Are you gearing up for a career in Payroll Associate? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Payroll Associate and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

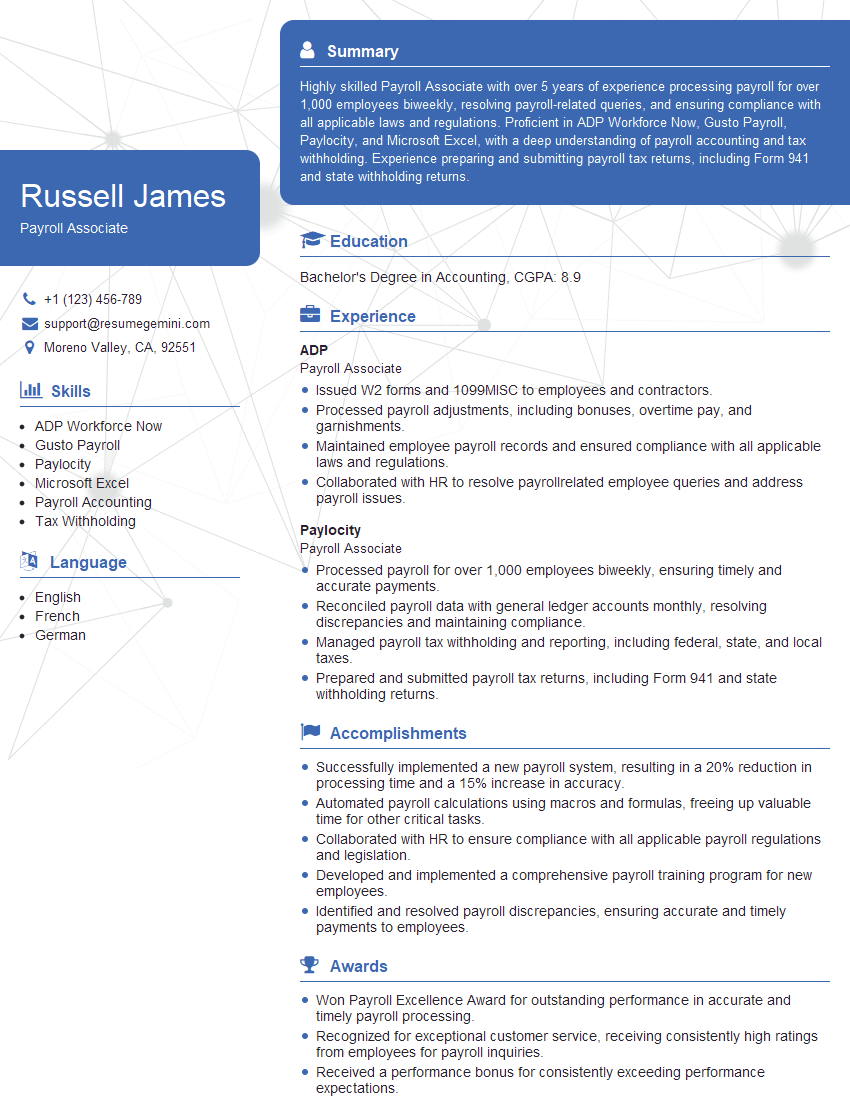

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Payroll Associate

1. Explain the steps involved in processing a payroll.

The steps involved in processing a payroll are as follows:

- Collecting employee time and attendance data.

- Calculating gross pay.

- Calculating deductions.

- Calculating net pay.

- Issuing paychecks.

- Filing payroll taxes.

2. What are the different types of payroll deductions?

The different types of payroll deductions are:

- Pre-tax deductions: These deductions are taken out of an employee’s gross pay before taxes are calculated. Common pre-tax deductions include health insurance premiums, retirement contributions, and dependent care expenses.

- Post-tax deductions: These deductions are taken out of an employee’s gross pay after taxes are calculated. Common post-tax deductions include union dues, charitable contributions, and parking fees.

- Voluntary deductions: These deductions are taken out of an employee’s gross pay at the employee’s request. Common voluntary deductions include savings plan contributions, gym memberships, and charitable contributions.

3. What are the most common payroll errors?

The most common payroll errors are:

- Data entry errors: These errors occur when inaccurate data is entered into the payroll system. Common data entry errors include incorrect employee names, social security numbers, and pay rates.

- Calculation errors: These errors occur when the payroll system performs incorrect calculations. Common calculation errors include incorrect gross pay, deductions, and net pay.

- Tax errors: These errors occur when the payroll system calculates incorrect tax withholding amounts. Common tax errors include incorrect federal income tax withholding, social security tax withholding, and Medicare tax withholding.

4. What are the consequences of payroll errors?

The consequences of payroll errors can include:

- Financial losses: Payroll errors can result in financial losses for both the employee and the employer. For example, an employee may be underpaid or overpaid, and the employer may have to pay interest or penalties on late or incorrect tax payments.

- Legal liability: Payroll errors can lead to legal liability for the employer. For example, the employer may be liable for unpaid wages, back taxes, or penalties.

- Reputational damage: Payroll errors can damage the employer’s reputation. For example, employees may lose trust in the employer if they are not paid correctly.

