Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Payroll Analyst interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Payroll Analyst so you can tailor your answers to impress potential employers.

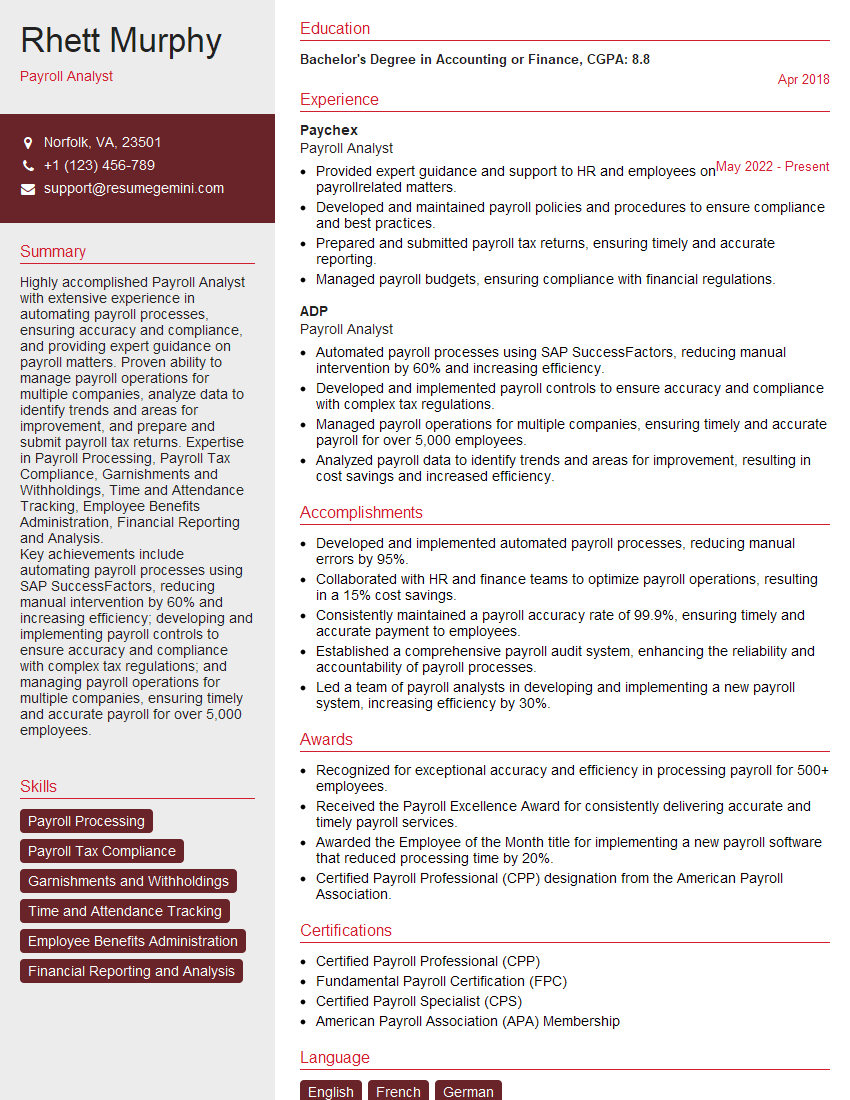

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Payroll Analyst

1. Explain the different types of payroll systems and their advantages and disadvantages?

There are two main types of payroll systems: manual and automated.

- Manual payroll systems are processed by hand, which can be time-consuming and error-prone.

- Automated payroll systems use software to process payroll, which can save time and reduce errors.

Automated payroll systems can be further classified into:

- In-house payroll systems are installed on the company’s own computers.

- Outsourcing payroll systems are hosted by a third-party provider.

The advantages and disadvantages of each type of payroll system are as follows:

- Manual payroll systems are less expensive to set up and maintain than automated payroll systems, but they are more time-consuming and error-prone.

- Automated payroll systems are more expensive to set up and maintain than manual payroll systems, but they can save time and reduce errors.

- In-house payroll systems give the company more control over the payroll process, but they require the company to have the necessary IT infrastructure and expertise.

- Outsourcing payroll systems can free up the company’s time and resources, but it can also lead to a loss of control over the payroll process.

