Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Payment Collector position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

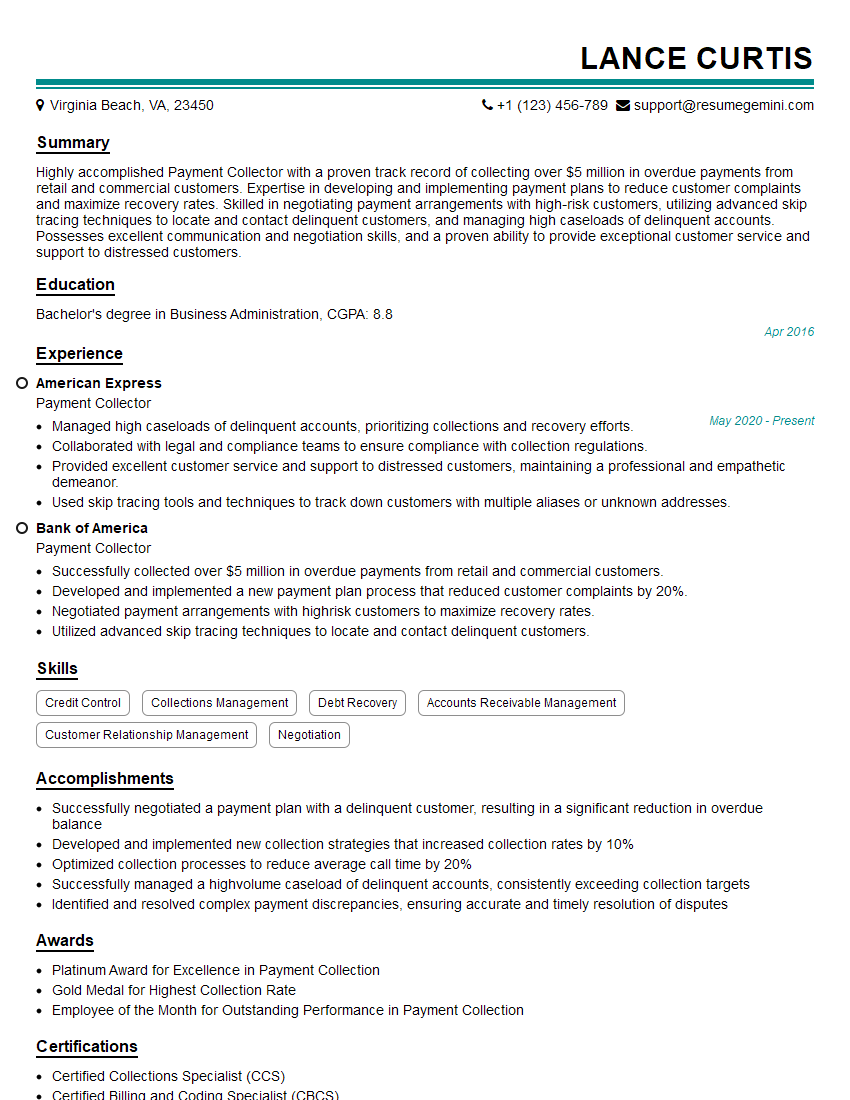

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Payment Collector

1. Describe the key duties and responsibilities of a Payment Collector.

As a Payment Collector, my primary responsibilities would include:

- Processing payments accurately and efficiently using various payment methods (cash, check, credit/debit card, online transfers).

- Maintaining detailed records of all payments received.

- Reconciling payments with invoices and other financial documents.

- Handling customer inquiries and resolving payment-related issues.

- Complying with all applicable laws and regulations related to payment processing.

2. What are the common challenges faced by Payment Collectors and how would you overcome them?

Some common challenges faced by Payment Collectors include:

Dealing with difficult customers

- Maintain professionalism and empathy while addressing customer concerns.

- Listen actively and try to understand their perspective.

- Follow established protocols and seek support from supervisors when necessary.

Handling large volumes of transactions

- Prioritize tasks effectively and manage time wisely.

- Utilize automation tools to streamline the processing process.

- Work efficiently and maintain a high level of accuracy.

3. How do you stay up-to-date with the latest payment processing regulations and technologies?

To stay current with payment processing regulations and technologies, I:

- Attend industry conferences and webinars.

- Read trade publications and online resources.

- Consult with colleagues and industry experts.

- Undertake training programs offered by payment processing companies.

4. Explain how you would handle a situation where a customer disputing a payment.

In the event of a customer disputing a payment, I would:

- Listen attentively to the customer’s concerns and gather all relevant information.

- Review the transaction records and supporting documentation to verify the accuracy of the payment.

- Contact the customer to discuss the findings and explain the company’s policies.

