Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Payroll Master interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Payroll Master so you can tailor your answers to impress potential employers.

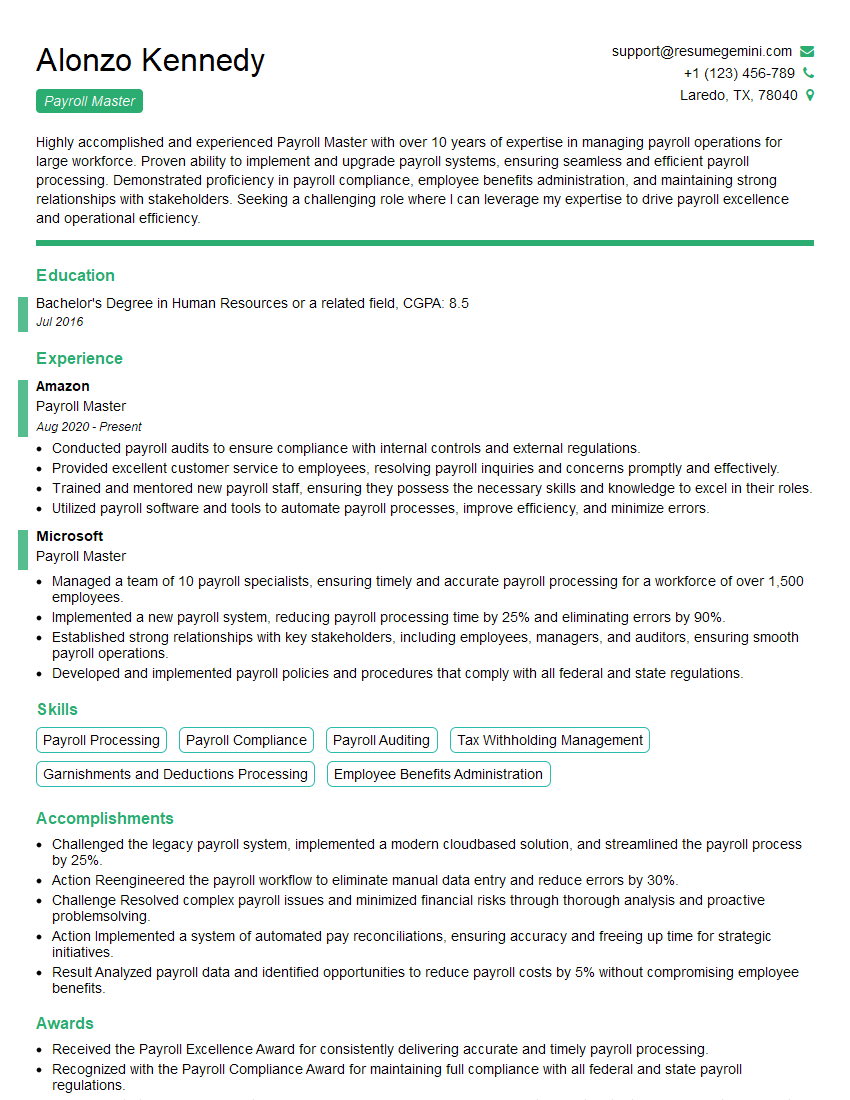

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Payroll Master

1. What are the key responsibilities of a Payroll Master?

As a Payroll Master, my primary responsibilities include:

- Processing payroll accurately and on time, ensuring compliance with all applicable laws and regulations.

- Calculating employee pay, deductions, and benefits, considering various factors such as hours worked, overtime, and bonuses.

- Preparing and distributing paychecks or electronic funds transfers, ensuring timely and secure delivery.

- Maintaining accurate payroll records, including timekeeping, earnings, deductions, and employee tax information.

- Resolving payroll-related inquiries and issues from employees, managers, and external stakeholders.

2. Describe your experience in payroll tax compliance.

Tax Withholding Calculations

- Determine applicable tax withholding rates based on employee information, such as W-4 forms or state withholding allowances.

- Calculate federal, state, and local income taxes, as well as social security and Medicare contributions.

- Ensure accurate withholding calculations, considering factors such as special allowances, bonuses, and overtime pay.

Tax Reporting and Filing

- Prepare and file payroll tax returns, including Form 941, Form 940, and state unemployment insurance returns.

- Coordinate with external vendors and tax agencies to ensure timely and accurate filings.

- Maintain detailed records for tax audits and compliance purposes.

3. How do you ensure the confidentiality of sensitive employee payroll information?

Confidentiality is paramount in payroll management. I adhere to the following protocols to ensure the security of employee data:

- Restrict access to payroll information and systems to authorized personnel only.

- Implement strong password protection and data encryption measures.

- Educate employees about the importance of data privacy and confidentiality.

- Regularly review and update data security protocols to stay abreast of evolving threats.

- Comply with all applicable laws and regulations regarding data protection.

4. What is your approach to handling payroll discrepancies and errors?

Payroll discrepancies and errors can occur despite meticulous planning. My approach to handling these situations includes:

- Promptly identifying and investigating any variances or errors.

