Are you gearing up for a career in Payroll Processor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Payroll Processor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

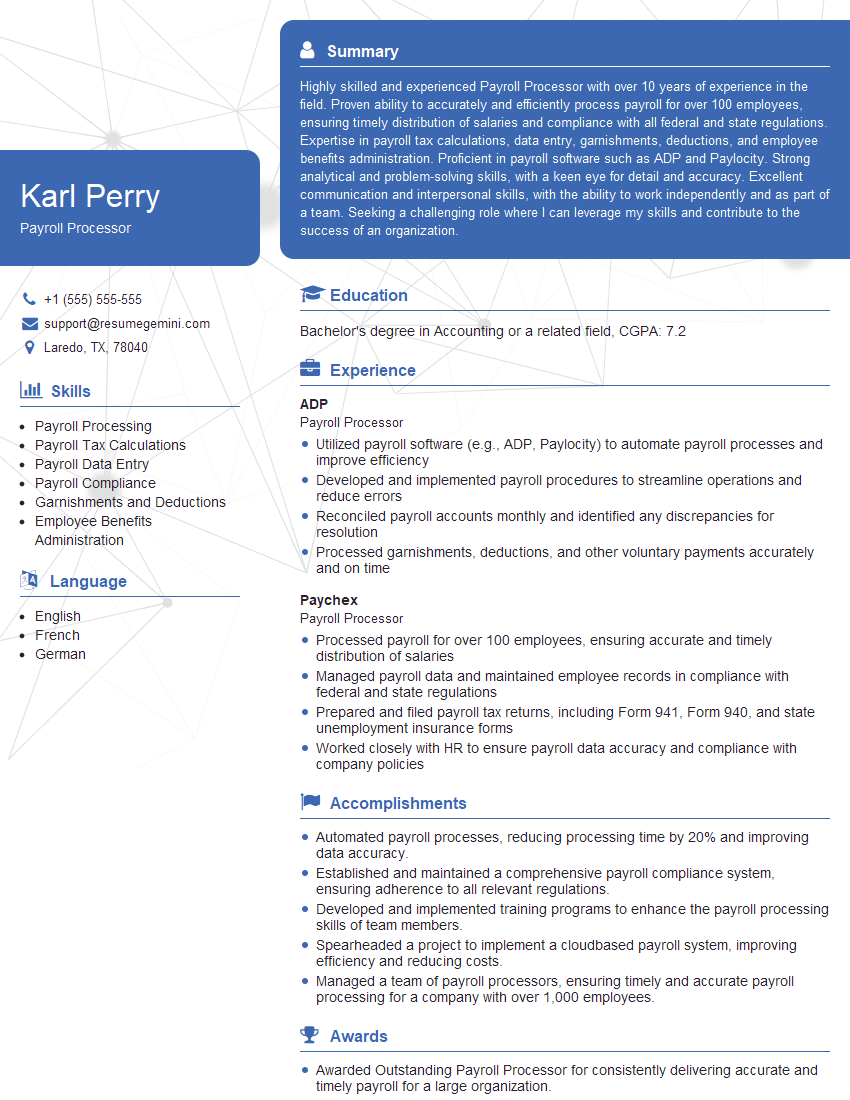

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Payroll Processor

1. What are the key responsibilities of a Payroll Processor?

The key responsibilities of a Payroll Processor include:

- Calculate and process employee payroll in accordance with company payroll policies and procedures

- Ensure accurate calculation of employee wages, including regular pay, overtime, bonuses, and commissions

- Process payroll deductions, including taxes, insurance premiums, and other employee benefits

- Maintain and update employee payroll records, including time cards, earnings statements, and tax forms

- Resolve payroll discrepancies and errors promptly and efficiently

2. What is gross pay and net pay? How do you calculate it?

Gross pay:

- Gross pay is the total amount of money an employee earns before any deductions are taken out

- To calculate gross pay, add up all of the employee’s earnings, including regular pay, overtime, bonuses, and commissions

Net pay:

- Net pay is the amount of money an employee receives after all deductions have been taken out

- To calculate net pay, subtract all of the employee’s deductions from their gross pay

3. What are the different types of payroll deductions?

The different types of payroll deductions include:

- Federal income tax

- State income tax

- Social Security tax

- Medicare tax

- Employee benefits, such as health insurance premiums, retirement contributions, and child support

4. How do you handle payroll errors?

When a payroll error occurs, it is important to take the following steps:

