Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Paying Teller interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Paying Teller so you can tailor your answers to impress potential employers.

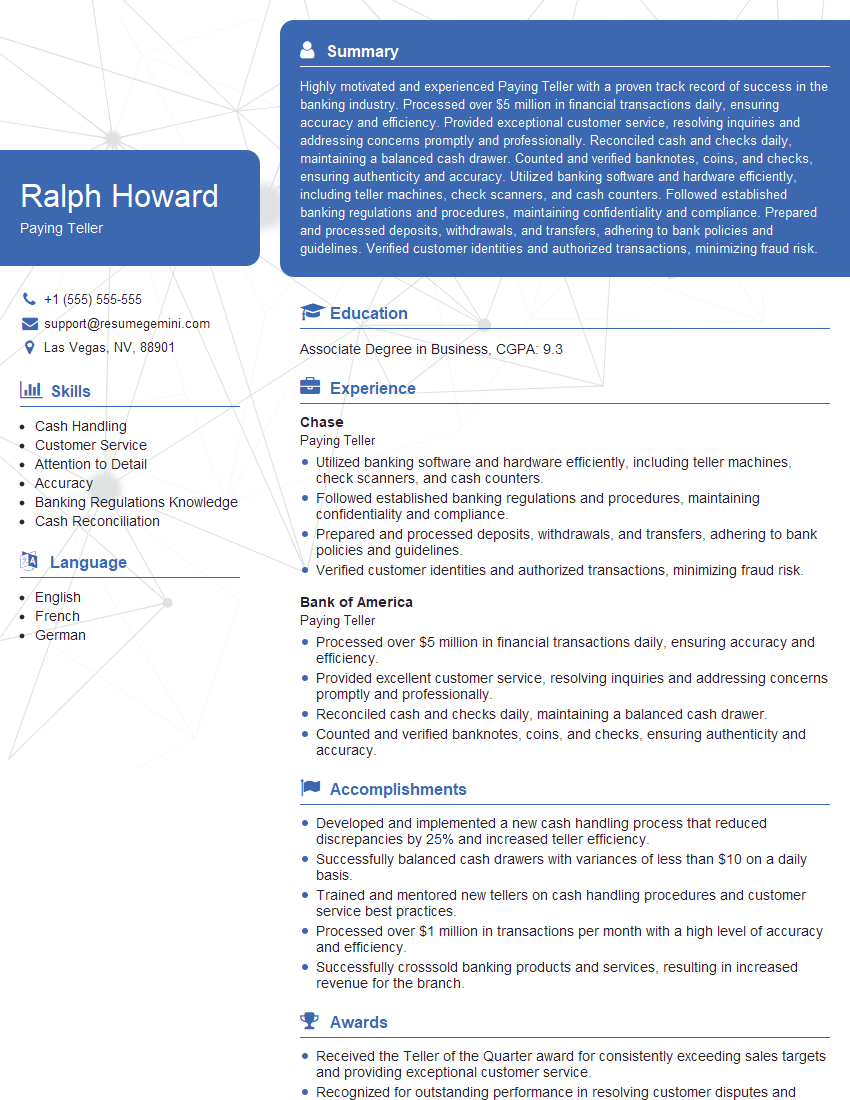

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Paying Teller

1. Describe the key responsibilities and duties of a Paying Teller?

- Receive and process payments for various forms, including cash, checks, and money orders

- Disburse payments in the form of cash, checks, or electronic transfers

- Verify the authenticity and accuracy of documents, such as checks and identification cards

- Maintain accurate records of all transactions

- Provide excellent customer service and resolve any queries or issues promptly

2. What are some essential skills and qualifications required to be a Paying Teller?

- Strong cash handling skills and experience

- Expertise in handling various payment forms and processing transactions

- Attention to detail and accuracy in data entry and recordkeeping

- Excellent communication and interpersonal skills for interacting with customers

