Are you gearing up for an interview for a Payroll Assistant position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Payroll Assistant and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

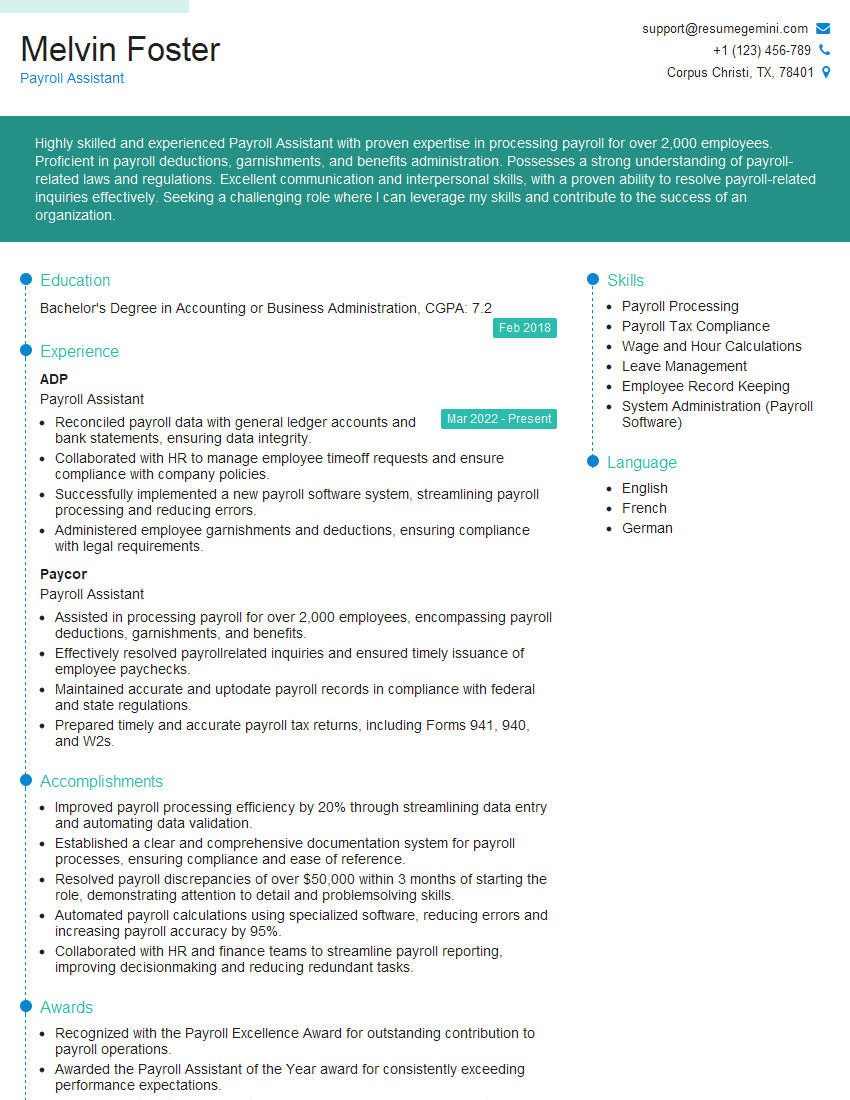

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Payroll Assistant

1. Explain the steps involved in calculating gross pay for an employee?

The steps involved in calculating gross pay for an employee are as follows:

- Gather the employee’s time worked and pay rate.

- Multiply the hours worked by the pay rate to get the gross pay.

- Add any additional pay, such as overtime or bonuses, to the gross pay.

- Subtract any deductions, such as taxes or health insurance, from the gross pay to get the net pay.

2. What are the different types of payroll deductions that can be made from an employee’s pay?

Federal Income Tax

- Mandatory deduction based on employee’s income and withholding allowances.

Social Security Tax

- Mandatory deduction that funds retirement and disability benefits.

Medicare Tax

- Mandatory deduction that funds health insurance for elderly and disabled.

State Income Tax

- Mandatory deduction in states that have an income tax.

Health Insurance Premiums

- Voluntary deduction for employee’s health insurance coverage.

Retirement Contributions

- Voluntary deduction for employee’s retirement savings.

3. What are the most common payroll errors and how can they be avoided?

- Incorrect pay rates: Ensure accurate pay rates are used by verifying with HR or contracts.

- Timekeeping errors: Implement a reliable timekeeping system and regularly review timesheets for accuracy.

- Deduction errors: Verify deduction amounts with employees and ensure they are authorized.

- Tax calculation errors: Use payroll software or consult tax tables to ensure accurate tax calculations.

- Net pay errors: Double-check calculations and compare results with previous payrolls.

4. What are the key responsibilities of a Payroll Assistant?

- Process payroll accurately and on time.

