Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Paymaster of Purses interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Paymaster of Purses so you can tailor your answers to impress potential employers.

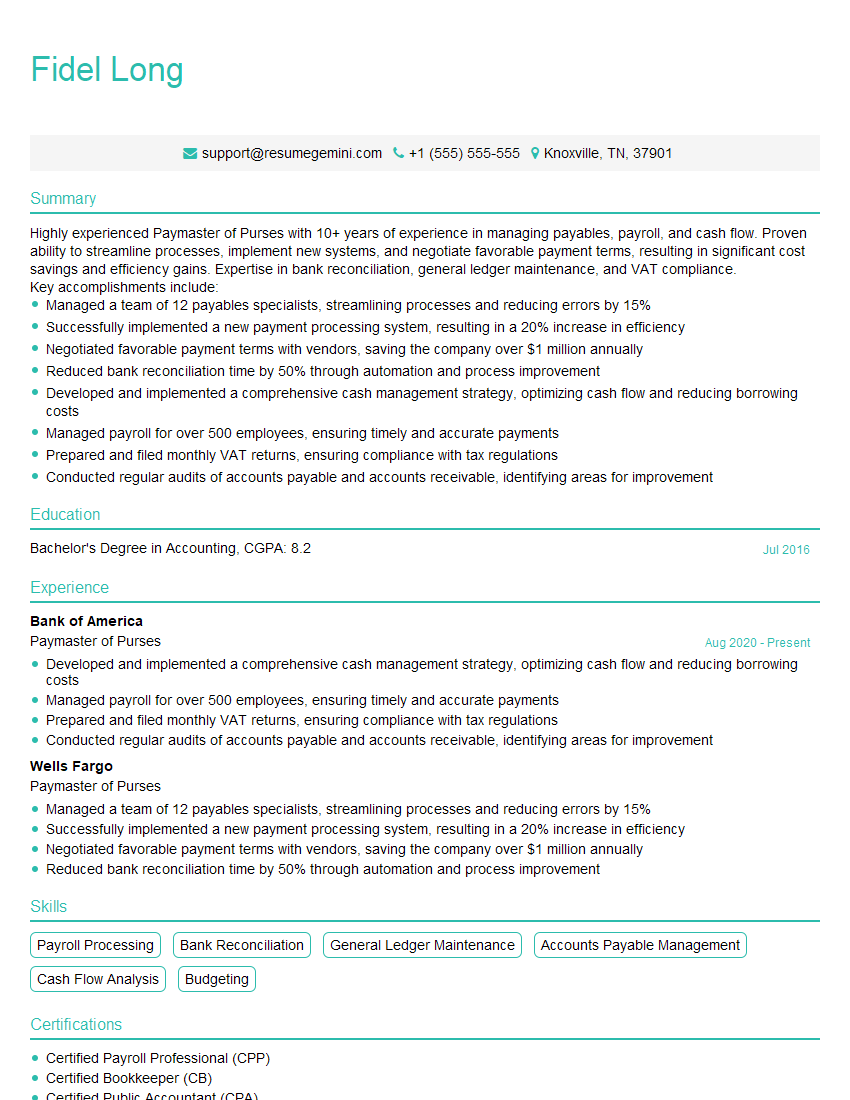

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Paymaster of Purses

1. What are the key responsibilities of a Paymaster of Purses?

- Supervising and coordinating the daily operations of the treasury department.

- Managing cash flow, ensuring that there are adequate funds to meet operational and financial obligations.

- Preparing and administering the organization’s budget and financial plans.

- Developing and implementing financial policies and procedures.

- Reporting on financial performance and compliance to management and external stakeholders.

2. What are the core competencies required for a successful Paymaster of Purses?

- Strong understanding of treasury management principles and practices.

- Experience in financial planning and budgeting.

- Knowledge of accounting and auditing standards.

- Excellent communication and interpersonal skills.

- Ability to work independently and as part of a team.

3. Can you explain the role of risk management in treasury operations?

- Identifying and assessing financial risks.

- Developing and implementing risk mitigation strategies.

- Monitoring and reporting on risk exposures.

- Ensuring compliance with regulatory and industry best practices.

- Protecting the organization from financial losses.

4. What are the emerging trends in treasury management?

- Digitalization and automation of treasury processes.

- Increased focus on data analytics and risk management.

- Adoption of sustainable and ethical investing practices.

- Integration of treasury functions with other business units.