5. How can you prevent payroll errors?

There are several steps that can be taken to prevent payroll errors, including:

- Establishing sound payroll procedures: The employer should develop and implement sound payroll procedures to ensure accuracy and efficiency.

- Training payroll staff: The employer should provide training to payroll staff on the payroll system and procedures.

- Using payroll software: Payroll software can help to automate many of the tasks involved in processing payroll, which can reduce the risk of errors.

- Regularly reviewing payroll data: The employer should regularly review payroll data to identify and correct any errors.

6. What are the different types of payroll reports?

The different types of payroll reports include:

- Payroll register: The payroll register is a summary of payroll transactions for a specific period.

- Payroll journal: The payroll journal is a detailed record of payroll transactions for a specific period.

- Payroll tax returns: Payroll tax returns are filed with the government to report payroll taxes withheld from employee pay.

- Year-end payroll reports: Year-end payroll reports provide a summary of payroll transactions for the entire year.

7. What are the key payroll compliance requirements?

The key payroll compliance requirements include:

- Withholding federal income tax: Employers are required to withhold federal income tax from employee pay.

- Withholding social security tax: Employers are required to withhold social security tax from employee pay.

- Withholding Medicare tax: Employers are required to withhold Medicare tax from employee pay.

- Paying unemployment insurance taxes: Employers are required to pay unemployment insurance taxes.

- Filing payroll tax returns: Employers are required to file payroll tax returns with the government.

8. What are the advantages of using a payroll service provider?

The advantages of using a payroll service provider include:

- Accuracy: Payroll service providers have the expertise and experience to ensure that payroll is processed accurately.

- Efficiency: Payroll service providers can automate many of the tasks involved in processing payroll, which can save the employer time and money.

- Compliance: Payroll service providers can help the employer to comply with all applicable payroll laws and regulations.

- Security: Payroll service providers have the necessary security measures in place to protect employee payroll data.

9. What are the different types of payroll fraud?

The different types of payroll fraud include:

- Time theft: Time theft occurs when an employee is paid for hours that they did not work.

- Buddy punching: Buddy punching occurs when an employee punches in or out for another employee.

- Payroll padding: Payroll padding occurs when an employer adds fictitious employees to the payroll.

- Withholding fraud: Withholding fraud occurs when an employer fails to withhold the correct amount of taxes from employee pay.

10. How can you prevent payroll fraud?

There are several steps that can be taken to prevent payroll fraud, including:

- Establishing a clear payroll policy: The employer should develop and implement a clear payroll policy to deter fraud.

- Implementing timekeeping controls: The employer should implement timekeeping controls to prevent time theft.

- Monitoring payroll transactions: The employer should regularly monitor payroll transactions to identify any suspicious activity.

- Conducting payroll audits: The employer should conduct regular payroll audits to detect and prevent fraud.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Payroll Associate.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Payroll Associate‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Payroll Associates are responsible for ensuring that all employees are paid accurately and on time. They also play a key role in maintaining compliance with federal and state payroll regulations.

1. Processing Payroll

This involves calculating employee earnings, including wages, overtime, and bonuses, and deducting taxes and other withholdings. Payroll Associates must also ensure that all payroll information is accurate and complete.

- Calculating employee earnings, including wages, overtime, and bonuses

- Deducting taxes and other withholdings

- Ensuring that all payroll information is accurate and complete

2. Maintaining Payroll Records

Payroll Associates are responsible for maintaining accurate and up-to-date payroll records. This includes keeping track of employee time and attendance, as well as payroll transactions. Payroll Associates must also be able to reconcile payroll records with other accounting records.

- Keeping track of employee time and attendance

- Maintaining payroll transactions

- Reconciling payroll records with other accounting records

3. Filing Payroll Taxes

Payroll Associates are responsible for filing payroll taxes with the appropriate federal and state agencies. This includes calculating and paying payroll taxes, as well as filing payroll tax returns.

- Calculating and paying payroll taxes

- Filing payroll tax returns

4. Other Responsibilities

In addition to the above responsibilities, Payroll Associates may also be responsible for the following:

- Providing customer service to employees

- Answering questions about payroll

- Assisting with payroll audits

Interview Tips

Preparing for a job interview can be a daunting task, but there are a few things you can do to increase your chances of success. Here are a few tips:

1. Research the Company and the Position

Take some time to learn about the company you’re interviewing with and the position you’re applying for. This will help you answer questions intelligently and show the interviewer that you’re interested in the job.

- Visit the company’s website

- Read the job description carefully

- Talk to people who work at the company

2. Practice Answering Common Interview Questions

There are a few common interview questions that you’re likely to be asked. It’s a good idea to practice answering these questions ahead of time so that you can deliver your answers confidently.

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

3. Be Yourself

It’s important to be yourself during a job interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. Just relax and be yourself, and the rest will follow.

- Don’t try to be someone you’re not

- Relax and be yourself

4. Follow Up

After the interview, be sure to follow up with the interviewer. This shows that you’re interested in the position and that you’re serious about your application.

- Send a thank-you note

- Call the interviewer to follow up

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Payroll Associate interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.