Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Payroll Accounting Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

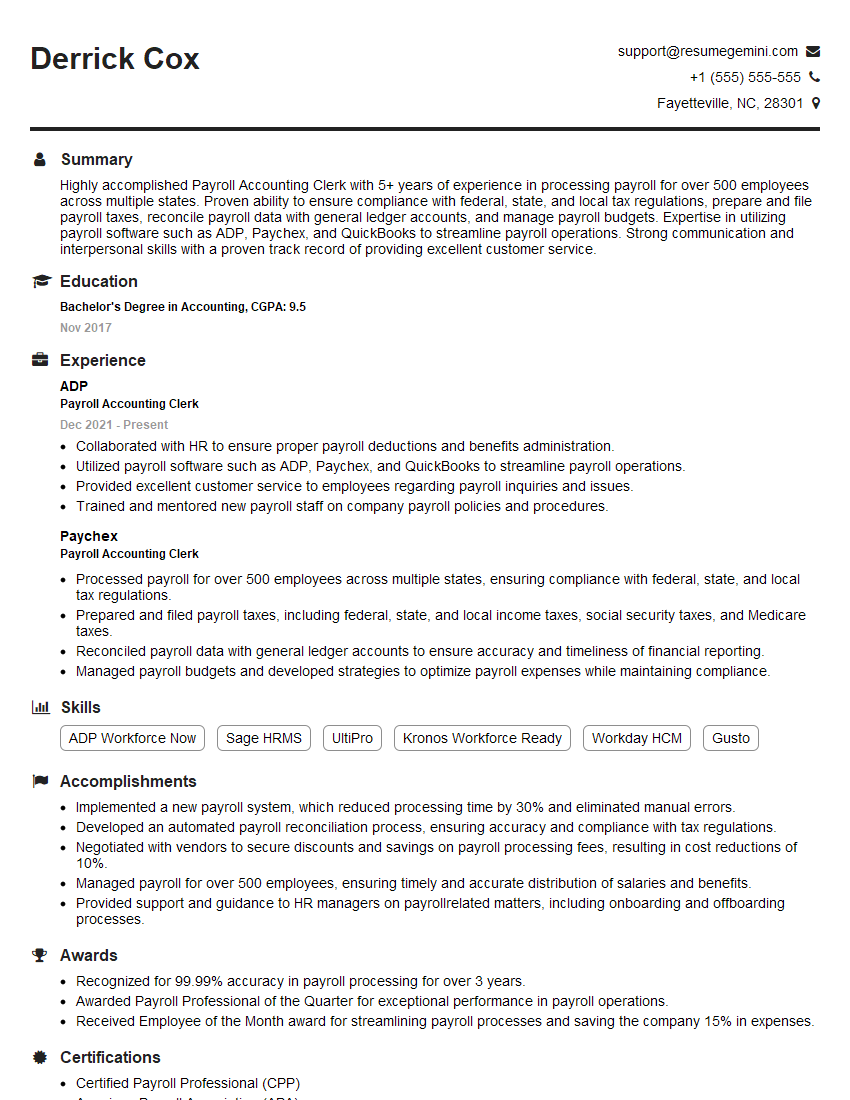

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Payroll Accounting Clerk

1. What are the key responsibilities of a Payroll Accounting Clerk?

As a Payroll Accounting Clerk, I am responsible for accurately processing payroll for employees, ensuring compliance with all applicable laws and regulations. My key responsibilities include:

- Calculating employee pay based on hours worked, overtime, and other factors

- Withholding and remitting taxes, including federal, state, and local income taxes, and FICA

- Making deductions for benefits, such as health insurance, 401(k) contributions, and union dues

- Issuing paychecks or direct deposits

- Preparing payroll reports and maintaining payroll records

- Answering employee inquiries and resolving payroll issues

- Staying up-to-date on changes to payroll laws and regulations

2. What are the most important qualities of a successful Payroll Accounting Clerk?

To be successful in this role, I believe the most important qualities are:

- Accuracy and attention to detail

- Strong analytical and problem-solving skills

- Excellent communication and interpersonal skills

- Knowledge of payroll laws and regulations

- Ability to work independently and as part of a team

- Ability to meet deadlines and manage workload

- Proficiency in using payroll software

3. What are some of the challenges you have faced in your previous payroll accounting roles, and how did you overcome them?

