may have.

2. Item Evaluation and Loan Processing

Pawnbrokers assess the value of pledged items based on factors like condition, age, and market demand. They determine the loan amount, interest rates, and repayment terms in accordance with company policies. They also complete necessary paperwork and maintain accurate records.

3. Collateral Management

Pawnbrokers are responsible for the safekeeping and storage of pledged items. They maintain accurate inventory records, ensure items are properly stored and protected, and handle redemptions or sales of unredeemed items.

4. Regulatory Compliance

Pawnbrokers must comply with federal, state, and local laws and regulations governing pawnshops. This includes adhering to anti-money laundering and know-your-customer (KYC) requirements, maintaining proper documentation, and reporting suspicious activities.

Interview Tips

To prepare for a pawnbroker interview, candidates should thoroughly research the industry, the specific pawnshop they are applying to, and the key job responsibilities outlined above. Additionally, the following tips can help candidates ace the interview:

1. Emphasize Customer Service Skills

Pawnbrokers interact with a diverse range of customers, so it is essential to demonstrate strong interpersonal and communication skills. Highlight your ability to build rapport, listen actively, and resolve issues professionally.

2. Showcase Knowledge of Pawnbroking Practices

Research the pawnshop’s loan policies, interest rates, and collateral acceptance criteria. Be prepared to discuss your understanding of how pawnbroking works and how you would evaluate and process loans.

3. Highlight Attention to Detail

Pawnbrokers handle valuable items and sensitive customer information. Emphasize your attention to detail, accuracy, and ability to maintain organized and thorough records.

4. Demonstrate Financial Acumen

Pawnbrokers need to have a basic understanding of financial concepts such as loan calculations, interest rates, and repayment schedules. Be prepared to answer questions about your financial knowledge and how you would handle money-related transactions.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Pawnbroker, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Pawnbroker positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.