Feeling lost in a sea of interview questions? Landed that dream interview for Payroll Specialist but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Payroll Specialist interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

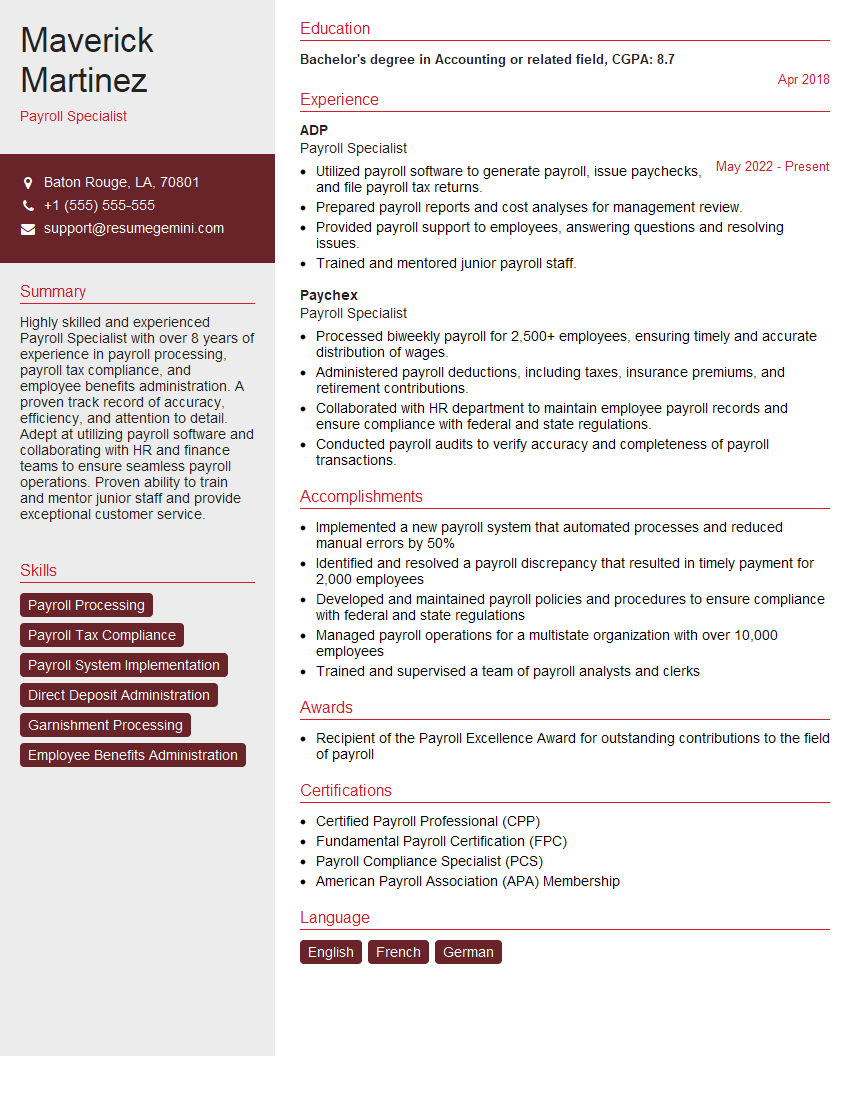

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Payroll Specialist

1. What are the key responsibilities of a Payroll Specialist?

- Calculating and issuing employee salaries and wages

- Processing payroll deductions and taxes

- Maintaining payroll records and reports

- Answering employee inquiries about payroll

- Staying up-to-date on payroll laws and regulations

2. What are the qualifications of a successful Payroll Specialist?

Education

- Associate’s or bachelor’s degree in accounting, finance, or a related field

Experience

- 2-3 years of experience in payroll processing

Skills

- Strong understanding of payroll laws and regulations

- Excellent attention to detail and accuracy

- Ability to work independently and as part of a team

- Proficient in Microsoft Office Suite, especially Excel

- Knowledge of payroll software, such as ADP or QuickBooks

3. What is the difference between gross pay and net pay?

- Gross pay is the total amount of money an employee earns before taxes and other deductions are taken out.