In my previous role, one of the challenges I faced was a complex payroll issue involving a large number of employees. The issue was caused by a software glitch that resulted in incorrect deductions being made from employee paychecks.

To overcome this challenge, I worked closely with the IT department to identify the source of the problem and correct the software. I also communicated regularly with the affected employees to keep them informed of the situation and provide updates on the progress of the resolution.

Another challenge I faced was the implementation of a new payroll system. I was responsible for leading the project and ensuring a smooth transition for all employees. I worked closely with the vendor to configure the system and train employees on the new processes.

4. How do you stay up-to-date on changes to payroll laws and regulations?

I stay up-to-date on changes to payroll laws and regulations by:

- Reading industry publications and attending webinars

- Participating in professional development courses

- Networking with other payroll professionals

- Consulting with legal counsel and tax advisors

5. What are some of the best practices for ensuring the accuracy of payroll processing?

To ensure the accuracy of payroll processing, I always follow these best practices:

- Verifying all data before processing payroll

- Using automated processes to minimize errors

- Reconciling payroll data with other accounting records

- Reviewing payroll reports carefully before finalizing

- Training employees on payroll procedures

6. What are your strengths and weaknesses as a Payroll Accounting Clerk?

My strengths as a Payroll Accounting Clerk include my:

- Accuracy and attention to detail

- Strong analytical and problem-solving skills

- Excellent communication and interpersonal skills

- Knowledge of payroll laws and regulations

- Ability to work independently and as part of a team

- Ability to meet deadlines and manage workload

- Proficiency in using payroll software

7. What are your salary expectations for this position?

My salary expectations for this position are in line with the market rate for similar roles in this industry. I am confident that I can bring value to your organization and am willing to negotiate a salary that is fair and competitive.

8. Why are you interested in working for our company?

I am interested in working for your company because I am impressed by your commitment to providing excellent customer service and your reputation for being a leader in the industry. I believe that my skills and experience would be a valuable asset to your team, and I am eager to contribute to the success of your organization.

9. What are your career goals for the next 5 years?

In the next 5 years, I hope to continue to develop my skills and knowledge in payroll accounting. I am interested in pursuing a leadership role and eventually becoming a Payroll Manager. I am confident that my hard work and dedication will help me achieve my career goals.

10. What questions do you have for me about the position or the company?

I am very interested in the position and the company, and I have a few questions for you:

- What are the most important priorities for the Payroll Accounting Clerk in the next 6 months?

- What opportunities are there for professional development and growth within the company?

- What is the company culture like?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Payroll Accounting Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Payroll Accounting Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Payroll Accounting Clerks play a crucial role in managing and processing employee payrolls. Their responsibilities encompass a wide range of tasks, including:

1. Payroll Preparation and Distribution

Calculating and preparing payroll;

Distributing paychecks or electronic payments;

Reconciling payroll accounts.

2. Tax and Compliance

Withholding and depositing payroll taxes (federal, state, and local);

Filing payroll tax returns;

Maintaining compliance with labor laws.

3. Recordkeeping and Reporting

Maintaining payroll records;

Preparing payroll reports;

Providing data for financial reporting.

4. Employee Relations

Answering employee inquiries about payroll;

Processing employee benefits;

Assisting with employee onboarding and offboarding.

Interview Tips

Preparing thoroughly for an interview can boost your confidence and increase your chances of making a strong impression. Here are some tips to help you ace the interview for a Payroll Accounting Clerk position:

1. Research the Company

Familiarize yourself with the company’s website, products, services, and recent news;

Research the industry and its trends.

2. Practice Common Interview Questions

Prepare answers to common interview questions, such as:

- “Tell me about yourself.”;

- “Why are you interested in this position?”;

- “What are your strengths and weaknesses?”

3. Highlight Relevant Skills and Experience

Emphasize your skills in payroll processing, tax compliance, and accounting software proficiency;

Quantify your accomplishments whenever possible.

4. Prepare Questions for the Interviewer

Asking thoughtful questions at the end of the interview demonstrates your interest and engagement;

Examples include: “What are the biggest challenges facing the payroll department?” or “How does the company handle employee benefits?”

5. Dress Professionally and Arrive on Time

First impressions matter, so dress professionally and arrive for the interview on time.

Maintain eye contact, speak clearly, and be enthusiastic throughout the interview.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Payroll Accounting Clerk, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Payroll Accounting Clerk positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.