Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Payment Processor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

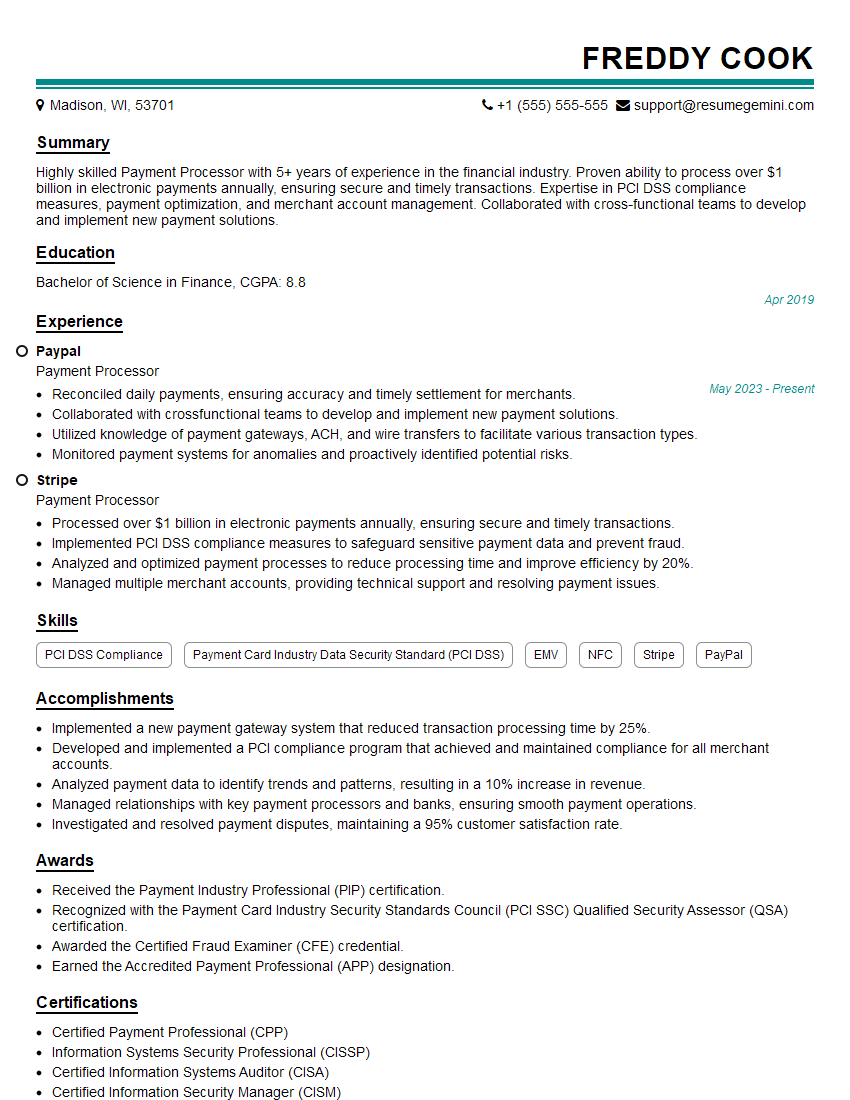

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Payment Processor

1. What are the fundamental principles and processes involved in payment processing?

- Authorization: Verifying the customer’s payment information and ensuring sufficient funds are available.

- Settlement: Transferring funds from the customer’s account to the merchant’s account.

- Clearing: Communicating transaction details among financial institutions and central banks.

- Risk management: Identifying and mitigating potential fraud or payment disputes.

2. Explain the different types of payment systems and their respective strengths and weaknesses.

Card-based systems:

- Strengths: Widely accepted, convenient, secure.

- Weaknesses: High transaction fees, potential for fraud.

ACH (Automated Clearing House) systems:

- Strengths: Low transaction fees, ideal for bulk payments.

- Weaknesses: Slow processing times, less secure than card-based systems.

3. Describe the role of interchange fees in payment processing and their impact on merchants.

- Interchange fees are charged by banks or card networks to merchants for each transaction.

- They cover the processing costs and provide revenue for financial institutions.

- Merchants may pass on interchange fees to customers through higher prices or surcharges.

