Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Payroll Coordinator interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Payroll Coordinator so you can tailor your answers to impress potential employers.

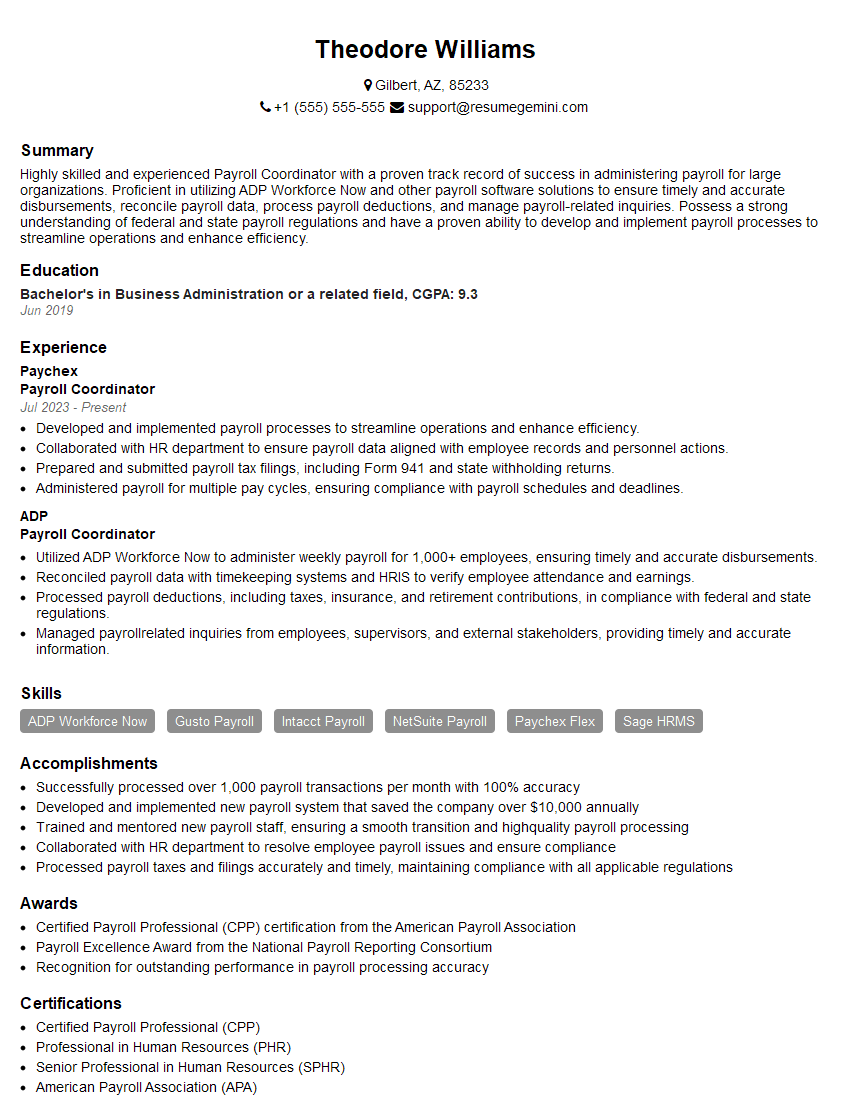

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Payroll Coordinator

1. Can you describe the payroll life cycle from start to finish?

- The payroll life cycle typically begins with the collection of employee time and attendance data.

- This data is then used to calculate gross pay, which is the total amount of compensation earned by an employee before any deductions are withheld.

- Gross pay is then subject to various deductions, such as taxes, health insurance premiums, and retirement contributions.

- The resulting net pay is the amount of money that is actually paid to the employee.

- The payroll life cycle ends with the distribution of net pay to employees.

2. What are some of the most common payroll errors?

Incorrect calculations

- Math errors, such as miscalculating an employee’s hourly rate or overtime pay.

- Data entry errors, such as entering an employee’s social security number incorrectly.

Missing or late payments

- Systems errors, such as a payroll software glitch that causes payments to be delayed.

- Human errors, such as forgetting to process an employee’s time card or check.

Compliance issues

- Failing to withhold the correct amount of taxes.

- Not providing employees with the required pay stubs or other documentation.

3. What are some of the best practices for payroll processing?

- Use a payroll software program to automate calculations and reduce the risk of errors.

- Establish clear deadlines for submitting time and attendance data.

- Review payroll reports carefully before submitting them for payment.

- Keep accurate records of all payroll transactions.

- Train your staff on payroll procedures and best practices.

4. What are some of the challenges of payroll processing?

- Dealing with complex tax laws and regulations.

- Keeping up with changes in payroll software and technology.

- Ensuring the accuracy and confidentiality of employee payroll data.

- Meeting payroll deadlines while maintaining compliance with all applicable laws and regulations.