2. What are the key components of a payroll system?

Payroll data

- Employee data, such as name, address, and Social Security number

- Time and attendance data, such as hours worked and overtime

- Earning data, such as wages, salaries, and bonuses

- Deduction data, such as taxes, insurance, and retirement contributions

Payroll calculations

- Gross pay is calculated by adding together all earnings.

- Net pay is calculated by subtracting all deductions from gross pay.

- Taxes are calculated based on gross pay and withholding allowances.

- Deductions are calculated based on employee elections and employer contributions.

Payroll reporting

- Pay stubs are issued to employees.

- Payroll reports are filed with the government.

- Payroll data is used for financial reporting.

3. What are the most common payroll errors?

- Incorrect time and attendance data

- Incorrect earning data

- Incorrect deduction data

- Incorrect tax calculations

- Incorrect net pay calculations

4. How can payroll errors be prevented?

- Use a reliable payroll system.

- Train payroll staff on the payroll system and payroll procedures.

- Review payroll data regularly for errors.

- Have a system in place to correct payroll errors.

5. What are the different types of payroll reports?

- Payroll registers

- Pay stubs

- Tax reports

- Financial reports

6. What are the different types of payroll taxes?

- Federal income tax

- State income tax

- Social Security tax

- Medicare tax

- Unemployment insurance tax

7. What are the different types of payroll deductions?

- Pre-tax deductions, such as 401(k) contributions and health insurance premiums

- Post-tax deductions, such as Roth IRA contributions and union dues

8. What are the different types of payroll software?

- On-premises payroll software

- Cloud-based payroll software

- Open-source payroll software

9. What are the latest trends in payroll?

- The use of cloud-based payroll software

- The use of mobile payroll apps

- The use of artificial intelligence (AI) to automate payroll processes

10. What are the key skills and qualifications for a payroll analyst?

- Strong knowledge of payroll laws and regulations

- Experience with payroll software

- Excellent communication and interpersonal skills

- Attention to detail and accuracy

- Ability to work independently and as part of a team

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Payroll Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Payroll Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Payroll Analysts are responsible for ensuring that employees are paid accurately and on time. They work with HR and accounting to ensure that payroll is processed efficiently and in compliance with all applicable laws and regulations.

1. Process Payroll

Payroll Analysts are responsible for processing payroll for all employees. This includes calculating gross and net pay, withholding taxes, and making deductions for benefits.

- Calculate gross and net pay

- Withhold taxes

- Make deductions for benefits

2. Prepare Payroll Reports

Payroll Analysts are also responsible for preparing payroll reports. These reports may include summaries of payroll expenses, tax liabilities, and employee earnings.

- Prepare payroll summaries

- File tax returns

- Provide employee earnings statements

3. Maintain Payroll Records

Payroll Analysts are responsible for maintaining payroll records. These records may include time cards, pay stubs, and tax forms.

- Maintain time cards

- Issue pay stubs

- File tax forms

4. Resolve Payroll Issues

Payroll Analysts are also responsible for resolving payroll issues. These issues may include errors in pay, deductions, or taxes.

- Investigate and resolve payroll errors

- Answer employee questions about payroll

- Work with HR and accounting to resolve payroll issues

Interview Tips

To prepare for a Payroll Analyst interview, you should research the company and the position. You should also practice answering common interview questions. Here are a few tips:

1. Research the Company and the Position

Before your interview, it is important to research the company and the position. This will help you understand the company’s culture and the specific responsibilities of the Payroll Analyst role.

- Visit the company’s website

- Read the job description

- Talk to people who work at the company

2. Practice Answering Common Interview Questions

There are a number of common interview questions that you are likely to be asked. It is important to practice answering these questions so that you can give clear and concise answers.

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

3. Prepare Questions to Ask the Interviewer

At the end of the interview, you will likely be given the opportunity to ask the interviewer questions. This is a great opportunity to learn more about the company and the position.

- What are the biggest challenges facing the Payroll Analyst team?

- What is the company’s culture like?

- What are the opportunities for advancement?

4. Dress Professionally and Arrive on Time

It is important to dress professionally for your interview. You should also arrive on time. This will show the interviewer that you are serious about the position.

- Wear a suit or business casual attire

- Arrive 15 minutes early for your interview

- Be prepared to answer questions about your experience and qualifications

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Payroll Analyst interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.