- Communicating with affected employees and managers to gather relevant information and verify details.

- Analyzing the underlying causes of errors to prevent recurrence.

- Making necessary corrections and adjustments to ensure accurate payroll processing.

- Documenting the resolution process and any corrective actions taken.

5. How do you keep up-to-date with the latest changes in payroll laws and regulations?

Staying abreast of evolving payroll laws and regulations is crucial. I utilize the following strategies to ensure compliance:

- Regularly attend industry conferences and webinars to learn about updates and best practices.

- Subscribe to professional publications and newsletters for up-to-date information on payroll regulations.

- Network with other payroll professionals to share knowledge and insights.

- Review government websites and publications for official updates and guidance.

- Seek professional development opportunities, such as certifications, to enhance my understanding of payroll laws.

6. What is your experience with payroll software and systems?

I have extensive experience with various payroll software and systems, including:

- ADP Workforce Now

- Paylocity

- Ultimate Software UltiPro

- Sage Intacct

- QuickBooks Payroll

I am proficient in utilizing these systems to process payroll, manage employee data, and generate reports.

7. How do you handle payroll for employees with multiple pay rates or complex deductions?

Processing payroll for employees with multiple pay rates or complex deductions requires attention to detail and accuracy. I follow these steps:

- Review employee contracts and timekeeping records to determine applicable pay rates and deductions.

- Configure payroll systems to handle multiple pay rates and complex deductions.

- Verify calculations and ensure that deductions are applied correctly.

- Provide clear and detailed pay stubs to employees, explaining various deductions and withholdings.

- Address any queries or concerns from employees regarding their payroll.

8. What are your strengths and weaknesses as a Payroll Master?

Strengths

- Exceptional accuracy and attention to detail in payroll processing.

- Strong knowledge of payroll laws and regulations, ensuring compliance.

- Proficient in various payroll software and systems, enabling efficient processing.

- Excellent communication and interpersonal skills, building strong relationships with employees and managers.

- Ability to work independently and as part of a team, managing multiple tasks effectively.

Weaknesses

- I am always eager to improve, and I recognize the need to stay updated on emerging trends in payroll.

- I am sometimes too detail-oriented, which can lead to spending more time than necessary on certain tasks.

9. What are your salary expectations for this role?

My salary expectations are based on my experience, qualifications, and the market value for similar positions in the industry. I am confident that my skills and abilities would be a valuable asset to your organization, and I am open to discussing a salary package that is commensurate with my contributions.

10. Why are you interested in working as a Payroll Master for our company?

I am drawn to your company’s commitment to excellence and innovation in the industry. Your reputation for providing outstanding employee benefits and a positive work environment is highly appealing to me. As a Payroll Master, I believe I can leverage my skills to contribute to your company’s success while also developing my professional capabilities.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Payroll Master.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Payroll Master‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Payroll Master is responsible for the accurate and timely processing of payroll for all employees of the organization. This role requires a strong understanding of payroll regulations, tax laws, and accounting principles.

1. Payroll Processing

The Payroll Master is responsible for the following tasks:

- Calculating employee pay, including regular wages, overtime, bonuses, and deductions

- Preparing and distributing paychecks or direct deposits

- Maintaining employee payroll records

2. Payroll Compliance

The Payroll Master is responsible for ensuring that the organization complies with all applicable payroll regulations, including:

- Federal and state income tax withholding

- Social Security and Medicare taxes

- Unemployment insurance

- Workers’ compensation

3. Payroll Accounting

The Payroll Master is responsible for the following accounting tasks:

- Reconciling payroll expenses with general ledger accounts

- Preparing payroll reports for management and external auditors

- Filing payroll tax returns

4. Payroll Administration

The Payroll Master is responsible for the following administrative tasks:

- Managing employee payroll inquiries

- Processing payroll changes, such as new hires, terminations, and pay adjustments

- Training new employees on payroll procedures

Interview Tips

To ace an interview for a Payroll Master position, it is important to prepare thoroughly and demonstrate your knowledge, skills, and experience. Here are some tips to help you succeed:

1. Research the Company and the Role

Before the interview, take some time to research the company and the specific role you are applying for. This will help you understand the company’s culture, values, and business goals. You should also review the job description and make sure you have a clear understanding of the responsibilities and qualifications required for the position.

2. Prepare Answers to Common Interview Questions

There are some common interview questions that you are likely to be asked, such as “Why are you interested in this role?” and “What are your strengths and weaknesses?” It is helpful to prepare answers to these questions ahead of time so that you can deliver them confidently and clearly during the interview.

3. Highlight Your Skills and Experience

Be sure to highlight your skills and experience that are relevant to the Payroll Master position. For example, you could discuss your experience with payroll processing, payroll compliance, or payroll accounting. You should also provide specific examples of your work to demonstrate your abilities.

4. Be Enthusiastic and Professional

It is important to be enthusiastic and professional throughout the interview. Make eye contact with the interviewer, smile, and be polite. You should also dress appropriately and arrive on time for your interview.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Payroll Master interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!