- Use of artificial intelligence and machine learning to enhance treasury operations.

5. How do you approach the development and implementation of financial policies and procedures?

- Analyzing existing policies and procedures.

- Consulting with stakeholders to identify areas for improvement.

- Developing draft policies and procedures based on best practices and industry standards.

- Reviewing and approving policies and procedures with management.

- Communicating and training employees on new policies and procedures.

6. How do you ensure the accuracy and integrity of financial reporting?

- Establishing and maintaining a robust system of internal controls.

- Reviewing and reconciling financial transactions on a regular basis.

- Obtaining external audits and certifications to verify the accuracy of financial statements.

- Adhering to ethical and professional standards.

- Maintaining a strong relationship with external auditors.

7. How do you measure and evaluate the performance of the treasury department?

- Tracking key financial metrics, such as cash flow, return on investment, and compliance.

- Conducting regular internal audits and reviews.

- Comparing performance to industry benchmarks.

- Conducting customer satisfaction surveys.

- Identifying areas for improvement and developing action plans.

8. How do you stay up-to-date on the latest trends and developments in the financial industry?

- Attending industry conferences and webinars.

- Reading financial publications and industry reports.

- Participating in professional development programs.

- Networking with other professionals in the field.

- Obtaining professional certifications.

9. Have you implemented any innovative or successful initiatives in your previous role?

- Developed and implemented a new treasury management system that significantly improved efficiency and reduced costs.

- Led a team that developed a new investment strategy that generated significant returns for the organization.

- Established a risk management framework that identified and mitigated financial risks.

- Improved the accuracy and timeliness of financial reporting.

- Established a strong relationship with external auditors.

10. How do you approach the management of a team and the development of your staff?

- Creating a positive and supportive work environment.

- Providing clear and concise instructions.

- Delegating responsibilities and empowering staff.

- Providing regular feedback and coaching.

- Recognizing and rewarding employee achievements.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Paymaster of Purses.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Paymaster of Purses‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Paymaster of Purses is a senior-level financial executive responsible for managing the organization’s financial resources, ensuring compliance with financial regulations, and providing strategic guidance.

1. Financial Management

Oversee all aspects of the organization’s financial operations, including budgeting, cash flow, and investment.

- Prepare and manage the annual budget.

- Forecast and manage cash flow.

2. Regulatory Compliance

Ensure the organization complies with all applicable financial regulations, including GAAP, IFRS, and SEC regulations.

- Develop and implement policies and procedures to ensure compliance.

- Conduct regular internal audits to identify and mitigate risks.

3. Financial Reporting

Prepare and distribute timely and accurate financial reports to stakeholders, including investors, creditors, and management.

- Prepare quarterly and annual financial statements.

- Respond to investor inquiries and provide financial analysis.

4. Strategic Planning

Provide strategic guidance to the organization on financial matters, including capital allocation, investment, and growth opportunities.

- Develop and implement financial plans to support the organization’s strategic objectives.

- Identify and evaluate potential investment opportunities.

Interview Tips

Preparing for an interview can be daunting, especially for a high-stakes position like Paymaster of Purses. Here are a few tips and tricks to help you ace the interview:

1. Research the Company

Take the time to learn about the company’s history, financial performance, and industry position. This will help you understand the company’s culture and priorities, and show the interviewer that you’re genuinely interested in the role.

- Visit the company’s website and read their financial reports.

- Follow the company on social media and read industry news.

2. Practice Your Answers

Spend some time practicing your answers to common interview questions. This will help you feel more confident and prepared during the interview itself. Some questions you may want to prepare for include:

- “Tell me about your experience in financial management.”

- “How do you ensure compliance with financial regulations?”

- “What are your strengths and weaknesses as a financial executive?”

3. Be Prepared to Talk About Your Experience

The interviewer will likely ask you about your experience in financial management. Be prepared to discuss your skills and accomplishments in detail, and provide specific examples of your work.

- Use the STAR method to answer interview questions (Situation, Task, Action, Result).

- Quantify your accomplishments whenever possible.

4. Be Professional and Enthusiastic

First impressions matter, so make sure to dress professionally and arrive at the interview on time. Be polite and respectful to everyone you meet, and maintain a positive attitude throughout the interview. Your enthusiasm for the role will be evident to the interviewer, and will help you stand out from other candidates.

- Make eye contact and smile when you greet the interviewer.

- Be engaged in the conversation and ask thoughtful questions.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Paymaster of Purses interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!