Are you gearing up for a career in Payroll and Benefits Specialist? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Payroll and Benefits Specialist and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

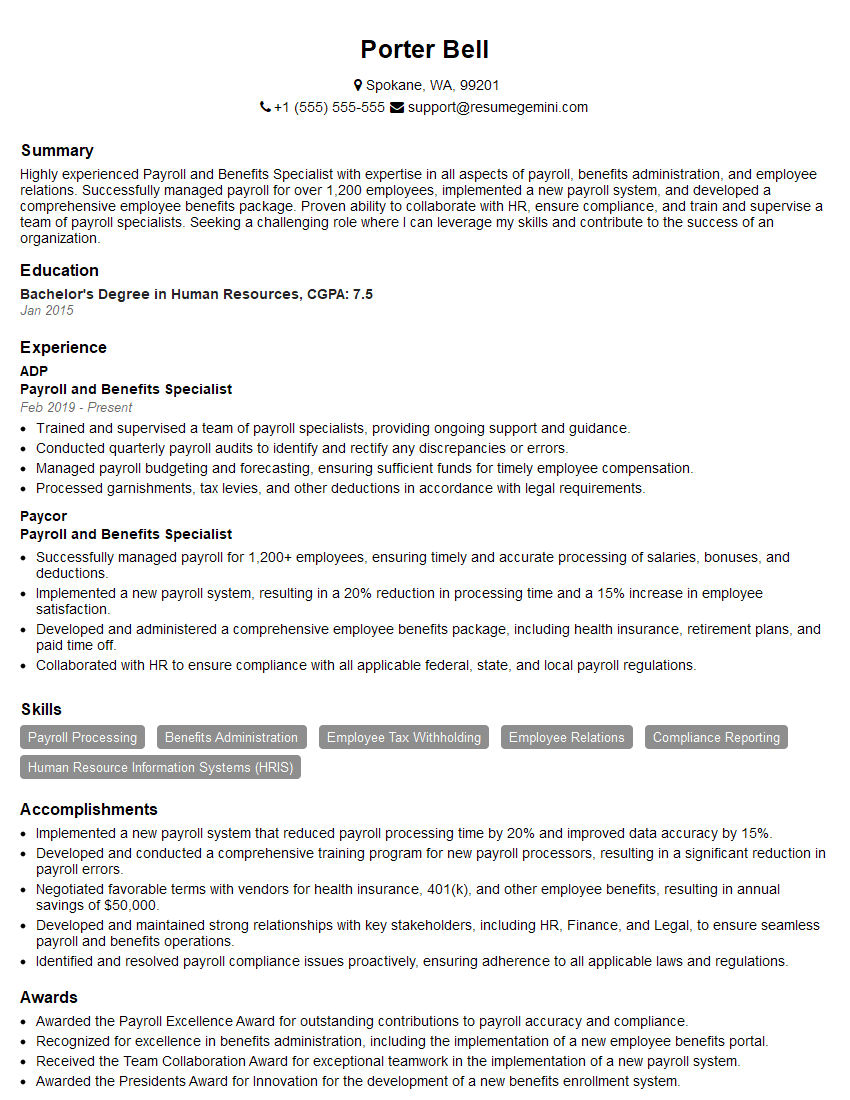

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Payroll and Benefits Specialist

1. What are the key responsibilities of a Payroll and Benefits Specialist?

The key responsibilities of a Payroll and Benefits Specialist typically include:

- Processing payroll accurately and on time

- Withholding and remitting payroll taxes

- Managing employee benefits plans

- Advising employees on benefits and compensation

- Ensuring compliance with all applicable laws and regulations

2. What are the key skills and qualifications required for a Payroll and Benefits Specialist?

Technical Skills

- Proficient in payroll processing software

- Knowledge of payroll tax laws and regulations

- Understanding of employee benefits plans

- Strong attention to detail and accuracy

- Excellent communication and interpersonal skills

Qualifications

- Bachelor’s degree in human resources, business administration, or a related field

- Professional certification in payroll or benefits administration

- At least 3 years of experience in payroll and benefits administration

3. What are the common challenges that Payroll and Benefits Specialists face?

Some common challenges that Payroll and Benefits Specialists face include:

- Keeping up with changing payroll and benefits laws and regulations

- Ensuring the accuracy and timeliness of payroll processing

- Managing employee benefits plans that meet the needs of the organization and its employees

- Communicating effectively with employees about their payroll and benefits

- Working with a variety of stakeholders, including employees, managers, and vendors

4. What are the trends that are shaping the future of payroll and benefits administration?

Some of the trends that are shaping the future of payroll and benefits administration include:

- The increasing use of technology to automate payroll and benefits processes

- The growing demand for flexible and customizable benefits plans

- The need for greater compliance with payroll and benefits laws and regulations

- The importance of data analytics to improve payroll and benefits decision-making