5. What are some of the key skills and qualities of a successful payroll coordinator?

- Strong attention to detail.

- Excellent math skills.

- Knowledge of payroll software and technology.

- Understanding of tax laws and regulations.

- Ability to work independently and as part of a team.

- Excellent communication and interpersonal skills.

6. What are some of the latest trends in payroll processing?

- The use of cloud-based payroll software.

- The adoption of mobile payroll solutions.

- The increasing use of data analytics to improve payroll efficiency.

- The growing trend towards self-service payroll.

7. What is your experience with payroll accounting?

- I have over 5 years of experience working as a payroll accountant for a large healthcare organization.

- In this role, I was responsible for all aspects of payroll processing, including:

- Collecting and verifying time and attendance data.

- Calculating gross pay, deductions, and net pay.

- Withholding taxes and other deductions.

- Preparing and distributing paychecks.

- Filing payroll tax returns.

- I am also proficient in using various payroll accounting software programs.

8. What are your thoughts on the future of payroll processing?

- I believe that the future of payroll processing lies in automation and self-service.

- As technology continues to evolve, payroll software will become more automated, which will free up payroll professionals to focus on more strategic tasks.

- Employees will also increasingly be able to access their payroll information and make changes to their payroll deductions through self-service portals.

9. What is your favorite thing about working as a payroll coordinator?

- I enjoy the challenge of ensuring that employees are paid accurately and on time.

- I also appreciate the opportunity to learn about new payroll laws and regulations.

- Most of all, I enjoy working with a team of dedicated professionals who are committed to providing excellent customer service.

10. What is your least favorite thing about working as a payroll coordinator?

- My least favorite thing about working as a payroll coordinator is the tight deadlines that we often have to meet.

- It can be stressful to know that employees are counting on you to get their paychecks on time.

- However, I am always able to meet the deadlines, and I take pride in my work.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Payroll Coordinator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Payroll Coordinator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Payroll Coordinators are responsible for ensuring that employees are paid accurately and on time. They work closely with the Human Resources department and the accounting department to ensure that all payroll information is accurate and compliant with all applicable laws and regulations.

1. Process payroll

Payroll Coordinators are responsible for processing payroll for all employees. This includes calculating wages, withholding taxes, and making deductions for benefits. They also prepare and distribute paychecks or direct deposits.

- Calculate wages and salaries

- Withhold taxes and other deductions

- Prepare and distribute paychecks or direct deposits

2. Maintain payroll records

Payroll Coordinators are responsible for maintaining payroll records for all employees. This includes keeping track of hours worked, wages earned, and deductions made. They also maintain records of all payroll transactions.

- Keep track of hours worked

- Maintain records of wages earned

- Keep records of deductions made

- Maintain records of all payroll transactions

3. File payroll taxes

Payroll Coordinators are responsible for filing payroll taxes with the appropriate government agencies. This includes withholding taxes, Social Security taxes, and Medicare taxes. They also file quarterly and annual payroll tax returns.

- Withhold taxes

- File quarterly and annual payroll tax returns

4. Answer employee questions about payroll

Payroll Coordinators are responsible for answering employee questions about payroll. This includes questions about wages, deductions, and benefits. They also provide employees with copies of their pay stubs and W-2 forms.

- Answer employee questions about wages

- Answer employee questions about deductions

- Answer employee questions about benefits

- Provide employees with copies of their pay stubs and W-2 forms

Interview Tips

Preparing for a Payroll Coordinator interview can be daunting, but with the right tips and tricks, you can increase your chances of success. Here are a few things you can do to prepare for your interview:

1. Research the company and the position

Before you go on an interview, it’s important to do your research. This means learning about the company, the position you’re applying for, and the industry. This will help you to answer questions intelligently and show the interviewer that you’re genuinely interested in the job.

- Visit the company’s website

- Read the job description carefully

- Research the industry

2. Practice answering common interview questions

There are a few common interview questions that you’re likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It’s a good idea to practice answering these questions in advance so that you can deliver your answers confidently and clearly.

- Practice answering “Tell me about yourself”

- Practice answering “Why are you interested in this position?”

3. Be prepared to talk about your experience

The interviewer will want to know about your experience in payroll. Be prepared to talk about your skills and accomplishments, and how they relate to the job requirements. If you have any relevant experience, be sure to highlight it in your resume and during the interview.

- Highlight your skills and accomplishments

- Quantify your results

4. Dress professionally

First impressions matter, so it’s important to dress professionally for your interview. This doesn’t mean you have to wear a suit, but you should dress in clean, pressed clothes that are appropriate for a business setting.

- Dress in clean, pressed clothes

- Avoid wearing casual clothes

- Make sure your clothes fit well

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Payroll Coordinator, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Payroll Coordinator positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.