- Identify the error and its source

- Determine the impact of the error on the employee’s pay

- Correct the error and recalculate the employee’s pay

- Communicate the error and its resolution to the employee

5. What is your experience with payroll software?

- I have experience with a variety of payroll software, including ADP, Paychex, and QuickBooks

- I am proficient in using these software programs to process payroll, calculate taxes, and generate reports

6. What are the key tax laws that affect payroll processing?

The key tax laws that affect payroll processing include:

- The Federal Insurance Contributions Act (FICA)

- The Federal Unemployment Tax Act (FUTA)

- The Fair Labor Standards Act (FLSA)

- The Affordable Care Act (ACA)

7. What are the different types of payroll reports?

The different types of payroll reports include:

- Payroll register

- Earnings statement

- Tax report

- Quarterly report

- Year-end report

8. How do you stay up-to-date on payroll regulations?

I stay up-to-date on payroll regulations by:

- Attending payroll seminars and workshops

- Reading payroll publications and websites

- Consulting with payroll professionals

9. What are your strengths and weaknesses as a Payroll Processor?

My strengths as a Payroll Processor include:

- Accuracy and attention to detail

- Strong knowledge of payroll regulations

- Proficient in using payroll software

- Excellent problem-solving skills

- Ability to work independently and as part of a team

My weaknesses as a Payroll Processor include:

- I can be somewhat slow when processing large volumes of payroll

- I am not always comfortable with public speaking

10. What is your salary expectation?

My salary expectation is between $50,000 and $60,000 per year

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Payroll Processor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Payroll Processor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Payroll Processor is entrusted with the crucial task of ensuring accurate and timely payment of employees’ salaries. This demanding role requires a combination of technical expertise, attention to detail, and excellent interpersonal skills. Key job responsibilities include:

1. Payroll Preparation and Distribution

Process payroll transactions to ensure timely and accurate distribution of employee salaries, deductions, and benefits.

- Collect and review employee time and attendance records.

- Calculate gross pay, deductions, and net pay using payroll software.

- Prepare paychecks, direct deposits, and payroll reports.

2. Tax and Deduction Management

Comply with federal, state, and local payroll tax laws and regulations.

- Withhold and remit appropriate taxes (e.g., income tax, Social Security, Medicare, unemployment insurance).

- Manage employee deductions (e.g., health insurance, retirement contributions).

- File quarterly and annual tax returns with relevant tax agencies.

3. Employee Benefits Administration

Administer employee benefits programs to ensure compliance and employee satisfaction.

- Enroll employees in health insurance, retirement plans, paid time off, and other benefits.

- Process and track employee benefit transactions (e.g., deductions, claims).

- Communicate benefit information to employees and address their inquiries.

4. Recordkeeping and Reporting

Maintain accurate and up-to-date payroll records and generate reports for internal and external stakeholders.

- Document all payroll transactions and maintain employee payroll files.

- Generate payroll summaries, reports for management, and regulatory compliance.

- Respond to audits and requests for information from government agencies.

Interview Tips

To ace the interview for a Payroll Processor position, it is essential to prepare thoroughly and present yourself professionally. Here are some interview tips to help you succeed:

1. Research the Company and Role

Familiarize yourself with the company’s industry, products/services, and payroll practices. Research the specific role and its responsibilities to demonstrate your interest and understanding.

2. Practice Answering Common Interview Questions

Prepare answers to common payroll interview questions, such as:

- Tell me about your experience with payroll processing.

- How do you handle payroll in a timely and accurate manner?

- Explain your knowledge of payroll tax regulations.

3. Highlight Your Skills and Experience

Emphasize the skills and experience that make you the ideal candidate for the role. Quantify your accomplishments whenever possible, using specific metrics and examples.

- Highlight your proficiency in payroll software.

- Share examples of how you streamlined payroll processes or resolved payroll issues.

- Demonstrate your understanding of federal and state payroll laws.

4. Prepare for Problem-Solving Questions

Payroll Processors often encounter real-world problems. Be prepared to discuss how you would handle scenarios such as:

- An employee’s payroll is incorrect.

- A payroll tax deadline is approaching quickly.

- An employee has an unusual payroll deduction.

5. Be Professional and Enthusiastic

Dress professionally, arrive on time for your interview, and maintain eye contact with the interviewer. Show your enthusiasm for the position and express your confidence in your abilities.

6. Ask Thoughtful Questions

At the end of the interview, ask insightful questions that demonstrate your interest and understanding. This shows the interviewer that you are engaged and eager to learn more.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Payroll Processor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.