5. What are your strengths as a Payroll and Benefits Specialist?

My strengths as a Payroll and Benefits Specialist include:

- My strong technical skills in payroll processing software and my knowledge of payroll tax laws and regulations

- My understanding of employee benefits plans and my ability to advise employees on their options

- My strong attention to detail and accuracy, which ensures that payroll is processed correctly and on time

- My excellent communication and interpersonal skills, which allow me to build strong relationships with employees and other stakeholders

6. What are your weaknesses as a Payroll and Benefits Specialist?

One of my weaknesses as a Payroll and Benefits Specialist is that I can sometimes be too detail-oriented, which can lead to me spending too much time on tasks that are not as important.

I am also not as familiar with some of the more complex aspects of benefits administration, such as plan design and funding. However, I am eager to learn more about these topics and I am confident that I can quickly develop the necessary skills and knowledge.

7. Why are you interested in this position?

I am interested in this position because I am passionate about payroll and benefits administration and I believe that I have the skills and experience necessary to be successful in this role.

I am also excited about the opportunity to work for your company, which has a strong reputation for its commitment to its employees and its customers.

8. What are your salary expectations?

My salary expectations are in line with the market rate for Payroll and Benefits Specialists with my level of experience and qualifications.

I am open to negotiating a salary that is fair and equitable for both parties.

9. What are your short-term and long-term career goals?

Short-Term Goals

- To become a certified Payroll and Benefits Specialist

- To develop a deep understanding of all aspects of payroll and benefits administration

- To build a strong network of relationships with other professionals in the field

Long-Term Goals

- To become a leader in the field of payroll and benefits administration

- To develop and implement innovative solutions to payroll and benefits challenges

- To help organizations create and maintain successful payroll and benefits programs

10. Do you have any questions for me?

I do have a few questions for you:

- What are the biggest challenges that your organization is currently facing in terms of payroll and benefits administration?

- What are your organization’s short-term and long-term goals for payroll and benefits administration?

- What are the opportunities for professional development and advancement within your organization for Payroll and Benefits Specialists?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Payroll and Benefits Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Payroll and Benefits Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Payroll and Benefits Specialists are responsible for ensuring that employees are paid accurately and on time, and that they have access to the benefits they are entitled to.

1. Payroll Processing

This includes collecting time and attendance data, calculating payroll taxes, and issuing paychecks.

- Calculate payroll taxes, such as federal and state income taxes, Social Security, and Medicare.

- Issue paychecks or direct deposits to employees.

2. Benefits Administration

This includes managing health insurance, retirement plans, and other employee benefits. Benefits Specialists must stay up-to-date on changes to benefits laws and regulations.

- Enroll employees in health insurance, retirement plans, and other benefits.

- Answer employee questions about benefits.

3. Compliance

Payroll and Benefits Specialists must ensure that the organization is in compliance with all applicable laws and regulations.

- File payroll taxes with the IRS and state tax authorities.

- Stay up-to-date on changes to payroll and benefits laws and regulations.

4. Reporting

Payroll and Benefits Specialists must generate reports on payroll and benefits data.

- Generate reports on payroll expenses, employee benefits costs, and other data.

- Provide information to auditors and other outside parties.

Interview Tips

Here are some tips to help you ace your interview for a Payroll and Benefits Specialist position:

1. Research the company and the position

Before the interview, take some time to learn about the company and the specific Payroll and Benefits Specialist position you are applying for. This will help you to understand the company’s culture and values, as well as the specific skills and qualifications they are looking for in a candidate.

- Visit the company’s website and social media pages.

- Read articles and news stories about the company.

- Talk to people you know who work for the company.

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It is helpful to practice your answers to these questions in advance so that you can deliver them confidently and concisely.

- Use the STAR method to answer interview questions.

- Be specific and provide examples.

- Tailor your answers to the specific job you are applying for.

3. Be prepared to talk about your experience and skills

In addition to practicing your answers to common interview questions, you should also be prepared to talk about your experience and skills. This includes your experience in payroll and benefits administration, as well as your knowledge of payroll and benefits laws and regulations.

- Highlight your experience in payroll processing, benefits administration, and compliance.

- Quantify your accomplishments and provide specific examples.

- Demonstrate your knowledge of payroll and benefits laws and regulations.

4. Ask questions

At the end of the interview, be sure to ask the interviewer questions about the company, the position, and the team you would be working with. This shows that you are interested in the opportunity and that you are serious about the position.

- Ask questions about the company’s culture and values.

- Ask questions about the specific role and responsibilities of the Payroll and Benefits Specialist.

- Ask questions about the team you would be working with.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Payroll and Benefits Specialist role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.