Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Payroll Representative interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Payroll Representative so you can tailor your answers to impress potential employers.

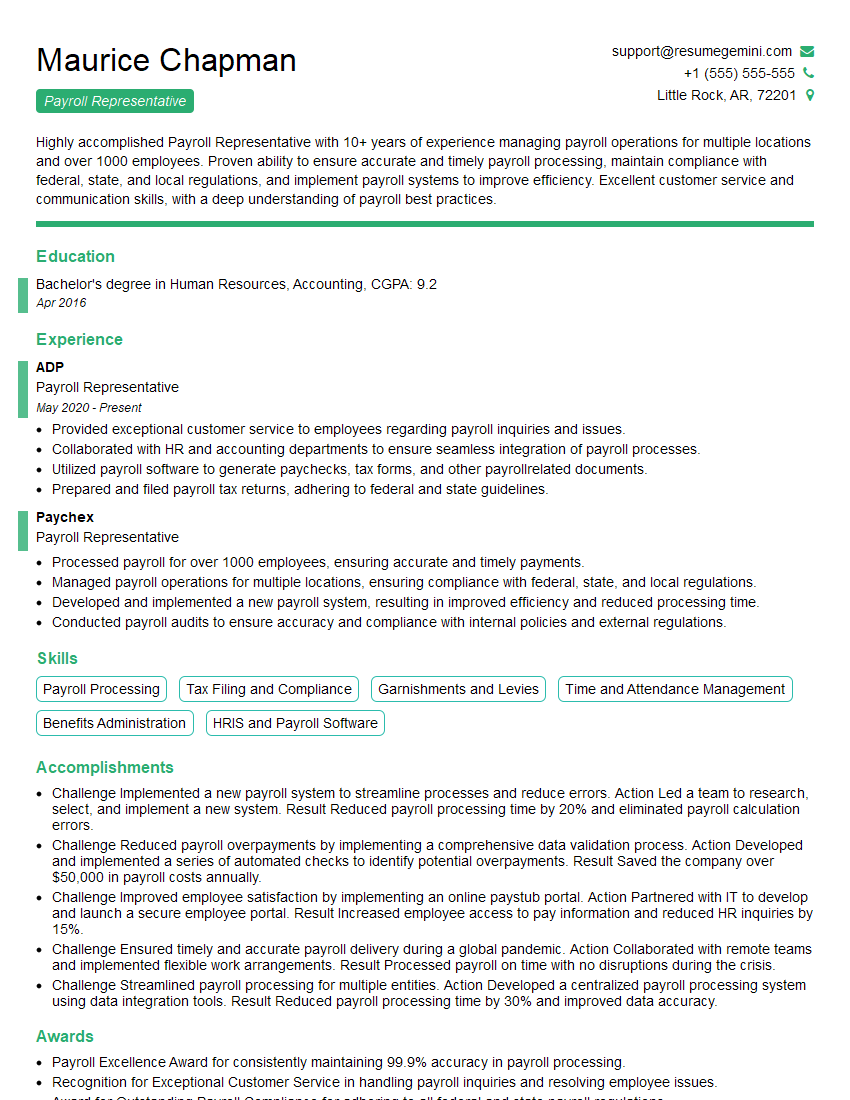

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Payroll Representative

1. How do you handle payroll for employees who have multiple pay rates?

I would first determine the employee’s regular rate of pay and overtime rate of pay. Then, I would calculate the employee’s gross pay for the regular hours worked at the regular rate of pay. Next, I would calculate the employee’s gross pay for the overtime hours worked at the overtime rate of pay. Finally, I would add the employee’s regular gross pay and overtime gross pay to arrive at the employee’s total gross pay.

2. What are the different types of payroll deductions?

Pre-tax deductions

- 401(k) contributions

- Health insurance premiums

- Dental insurance premiums

- Vision insurance premiums

- Life insurance premiums

Post-tax deductions

- Roth 401(k) contributions

- Flexible spending account contributions

- Union dues

- Charity contributions

3. What are the most common payroll errors?

Some of the most common payroll errors include:

- Incorrectly calculating employee pay

- Failing to withhold the correct amount of taxes

- Issuing duplicate paychecks

- Failing to file payroll taxes on time

- Paying employees who are not authorized to work

4. What are the key steps involved in the payroll process?

The key steps involved in the payroll process include:

- Collecting employee time and attendance information

- Calculating employee pay

- Withholding the correct amount of taxes

- Issuing paychecks

- Filing payroll taxes

5. What are the different methods of payroll processing?

The different methods of payroll processing include:

- Manual payroll processing

- Semi-automated payroll processing

- Fully automated payroll processing

The best method of payroll processing for a particular company will depend on the size of the company, the number of employees, and the complexity of the payroll process.