4. How do you handle and mitigate chargebacks in payment processing?

- Implement fraud prevention measures, such as address verification and card verification value (CVV) checks.

- Provide clear and concise terms and conditions to customers.

- Investigate chargebacks promptly and respond to customer inquiries.

5. What are the emerging trends and innovations in payment processing?

- Mobile payments and digital wallets.

- Biometric authentication and tokenization.

- Artificial intelligence (AI) for fraud detection and risk management.

6. What are the key performance indicators (KPIs) for evaluating the effectiveness of a payment processor?

- Transaction volume and value.

- Authorization and settlement rates.

- Chargeback ratio.

- Customer satisfaction.

7. How do you ensure the security and compliance of payment processing systems?

- Implement industry-standard encryption and security protocols.

- Comply with PCI DSS (Payment Card Industry Data Security Standard).

- Monitor systems for potential vulnerabilities and threats.

8. What are the key considerations for integrating a payment processor into an e-commerce platform?

- Security and compliance.

- Ease of integration and compatibility with existing systems.

- Transaction fees and pricing structure.

- Customer support and technical assistance.

9. How do you handle cross-border payments and currency conversion?

- Partner with international payment networks and foreign exchange providers.

- Provide clear currency conversion rates and options to customers.

- Monitor exchange rate fluctuations and adjust accordingly.

10. What are the best practices for optimizing payment processing efficiency and reducing costs?

- Negotiate lower interchange fees with banks and card networks.

- Use volume discounts and payment gateways that offer cost-effective solutions.

- Implement self-service tools for customers to resolve issues and reduce support expenses.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Payment Processor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Payment Processor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Payment Processor ensures seamless and secure processing of financial transactions. Their primary role involves managing the flow of funds between various parties in a secure and timely manner.

1. Transaction Processing

Reviewing and authorizing financial transactions, including debit and credit card payments, ACH transfers, and online payments.

- Verifying customer information, detecting fraud, and safeguarding sensitive data.

- Applying rules and regulations to ensure compliance with industry standards and client requirements.

2. Reconciliation and Settlement

Reconciling transaction records, identifying discrepancies, and ensuring accurate settlement of funds.

- Preparing and distributing statements to clients and merchants, reflecting transaction details and account balances.

- Managing disputes, investigating chargebacks, and resolving payment-related issues.

3. Customer Support and Relationship Management

Providing excellent customer service to merchants and consumers, addressing inquiries and resolving complaints promptly.

- Building strong relationships with clients, understanding their needs, and tailoring solutions accordingly.

- Educating clients on payment processing best practices, compliance requirements, and risk mitigation strategies.

4. Risk Management and Fraud Detection

Implementing and monitoring fraud prevention measures, identifying suspicious transactions, and mitigating risks.

- Collaborating with Fraud Teams, law enforcement, and risk management professionals to ensure the integrity of transactions.

- Staying abreast of industry trends, emerging threats, and regulatory changes related to fraud and risk management.

Interview Tips

Preparing for a Payment Processor interview requires a thorough understanding of the role and the industry. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Familiarize yourself with the company’s history, products, and services. Understand the payment processing industry, including key trends, regulations, and competitive landscape.

- Visit the company website and review industry publications to gain insights.

- Connect with industry professionals on LinkedIn to learn about the latest developments.

2. Highlight Your Skills and Experience

Emphasize your technical skills in payment processing, such as authorization, settlement, and fraud detection. Showcase your knowledge of industry standards, compliance requirements, and risk management practices.

- Quantify your accomplishments using specific metrics and results whenever possible.

- Prepare examples that demonstrate your ability to solve problems, manage complex transactions, and provide excellent customer service.

3. Be Enthusiastic and Professional

Convey your passion for the payment processing industry and demonstrate your willingness to learn and grow. Maintain a positive and professional demeanor throughout the interview.

- Ask thoughtful questions to show your engagement and interest in the role.

- Dress appropriately and arrive on time for the interview.

4. Practice Common Interview Questions

Anticipate common interview questions and prepare your responses. Practice answering questions related to your experience, skills, knowledge of the industry, and your reasons for pursuing the role.

- Consider using the STAR method (Situation, Task, Action, Result) to structure your answers.

- Seek feedback from a friend, family member, or career counselor on your responses.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Payment Processor, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Payment Processor positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.