- Basic knowledge of banking regulations and policies

- Ability to work efficiently in a fast-paced and demanding environment

3. How do you ensure the accuracy and security of transactions while working as a Paying Teller?

- Verify the identity of customers and the authenticity of documents

- Count cash and checks carefully and use a cash drawer

- Record all transactions accurately and balance the cash drawer at the end of the shift

- Follow all bank policies and procedures to prevent fraud and errors

- Report any suspicious or unusual transactions to supervisors

4. What should you do if a customer presents a suspicious check or other document?

- Remain calm and do not confront the customer

- Inform your supervisor immediately

- Document the incident thoroughly, including the customer’s details and the document in question

- Follow bank policies and procedures for handling suspicious transactions

5. Describe a situation where you demonstrated excellent customer service as a Paying Teller?

- Handled a difficult customer who was upset about a transaction

- Resolved a dispute between two customers over a payment

- Went the extra mile to help a customer with a complex transaction

- Received compliments from customers for providing friendly and efficient service

6. How do you stay up-to-date with the latest banking regulations and technologies?

- Attend training sessions and seminars

- Read industry publications and websites

- Stay informed about new technologies and advancements in banking

- Consult with colleagues and supervisors to gather insights

7. What are some common challenges you have faced as a Paying Teller and how did you overcome them?

- Dealing with large volumes of transactions during peak hours

- Handling difficult or upset customers

- Balancing accuracy with the need for speed

- Staying alert and focused despite repetitive tasks

8. Why are you interested in working as a Paying Teller at our bank?

Emphasize your financial experience and skills

- I have several years of experience working as a Paying Teller

- I am proficient in cash handling, transaction processing, and customer service

Highlight your knowledge of our bank

- I am familiar with your bank’s reputation for providing excellent customer service

- I believe that my skills and experience would be a valuable asset to your team

Express your enthusiasm

- I am eager to learn and grow within your organization

- I am confident that I can make a significant contribution to your bank

9. What are your career aspirations and how does this role align with them?

Explain your interest in the banking industry

- I am passionate about the financial services industry

- I believe that a Paying Teller role is a great starting point for a career in banking

Describe your career goals

- My ultimate goal is to become a Branch Manager

- I believe that the skills and experience I gain as a Paying Teller will be essential for my future success

Demonstrate your willingness to learn and grow

- I am eager to take on new challenges and responsibilities

- I am confident that I have the potential to excel in this role and beyond

10. Do you have any questions for me about the Paying Teller position or our bank?

- Inquire about training and development opportunities

- Ask about the bank’s commitment to customer service

- Seek information about the bank’s culture and values

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Paying Teller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Paying Teller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Paying Teller is responsible for performing various crucial tasks in the banking environment, including but not limited to:

1. Cash Transactions

Handle transactions involving deposits, withdrawals, and exchanges of currency and checks.

2. Account Maintenance

Verify and process withdrawals, deposits, and other account updates.

3. Customer Service

Assist customers with queries, offer financial advice, and provide excellent service.

4. Fraud Prevention

Detect and prevent fraudulent activities, including counterfeit currency and forged checks.

Interview Tips

To help candidates ace their interview for a Paying Teller position, consider the following preparation tips and hacks:

1. Highlight Customer Service Skills

Emphasize your ability to handle customer interactions efficiently and professionally, showcasing your active listening skills and empathy.

2. Quantify Responsibilities

Use specific numbers and examples to demonstrate the scope and impact of your previous teller experience, such as processing a large number of transactions or resolving customer issues effectively.

3. Be Aware of Banking Regulations

Familiarize yourself with common banking regulations and best practices, as interviewers will expect you to have a basic understanding of these.

4. Demonstrate Attention to Detail

Highlight your meticulous nature and accuracy in handling cash and processing transactions. Mention any specific techniques or methods you use to ensure precision.

5. Practice Common Interview Questions

Prepare for common interview questions, such as “Why are you interested in this role?” or “Tell me about a time you handled a difficult customer situation.”

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Paying Teller interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.