- Calculate gross and net pay, withholdings, and deductions.

- Maintain employee payroll records.

- Prepare and distribute paychecks or direct deposits.

- File payroll tax returns.

- Assist with payroll audits.

5. What is the difference between a W-2 and a 1099 form?

- W-2: Issued to employees by their employers, reporting wages and taxes withheld.

- 1099: Issued to independent contractors or self-employed individuals, reporting payments received.

6. What are the advantages of using a payroll service?

- Accuracy and Compliance: Payroll services ensure accurate and compliant payroll processing.

- Time-Saving: Outsourcing payroll frees up internal resources for other tasks.

- Cost-Effective: Payroll services can be more cost-effective than managing payroll in-house.

- Expertise: Payroll services have specialized knowledge and stay up-to-date with regulations.

- Data Security: Payroll services implement robust security measures to protect employee data.

7. What is the importance of maintaining confidentiality in payroll processing?

- Legal Obligations: Payroll data is protected by privacy laws and regulations.

- Employee Trust: Maintaining confidentiality builds trust and loyalty among employees.

- Data Security: Sensitive payroll information should be handled securely to prevent breaches.

- Professional Ethics: Payroll professionals are ethically bound to respect employee privacy.

8. How do you stay up-to-date on changes in payroll laws and regulations?

- Industry Publications: Subscribe to payroll newsletters and magazines.

- Professional Organizations: Join organizations like the American Payroll Association.

- Continuing Education: Attend workshops and seminars on payroll updates.

- Government Websites: Regularly review websites of the IRS and state tax agencies.

9. What are some of the challenges you have faced in your previous payroll roles and how did you overcome them?

Challenge: Implementing a new payroll system.

Solution: Collaborated with IT and HR to develop a comprehensive implementation plan, ensuring a smooth transition.

Challenge: Dealing with complex tax issues.

Solution: Consulted with tax professionals and utilized industry resources to ensure accurate and timely tax filings.

10. What are your strengths and weaknesses as a Payroll Assistant?

Strengths:

- Strong attention to detail and accuracy.

- Excellent communication and interpersonal skills.

- Proficient in payroll software and processes.

- Understanding of payroll laws and regulations.

- Committed to confidentiality and ethical practices.

Weaknesses:

- Limited experience with a specific industry or payroll system.

- Working under tight deadlines can sometimes be stressful.

- Continuously working on improving my time management skills.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Payroll Assistant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Payroll Assistant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Payroll Assistants play a crucial role in the financial operations of an organization. Their primary responsibilities include:

1. Payroll Processing and Calculation

Calculating and processing payroll data includes:

- Gathering and verifying employee time and attendance records

- Calculating gross and net pay, including wages, overtime, bonuses, and deductions

- Withholding taxes, social security contributions, and other deductions

- Issuing paychecks, direct deposits, or other forms of payment

2. Payroll Reporting and Compliance

Ensuring compliance with payroll regulations:

- Preparing and filing payroll tax returns

- Maintaining accurate payroll records for audits and inspections

- Communicating payroll-related information to employees and relevant stakeholders

3. Payroll Administration

Managing payroll-related tasks and processes:

- Onboarding and offboarding employees

- Processing payroll changes, such as address updates or deductions

- Reconciling payroll accounts and ensuring accuracy

- Resolving payroll inquiries and addressing employee concerns

4. Data Entry and Maintenance

Accurate data management:

- Entering and updating employee information in payroll systems

- Maintaining up-to-date payroll records

- Preparing and distributing payroll reports

Interview Tips

To ace the interview for a Payroll Assistant position, candidates should follow these tips:

1. Research the Company and Role

Demonstrate your interest by learning about the company’s industry, mission, and payroll processes. Understand the specific responsibilities and expectations of the Payroll Assistant role within the organization.

2. Highlight Relevant Skills and Experience

Emphasize your proficiency in payroll processing, compliance, and administration. Showcase your attention to detail, accuracy, and ability to manage sensitive financial information. Highlight any previous experience in payroll or related fields.

3. Prepare for Common Interview Questions

Practice answering common interview questions, such as:

- Tell us about your experience in payroll processing.

- How do you ensure accuracy and compliance in payroll calculations?

- What software platforms have you used for payroll management?

4. Demonstrate Strong Attention to Detail

Payroll requires meticulous attention to accuracy. Provide examples of your ability to handle complex calculations, identify errors, and maintain organized records. Highlight your ability to work independently and meet deadlines.

5. Show a Professional and Ethical Demeanor

Payroll involves handling confidential employee information. Emphasize your professionalism, integrity, and adherence to ethical guidelines. Demonstrate your ability to maintain confidentiality and protect sensitive data.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Payroll Assistant interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!