6. What are the advantages and disadvantages of using a payroll service?

Advantages

- Payroll services can save companies time and money.

- Payroll services can help companies avoid payroll errors.

- Payroll services can provide companies with access to expertise and support.

Disadvantages

- Payroll services can be expensive.

- Payroll services can have limited flexibility.

- Payroll services can be subject to errors.

7. What are the key qualities of a successful payroll representative?

Some of the key qualities of a successful payroll representative include:

- Accuracy

- Attention to detail

- Strong mathematical skills

- Excellent communication skills

- Ability to work independently and as part of a team

8. What are the biggest challenges facing payroll professionals today?

Some of the biggest challenges facing payroll professionals today include:

- The increasing complexity of payroll laws and regulations

- The need to stay up-to-date on the latest payroll technology

- The need to protect employee data and privacy

- The need to work with a diverse workforce

9. What are some of the trends in the payroll industry?

Some of the trends in the payroll industry include:

- The increasing use of payroll technology

- The growing popularity of employee self-service

- The need for greater payroll compliance

- The increasing importance of payroll data security

10. How do you stay up-to-date on the latest payroll laws and regulations?

I stay up-to-date on the latest payroll laws and regulations by reading industry publications, attending conferences, and taking online courses.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Payroll Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Payroll Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Payroll Representatives are responsible for the accurate and timely processing of payroll for employees. They work closely with Human Resources and other departments to ensure that all payroll information is correct and up-to-date. Key job responsibilities include:

1. Payroll Processing

Calculating and processing payroll for employees, including regular wages, overtime, bonuses, and deductions.

- Verifying time and attendance records for accuracy.

- Calculating and withholding taxes, including federal, state, and local income taxes, Social Security, and Medicare.

- Calculating and deducting voluntary deductions, such as health insurance, retirement contributions, and union dues.

- Issuing paychecks or direct deposits to employees.

2. Payroll Reporting

Preparing and filing payroll reports, including payroll tax returns, W-2s, and 1099s.

- Complying with all federal, state, and local payroll reporting requirements.

- Maintaining accurate payroll records for auditing purposes.

3. Employee Benefits Administration

Administering employee benefits, such as health insurance, retirement plans, and paid time off.

- Enrolling employees in benefits plans.

- Processing claims for employee benefits.

- Providing customer service to employees regarding payroll and benefits.

4. Payroll System Management

Maintaining and updating payroll systems, including software and hardware.

- Troubleshooting payroll system issues.

- Implementing new payroll software or updates.

- Providing training to employees on payroll systems.

Interview Tips

Preparing for a payroll representative interview can help you make a great impression and increase your chances of getting the job. Here are some tips and tricks you can use to prepare for your interview:

1. Research the Company and the Position

Take some time to learn about the company you’re applying to and the specific payroll representative position. This will help you answer questions about the company and show that you’re interested in the job.

- Visit the company’s website.

- Read the job description carefully.

- Look for news articles or other information about the company.

2. Practice Answering Common Interview Questions

There are some common interview questions that you’re likely to be asked in a payroll representative interview. It’s a good idea to practice answering these questions so that you can give confident and well-thought-out responses.

- Tell me about your experience in payroll processing.

- What are your strengths and weaknesses as a payroll representative?

- Why are you interested in this position?

- What are your salary expectations?

3. Be Prepared to Talk About Your Skills and Experience

The interviewer will want to know about your skills and experience in payroll processing. Be sure to highlight your experience in calculating payroll, withholding taxes, and administering employee benefits. You should also be prepared to talk about your customer service skills and your ability to work independently and as part of a team.

- Quantify your accomplishments whenever possible.

- Use specific examples to illustrate your skills and experience.

- Be prepared to talk about your knowledge of payroll laws and regulations.

4. Dress Professionally and Arrive on Time

First impressions matter, so it’s important to dress professionally and arrive on time for your interview. This shows that you’re respectful of the interviewer’s time and that you take the interview seriously.

- Choose clothing that is clean, pressed, and appropriate for a business setting.

- Arrive for your interview on time, or even a few minutes early.

- Be polite and respectful to everyone you meet, including the receptionist and other employees.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Payroll Representative interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!