- Work with the customer to resolve the dispute amicably or escalate the matter to my supervisor if necessary.

5. What is your understanding of PCI DSS compliance? How do you ensure compliance in your work?

PCI DSS (Payment Card Industry Data Security Standard) is a set of security standards designed to protect cardholder data. I am familiar with the requirements of PCI DSS and ensure compliance in my work by:

- Maintaining a secure work environment and limiting access to cardholder data.

- Properly storing and transmitting cardholder data using encryption and other security measures.

- Regularly updating and monitoring security systems to prevent data breaches.

6. Describe a time when you effectively resolved a customer issue related to payment processing.

In my previous role, a customer reported an incorrect charge on their credit card statement. I:

- Investigated the transaction records and found that the error occurred due to a system glitch.

- Contacted the customer to explain the situation and apologize for the inconvenience.

- Processed a refund for the incorrect amount and reversed the transaction.

- Followed up with the customer to ensure their satisfaction and offered a small token of appreciation.

7. How do you handle situations where customers are unable to make payments on time?

In cases where customers are unable to make payments on time, I:

- Contact the customer to understand their situation and discuss payment options.

- Offer flexible payment arrangements or payment extensions if possible.

- Work with the customer to create a payment plan that fits their financial situation.

- Document all conversations and agreements to ensure clarity and accountability.

8. Explain the process of reconciling payments with invoices and other financial documents.

The reconciliation process involves:

- Matching payments to corresponding invoices.

- Verifying the accuracy of payment amounts and invoice details.

- Identifying any discrepancies or missing payments.

- Documenting and reporting any exceptions or adjustments.

- Maintaining a record of all reconciliation activities for audit purposes.

9. Describe your experience with payment processing software and tools.

I am proficient in using various payment processing software and tools, including:

- Credit card terminals and POS systems.

- Online payment gateways and e-commerce platforms.

- Accounting and reconciliation software.

- Customer relationship management (CRM) systems.

10. What are your key strengths and weaknesses as a Payment Collector?

My key strengths include:

- Strong attention to detail and accuracy.

- Excellent customer service and communication skills.

- Proficiency in payment processing software and technologies.

- Ability to work independently and as part of a team.

As for weaknesses, I am always striving to improve my time management skills and explore new payment processing solutions.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Payment Collector.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Payment Collector‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Payment Collectors are responsible for collecting payments from customers and ensuring timely receipt of funds. Their primary duties include:

1. Processing Payments

Process payments received through various channels, including cash, checks, credit cards, and online payments.

- Verify payment details and ensure accuracy.

- Issue receipts and update payment records.

2. Collections

Contact delinquent customers to collect outstanding payments.

- Negotiate payment plans and arrange alternative payment methods.

- Resolve disputes and address customer concerns.

3. Customer Service

Provide excellent customer service and resolve inquiries related to payments.

- Answer phone calls, emails, and other inquiries promptly.

- Maintain positive relationships with customers.

4. Reporting and Reconciliation

Prepare reports on payment activities and reconcile accounts receivable.

- Identify discrepancies and resolve errors.

- Ensure compliance with financial regulations.

Interview Tips

To ace the interview for a Payment Collector position, it’s crucial to prepare thoroughly. Here are some effective tips:

1. Research the Company

Research the company’s industry, size, and financial standing. This will help you understand their business model and payment collection needs.

- Visit the company’s website and social media pages.

- Read industry news and financial reports.

2. Highlight Your Skills

Emphasize your skills in customer service, collections, and financial management. Provide specific examples that demonstrate your ability to resolve disputes, negotiate payment plans, and maintain customer relationships.

- Quantify your accomplishments whenever possible.

- Use action verbs and specific details to describe your work experience.

3. Practice Your Answers

Anticipate common interview questions and practice your answers. This will help you feel more confident and articulate during the interview. Focus on highlighting your strengths and aligning your qualifications with the job requirements.

- Consider using the STAR method (Situation, Task, Action, Result) to structure your answers.

- Ask a friend or family member to conduct a mock interview.

4. Prepare Questions

During the interview, it’s a great idea to ask thoughtful questions to show your interest and engagement. This also gives you an opportunity to clarify any details about the role or the company.

- Ask about the company’s payment collection process and challenges.

- Inquire about the expectations for customer service and dispute resolution.

5. Dress Professionally

First impressions matter, so dress professionally and appropriately for the interview. This conveys that you respect the company and are serious about the position.

- Consider wearing business attire such as a suit or dress.

- Ensure your clothes are clean, pressed, and free of wrinkles.

Remember, preparation is key to success. By following these tips, you can increase your chances of impressing the interviewer and landing the job as a Payment Collector.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Payment Collector interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!