- Net pay is the amount of money an employee receives after taxes and other deductions have been taken out.

4. What are the different types of payroll deductions?

- Mandatory deductions: These are deductions that are required by law, such as taxes and Social Security.

- Voluntary deductions: These are deductions that are not required by law, such as health insurance premiums and retirement contributions.

5. What are the different types of payroll taxes?

- Federal income tax

- State income tax

- Social Security tax

- Medicare tax

- Unemployment insurance tax

6. What is the difference between a W-2 and a 1099?

- A W-2 is a tax form that is issued to employees. It reports the employee’s wages and taxes for the year.

- A 1099 is a tax form that is issued to independent contractors. It reports the income that the independent contractor earned from the business.

7. What are the most common payroll errors?

- Incorrectly calculating employee hours

- Misclassifying employees as exempt or non-exempt

- Incorrectly withholding taxes

- Failing to file payroll taxes on time

8. What are the best practices for payroll processing?

- Establish a clear payroll schedule

- Use a payroll software to automate the process

- Review payroll reports regularly for accuracy

- Train employees on payroll procedures

9. What are the ethical responsibilities of a Payroll Specialist?

- Maintaining confidentiality of employee payroll information

- Complying with all applicable laws and regulations

- Avoiding conflicts of interest

10. What are the future trends in payroll processing?

- Increased use of artificial intelligence

- Adoption of blockchain technology

- Greater emphasis on employee self-service

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Payroll Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Payroll Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Payroll Specialists are responsible for ensuring that employees are paid accurately and on time. They work with human resources, accounting, and other departments to collect and process payroll data, and they are responsible for ensuring that all payroll taxes and deductions are calculated correctly. In addition, Payroll Specialists may also be responsible for preparing and distributing paychecks, and for answering employee questions about payroll. Some of the key job responsibilities of a Payroll Specialist include:

1. Processing payroll

This involves collecting and entering employee time and attendance data, calculating gross and net pay, and issuing paychecks or direct deposits. Payroll Specialists must also be familiar with all applicable payroll laws and regulations, and they must be able to correctly calculate payroll taxes and deductions.

2. Preparing and distributing reports

Payroll Specialists are responsible for preparing and distributing a variety of payroll reports, including payroll summaries, earnings statements, and tax reports. These reports are used by management to make informed decisions about payroll and by employees to track their earnings and deductions.

3. Answering employee questions

Payroll Specialists are often the first point of contact for employees with questions about their paychecks or other payroll-related matters. They must be able to answer these questions accurately and promptly, and they must be able to resolve any payroll errors or discrepancies.

4. Maintaining payroll records

Payroll Specialists are responsible for maintaining accurate and up-to-date payroll records, including employee time records, pay stubs, and tax reports. These records must be kept for a specified period of time, and they must be available for inspection by government agencies.

Interview Tips

Interviewing for a Payroll Specialist position can be daunting, but there are a few things you can do to prepare and increase your chances of success. Here are a few interview tips to help you ace your interview:

1. Research the company and the position

This will help you understand the company’s culture and the specific requirements of the position. You can research the company’s website, read articles about the company, and talk to people who work there. You should also review the job description carefully and make sure you understand the key responsibilities of the position.

2. Practice answering common interview questions

There are a few common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. You should practice answering these questions in advance so that you can deliver your answers confidently and concisely.

3. Be prepared to discuss your experience and qualifications

The interviewer will want to know about your experience and qualifications as they relate to the position. Be prepared to discuss your skills in payroll processing, report preparation, and customer service. You should also be able to provide examples of your work and demonstrate your knowledge of payroll laws and regulations.

4. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally for your interview. You should also arrive on time and be prepared to wait a few minutes if the interviewer is running behind schedule.

5. Be confident and enthusiastic

The interviewer will be able to tell if you are confident and enthusiastic about the position. Be yourself and let your personality shine through. The more confident you are, the more likely you are to make a good impression.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Payroll Specialist interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!